EU indices slightly positive this morning | TA focus on LafargeHolcim

INDICES

Fridday, European stocks remained on the upside, with the Stoxx Europe 600 Index adding 0.9%. Germany's DAX 30 gained 1.4% and France's CAC 40 was up 1.1%. The U.K.'s FTSE 100 was closed for a bank holiday.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded higher Friday.

76% of the shares trade above their 20D MA vs 70% Thursday (below the 20D moving average).

25% of the shares trade above their 200D MA vs 24% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.77pts to 29.66, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

automobiles & parts, construction & materials, industrial goods & services

Europe worst 3 sectors

insurance, health care, retail

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.55% (below its 20D MA). The 2yr-10yr yield spread fell 3bps to -24bps (below its 20D MA).

ECONOMIC DATA

FR 14:00: 6-Mth BTF auction, exp.: -0.46%

FR 14:00: 12-Mth BTF auction, exp.: -0.46%

FR 14:00: 3-Mth BTF auction, exp.: -0.48%

MORNING TRADING

In Asian trading hours, EUR/USD rose to 1.0848 and GBP/USD climbed to 1.2428.USD/JPY advanced to 106.81.

Spot gold rebounded to $1,709 an ounce.

#UK - IRELAND#

Polymetal International, a precious metals miner, announced that it has agreed to sell North Kaluga property to North Kaluga Mining for a total transaction value of 27 million dollars.

Diploma, a specialised technical products and services provider, posted 1Q results: "Group revenues increased by 9% to £283.6m (2019: £260.4m). Adjusted operating profit increased by 9% to £49.9m (2019: £45.6m). (...) Adjusted profit before tax increased by 6% to £48.4m (2019: £45.5m) and adjusted earnings per share (EPS) also increased by 6% to 32.3p (2019: 30.5p). (...) However, in light of the COVID-19 pandemic, the Directors have decided to suspend the interim dividend (2019: 8.5p per share)."

Victrex, high performance polymer solutions provided, released 1H results: "Group revenue was £151.5m, 4% up on the prior year (H1 2019: £145.7m). (...) Underlying PBT of £52.0m was down 1% on the prior year (H1 2019: £52.4m). (...) Adjusted earnings per share of 50.0p was 7% down (H1 2019: 53.7p per share). (...) Against an uncertain Outlook, the Board believes it is in the best interests of all our stakeholders to defer an interim dividend at this stage."

Next, a retail group, was downgraded to "neutral" from "buy" at Goldman Sachs.

#GERMANY#

Henkel, a chemical and consumer goods company, announced that 1Q revenue dropped 0.8% on year (-0.9% organic growth) to 4.93 billion euros. The company said: "As the dynamic development of the COVID-19 pandemic impacts the global economy, a reliable and realistic evaluation of the future business performance of Henkel is currently not possible."

Carl Zeiss Meditec, a medical technology company, reported that 1H EBIT slid 7.2% on year to 103 million euros on revenue of 715 million euros, up 7.2% (+5.8% currency adjusted).

LEG Immobilien, a property group, posted 1Q funds from operations (FFO I) increased 10.7% on year to 94 million euros and EBITDA rose 5.5% to 110 million euros on rental income of 154 million euros, up 4.9%. The company confirmed its full-year FF I forecast of 370 - 380 million euros.

#SPAIN#

Amadeus, an IT solutions provider, was upgraded to "buy" from "neutral" at UBS.

#BENELUX#

ArcelorMittal's, a steel producer, credit rating was downgraded to "Ba1", a junk rating" from "Baa3" at Moody's, outlook "Stable". The rating agency said: "The steel industry is a highly cyclical industry with strong exposure to general economic conditions, which Moody's expects to materially worsen this year amid the spreading coronavirus globally, which will dampen activity in many of ArcelorMittal's end-markets."

Groupe Bruxelles Lambert, an investment holding company, was upgraded to "hold" from "sell" at HSBC.

#SWITZERLAND#

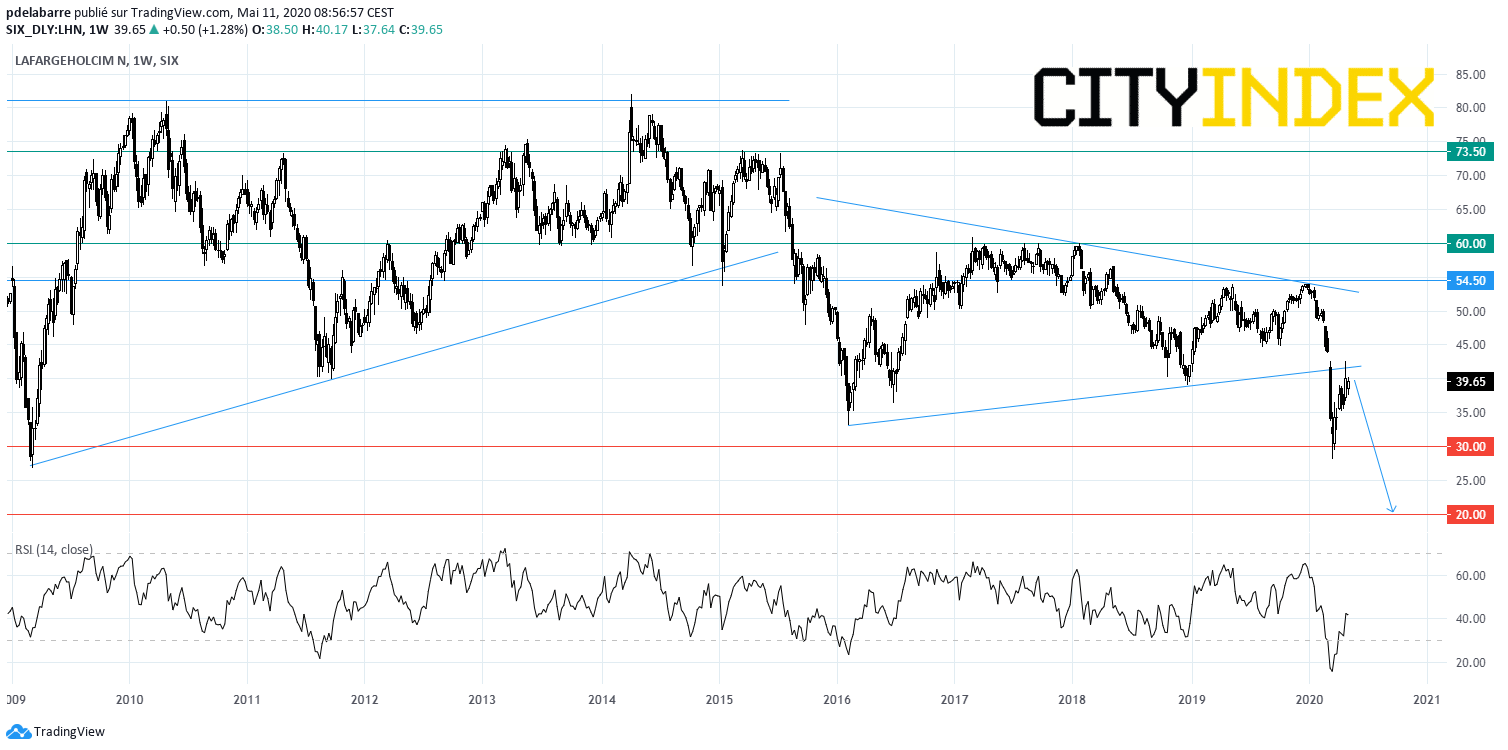

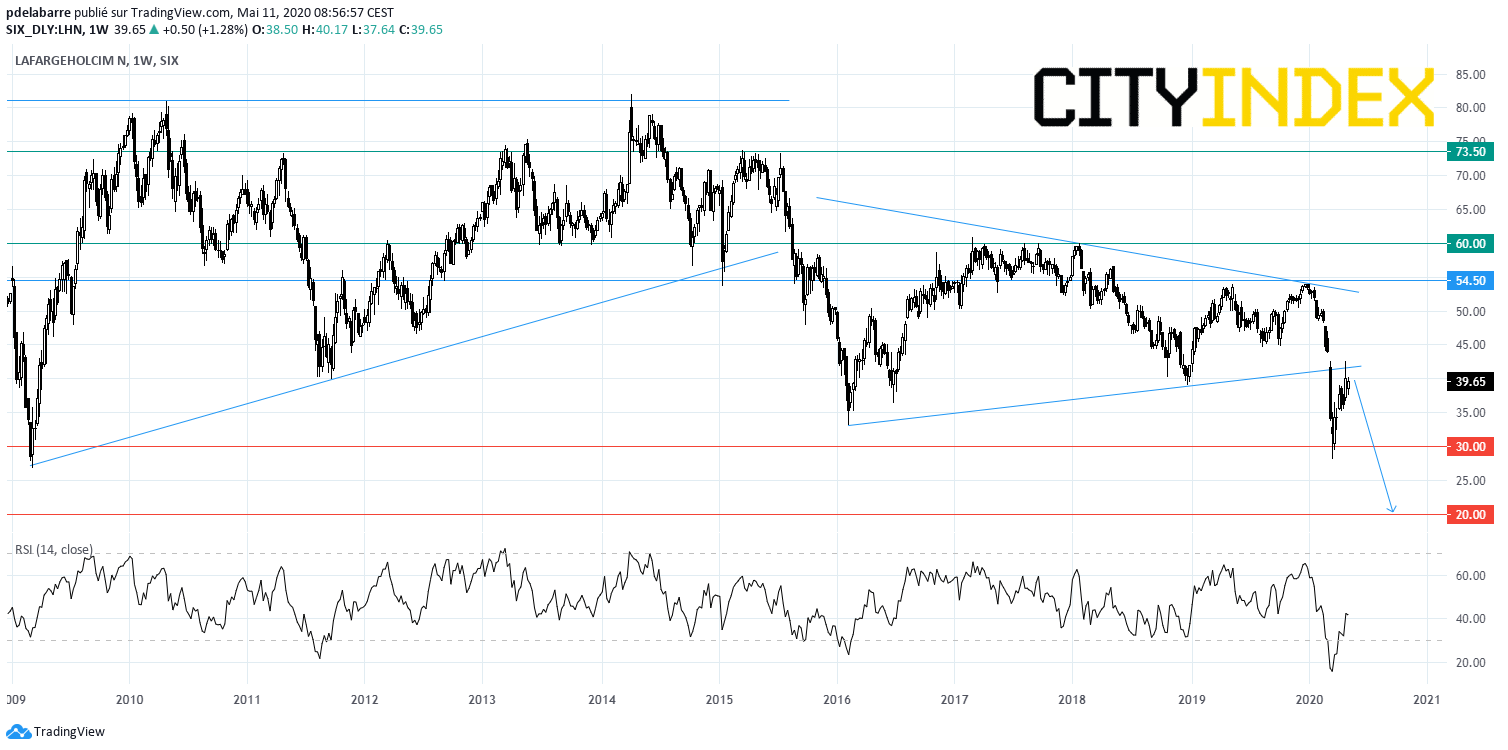

LafargeHolcim, a building materials supplier, reported that its agreement with San Miguel Corp for the sales of its entire 85.7% stake in Holcim Philippines lapsed, as the Philippines Competition Authority did not issue an approval of the transaction within the required time period. From a chartist point of view,a technical recovery has probably been completed due to the lower boundary of a bearish continuation pattern in symmetrical triangle shaped between early 2016 & 2020.

Source: GAIN Capital, TradingView

#SWEDEN#

Hennes & Mauritz, a clothing retailer, was downgraded to "sell" from "neutral" at Goldman Sachs.

EX-DIVIDEND

Air Liquide: E2.7, Coloplast: DKK5

Fridday, European stocks remained on the upside, with the Stoxx Europe 600 Index adding 0.9%. Germany's DAX 30 gained 1.4% and France's CAC 40 was up 1.1%. The U.K.'s FTSE 100 was closed for a bank holiday.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded higher Friday.

76% of the shares trade above their 20D MA vs 70% Thursday (below the 20D moving average).

