EU indices slightly up | TA focus on Hugo Boss

INDICES

Yesterday, European stocks recorded beefy gains, with the Stoxx Europe 600 Index advancing 2.9%. Germany's DAX 30 surged 3.4%, France's CAC 40 rose 2.8%, and the U.K.'s FTSE 100 jumped 2.9%.

EUROPE ADVANCE/DECLINE

97% of STOXX 600 constituents traded higher yesterday.

73% of the shares trade above their 20D MA vs 44% Monday (below the 20D moving average).

38% of the shares trade above their 200D MA vs 32% Monday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.32pts to 36.1, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

construction & materials, banks, telecommunications

Europe worst 3 sectors

travel & leisure, real estate, health care

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.45% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: May Core Inflation Rate MoM, exp.: 0.1%

UK 07:00: May PPI Output YoY, exp.: -0.7%

UK 07:00: May PPI Input YoY, exp.: -9.8%

UK 07:00: May PPI Input MoM, exp.: -5.1%

UK 07:00: May PPI Output MoM, exp.: -0.7%

UK 07:00: May Core Inflation Rate YoY, exp.: 1.4%

UK 07:00: May Inflation Rate MoM, exp.: -0.2%

UK 07:00: May Inflation Rate YoY, exp.: 0.8%

UK 07:00: May PPI Core Output YoY, exp.: 0.6%

UK 07:00: May PPI Core Output MoM, exp.: -0.1%

UK 07:00: May Retail Price Idx MoM, exp.: 0%

UK 07:00: May Retail Price Idx YoY, exp.: 1.5%

EC 10:00: May Inflation Rate MoM final, exp.: 0.3%

EC 10:00: May Core Inflation Rate YoY final, exp.: 0.9%

EC 10:00: May Inflation Rate YoY final, exp.: 0.3%

EC 10:00: Apr Construction Output YoY, exp.: -15.4%

EC 10:00: ECB Mersch speech

GE 10:40: 10-Year Bund auction, exp.: -0.47%

EC 12:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.1259 while GBP/USD dropped to 1.2546. USD/JPY fell to 107.22. This morning, government data showed that Japan's exports decline 28.3% on year in May (-26.1% expected) and imports sank 26.2% (-20.4% expected),

Spot gold eased to $1,724 an ounce.

#UK - IRELAND#

Berkeley, a property developer, posted full-year results: "Revenue of £1,920.4 million in the year (2019: £2,957.4 million) arose primarily from the sale of new homes in London and the South East. (...) Pre-tax return on equity for the year is 16.6%, compared to 27.9% last year reflecting the return of profitability to normal levels. Basic earnings per share has decreased by 32.5% from 481.1 pence to 324.9 pence. (...) Berkeley starts the coming year from a position of relative strength, with net cash of £1,138.9 million, forward sales of £1.9 billion and an estimated £6.4 billion of gross profit in our land holdings."

Kingfisher, a retailer, announced that full-year post-tax profit plunged 95.9% on year to 8 million pounds, citing 441 million exceptional charges related to store and Russia impairments. Also, Revenue was down 1.5% (-1.5% like-for-like) to 11.51 billion pounds. The company said "no specific guidance provided for FY 20/21 given the uncertainty around COVID-19".

BHP Group, a multinational mining group, announced the appointment of David Lamont, currently CFO of ASX-listed global biotech company CSL, as new CFO, effective December 1.

Serco Group, a provider of public services, issued a 1H trading update: "We expect revenue of around £1.8bn in the first half of 2020, around 23% higher than the £1.5bn reported in the first half of 2019. (...) We expect first half UTP (Underlying trading profit) of £75m-£80m, about 50% more than the £51m reported last year."

William Hill, a bookmaker, announced it has raised 224 million pounds through the placing of new ordinary shares of 10p each.

WPP, an advertising and public relations company, was upgraded to "buy" from "neutral" at Goldman Sachs.

#GERMANY#

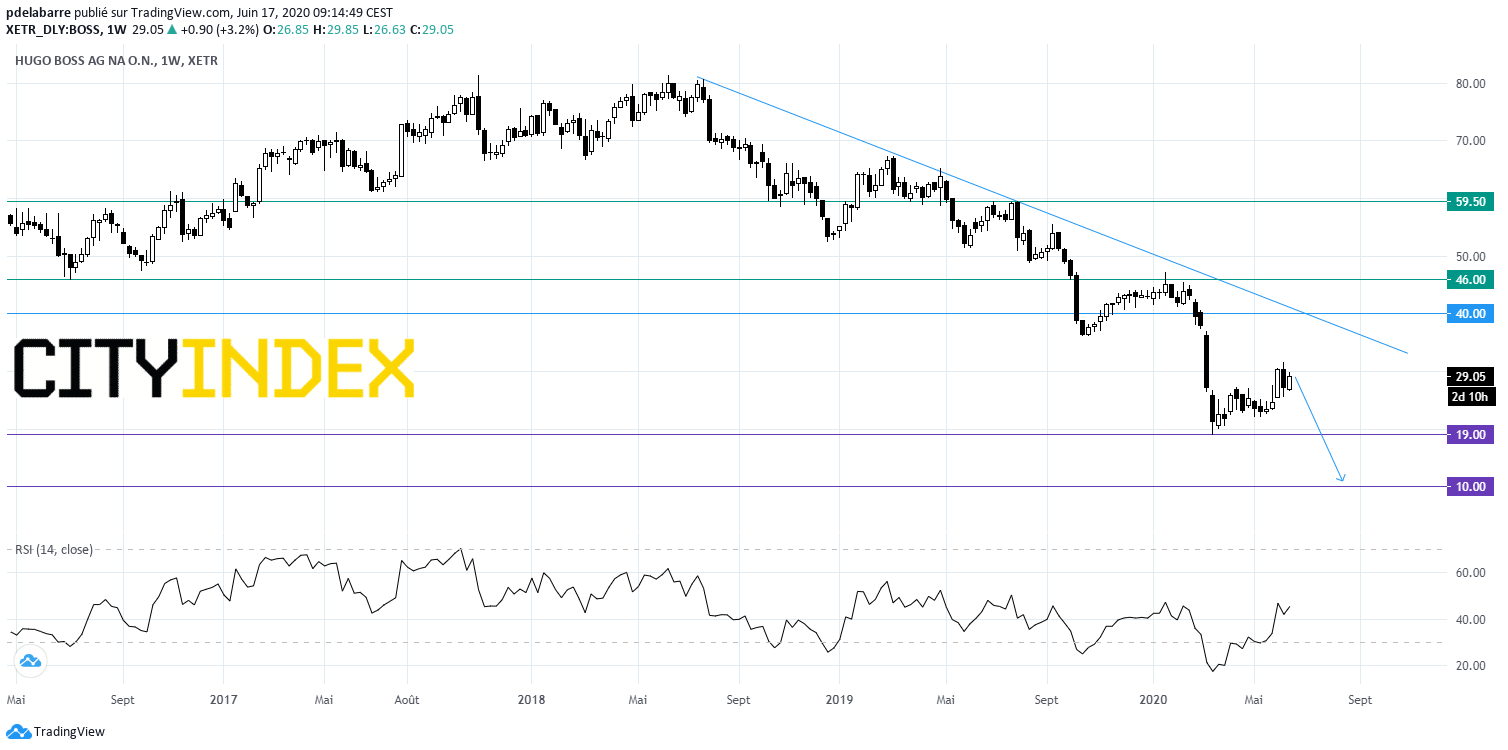

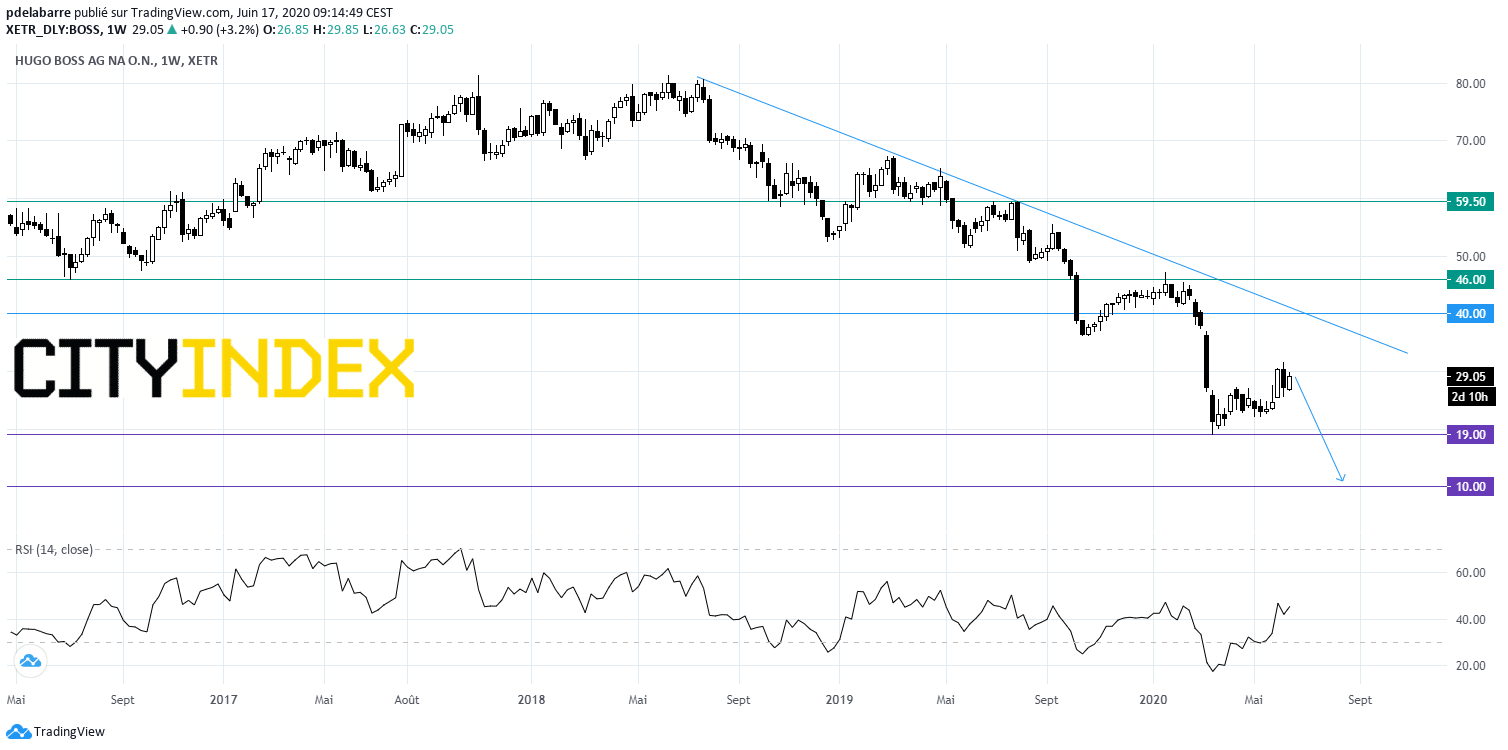

Hugo Boss, a luxury fashion house, announced the appointment of Daniel Grieder, former CEO of Tommy Hilfiger Global and PVH Europe, as future CEO for period of five years starting on June 1, 2021. From a chartist point of view, the share is capped by a declining trend line drawn from 2018 and continues to develop a process of lower tops and lower bottoms. Look for a re-test of 19 and even 10 in extension.

Source: GAIN Capital, TradingView

RWE, an electricity and gas supplier, was upgraded to "buy" from "hold" at HSBC.

#FRANCE#

Icade, a real estate investment trust, said easyHotel has signed an 12-year off-plan lease for a 180-room hotel covering 4,000 square metre to be housed in its soon-to-be-built JUMP building, located in Paris. Financial terms were not disclosed.

BNP Paribas, a banking group, was downgraded to "sell" from "hold" at Societe Generale.

#SPAIN#

Iberdrola, a Spanish electric utility group, announced that it has agreed to acquire Australian renewable energy company Infigen for 0.86 Australian dollar per share, implying a diluted equity value of 841 million Australian dollars.

#BENELUX#

Colruyt, a retail group, announced that full-year net income rose 12.2% on year to 431 million euros and EBIT grew 5.4% to 511 million euros on revenue of 9.58 billion euros, up 1.6% (+1.7% on a comparable basis). The company proposed a gross dividend of 1.35 euros per share.

#ITALY#

Recordati, a pharmaceutical group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#SWITZERLAND#

Novartis, a pharmaceutical group, said the U.S. Food and Drug Administration has approved its Cosentyx for the treatment of active non-radiographic axial spondyloarthritis.

#SCANDINAVIA - DENMARK#

Telia, a Swedish telecommunications group, confirmed that it is in talks regarding a potential sale of its indirect stake in Turkcell to the Turkish Wealth Fund for 530 million dollars.

Pandora, a Danish jewellery retailer, was upgraded to "buy" from "hold" at HSBC.

EX-DIVIDEND

Swedbank: SEK8.8

Yesterday, European stocks recorded beefy gains, with the Stoxx Europe 600 Index advancing 2.9%. Germany's DAX 30 surged 3.4%, France's CAC 40 rose 2.8%, and the U.K.'s FTSE 100 jumped 2.9%.

EUROPE ADVANCE/DECLINE

97% of STOXX 600 constituents traded higher yesterday.

73% of the shares trade above their 20D MA vs 44% Monday (below the 20D moving average).

38% of the shares trade above their 200D MA vs 32% Monday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.32pts to 36.1, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

construction & materials, banks, telecommunications

Europe worst 3 sectors

travel & leisure, real estate, health care

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.45% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: May Core Inflation Rate MoM, exp.: 0.1%

UK 07:00: May PPI Output YoY, exp.: -0.7%

UK 07:00: May PPI Input YoY, exp.: -9.8%

UK 07:00: May PPI Input MoM, exp.: -5.1%

UK 07:00: May PPI Output MoM, exp.: -0.7%

UK 07:00: May Core Inflation Rate YoY, exp.: 1.4%

UK 07:00: May Inflation Rate MoM, exp.: -0.2%

UK 07:00: May Inflation Rate YoY, exp.: 0.8%

UK 07:00: May PPI Core Output YoY, exp.: 0.6%

UK 07:00: May PPI Core Output MoM, exp.: -0.1%

UK 07:00: May Retail Price Idx MoM, exp.: 0%

UK 07:00: May Retail Price Idx YoY, exp.: 1.5%

EC 10:00: May Inflation Rate MoM final, exp.: 0.3%

EC 10:00: May Core Inflation Rate YoY final, exp.: 0.9%

EC 10:00: May Inflation Rate YoY final, exp.: 0.3%

EC 10:00: Apr Construction Output YoY, exp.: -15.4%

EC 10:00: ECB Mersch speech

GE 10:40: 10-Year Bund auction, exp.: -0.47%

EC 12:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.1259 while GBP/USD dropped to 1.2546. USD/JPY fell to 107.22. This morning, government data showed that Japan's exports decline 28.3% on year in May (-26.1% expected) and imports sank 26.2% (-20.4% expected),

Spot gold eased to $1,724 an ounce.

#UK - IRELAND#

Berkeley, a property developer, posted full-year results: "Revenue of £1,920.4 million in the year (2019: £2,957.4 million) arose primarily from the sale of new homes in London and the South East. (...) Pre-tax return on equity for the year is 16.6%, compared to 27.9% last year reflecting the return of profitability to normal levels. Basic earnings per share has decreased by 32.5% from 481.1 pence to 324.9 pence. (...) Berkeley starts the coming year from a position of relative strength, with net cash of £1,138.9 million, forward sales of £1.9 billion and an estimated £6.4 billion of gross profit in our land holdings."

Kingfisher, a retailer, announced that full-year post-tax profit plunged 95.9% on year to 8 million pounds, citing 441 million exceptional charges related to store and Russia impairments. Also, Revenue was down 1.5% (-1.5% like-for-like) to 11.51 billion pounds. The company said "no specific guidance provided for FY 20/21 given the uncertainty around COVID-19".

BHP Group, a multinational mining group, announced the appointment of David Lamont, currently CFO of ASX-listed global biotech company CSL, as new CFO, effective December 1.

Serco Group, a provider of public services, issued a 1H trading update: "We expect revenue of around £1.8bn in the first half of 2020, around 23% higher than the £1.5bn reported in the first half of 2019. (...) We expect first half UTP (Underlying trading profit) of £75m-£80m, about 50% more than the £51m reported last year."

William Hill, a bookmaker, announced it has raised 224 million pounds through the placing of new ordinary shares of 10p each.

WPP, an advertising and public relations company, was upgraded to "buy" from "neutral" at Goldman Sachs.

#GERMANY#

Hugo Boss, a luxury fashion house, announced the appointment of Daniel Grieder, former CEO of Tommy Hilfiger Global and PVH Europe, as future CEO for period of five years starting on June 1, 2021. From a chartist point of view, the share is capped by a declining trend line drawn from 2018 and continues to develop a process of lower tops and lower bottoms. Look for a re-test of 19 and even 10 in extension.

Source: GAIN Capital, TradingView

RWE, an electricity and gas supplier, was upgraded to "buy" from "hold" at HSBC.

#FRANCE#

Icade, a real estate investment trust, said easyHotel has signed an 12-year off-plan lease for a 180-room hotel covering 4,000 square metre to be housed in its soon-to-be-built JUMP building, located in Paris. Financial terms were not disclosed.

BNP Paribas, a banking group, was downgraded to "sell" from "hold" at Societe Generale.

#SPAIN#

Iberdrola, a Spanish electric utility group, announced that it has agreed to acquire Australian renewable energy company Infigen for 0.86 Australian dollar per share, implying a diluted equity value of 841 million Australian dollars.

#BENELUX#

Colruyt, a retail group, announced that full-year net income rose 12.2% on year to 431 million euros and EBIT grew 5.4% to 511 million euros on revenue of 9.58 billion euros, up 1.6% (+1.7% on a comparable basis). The company proposed a gross dividend of 1.35 euros per share.

#ITALY#

Recordati, a pharmaceutical group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#SWITZERLAND#

Novartis, a pharmaceutical group, said the U.S. Food and Drug Administration has approved its Cosentyx for the treatment of active non-radiographic axial spondyloarthritis.

#SCANDINAVIA - DENMARK#

Telia, a Swedish telecommunications group, confirmed that it is in talks regarding a potential sale of its indirect stake in Turkcell to the Turkish Wealth Fund for 530 million dollars.

Pandora, a Danish jewellery retailer, was upgraded to "buy" from "hold" at HSBC.

EX-DIVIDEND

Swedbank: SEK8.8

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM