EU indices significantly up | this morning TA focus on Airbus

INDICES

Yesterday, European stocks were broadly higher, with the Stoxx Europe 600 Index gaining 1.1%. Both Germany's DAX 30 and the U.K.'s FTSE 100 increased 1.4%, and France's CAC 40 was up 1.5%.

EUROPE ADVANCE/DECLINE

79% of STOXX 600 constituents traded higher yesterday.

70% of the shares trade above their 20D MA vs 59% Wednesday (below the 20D moving average).

24% of the shares trade above their 200D MA vs 22% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.38pts to 32.43, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

retail, basic resources, financial services

Europe worst 3 sectors

health care, automobiles & parts, telecommunications

INTEREST RATE

The 10yr Bund yield rose 7bps to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -21bps (above its 20D MA).

ECONOMIC DATA

FR : Victory in Europe Day

UK : May Day Bank Holiday

GE 07:00: Mar Balance of Trade, exp.: E20.8B

GE 07:00: Mar Balance of Trade s.a, exp.: E21.6B

GE 07:00: Mar Exports MoM s.a, exp.: 1.3%

GE 07:00: Mar Imports MoM s.a, exp.: -1.6%

GE 07:00: Mar Current Account, exp.: E23.7B

EC 09:00: Eurogroup Video Conference

MORNING TRADING

In Asian trading hours, EUR/USD climbed further to 1.0848 and GBP/USD advanced to 1.2401. USD/JPY was little changed at 106.34. This morning, government data showed that Japan's household spending dropped 6.0% on year in March (-6.5% estimated).

Spot gold extended its rally to $1,719 an ounce.

#UK - IRELAND#

U.K. stock market is closed for Early May Bank Holiday.

#GERMANY#

The German Federal Statistical Office reported a trade surplus of 17.4 billion euros in March (18.8 billion euros surplus expected), where exports dropped 11.8% on month (-5.0% expected) and imports slid 5.1% (-4.0% expected).

#FRANCE#

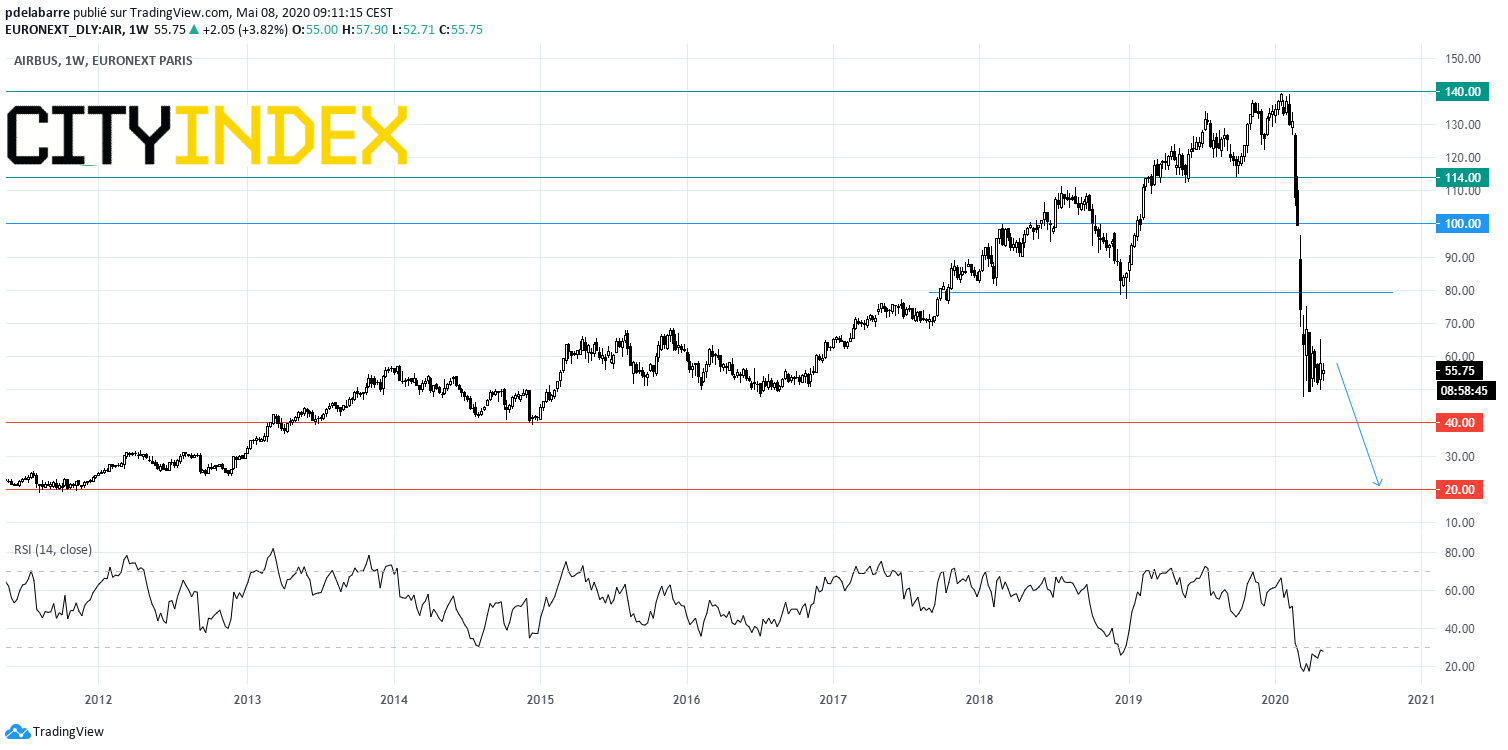

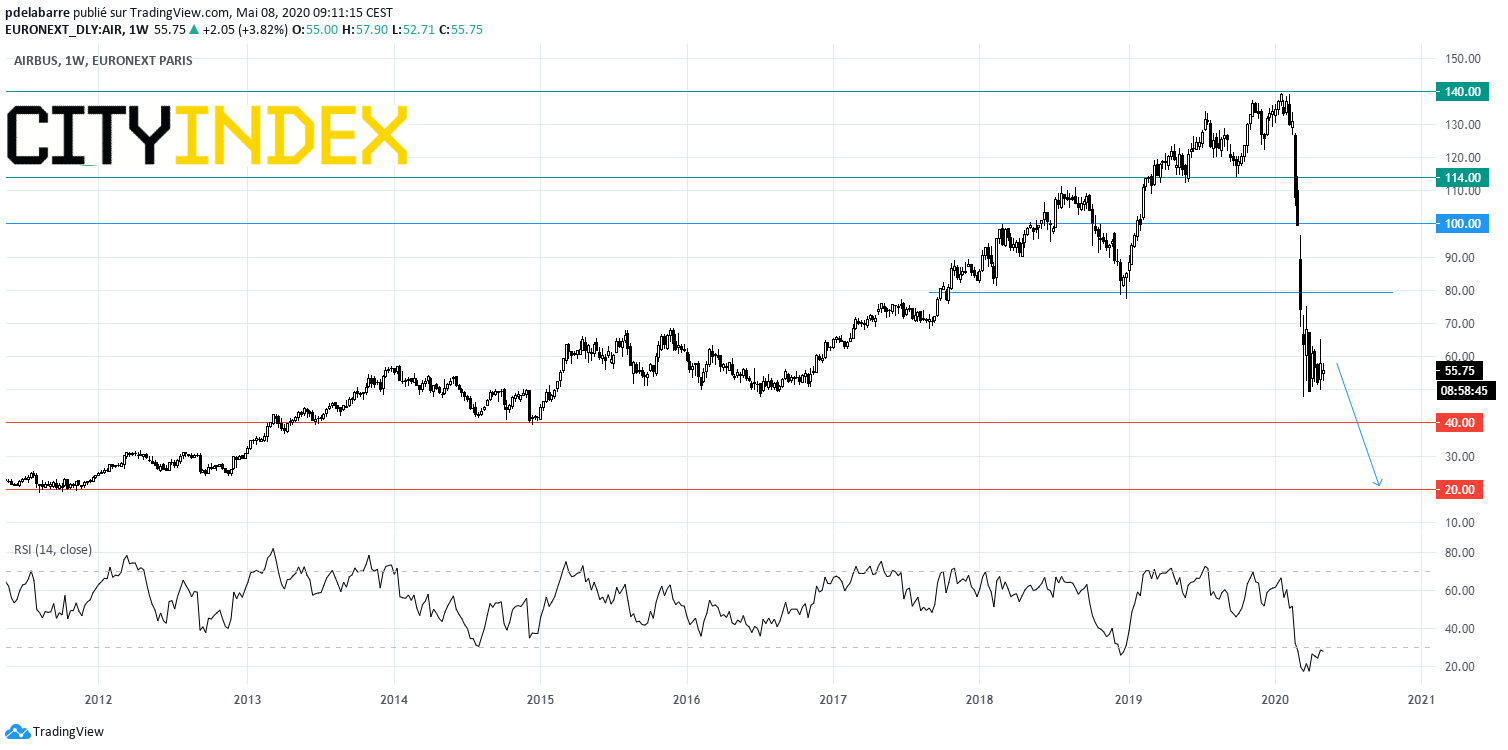

Airbus, an aircraft manufacturer, reported that it logged net orders for 9 commercial aircraft from its A320 production line from Avolon in April, and total net orders (after cancellations) stood at 299 aircraft, compared with 290 aircraft in March.

Source: GAIN Capital, TradingView

Euronext, a stock exchange operator, reported that total cash market transaction value rose 17.5% on year in April and equity derivatives volume increased 26.1%.

#SPAIN#

Ferrovial, a sustainable infrastructure operator, reported that 1Q net loss widened to 111 million euros from 98 million euros in the prior-year period, citing a 39 million euros provision for the Airports division due to the COVID-19. Meanwhile, EBITDA totaled 75 million euros, compared with an EBITDA loss of 231 million euros last year, on revenue of 1.38 billion euros, up 12%.

#BENELUX#

ING Groep, a banking and financial services group, announced that 1Q net income dropped 40.1% on year to 670 million euros, as loan loss provisions jumped to 661 million euros from 207 million euros in the prior-year period. Meanwhile, net interest income grew 0.5% to 3.50 billion euros, while CET1 ratio fell to 14.0% from 14.7% in the same quarter last year.

Galapagos, a pharmaceutical research company, posted 1Q net loss widened to 51 million euros from 49 million euros in the prior-year period, while operating loss narrowed 45 million euros from 53 million euros on revenue of 98 million euros, up from 33 million euros.

#ITALY#

#SWITZERLAND#

Swiss Re's, an insurance group, "AA-" credit rating outlook was revised to "Negative" from "Stable" at S&P Global Ratings. The rating agency said: "The negative outlook indicates the possibility that we could lower the ratings by one notch if the underwriting performance of Swiss Re's P/C business does not perform broadly in line with our expectations."

EX-DIVIDEND

Alcon: SF0.19, Hennes & Mauritz: SEK4.9

Yesterday, European stocks were broadly higher, with the Stoxx Europe 600 Index gaining 1.1%. Both Germany's DAX 30 and the U.K.'s FTSE 100 increased 1.4%, and France's CAC 40 was up 1.5%.

EUROPE ADVANCE/DECLINE

79% of STOXX 600 constituents traded higher yesterday.

70% of the shares trade above their 20D MA vs 59% Wednesday (below the 20D moving average).

24% of the shares trade above their 200D MA vs 22% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.38pts to 32.43, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

retail, basic resources, financial services

Europe worst 3 sectors

health care, automobiles & parts, telecommunications

INTEREST RATE

The 10yr Bund yield rose 7bps to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -21bps (above its 20D MA).

ECONOMIC DATA

FR : Victory in Europe Day

UK : May Day Bank Holiday

GE 07:00: Mar Balance of Trade, exp.: E20.8B

GE 07:00: Mar Balance of Trade s.a, exp.: E21.6B

GE 07:00: Mar Exports MoM s.a, exp.: 1.3%

GE 07:00: Mar Imports MoM s.a, exp.: -1.6%

GE 07:00: Mar Current Account, exp.: E23.7B

EC 09:00: Eurogroup Video Conference

MORNING TRADING

In Asian trading hours, EUR/USD climbed further to 1.0848 and GBP/USD advanced to 1.2401. USD/JPY was little changed at 106.34. This morning, government data showed that Japan's household spending dropped 6.0% on year in March (-6.5% estimated).

Spot gold extended its rally to $1,719 an ounce.

#UK - IRELAND#

U.K. stock market is closed for Early May Bank Holiday.

#GERMANY#

The German Federal Statistical Office reported a trade surplus of 17.4 billion euros in March (18.8 billion euros surplus expected), where exports dropped 11.8% on month (-5.0% expected) and imports slid 5.1% (-4.0% expected).

#FRANCE#

Airbus, an aircraft manufacturer, reported that it logged net orders for 9 commercial aircraft from its A320 production line from Avolon in April, and total net orders (after cancellations) stood at 299 aircraft, compared with 290 aircraft in March.

Source: GAIN Capital, TradingView

Euronext, a stock exchange operator, reported that total cash market transaction value rose 17.5% on year in April and equity derivatives volume increased 26.1%.

#SPAIN#

Ferrovial, a sustainable infrastructure operator, reported that 1Q net loss widened to 111 million euros from 98 million euros in the prior-year period, citing a 39 million euros provision for the Airports division due to the COVID-19. Meanwhile, EBITDA totaled 75 million euros, compared with an EBITDA loss of 231 million euros last year, on revenue of 1.38 billion euros, up 12%.

#BENELUX#

ING Groep, a banking and financial services group, announced that 1Q net income dropped 40.1% on year to 670 million euros, as loan loss provisions jumped to 661 million euros from 207 million euros in the prior-year period. Meanwhile, net interest income grew 0.5% to 3.50 billion euros, while CET1 ratio fell to 14.0% from 14.7% in the same quarter last year.

Galapagos, a pharmaceutical research company, posted 1Q net loss widened to 51 million euros from 49 million euros in the prior-year period, while operating loss narrowed 45 million euros from 53 million euros on revenue of 98 million euros, up from 33 million euros.

#ITALY#

Leonardo, an aerospace and defense company, said it swung to a 1Q net loss of 59 million euros from a net profit of 77 million euros in the prior-year period and EBIT sank 80.8% on year to 30 million euros on revenue of 2.59 billion euros, down 4.9%. The company announced the suspension of its 2020 guidance previous disclosed in March due to the COVID-19.

#SWITZERLAND#

Swiss Re's, an insurance group, "AA-" credit rating outlook was revised to "Negative" from "Stable" at S&P Global Ratings. The rating agency said: "The negative outlook indicates the possibility that we could lower the ratings by one notch if the underwriting performance of Swiss Re's P/C business does not perform broadly in line with our expectations."

EX-DIVIDEND

Alcon: SF0.19, Hennes & Mauritz: SEK4.9