EU indices slightly down| TA focus on Valeo

INDICES

Yesterday, European stocks closed in positive territory. The Stoxx Europe 600 Index advanced 0.32%. Germany's DAX 30 rose 0.96%, France's CAC 40 added 0.22%, and the U.K.'s FTSE 100 was up 0.13%.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded higher yesterday.

79% of the shares trade above their 20D MA vs 74% Monday (above the 20D moving average).

52% of the shares trade above their 200D MA vs 51% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.72pt to 23.49, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Financial Services, Utilities, Industrial

3mths relative low: Pers. & House. Goods

Europe Best 3 sectors

energy, automobiles & parts, financial services

Europe worst 3 sectors

health care, basic resources, telecommunications

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.46% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -21bps (above its 20D MA).

ECONOMIC DATA

GE 10:40: 30-Year Bund auction, exp.: -0.13%

GE 14:00: Bundesbank Buch speech

EC 16:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD firmed at 1.1542 while GBP/USD eased to 1.2723. USD/JPY fell further to 106.75. AUD/USD climbed to 0.7139. This morning, official data showed that Australia's preliminary retail sales grew 2.4% on month in June (+16.9% on month in May).

Spot gold marked a day-high near $1,866 before easing back to $1,858 an ounce

#UK - IRELAND#

Antofagasta, a mining giant, posted a 2Q production report: "Group copper production in Q2 2020 was 177,700 tonnes, a decrease of 8.4% compared to the previous quarter, (...) Group copper production in the first six months of the year was 371,700 tonnes, in line with expectations and 4.0% lower than in the same period last year. (...) Gold production for the quarter decreased by 29.3% to 46,000 ounces compared with Q1 mainly due to lower grades at Centinela, and for the first six months decreased by 25.5% to 111,100 ounces. (...) Molybdenum production was 3,100 tonnes, some 700 tonnes higher than previous quarter. For the year to date, production was 5,500 tonnes, 14.1% lower than in the same period last year. (...) Group copper production guidance is unchanged at the lower end of the original 725-755,000 tonnes guidance range, on the basis that no COVID-19 related shutdowns are required during the rest of the year."

Fresnillo, a precious metals miner, published a 2Q production report: "Quarterly silver production of 13.6 moz (including Silverstream), up 2.8% vs. 1Q20. (...) First half silver production of 26.8 moz (including Silverstream), down 2.7% vs. 1H19. (...) Quarterly gold production of 184.4 koz down 6.4% vs. 1Q20, (...) Quarterly and first half gold production decreased 16.7% and 11.8% vs. 2Q19 and 1H19 respectively. (...) Despite the uncertainty, 2020 silver production guidance remains in the range of 51 to 56 moz (including Silverstream) while gold production is now expected to be in a range of 785 to 815 koz (previously 815 to 900 koz) as a result of COVID-19 related disruption."

Melrose Industries, an investment company, released a 1H trading statement: "In the Period Group revenue declined by 27% which was reflective of trading in line with expectations until mid-March 2020 followed by a steep decline in the second quarter. (...) The Group was loss-making in the second quarter of this year, but rebounded to be breakeven at the adjusted operating profit level in the month of June as recovery started to take place. This means Melrose is likely to make a small adjusted operating profit in the Period."