25% of the shares trade above their 200D MA vs 24% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.77pts to 29.66, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

automobiles & parts, construction & materials, industrial goods & services

Europe worst 3 sectors

insurance, health care, retail

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.55% (below its 20D MA). The 2yr-10yr yield spread fell 3bps to -24bps (below its 20D MA).

ECONOMIC DATA

FR 14:00: 6-Mth BTF auction, exp.: -0.46%

FR 14:00: 12-Mth BTF auction, exp.: -0.46%

FR 14:00: 3-Mth BTF auction, exp.: -0.48%

MORNING TRADING

In Asian trading hours, EUR/USD rose to 1.0848 and GBP/USD climbed to 1.2428.USD/JPY advanced to 106.81.

Spot gold rebounded to $1,709 an ounce.

#UK - IRELAND#

Polymetal International, a precious metals miner, announced that it has agreed to sell North Kaluga property to North Kaluga Mining for a total transaction value of 27 million dollars.

Diploma, a specialised technical products and services provider, posted 1Q results: "Group revenues increased by 9% to £283.6m (2019: £260.4m). Adjusted operating profit increased by 9% to £49.9m (2019: £45.6m). (...) Adjusted profit before tax increased by 6% to £48.4m (2019: £45.5m) and adjusted earnings per share (EPS) also increased by 6% to 32.3p (2019: 30.5p). (...) However, in light of the COVID-19 pandemic, the Directors have decided to suspend the interim dividend (2019: 8.5p per share)."

Victrex, high performance polymer solutions provided, released 1H results: "Group revenue was £151.5m, 4% up on the prior year (H1 2019: £145.7m). (...) Underlying PBT of £52.0m was down 1% on the prior year (H1 2019: £52.4m). (...) Adjusted earnings per share of 50.0p was 7% down (H1 2019: 53.7p per share). (...) Against an uncertain Outlook, the Board believes it is in the best interests of all our stakeholders to defer an interim dividend at this stage."

Next, a retail group, was downgraded to "neutral" from "buy" at Goldman Sachs.

#GERMANY#

Henkel, a chemical and consumer goods company, announced that 1Q revenue dropped 0.8% on year (-0.9% organic growth) to 4.93 billion euros. The company said: "As the dynamic development of the COVID-19 pandemic impacts the global economy, a reliable and realistic evaluation of the future business performance of Henkel is currently not possible."

Carl Zeiss Meditec, a medical technology company, reported that 1H EBIT slid 7.2% on year to 103 million euros on revenue of 715 million euros, up 7.2% (+5.8% currency adjusted).

LEG Immobilien, a property group, posted 1Q funds from operations (FFO I) increased 10.7% on year to 94 million euros and EBITDA rose 5.5% to 110 million euros on rental income of 154 million euros, up 4.9%. The company confirmed its full-year FF I forecast of 370 - 380 million euros.

#SPAIN#

Amadeus, an IT solutions provider, was upgraded to "buy" from "neutral" at UBS.

#BENELUX#

ArcelorMittal's, a steel producer, credit rating was downgraded to "Ba1", a junk rating" from "Baa3" at Moody's, outlook "Stable". The rating agency said: "The steel industry is a highly cyclical industry with strong exposure to general economic conditions, which Moody's expects to materially worsen this year amid the spreading coronavirus globally, which will dampen activity in many of ArcelorMittal's end-markets."

Groupe Bruxelles Lambert, an investment holding company, was upgraded to "hold" from "sell" at HSBC.

#SWITZERLAND#

LafargeHolcim, a building materials supplier, reported that its agreement with San Miguel Corp for the sales of its entire 85.7% stake in Holcim Philippines lapsed, as the Philippines Competition Authority did not issue an approval of the transaction within the required time period. From a chartist point of view,a technical recovery has probably been completed due to the lower boundary of a bearish continuation pattern in symmetrical triangle shaped between early 2016 & 2020.

Source: GAIN Capital, TradingView

#SWEDEN#

Hennes & Mauritz, a clothing retailer, was downgraded to "sell" from "neutral" at Goldman Sachs.

EX-DIVIDEND

Air Liquide: E2.7, Coloplast: DKK5

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM