EU indices still down this morning | TA focus on Bouygues

INDICES

Yesterday, European stocks returned to negative territory, with the Stoxx Europe 600 Index losing 1.9%. Germany's DAX 30 sank 2.6%, France's CAC 40 slumped 2.9%, and the U.K.'s FTSE 100 was down 1.5%.

EUROPE ADVANCE/DECLINE

83% of STOXX 600 constituents traded lower or unchanged yesterday.

50% of the shares trade above their 20D MA vs 71% Tuesday (below the 20D moving average).

24% of the shares trade above their 200D MA vs 26% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 5.75pts to 33.42, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Technology, Healthcare

3mths relative low: Insurance

Europe Best 3 sectors

health care, utilities, technology

Europe worst 3 sectors

travel & leisure, automobiles & parts, banks

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -20bps (above its 20D MA).).

ECONOMIC DATA

FR 06:30: Q1 Unemployment Rate, exp.: 8.1%

GE 07:00: Apr Harmonised Inflation Rate YoY final, exp.: 1.3%

GE 07:00: Apr Harmonised Inflation Rate MoM final, exp.: 0.1%

GE 07:00: Apr Inflation Rate MoM final, exp.: 0.1%

GE 07:00: Apr Inflation Rate YoY final, exp.: 1.4%

GE 07:00: Apr Wholesale Prices MoM, exp.: -0.4%

GE 07:00: Apr Wholesale Prices YoY, exp.: -1.5%

EC 09:00: ECB Economic Bulletin

FR 09:00: IEA Oil Market Report

UK 10:45: 10-Year Treasury Gilt auction, exp.: 0.26%

EC 16:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD remained subdued at 1.0815 and GBP/USD dropped further to 1.2218. USD/JPY fell to 106.90. AUD/USD slipped to 0.6441. Australia's official jobs report show that the economy shed 594,300 jobs in April (-575,000 jobs expected), while jobless rate climbed to 6.2% (8.2% expected) from 5.2%.

Spot gold held gains at $1,715 an ounce.

#UK - IRELAND#

3i Group, an investment firm, reported full-year results: "Total return of 253 million pounds or 3% on opening shareholders' funds (March 2019: 1,252 million pounds, 18%) and NAV per share of 804 pence (31 March 2019: 815 pence) (...) Our Private Equity business delivered a gross investment return of 352 million pounds or 6% (March 2019: 1,148 million pounds, 20%). (...) Our Infrastructure business delivered a gross investment return of (39) million pounds, or (4)% (March 2019: 210 million pounds, 25%). (...) driven primarily by the decline in the share price of 3i Infrastructure plc as a result of the broader market volatility in March 2020. (...) Total dividend of 35 pence per share for FY2020, with a dividend of 17.5 pence per share to be paid in July 2020."

Persimmon, a house builder, provided a COVID-19 update: "During the week beginning 4 May 2020 c. 65% of production capacity had been restored. (...) In the eight weeks ended 10 May 2020 the Group secured 1,351 gross private sales reservations, with a total of 1,300 legal completions being made in the same period. Cancellation levels remain in line with historic trends. (...) will reopen its sales offices in England on Friday 15 May 2020."

Hargreaves Lansdown, an investment service company, published a trading update for the four-month period April 30: "Net new business was 4.0 billion pounds during the period (2019: 2.9 billion pounds), taking year to date net inflows to 6.3 billion pounds (2019: 5.4 billion pounds). (...) Falling stock markets driven by the global impact of COVID-19 have led to a negative market movement in AUA (Assets under administration) in the period of 12.4 billion pounds. (...) AUA was 96.7 billion pounds as at 30 April 2020 (105.2 billion pounds at end-2019). (...) The Board's current intention remains to operate its stated dividend policy for the 2020 financial year."

WH Smith, a retailer, announced 1H results: "Total Group revenue was up 7% compared to last year at £747m (2019: £695m) with Group LFL revenue down 1%. (...) Group profit from trading operations increased to £93m (2019: £92m) with Headline Group profit before tax at £80m (2019: £81m). (...) Following the disruption to the business from the Covid-19 pandemic, the Board has announced that it will not be paying an interim dividend in the current financial year."

Grainger, residential property group, posted 1H results: "Net rental income up +27% to £37.0m in H1 (HY19: £29.1m). (...) Adjusted earnings were in line with expectations at £33.7m (HY19: £38.3m) due to higher levels of asset recycling last year. (...) Profit before tax was £49.6m (HY19: £54.3m). (...) Adjusted EPRA earnings were up +9% to £16.0m (HY19: £14.7m). (...) Dividend policy maintained with interim dividend per share increased +6% to 1.83p per share (HY19: 1.73p)."

#GERMANY#

Deutsche Telekom, a telecommunications group, announced that 1Q adjusted net income climbed 8.5% on year to 1.28 billion euros and adjusted EBITDA AL rose 10.2% to 6.54 billion euros on revenue of 19.94 billion euros, up 2.3%. The company added: "The Group expects the pandemic to have limited impact on revenue, (...) As such, taking into account all foreseeable consequences of the pandemic, the Group confirms its guidance for the current financial year."

RWE, an electric utilities company, reported that 1Q adjusted EBITDA increased 19% on year to 1.3 billion euros and adjusted net income totaled 603 million euros.The company confirmed its full-year adjusted EBITDA guidance of 2.7 - 3.0 billion euros and adjusted net income forecast of 0.85 - 1.15 billion euros. Also, the company maintains its plan to increase the dividend to 0.85 euro per share for the current fiscal year from 0.80 euro per share in the prior year.

Wirecard, an internet technology and financial services provider, announced that 1Q preliminary EBITDA rose 26% on year to 199 million euros and confirmed its full-year EBITDA forecast of 1.00 - 1.12 billion euros.

Fraport, an airport operator, reported that Frankfurt Airport counted only 188,078 passengers in April, slumped 96.9% on year and down 45.7% in the first four months of 2020.

#FRANCE#

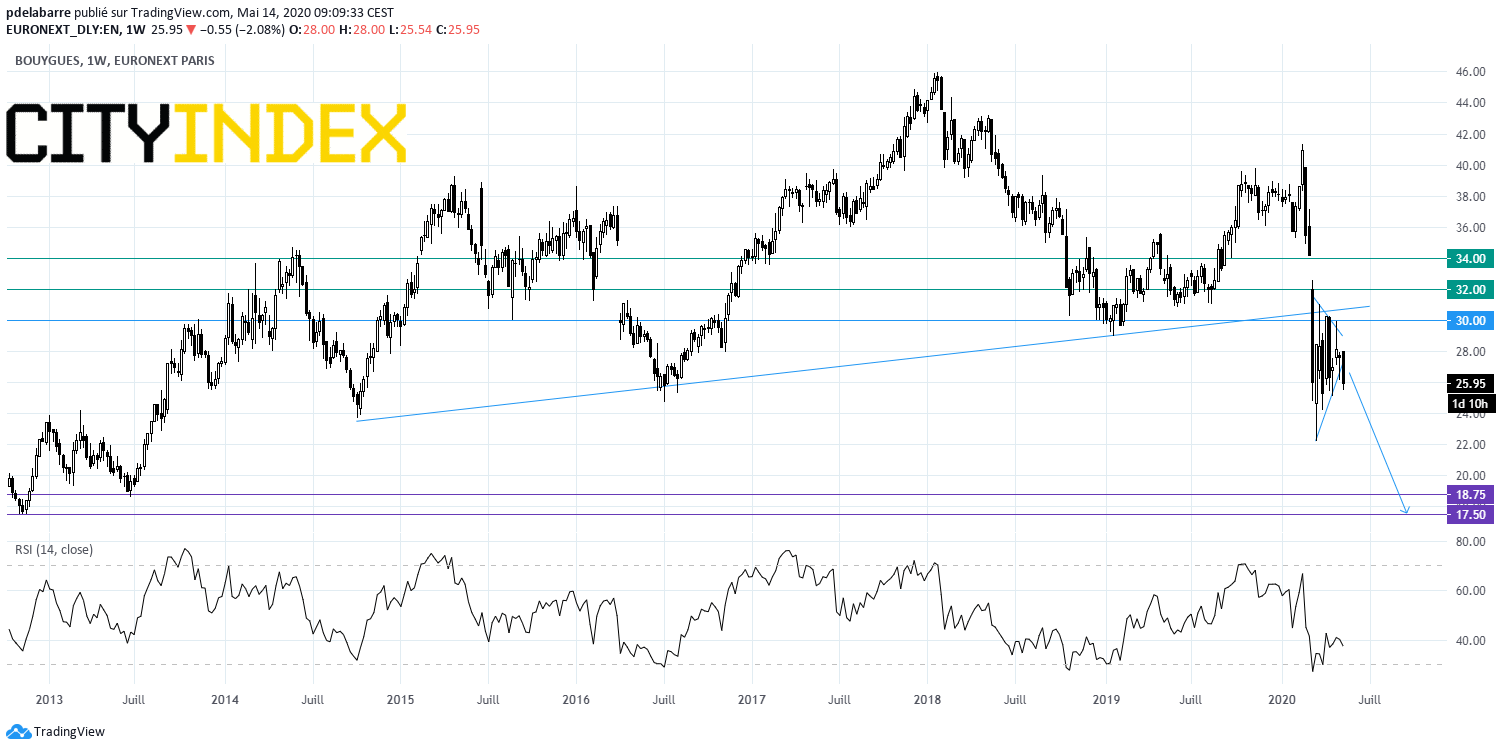

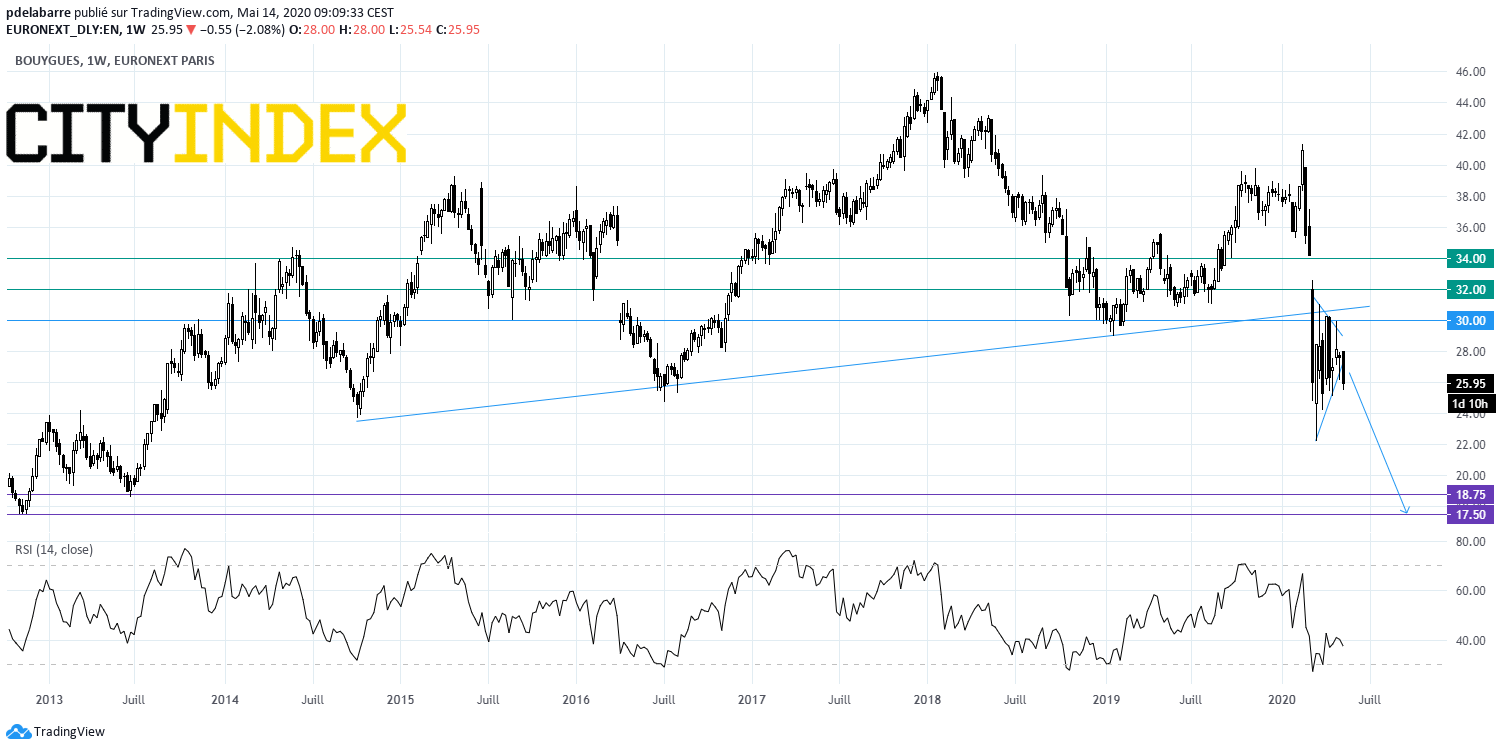

Bouygues, an industrial group, reported that 1Q net loss widened to 204 million euros from 59 million euros in the prior-year period and current operating loss increased to 242 million euros from 58 million euros, citing "initial effects of the Covid-19 pandemic". The company stated: "It is too soon to issue new 2020 full-year guidance for the Group, (...) we expect a greater impact on the second quarter results for the Group and in each activity." From a chartist point of view, prices have broken down a medium term rising trend line in place since 2014 and have more recently confirmed a bearish continuation pattern in symmetrical triangle. Below 30, look for 18.75 & 17.50.

Source: GAIN Capital, TradingView

Peugeot, an automobile group, announced that it has decided not to distribute a dividend related to fiscal year 2019, "in light of the impact from the current COVID-19 crisis". At the same time, the company said preparations for the merger with Fiat Chrysler Automobiles are advancing well and expected to be completed by 1Q 2021.

Euronext, a stock exchange operator, announced that 1Q net income jumped 71.2% on year to 96 million euros and EBITDA climbed 47.7% to 150 million euros on revenue of 237 million euros, up 55.2% (+29.5% organic growth).

#PORTUGAL#

Jeronimo Martins, a food distribution and specialized retail group, posted 1Q net income declined 43.8% on year to 35 million euros and EBITDA fell 0.4% to 309 million euros on revenue of 4.72 billion euros, up 11.0% (+9.5% like-for-like). The company said it has decided to withdraw its 2020 guidance and cut 2019 dividend to 0.207 euro per share from 0.345 euro per share previously planned due to the coronavirus pandemic.

#BENELUX#

KBC, a banking group, announced that it swung to a 1Q net loss of 5 million euros from a net profit of 430 million euros in the prior-year period, citing 141 million euros impairment charges, compared with 69 million euros last year. Net interest income grew 5.8% on year to 1.20 billion euros. Regarding full-year outlook, the bank said: "The full-year 2020 Net Interest Income guidance has been lowered from 4.65 billion euros to approximately 4.3 billion euros, (...) As a result of the coronavirus pandemic, we estimate the full-year 2020 Impairments at roughly 1.1 billion euros (base scenario)."

#ITALY#

Fiat Chrysler Automobiles, a vehicle manufacturer, said it has decided not to distribute an ordinary dividend in 2020 related to fiscal year 2019, citing COVID19 crisis impact. Meanwhile, the company confirmed that preparations for the merger with Peugeot are advancing well and expected to be completed before 1Q 2021.

#SWITZERLAND#

Zurich Insurance, an insurance company, reported that 1Q Property & Casualty (P&C) gross written premiums increased 5% on year to 9.68 billion dollars, up 7% on a like-for-like basis. The company added: "P&C claims from COVID-19 are subject to significant uncertainty. Experience to date and scenario analysis suggest these could be in region of USD 750 million for 2020."

Straumann, a tooth replacement solutions provider, announced plans to reduce 9% of its global workforce, approximately 660 jobs, this year. The company said: "The Group expects to achieve high double-digit million savings in 2020 - including the personnel reductions and restructuring costs of approximately CHF 15 million. In 2021, the expected savings from personnel reductions will be approximately CHF 30 million."

EX-DIVIDEND

Glaxosmithkline:19p, Royal Dutch Shell (RDSA): $0.16, Unilever: E0.4104, Unilever:36.14p

Yesterday, European stocks returned to negative territory, with the Stoxx Europe 600 Index losing 1.9%. Germany's DAX 30 sank 2.6%, France's CAC 40 slumped 2.9%, and the U.K.'s FTSE 100 was down 1.5%.

EUROPE ADVANCE/DECLINE

83% of STOXX 600 constituents traded lower or unchanged yesterday.

50% of the shares trade above their 20D MA vs 71% Tuesday (below the 20D moving average).

24% of the shares trade above their 200D MA vs 26% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 5.75pts to 33.42, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Technology, Healthcare

3mths relative low: Insurance

Europe Best 3 sectors

health care, utilities, technology

Europe worst 3 sectors

travel & leisure, automobiles & parts, banks

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -20bps (above its 20D MA).).

ECONOMIC DATA

FR 06:30: Q1 Unemployment Rate, exp.: 8.1%

GE 07:00: Apr Harmonised Inflation Rate YoY final, exp.: 1.3%

GE 07:00: Apr Harmonised Inflation Rate MoM final, exp.: 0.1%

GE 07:00: Apr Inflation Rate MoM final, exp.: 0.1%

GE 07:00: Apr Inflation Rate YoY final, exp.: 1.4%

GE 07:00: Apr Wholesale Prices MoM, exp.: -0.4%

GE 07:00: Apr Wholesale Prices YoY, exp.: -1.5%

EC 09:00: ECB Economic Bulletin

FR 09:00: IEA Oil Market Report

UK 10:45: 10-Year Treasury Gilt auction, exp.: 0.26%

EC 16:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD remained subdued at 1.0815 and GBP/USD dropped further to 1.2218. USD/JPY fell to 106.90. AUD/USD slipped to 0.6441. Australia's official jobs report show that the economy shed 594,300 jobs in April (-575,000 jobs expected), while jobless rate climbed to 6.2% (8.2% expected) from 5.2%.

Spot gold held gains at $1,715 an ounce.

#UK - IRELAND#

3i Group, an investment firm, reported full-year results: "Total return of 253 million pounds or 3% on opening shareholders' funds (March 2019: 1,252 million pounds, 18%) and NAV per share of 804 pence (31 March 2019: 815 pence) (...) Our Private Equity business delivered a gross investment return of 352 million pounds or 6% (March 2019: 1,148 million pounds, 20%). (...) Our Infrastructure business delivered a gross investment return of (39) million pounds, or (4)% (March 2019: 210 million pounds, 25%). (...) driven primarily by the decline in the share price of 3i Infrastructure plc as a result of the broader market volatility in March 2020. (...) Total dividend of 35 pence per share for FY2020, with a dividend of 17.5 pence per share to be paid in July 2020."

Persimmon, a house builder, provided a COVID-19 update: "During the week beginning 4 May 2020 c. 65% of production capacity had been restored. (...) In the eight weeks ended 10 May 2020 the Group secured 1,351 gross private sales reservations, with a total of 1,300 legal completions being made in the same period. Cancellation levels remain in line with historic trends. (...) will reopen its sales offices in England on Friday 15 May 2020."

Hargreaves Lansdown, an investment service company, published a trading update for the four-month period April 30: "Net new business was 4.0 billion pounds during the period (2019: 2.9 billion pounds), taking year to date net inflows to 6.3 billion pounds (2019: 5.4 billion pounds). (...) Falling stock markets driven by the global impact of COVID-19 have led to a negative market movement in AUA (Assets under administration) in the period of 12.4 billion pounds. (...) AUA was 96.7 billion pounds as at 30 April 2020 (105.2 billion pounds at end-2019). (...) The Board's current intention remains to operate its stated dividend policy for the 2020 financial year."

WH Smith, a retailer, announced 1H results: "Total Group revenue was up 7% compared to last year at £747m (2019: £695m) with Group LFL revenue down 1%. (...) Group profit from trading operations increased to £93m (2019: £92m) with Headline Group profit before tax at £80m (2019: £81m). (...) Following the disruption to the business from the Covid-19 pandemic, the Board has announced that it will not be paying an interim dividend in the current financial year."

Grainger, residential property group, posted 1H results: "Net rental income up +27% to £37.0m in H1 (HY19: £29.1m). (...) Adjusted earnings were in line with expectations at £33.7m (HY19: £38.3m) due to higher levels of asset recycling last year. (...) Profit before tax was £49.6m (HY19: £54.3m). (...) Adjusted EPRA earnings were up +9% to £16.0m (HY19: £14.7m). (...) Dividend policy maintained with interim dividend per share increased +6% to 1.83p per share (HY19: 1.73p)."

#GERMANY#

Deutsche Telekom, a telecommunications group, announced that 1Q adjusted net income climbed 8.5% on year to 1.28 billion euros and adjusted EBITDA AL rose 10.2% to 6.54 billion euros on revenue of 19.94 billion euros, up 2.3%. The company added: "The Group expects the pandemic to have limited impact on revenue, (...) As such, taking into account all foreseeable consequences of the pandemic, the Group confirms its guidance for the current financial year."

RWE, an electric utilities company, reported that 1Q adjusted EBITDA increased 19% on year to 1.3 billion euros and adjusted net income totaled 603 million euros.The company confirmed its full-year adjusted EBITDA guidance of 2.7 - 3.0 billion euros and adjusted net income forecast of 0.85 - 1.15 billion euros. Also, the company maintains its plan to increase the dividend to 0.85 euro per share for the current fiscal year from 0.80 euro per share in the prior year.

Wirecard, an internet technology and financial services provider, announced that 1Q preliminary EBITDA rose 26% on year to 199 million euros and confirmed its full-year EBITDA forecast of 1.00 - 1.12 billion euros.

Fraport, an airport operator, reported that Frankfurt Airport counted only 188,078 passengers in April, slumped 96.9% on year and down 45.7% in the first four months of 2020.

#FRANCE#

Bouygues, an industrial group, reported that 1Q net loss widened to 204 million euros from 59 million euros in the prior-year period and current operating loss increased to 242 million euros from 58 million euros, citing "initial effects of the Covid-19 pandemic". The company stated: "It is too soon to issue new 2020 full-year guidance for the Group, (...) we expect a greater impact on the second quarter results for the Group and in each activity." From a chartist point of view, prices have broken down a medium term rising trend line in place since 2014 and have more recently confirmed a bearish continuation pattern in symmetrical triangle. Below 30, look for 18.75 & 17.50.

Source: GAIN Capital, TradingView

Peugeot, an automobile group, announced that it has decided not to distribute a dividend related to fiscal year 2019, "in light of the impact from the current COVID-19 crisis". At the same time, the company said preparations for the merger with Fiat Chrysler Automobiles are advancing well and expected to be completed by 1Q 2021.

Euronext, a stock exchange operator, announced that 1Q net income jumped 71.2% on year to 96 million euros and EBITDA climbed 47.7% to 150 million euros on revenue of 237 million euros, up 55.2% (+29.5% organic growth).

#PORTUGAL#

Jeronimo Martins, a food distribution and specialized retail group, posted 1Q net income declined 43.8% on year to 35 million euros and EBITDA fell 0.4% to 309 million euros on revenue of 4.72 billion euros, up 11.0% (+9.5% like-for-like). The company said it has decided to withdraw its 2020 guidance and cut 2019 dividend to 0.207 euro per share from 0.345 euro per share previously planned due to the coronavirus pandemic.

#BENELUX#

KBC, a banking group, announced that it swung to a 1Q net loss of 5 million euros from a net profit of 430 million euros in the prior-year period, citing 141 million euros impairment charges, compared with 69 million euros last year. Net interest income grew 5.8% on year to 1.20 billion euros. Regarding full-year outlook, the bank said: "The full-year 2020 Net Interest Income guidance has been lowered from 4.65 billion euros to approximately 4.3 billion euros, (...) As a result of the coronavirus pandemic, we estimate the full-year 2020 Impairments at roughly 1.1 billion euros (base scenario)."

#ITALY#

Fiat Chrysler Automobiles, a vehicle manufacturer, said it has decided not to distribute an ordinary dividend in 2020 related to fiscal year 2019, citing COVID19 crisis impact. Meanwhile, the company confirmed that preparations for the merger with Peugeot are advancing well and expected to be completed before 1Q 2021.

#SWITZERLAND#

Zurich Insurance, an insurance company, reported that 1Q Property & Casualty (P&C) gross written premiums increased 5% on year to 9.68 billion dollars, up 7% on a like-for-like basis. The company added: "P&C claims from COVID-19 are subject to significant uncertainty. Experience to date and scenario analysis suggest these could be in region of USD 750 million for 2020."

Straumann, a tooth replacement solutions provider, announced plans to reduce 9% of its global workforce, approximately 660 jobs, this year. The company said: "The Group expects to achieve high double-digit million savings in 2020 - including the personnel reductions and restructuring costs of approximately CHF 15 million. In 2021, the expected savings from personnel reductions will be approximately CHF 30 million."

EX-DIVIDEND

Glaxosmithkline:19p, Royal Dutch Shell (RDSA): $0.16, Unilever: E0.4104, Unilever:36.14p

Latest market news

Today 08:15 AM

Today 05:45 AM