EU indices slightly up this morning | TA focus on Hermès

INDICES

Yesterday, European stocks were broadly higher, with the Stoxx Europe 600 Index rising 1.8%. Germany's DAX 30 climbed 1.6%, the U.K.'s FTSE 100 increased 2.3%, and France's CAC 40 was up 1.3%.

EUROPE ADVANCE/DECLINE

74% of STOXX 600 constituents traded higher yesterday.

69% of the shares trade above their 20D MA vs 63% Tuesday (below the 20D moving average).

20% of the shares trade above their 200D MA vs 17% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 4.26pts to 43.96, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

energy, basic resources, technology

Europe worst 3 sectors

retail, insurance, food & beverage

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.48% (below its 20D MA). The 2yr-10yr yield spread fell 5bps to -26bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: May GfK Consumer Confidence, exp.: 2.7

UK 07:00: Mar Public Sector Net Borrowing, exp.: £0.39B

FR 07:45: Apr Business Confidence, exp.: 98

FR 07:45: Apr Business Climate Indicator, exp.: 95

FR 08:15: Apr Markit Composite PMI Flash, exp.: 28.9

FR 08:15: Apr Markit Manufacturing PMI Flash, exp.: 43.2

FR 08:15: Apr Markit Services PMI Flash, exp.: 27.4

GE 08:30: Apr Markit Composite PMI Flash, exp.: 35

GE 08:30: Apr Markit Services PMI Flash, exp.: 31.7

GE 08:30: Apr Markit Manufacturing PMI Flash, exp.: 45.4

EC 09:00: Apr Markit Composite PMI Flash, exp.: 29.7

EC 09:00: Apr Markit Manufacturing PMI Flash, exp.: 44.5

EC 09:00: Apr Markit Services PMI Flash, exp.: 26.4

UK 09:30: Apr Markit/CIPS Manufacturing PMI Flash, exp.: 47.8

UK 09:30: Apr Markit/CIPS UK Services PMI Flash, exp.: 34.5

UK 09:30: Apr Markit/CIPS Composite PMI Flash, exp.: 36

UK 11:00: Apr CBI Industrial Trends Orders, exp.: -29

UK 11:00: Q2 CBI Business Optimism Idx, exp.: 23

UK 00:01: Apr Gfk Consumer Confidence, exp.: -34

MORNING TRADING

In Asian trading hours, EUR/USD dropped further to 1.0808 and GBP/USD eased to 1.2327. USD/JPY slipped to 107.77.

Spot gold marked a high nears $1,722 an ounce before retreating to $1,708 an ounce.

#UK - IRELAND#

Anglo American, a multinational mining group, released a 1Q trading update: "The onset of varying degrees of lock-down or distancing measures in a number of our operating countries towards the end of the quarter, combined with the impact of long-wall moves in our Metallurgical Coal business, led to 4% lower production compared to the same period of 2019, (...) production guidance (Rough diamond) has been revised to 25-27 million carats (previously 32-34 million carats). (...) Production guidance (metal in concentrate) is revised to 1.5-1.7 million ounces of platinum (previously 2.0-2.2 million ounces) and 1.0-1.2 million ounces of palladium (previously c.1.4 million ounces). (...) Kumba production guidance based on the current lock-down measures in South Africa has been revised to 37-39 million tonnes (previously 41.5-42.5 million tonnes), (...) Production guidance for export thermal coal based on the current lock-down measures in South Africa and Colombia has been revised to c.22 million tonnes (previously c.26 million tonnes)."

Compass Group, a food service company, provided a COVID-19 update: "In the last two weeks of March, the business performed in line with the expectations set out in our Coronavirus Trading Update of 17 March 2020. Organic revenue growth for Half Year 2020 was c.1.6%, within the 0%-2% expected range. (...) The drop through impact of lost revenues on HY operating profit was between 28%-29%, within the anticipated range of 25%-30%. (...) the Board has decided not to recommend an interim or a final dividend for the year ending 30 September 2020."

Meggitt, a high performance components manufacturer, posted a 1Q trading update: "Group revenue was up 5% on an organic basis in the first quarter, (...) Covid-19 will result in a significant reduction in demand across our civil aerospace business in 2020 in both OE and AM, (...) In light of a highly fluid market and global macro-economic situation, it remains the Board's position that it is too early to provide forward looking guidance at the current time."

Croda International, a speciality chemical company, published a COVID-19 update: "Core Business sales and Group profitability in the first quarter ended 31 March 2020 ('the quarter' or 'Q1') were broadly in line with the Board's expectations and the prior year. (...) As the second quarter commences, whilst conditions in some markets are more variable than usual, the value of our customer order book remains solid and in line with normal circumstances. (...) the Board has decided to pay the final 2019 ordinary dividend of 50.5 pence per share (£65.0m), announced in the Group's annual results in February 2020."

Taylor Wimpey, a house-building company, posted a trading statement: "Total Group completions (including joint ventures) in the 16 weeks to 19 April 2020 were 2,271 (2019 week 16: 2,644), reflecting the impact of our site closures. (...) As a result of our new digital reservation process, our order book has continued to increase and at week ending 19 April 2020, its total value stood at approximately £2,677 million (2019 week 16: £2,399 million)."

BHP Group, a giant metals group, was upgraded to "buy" from "hold" at Societe Generale.

Ryanair, an airline group, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

EasyJet, a low-cost airline, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#GERMANY#

Daimler, an automobile group, said it expects full-year revenue and EBIT to be below the prior year, as a result of the COVID-19 pandemic. The company reported that preliminary 1Q EBIT plunged 77.9% on year to 617 million euros.

Vonovia, a real estate group, is considering making a fresh acquisition offer for rival Deutsche Wohnen, which may be valued at 40 billion dollars, reported Bloomberg citing people familiar with the matter.

Sartorius, a pharmaceutical and laboratory equipment supplier, was downgraded to "sell" from "hold" at Societe Generale.

Sartorius Stedim Biotech, a biopharma company, was downgraded to "hold" from "buy" at Societe Generale.

#FRANCE#

Renault, a vehicle manufacturer, reported that 1Q revenue declined 19.2% on year (-18.3% at constant exchange rates and perimeter) to 10.13 billion euros, and vehicle sales were down 25.9% to 672,962 units. The company said: "To date, the impact that this pandemic will have on the Group's results is still impossible to assess."

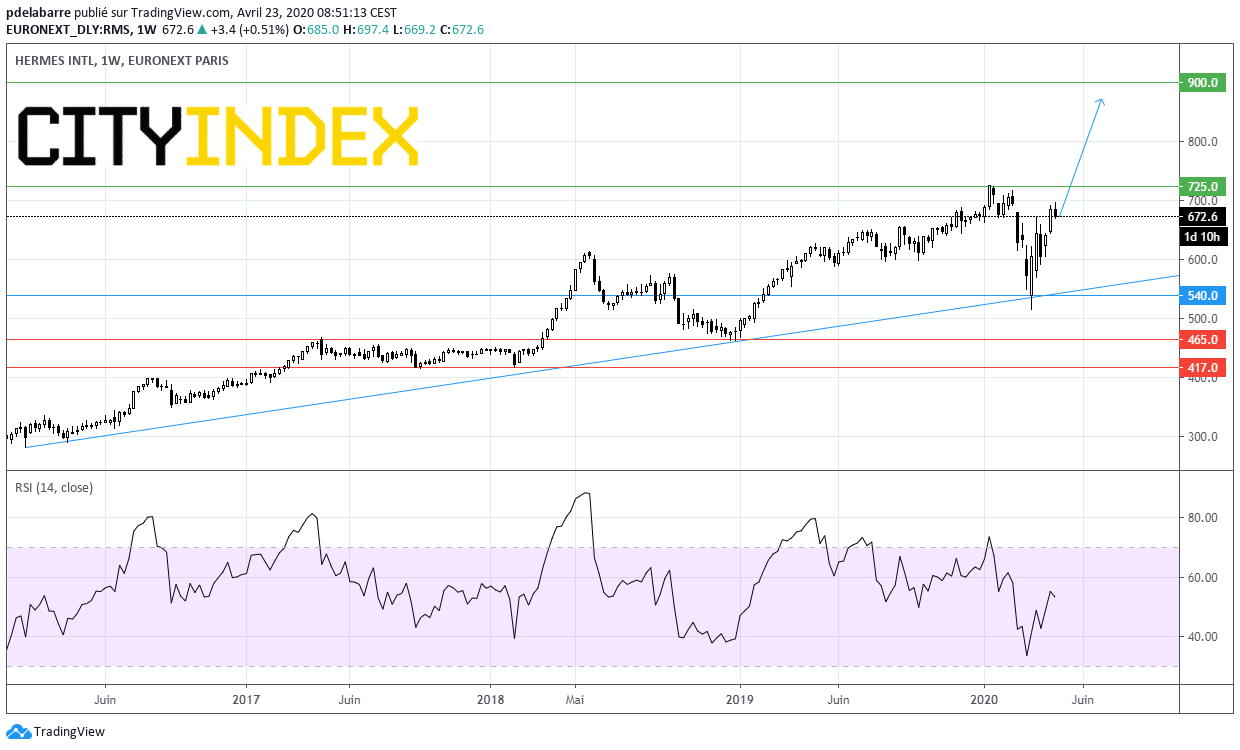

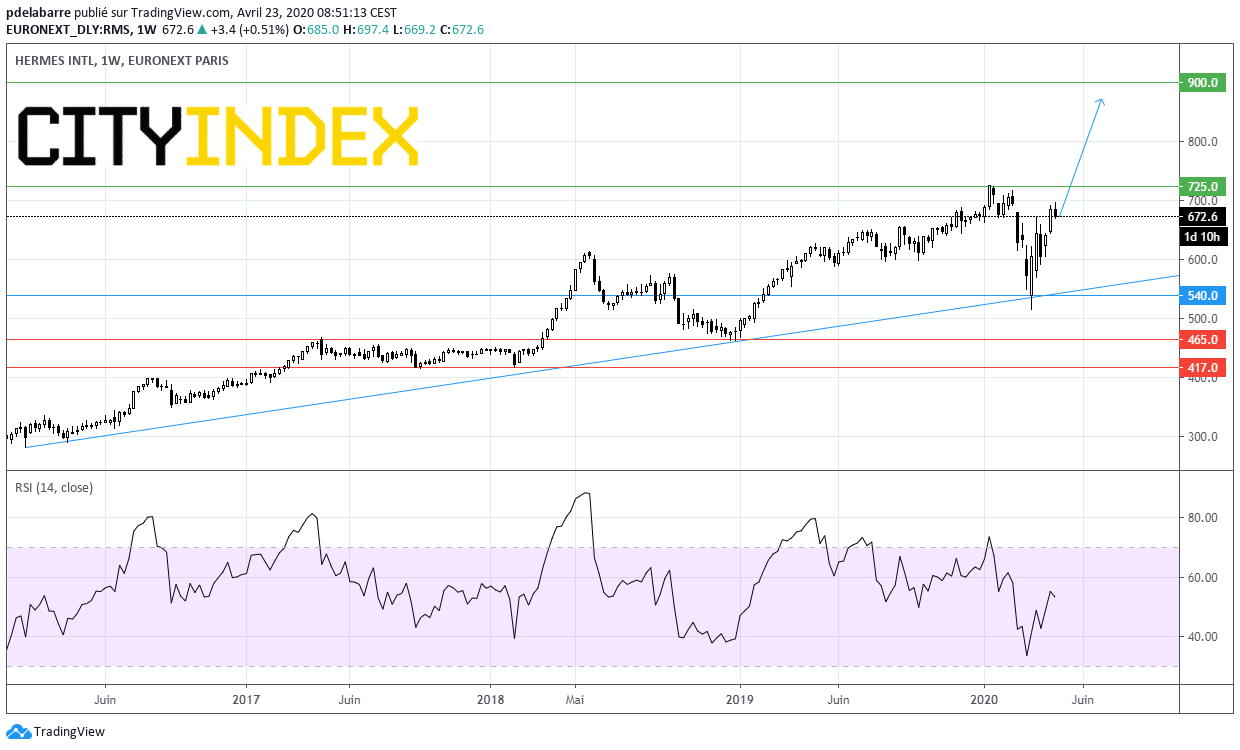

Hermes, a luxury goods manufacturer, reported that 1Q revenue fell 6.5% on year to 1.51 billion euros, down 7.7% at constant exchange rates.

Source: GAIN Capital, TradingView

Pernod Ricard, an alcoholic beverages producer, posted 3Q net sales slid 13.3% on year to 1.74 billion euros, down 14.5% organically. The company said: "Under current assumptions of the impact of Covid-19, we are confirming our guidance of an organic decline in Profit from Recurring Operations for full-year FY20 of c. -20%."

Schneider Electric, an electrical equipment manufacturer, announced that 1Q revenue dropped 7.6% on year (-6.4% organic growth) to 5.83 billion euros. The company added: "Given the fact that a large part of the world is under some form of partial or complete lockdown at the moment, the Group expects Q2 2020 and therefore H1 2020 to be significantly impacted."

Dassault Systemes, a software developer, posted 1Q adjusted EPS grew 9% on year to 0.95 euro on adjusted revenue of 1.14 billion euros, up 19% (+17% in constant currencies). The company said it is targeting stable year-on-year adjusted EPS of 3.65 - 3.72 euros for the full-year.

Air France-KLM, an airline company, was downgraded to "underweight" from "equalweight" at Morgan Stanley.

#BENELUX#

Just Eat Takeaway, online food delivery service provider, announced the launch of a capital increase of 400 million new shares and a concurrent offering of 300 million euros convertible bonds. The company said it intends to use the net proceeds to partially pay down revolving credit facilities, for general corporate purposes as well as to provide financial flexibility.

#SWITZERLAND#

Credit Suisse, a banking group, announced that 1Q net income surged 75% on year to 1.31 billion Swiss franc on net revenue of 5.78 billion Swiss franc, up 7%. Also, provision for credit losses jumped to 568 million Swiss franc from 81 million Swiss franc in the prior-year period, while CET1 ratio dropped to 12.1% from 12.6%. Regarding the outlook, the bank said: "The scale of the adverse economic impact of the COVID19 crisis is still difficult to assess and we would caution that we may also see further reserve build and

impairments in the coming quarters."

LafargeHolcim, a building materials supplier, was upgraded to "buy" from "hold" at HSBC.

#SCANDINAVIA#

Volvo, a Swedish vehicle manufacturer, reported that 1Q net income slumped 55.7% on year to 4.77 billion Swedish krona and operating income declined 47.9% to 7.37 billion Swedish krona on net sales of 91.45 billion Swedish krona, down 14.7%. The company stated: "The first quarter of 2020 was impacted by the measures in society to stop the spread of the COVID-19 pandemic. These began affecting our operations in China in February and had a severe impact on the Group as of mid-March."

Swedbank, a banking group, said it swung to a 1Q net loss of 1.69 billion Swedish krona from a net profit of 5.27 billion Swedish krona in the prior-year period, citing Swedish FSA's administrative fine and higher provisions for expected credit impairments related to the effects of Covid-19 and drop in oil prices. Also, net interest income increased 4% on year to 6.69 billion Swedish krona.

EX-DIVIDEND

Aviva:21.4p, Legal & General:12.64p, Rolls-Royce:7.1p, Sika: SF2.3

Yesterday, European stocks were broadly higher, with the Stoxx Europe 600 Index rising 1.8%. Germany's DAX 30 climbed 1.6%, the U.K.'s FTSE 100 increased 2.3%, and France's CAC 40 was up 1.3%.

EUROPE ADVANCE/DECLINE

74% of STOXX 600 constituents traded higher yesterday.

69% of the shares trade above their 20D MA vs 63% Tuesday (below the 20D moving average).

20% of the shares trade above their 200D MA vs 17% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 4.26pts to 43.96, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

energy, basic resources, technology

Europe worst 3 sectors

retail, insurance, food & beverage

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.48% (below its 20D MA). The 2yr-10yr yield spread fell 5bps to -26bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: May GfK Consumer Confidence, exp.: 2.7

UK 07:00: Mar Public Sector Net Borrowing, exp.: £0.39B

FR 07:45: Apr Business Confidence, exp.: 98

FR 07:45: Apr Business Climate Indicator, exp.: 95

FR 08:15: Apr Markit Composite PMI Flash, exp.: 28.9

FR 08:15: Apr Markit Manufacturing PMI Flash, exp.: 43.2

FR 08:15: Apr Markit Services PMI Flash, exp.: 27.4

GE 08:30: Apr Markit Composite PMI Flash, exp.: 35

GE 08:30: Apr Markit Services PMI Flash, exp.: 31.7

GE 08:30: Apr Markit Manufacturing PMI Flash, exp.: 45.4

EC 09:00: Apr Markit Composite PMI Flash, exp.: 29.7

EC 09:00: Apr Markit Manufacturing PMI Flash, exp.: 44.5

EC 09:00: Apr Markit Services PMI Flash, exp.: 26.4

UK 09:30: Apr Markit/CIPS Manufacturing PMI Flash, exp.: 47.8

UK 09:30: Apr Markit/CIPS UK Services PMI Flash, exp.: 34.5

UK 09:30: Apr Markit/CIPS Composite PMI Flash, exp.: 36

UK 11:00: Apr CBI Industrial Trends Orders, exp.: -29

UK 11:00: Q2 CBI Business Optimism Idx, exp.: 23

UK 00:01: Apr Gfk Consumer Confidence, exp.: -34

MORNING TRADING

In Asian trading hours, EUR/USD dropped further to 1.0808 and GBP/USD eased to 1.2327. USD/JPY slipped to 107.77.

Spot gold marked a high nears $1,722 an ounce before retreating to $1,708 an ounce.

#UK - IRELAND#

Anglo American, a multinational mining group, released a 1Q trading update: "The onset of varying degrees of lock-down or distancing measures in a number of our operating countries towards the end of the quarter, combined with the impact of long-wall moves in our Metallurgical Coal business, led to 4% lower production compared to the same period of 2019, (...) production guidance (Rough diamond) has been revised to 25-27 million carats (previously 32-34 million carats). (...) Production guidance (metal in concentrate) is revised to 1.5-1.7 million ounces of platinum (previously 2.0-2.2 million ounces) and 1.0-1.2 million ounces of palladium (previously c.1.4 million ounces). (...) Kumba production guidance based on the current lock-down measures in South Africa has been revised to 37-39 million tonnes (previously 41.5-42.5 million tonnes), (...) Production guidance for export thermal coal based on the current lock-down measures in South Africa and Colombia has been revised to c.22 million tonnes (previously c.26 million tonnes)."

Compass Group, a food service company, provided a COVID-19 update: "In the last two weeks of March, the business performed in line with the expectations set out in our Coronavirus Trading Update of 17 March 2020. Organic revenue growth for Half Year 2020 was c.1.6%, within the 0%-2% expected range. (...) The drop through impact of lost revenues on HY operating profit was between 28%-29%, within the anticipated range of 25%-30%. (...) the Board has decided not to recommend an interim or a final dividend for the year ending 30 September 2020."

Meggitt, a high performance components manufacturer, posted a 1Q trading update: "Group revenue was up 5% on an organic basis in the first quarter, (...) Covid-19 will result in a significant reduction in demand across our civil aerospace business in 2020 in both OE and AM, (...) In light of a highly fluid market and global macro-economic situation, it remains the Board's position that it is too early to provide forward looking guidance at the current time."

Croda International, a speciality chemical company, published a COVID-19 update: "Core Business sales and Group profitability in the first quarter ended 31 March 2020 ('the quarter' or 'Q1') were broadly in line with the Board's expectations and the prior year. (...) As the second quarter commences, whilst conditions in some markets are more variable than usual, the value of our customer order book remains solid and in line with normal circumstances. (...) the Board has decided to pay the final 2019 ordinary dividend of 50.5 pence per share (£65.0m), announced in the Group's annual results in February 2020."

Taylor Wimpey, a house-building company, posted a trading statement: "Total Group completions (including joint ventures) in the 16 weeks to 19 April 2020 were 2,271 (2019 week 16: 2,644), reflecting the impact of our site closures. (...) As a result of our new digital reservation process, our order book has continued to increase and at week ending 19 April 2020, its total value stood at approximately £2,677 million (2019 week 16: £2,399 million)."

BHP Group, a giant metals group, was upgraded to "buy" from "hold" at Societe Generale.

Ryanair, an airline group, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

EasyJet, a low-cost airline, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#GERMANY#

Daimler, an automobile group, said it expects full-year revenue and EBIT to be below the prior year, as a result of the COVID-19 pandemic. The company reported that preliminary 1Q EBIT plunged 77.9% on year to 617 million euros.

Vonovia, a real estate group, is considering making a fresh acquisition offer for rival Deutsche Wohnen, which may be valued at 40 billion dollars, reported Bloomberg citing people familiar with the matter.

Sartorius, a pharmaceutical and laboratory equipment supplier, was downgraded to "sell" from "hold" at Societe Generale.

Sartorius Stedim Biotech, a biopharma company, was downgraded to "hold" from "buy" at Societe Generale.

#FRANCE#

Renault, a vehicle manufacturer, reported that 1Q revenue declined 19.2% on year (-18.3% at constant exchange rates and perimeter) to 10.13 billion euros, and vehicle sales were down 25.9% to 672,962 units. The company said: "To date, the impact that this pandemic will have on the Group's results is still impossible to assess."

Hermes, a luxury goods manufacturer, reported that 1Q revenue fell 6.5% on year to 1.51 billion euros, down 7.7% at constant exchange rates.

Source: GAIN Capital, TradingView

Pernod Ricard, an alcoholic beverages producer, posted 3Q net sales slid 13.3% on year to 1.74 billion euros, down 14.5% organically. The company said: "Under current assumptions of the impact of Covid-19, we are confirming our guidance of an organic decline in Profit from Recurring Operations for full-year FY20 of c. -20%."

Schneider Electric, an electrical equipment manufacturer, announced that 1Q revenue dropped 7.6% on year (-6.4% organic growth) to 5.83 billion euros. The company added: "Given the fact that a large part of the world is under some form of partial or complete lockdown at the moment, the Group expects Q2 2020 and therefore H1 2020 to be significantly impacted."

Dassault Systemes, a software developer, posted 1Q adjusted EPS grew 9% on year to 0.95 euro on adjusted revenue of 1.14 billion euros, up 19% (+17% in constant currencies). The company said it is targeting stable year-on-year adjusted EPS of 3.65 - 3.72 euros for the full-year.

Air France-KLM, an airline company, was downgraded to "underweight" from "equalweight" at Morgan Stanley.

#BENELUX#

Just Eat Takeaway, online food delivery service provider, announced the launch of a capital increase of 400 million new shares and a concurrent offering of 300 million euros convertible bonds. The company said it intends to use the net proceeds to partially pay down revolving credit facilities, for general corporate purposes as well as to provide financial flexibility.

#SWITZERLAND#

Credit Suisse, a banking group, announced that 1Q net income surged 75% on year to 1.31 billion Swiss franc on net revenue of 5.78 billion Swiss franc, up 7%. Also, provision for credit losses jumped to 568 million Swiss franc from 81 million Swiss franc in the prior-year period, while CET1 ratio dropped to 12.1% from 12.6%. Regarding the outlook, the bank said: "The scale of the adverse economic impact of the COVID19 crisis is still difficult to assess and we would caution that we may also see further reserve build and

impairments in the coming quarters."

LafargeHolcim, a building materials supplier, was upgraded to "buy" from "hold" at HSBC.

#SCANDINAVIA#

Volvo, a Swedish vehicle manufacturer, reported that 1Q net income slumped 55.7% on year to 4.77 billion Swedish krona and operating income declined 47.9% to 7.37 billion Swedish krona on net sales of 91.45 billion Swedish krona, down 14.7%. The company stated: "The first quarter of 2020 was impacted by the measures in society to stop the spread of the COVID-19 pandemic. These began affecting our operations in China in February and had a severe impact on the Group as of mid-March."

Swedbank, a banking group, said it swung to a 1Q net loss of 1.69 billion Swedish krona from a net profit of 5.27 billion Swedish krona in the prior-year period, citing Swedish FSA's administrative fine and higher provisions for expected credit impairments related to the effects of Covid-19 and drop in oil prices. Also, net interest income increased 4% on year to 6.69 billion Swedish krona.

EX-DIVIDEND

Aviva:21.4p, Legal & General:12.64p, Rolls-Royce:7.1p, Sika: SF2.3