#FRANCE#

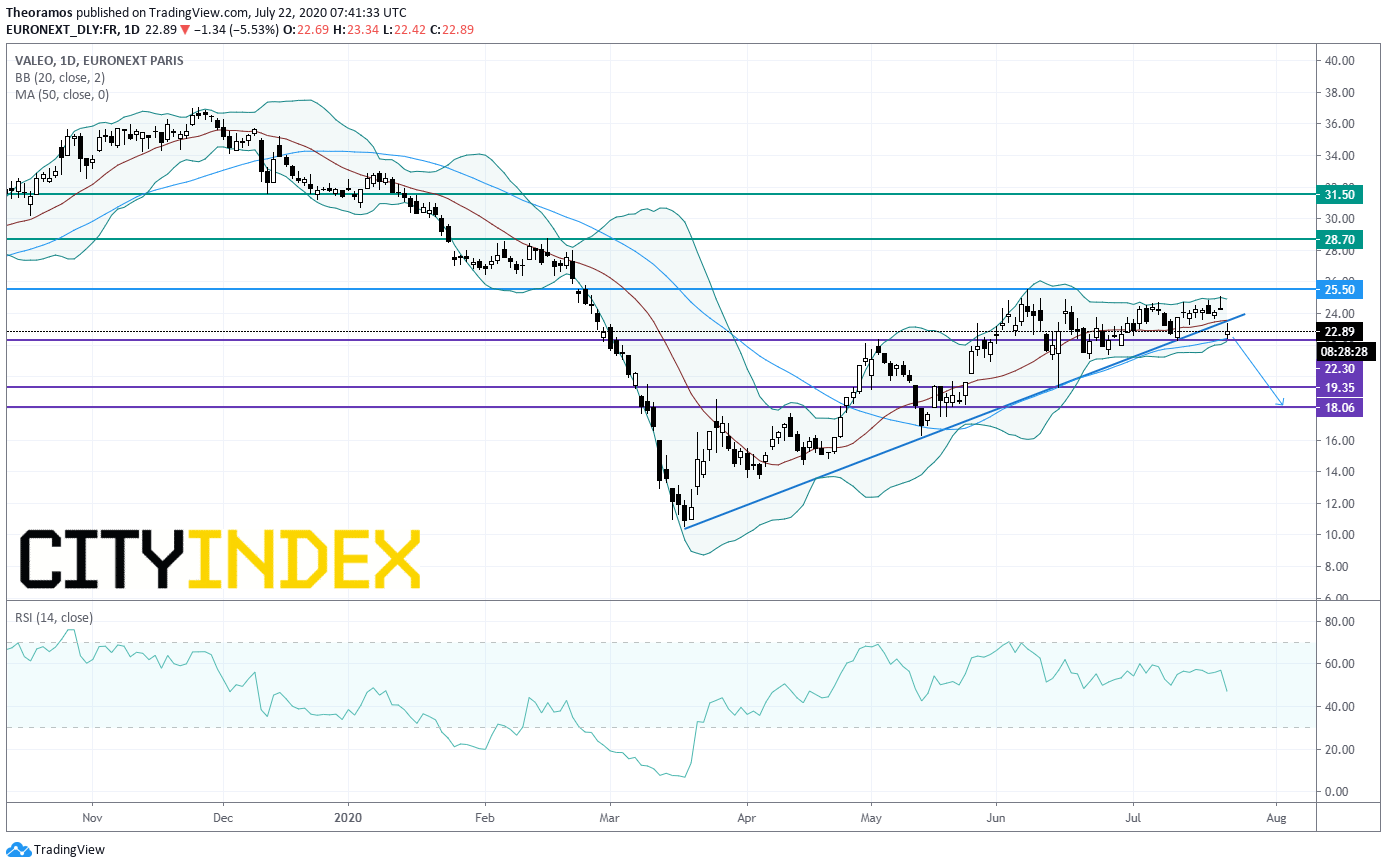

Valeo, an automotive supplier, announced that it swung to a 1H net loss of 1.22 billion euros from a net profit of 162 million euros in the prior-year period, citing 622 million euros one-off charges related to the Covid-19 crisis. Also, EBITDA declined 83% on year to 202 million euros on revenue of 7.06 billion euros, down 28%.

From a chartist point of view, the stock price has broken below a short term rising trendline. The share is trading between its 20 and 50 DMAs, while the RSI lacks momentum around its neutrality area at 50%. As long as the horizontal resistance threshold at 25.5E is not bypassed, the risk of a break below the support threshold at 22.3E will remain high with the horizontal support at 19.35E and the 50% Fibonacci retracement at 18.06E as next bearish targets. Alternatively, a rebound above 25.5E would reinstate a bullish bias.

Orpea, an operator in dependency care, posted 2Q revenue slipped 0.8% on year (-5.5% organic growth) to 923 million euros, while 1H revenue was up 3.5% (-0.9% organic growth) to 1.90 billion euros.

Ingenico, an electronic transactions technology company, is expected to report 1H results.

Ubisoft, a video game company, is expected to release a 1Q trading update.

Ipsen, a pharmaceutical company, was upgraded to "overweight" from "neutral" at JPMorgan.

#SPAIN#

Iberdrola, a Spanish electric utility company, is expected to release 1H results.

#BENELUX#

Akzo Nobel, a chemicals group, announced that 2Q net income dropped 44% on year to 129 million euros and adjusted EBITDA slid 19% to 321 million euros on revenue of 1.99 billion euros, down 19% (-17% at constant currencies).

From a charist point of view, the stock price is supported by a rising trend line since March. The 20DMA has played the role of support and the RSI is

Proximus, a Belgian telecommunications group, was upgraded to "buy" from "hold" at HSBC.

#SWITZERLAND#

ABB, a power and automation company, reported that 2Q net income jumped 398% on year to 319 million dollars, "benefited mainly from the absence of the charge booked in 2019 in relation to the sale of the solar inverters business". Meanwhile, operational EBITA fell 21% to 651 million dollars on revenue of 6.15 billion dollars, down 14% (-10% on a comparable basis).

Lindt & Sprungli, a chocolatier and confectionery company, was downgraded to "underweight" from "equalweight" at Barclays.

#SCANDINAVIA#

Norsk Hydro, an aluminum producer, said 2Q net loss widened to 1.47 billion Norwegian krone while underlying EBIT grew 8% on year to 949 million Norwegian krone on revenue of 30.93 billion Norwegian krone, down 21%.

EX-DIVIDEND

Swiss Life: SF5

Yesterday, European stocks closed in positive territory. The Stoxx Europe 600 Index advanced 0.32%. Germany's DAX 30 rose 0.96%, France's CAC 40 added 0.22%, and the U.K.'s FTSE 100 was up 0.13%.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded higher yesterday.

79% of the shares trade above their 20D MA vs 74% Monday (above the 20D moving average).

52% of the shares trade above their 200D MA vs 51% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.72pt to 23.49, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Financial Services, Utilities, Industrial

3mths relative low: Pers. & House. Goods

Europe Best 3 sectors

energy, automobiles & parts, financial services

Europe worst 3 sectors

health care, basic resources, telecommunications

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.46% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -21bps (above its 20D MA).

ECONOMIC DATA

GE 10:40: 30-Year Bund auction, exp.: -0.13%

GE 14:00: Bundesbank Buch speech

EC 16:00: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD firmed at 1.1542 while GBP/USD eased to 1.2723. USD/JPY fell further to 106.75. AUD/USD climbed to 0.7139. This morning, official data showed that Australia's preliminary retail sales grew 2.4% on month in June (+16.9% on month in May).

Spot gold marked a day-high near $1,866 before easing back to $1,858 an ounce

#UK - IRELAND#

Antofagasta, a mining giant, posted a 2Q production report: "Group copper production in Q2 2020 was 177,700 tonnes, a decrease of 8.4% compared to the previous quarter, (...) Group copper production in the first six months of the year was 371,700 tonnes, in line with expectations and 4.0% lower than in the same period last year. (...) Gold production for the quarter decreased by 29.3% to 46,000 ounces compared with Q1 mainly due to lower grades at Centinela, and for the first six months decreased by 25.5% to 111,100 ounces. (...) Molybdenum production was 3,100 tonnes, some 700 tonnes higher than previous quarter. For the year to date, production was 5,500 tonnes, 14.1% lower than in the same period last year. (...) Group copper production guidance is unchanged at the lower end of the original 725-755,000 tonnes guidance range, on the basis that no COVID-19 related shutdowns are required during the rest of the year."

Fresnillo, a precious metals miner, published a 2Q production report: "Quarterly silver production of 13.6 moz (including Silverstream), up 2.8% vs. 1Q20. (...) First half silver production of 26.8 moz (including Silverstream), down 2.7% vs. 1H19. (...) Quarterly gold production of 184.4 koz down 6.4% vs. 1Q20, (...) Quarterly and first half gold production decreased 16.7% and 11.8% vs. 2Q19 and 1H19 respectively. (...) Despite the uncertainty, 2020 silver production guidance remains in the range of 51 to 56 moz (including Silverstream) while gold production is now expected to be in a range of 785 to 815 koz (previously 815 to 900 koz) as a result of COVID-19 related disruption."

Melrose Industries, an investment company, released a 1H trading statement: "In the Period Group revenue declined by 27% which was reflective of trading in line with expectations until mid-March 2020 followed by a steep decline in the second quarter. (...) The Group was loss-making in the second quarter of this year, but rebounded to be breakeven at the adjusted operating profit level in the month of June as recovery started to take place. This means Melrose is likely to make a small adjusted operating profit in the Period."

#FRANCE#

Valeo, an automotive supplier, announced that it swung to a 1H net loss of 1.22 billion euros from a net profit of 162 million euros in the prior-year period, citing 622 million euros one-off charges related to the Covid-19 crisis. Also, EBITDA declined 83% on year to 202 million euros on revenue of 7.06 billion euros, down 28%.

From a chartist point of view, the stock price has broken below a short term rising trendline. The share is trading between its 20 and 50 DMAs, while the RSI lacks momentum around its neutrality area at 50%. As long as the horizontal resistance threshold at 25.5E is not bypassed, the risk of a break below the support threshold at 22.3E will remain high with the horizontal support at 19.35E and the 50% Fibonacci retracement at 18.06E as next bearish targets. Alternatively, a rebound above 25.5E would reinstate a bullish bias.

Source: GAIN Capital, TradingView

Ingenico, an electronic transactions technology company, is expected to report 1H results.

Ubisoft, a video game company, is expected to release a 1Q trading update.

Ipsen, a pharmaceutical company, was upgraded to "overweight" from "neutral" at JPMorgan.

#SPAIN#

Iberdrola, a Spanish electric utility company, is expected to release 1H results.

#BENELUX#

Akzo Nobel, a chemicals group, announced that 2Q net income dropped 44% on year to 129 million euros and adjusted EBITDA slid 19% to 321 million euros on revenue of 1.99 billion euros, down 19% (-17% at constant currencies).

From a charist point of view, the stock price is supported by a rising trend line since March. The 20DMA has played the role of support and the RSI is

Proximus, a Belgian telecommunications group, was upgraded to "buy" from "hold" at HSBC.

#SWITZERLAND#

ABB, a power and automation company, reported that 2Q net income jumped 398% on year to 319 million dollars, "benefited mainly from the absence of the charge booked in 2019 in relation to the sale of the solar inverters business". Meanwhile, operational EBITA fell 21% to 651 million dollars on revenue of 6.15 billion dollars, down 14% (-10% on a comparable basis).

Lindt & Sprungli, a chocolatier and confectionery company, was downgraded to "underweight" from "equalweight" at Barclays.

#SCANDINAVIA#

Norsk Hydro, an aluminum producer, said 2Q net loss widened to 1.47 billion Norwegian krone while underlying EBIT grew 8% on year to 949 million Norwegian krone on revenue of 30.93 billion Norwegian krone, down 21%.

EX-DIVIDEND

Swiss Life: SF5

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM