EU indices slightly up | TA focus on Reckitt Benckiser

INDICES

Yesterday, European stocks were broadly lower. The Stoxx Europe 600 Index declined 0.31%, France's CAC 40 fell 0.34% and the U.K.'s FTSE 100 was down 0.31%. Germany's DAX 30 ended flat.

EUROPE ADVANCE/DECLINE

57% of STOXX 600 constituents traded lower or unchanged yesterday.

46% of the shares trade above their 20D MA vs 48% Friday (below the 20D moving average).

49% of the shares trade above their 200D MA vs 49% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.34pt to 25.24, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial, Basic Resource

3mths relative low: Telecom., Media, Travel & Leisure

Europe Best 3 sectors

energy, real estate, banks

Europe worst 3 sectors

technology, telecommunications, health care

INTEREST RATE

The 10yr Bund yield rose 3bps to -0.45% (above its 20D MA). The 2yr-10yr yield spread rose 3bps to -17bps (above its 20D MA).

ECONOMIC DATA

UK 11:00: Jul CBI Distributive Trades, exp.: -37

MORNING TRADING

In Asian trading hours, EUR/USD sank back to 1.1726, and GBP/USD broke above 1.1700 and GBP/USD declined to 1.2852. AUD/USD marked a high of 0.7177 before pulling back to 0.7128. USD/JPY rebounded up to 105.57.

Spot gold posted a sharp retreat touching a low of $1.932 an ounce. Spot silver tested the support at $24.00 an ounce.

#UK - IRELAND#

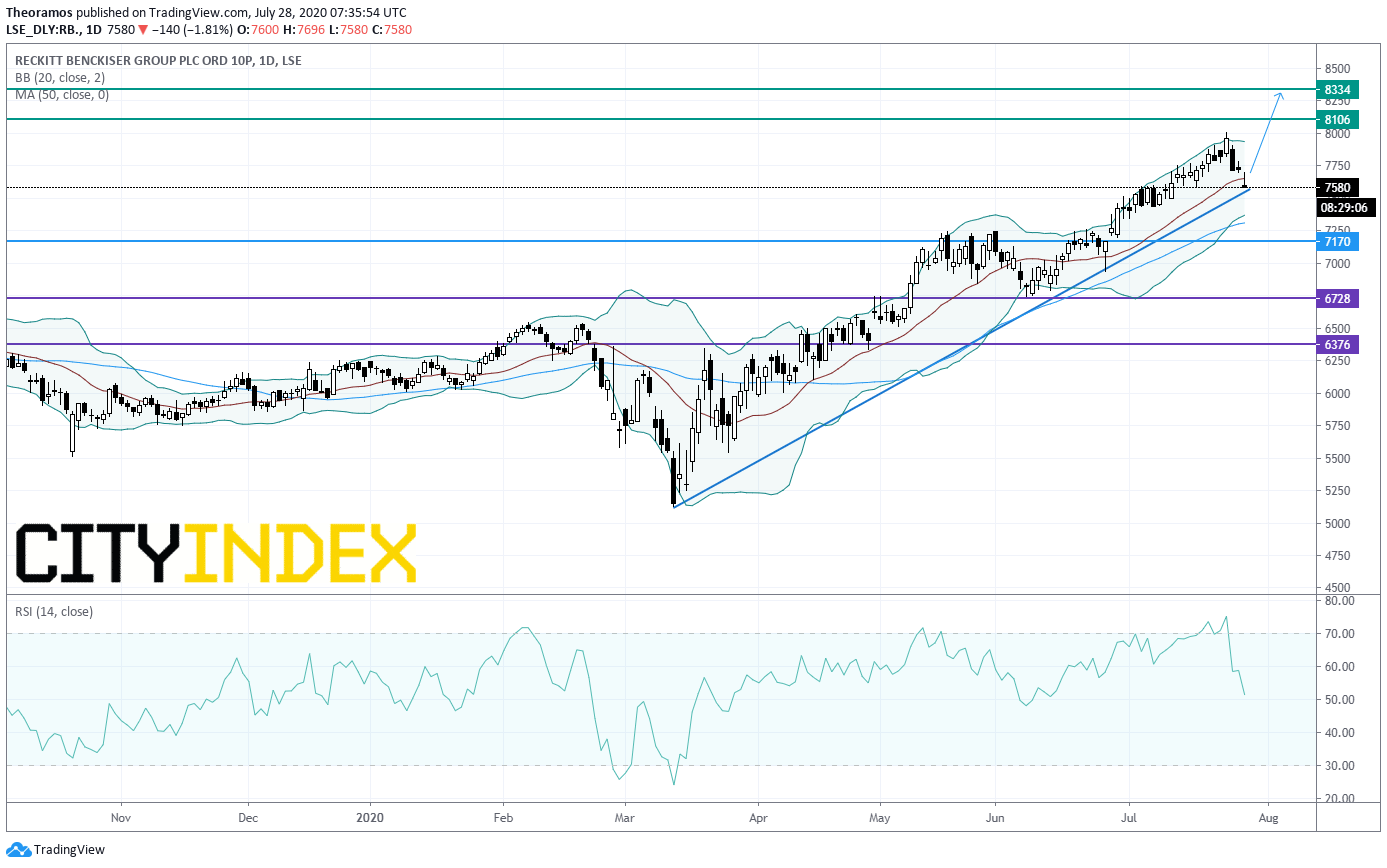

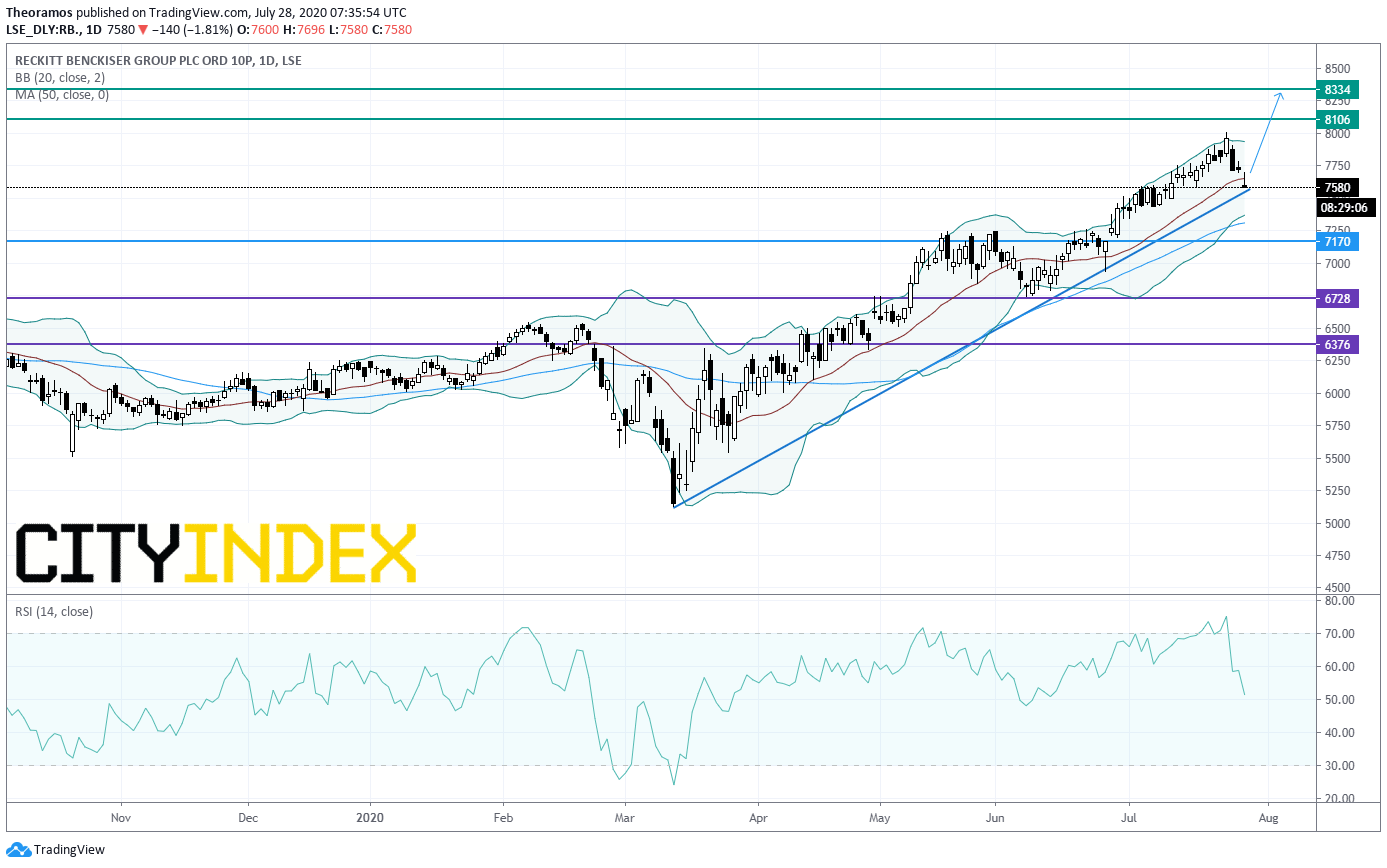

Reckitt Benckiser, which produces household and food products, reported first-half results: "Net revenues were 6,911 million pounds (2019: 6,240 million pounds) with LFL (like-for-like) net revenue growth of 11.9%, (...) a tailwind from COVID-19 effects of around 9-10%, (...) adjusted operating profits were up 15.0% on a reported basis, at 1,696 million pounds (2019: 1,475 million pounds) (...) Adjusted diluted earnings per share in the first half were 166.5 pence (2019: 145.4 pence), up 14.5%. (...) The Board of Directors has declared an interim dividend of 73.0 pence (H1 2019: 73.0 pence), (...) 2020 performance now expected to be better than April expectations, although the outlook for the balance of 2020 remains uncertain."

From a daily point of view, the share price is supported by a rising trend line drawn since March. The stock trades above its rising 50DMA. Above 7170p, the targets are set at the previous all-time high at 8106p, and 8334p in extension. Alternatively, a break of 7170p would call for a reversal trend.

Source: GAIN Capital, TradingView

St. James's Place, a wealth management group, posted first-half results: "The Underlying cash result, which is a key metric that provides a good indicator of underlying performance and the impact of our investment programmes, was 114.4 million pounds (six months to 30 June 2019: 125.1 million pounds, year to 31 December 2019: 273.1 million pounds). (...) Group funds under management of 115.7 billion pounds (31 December 2019: 117.0 billion pounds)."

Fresnillo Plc, a miner, announced first-half results: " Profit for the period of 56.5 million U.S. dollars, down 20.3%, virtually all as a result of the adverse effect of the 21.9% devaluation of the MXN vs USD on deferred taxes (non-cash item) (...) Adjusted EPS of 11.8 U.S. cents per share, up 40.5% (...) Interim dividend of 16.9 million U.S. dollar (2.3 U.S. cents per share)."

#FRANCE#

Peugeot, a French car maker, reported first-half net income plunged to 595 million euros from 1.83 billion euros in the prior-year period on revenue of 25.12 billion euros, down 34.5% on year. The Company said: "In 2020, the Group anticipates a decrease by 25% of the automotive market in Europe, by 30% in Russia and Latin America, and by 10% in China. (...) Groupe PSA has set the target to deliver over 4.5% Automotive adjusted operating margin on average for the period 2019-2021."

Carrefour, Kering : 1H results expected

#SPAIN#

Aena 1H results expected

#BENELUX#

ING Groep, a Dutch bank, said it will book a goodwill impairment of about 300 million euros in the second quarter, citing "the negative developments in the macro-economic outlook for the relevant business units in the context of the Covid-19 pandemic".

#ITALY#

STMicroelectronics, which makes semiconductor integrated circuits, announced plans to sell 1.5 billion dollars worth of bonds convertible into shares, saying it will use the proceeds for general corporate purposes including early redemption of the 2022 convertibles.

#SCANDINAVIA#

YIT Oyj, a Finnish construction company, announced second-quarter results: "In spite of prevailing uncertainty and demand volatility caused by the coronavirus pandemic, YITs operations in the second quarter performed well without major disturbances. The Groups adjusted operating profit decreased to 5 million euros (28 million euros in the prior-year period), negatively impacted by financial settlements of 17 million euros in the Business premises segment. The rest of our businesses performed according to our expectations."

Yesterday, European stocks were broadly lower. The Stoxx Europe 600 Index declined 0.31%, France's CAC 40 fell 0.34% and the U.K.'s FTSE 100 was down 0.31%. Germany's DAX 30 ended flat.

EUROPE ADVANCE/DECLINE

57% of STOXX 600 constituents traded lower or unchanged yesterday.

46% of the shares trade above their 20D MA vs 48% Friday (below the 20D moving average).

49% of the shares trade above their 200D MA vs 49% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.34pt to 25.24, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial, Basic Resource

3mths relative low: Telecom., Media, Travel & Leisure

Europe Best 3 sectors

energy, real estate, banks

Europe worst 3 sectors

technology, telecommunications, health care

INTEREST RATE

The 10yr Bund yield rose 3bps to -0.45% (above its 20D MA). The 2yr-10yr yield spread rose 3bps to -17bps (above its 20D MA).

ECONOMIC DATA

UK 11:00: Jul CBI Distributive Trades, exp.: -37

MORNING TRADING

In Asian trading hours, EUR/USD sank back to 1.1726, and GBP/USD broke above 1.1700 and GBP/USD declined to 1.2852. AUD/USD marked a high of 0.7177 before pulling back to 0.7128. USD/JPY rebounded up to 105.57.

Spot gold posted a sharp retreat touching a low of $1.932 an ounce. Spot silver tested the support at $24.00 an ounce.

#UK - IRELAND#

Reckitt Benckiser, which produces household and food products, reported first-half results: "Net revenues were 6,911 million pounds (2019: 6,240 million pounds) with LFL (like-for-like) net revenue growth of 11.9%, (...) a tailwind from COVID-19 effects of around 9-10%, (...) adjusted operating profits were up 15.0% on a reported basis, at 1,696 million pounds (2019: 1,475 million pounds) (...) Adjusted diluted earnings per share in the first half were 166.5 pence (2019: 145.4 pence), up 14.5%. (...) The Board of Directors has declared an interim dividend of 73.0 pence (H1 2019: 73.0 pence), (...) 2020 performance now expected to be better than April expectations, although the outlook for the balance of 2020 remains uncertain."

From a daily point of view, the share price is supported by a rising trend line drawn since March. The stock trades above its rising 50DMA. Above 7170p, the targets are set at the previous all-time high at 8106p, and 8334p in extension. Alternatively, a break of 7170p would call for a reversal trend.

Source: GAIN Capital, TradingView

St. James's Place, a wealth management group, posted first-half results: "The Underlying cash result, which is a key metric that provides a good indicator of underlying performance and the impact of our investment programmes, was 114.4 million pounds (six months to 30 June 2019: 125.1 million pounds, year to 31 December 2019: 273.1 million pounds). (...) Group funds under management of 115.7 billion pounds (31 December 2019: 117.0 billion pounds)."

Fresnillo Plc, a miner, announced first-half results: " Profit for the period of 56.5 million U.S. dollars, down 20.3%, virtually all as a result of the adverse effect of the 21.9% devaluation of the MXN vs USD on deferred taxes (non-cash item) (...) Adjusted EPS of 11.8 U.S. cents per share, up 40.5% (...) Interim dividend of 16.9 million U.S. dollar (2.3 U.S. cents per share)."

#FRANCE#

Peugeot, a French car maker, reported first-half net income plunged to 595 million euros from 1.83 billion euros in the prior-year period on revenue of 25.12 billion euros, down 34.5% on year. The Company said: "In 2020, the Group anticipates a decrease by 25% of the automotive market in Europe, by 30% in Russia and Latin America, and by 10% in China. (...) Groupe PSA has set the target to deliver over 4.5% Automotive adjusted operating margin on average for the period 2019-2021."

Carrefour, Kering : 1H results expected

#SPAIN#

Aena 1H results expected

#BENELUX#

ING Groep, a Dutch bank, said it will book a goodwill impairment of about 300 million euros in the second quarter, citing "the negative developments in the macro-economic outlook for the relevant business units in the context of the Covid-19 pandemic".

#ITALY#

STMicroelectronics, which makes semiconductor integrated circuits, announced plans to sell 1.5 billion dollars worth of bonds convertible into shares, saying it will use the proceeds for general corporate purposes including early redemption of the 2022 convertibles.

#SCANDINAVIA#

YIT Oyj, a Finnish construction company, announced second-quarter results: "In spite of prevailing uncertainty and demand volatility caused by the coronavirus pandemic, YITs operations in the second quarter performed well without major disturbances. The Groups adjusted operating profit decreased to 5 million euros (28 million euros in the prior-year period), negatively impacted by financial settlements of 17 million euros in the Business premises segment. The rest of our businesses performed according to our expectations."

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM