EU Indices significantly down this morning | TA focus on SAP

INDICES

Yesterday, European stocks were higher, with the Stoxx Europe 600 Index rising 0.7%. Both Germany's DAX 30 and the U.K.'s FTSE 100 added 0.5%, and France's CAC 40 was up 0.7%.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded higher yesterday.

82% of the shares trade above their 20D MA vs 85% Friday (above the 20D moving average).

21% of the shares trade above their 200D MA vs 20% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.06pts to 41.2, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Healthcare

3mths relative low: Banks, Real Estate

Europe Best 3 sectors

health care, personal & household goods, media

Europe worst 3 sectors

real estate, automobiles & parts, travel & leisure

INTEREST RATE

The 10yr Bund yield was unchanged to -0.47% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Feb Average Earnings excl. Bonus, exp.: 3.1%

UK 07:00: Feb Average Earnings incl. Bonus, exp.: 3.1%

UK 07:00: Feb Unemployment Rate, exp.: 3.9%

UK 07:00: Mar Claimant Count chg, exp.: 17.3K

UK 07:00: Jan Employment chg, exp.: 184K

EC 10:00: Apr ZEW Economic Sentiment Idx, exp.: -49.5

GE 10:00: Apr ZEW Current Conditions, exp.: -43.1

GE 10:00: Apr ZEW Economic Sentiment Idx, exp.: -49.5

GE 10:40: 2-Year Schatz auction, exp.: -0.65%

UK 10:45: 5-Year Treasury Gilt auction, exp.: 0.12%

MORNING TRADING

In Asian trading hours, EUR/USD dipped 1.0829 and GBP/USD fell to 1.2403. USD/JPY was little changed at 107.66.

Spot gold retreated to $1,687 an ounce.

#UK - IRELAND#

Associated British Foods, a food processing and retailing company, posted a 1H trading update: "Revenue for the group of £7.6bn was 2% ahead of last year at actual exchange rates and 3% ahead at constant currency. Adjusted profit before tax of £636m was 1% ahead of last year at actual exchange rates. Adjusted operating profit of £682m was 7% ahead of last year at actual exchange rates. (...) Adjusted earnings per share increased by 1%. (...) it is too early to provide earnings guidance for the remainder of the current financial year."

London Stock Exchange, a stock market operator, released a 1Q trading statement: "Q1 total income up 13% year-on-year to £615 million, driven by increased equity trading in Capital Markets and higher clearing activity across listed and OTC products leading to higher NTI in Post Trade. (...) While the Group has performed well in Q1, it is too early to comment specifically on the impact of the coronavirus pandemic on the outlook for LSEG and its customers for the remainder of the year."

Halma, a life-saving technology company, issued an update on Covid-19: "We continue to expect our adjusted profit before tax for the year ended 31 March 2020 to be in a range of £265 million to £270 million, (...) We expect revenues to be approximately £1,330 million. (...) The COVID-19 pandemic is expected to have a net adverse impact on our markets and our full year financial results to 31 March 2021, which are likely to have a significant second half weighting even though the timing and profile of recovery remains uncertain at this stage."

Quilter, a financial services company, released a 1Q trading update: "Assets under Management and Administration (AuMA) of £95.3 billion at the end of March 2020, with: Net inflows of £0.5 billion, stable on prior year (Q1 2019: £0.5 billion); (...) Average AuMA for the quarter at £105.2 billion versus £105.7 billion for full year 2019."

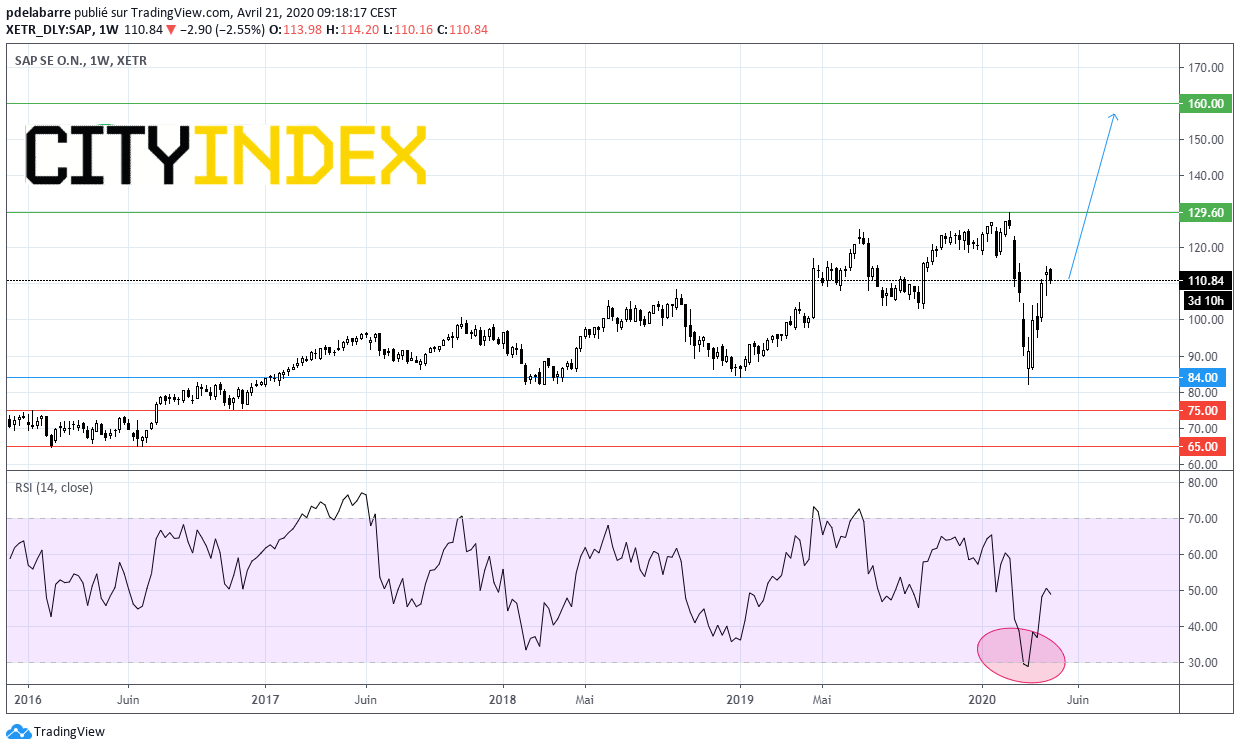

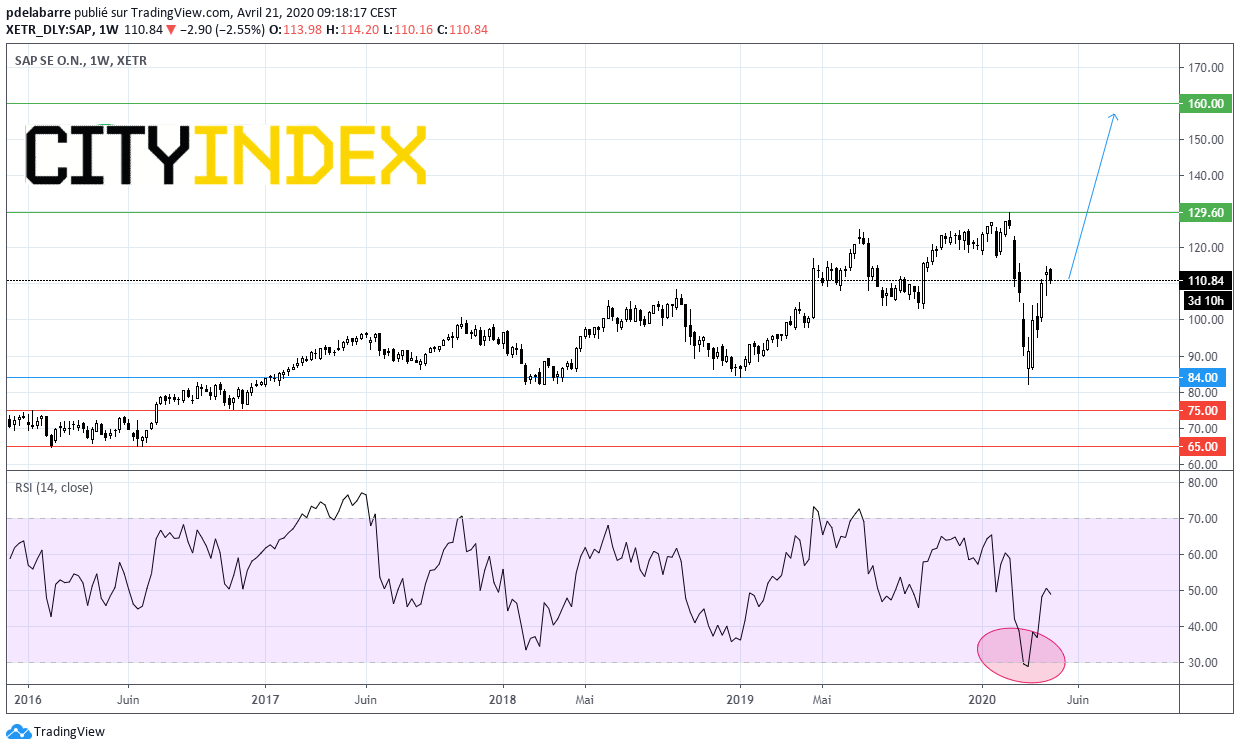

#GERMANY#

SAP, a software developer, announced that 1Q adjusted net income fell 6% on year to 1.02 billion euros while adjusted operating income increased 1% to 1.48 billion euros on adjusted revenue of 6.52 billion euros, up 7% (+5% at constant currency).

Source: GAIN Capital, TradingView

Sartorius, a pharmaceutical and laboratory equipment supplier, reported that 1Q underlying net income rose 17.5% on year to 57 million euros and underlying EBITDA grew 20.9% to 138 million euros on revenue of 510 million euros, up 17.0% (+16.5% at constant currency). The company said it now expects full-year revenue to increase by 15% - 19%, compared with 10% - 13% previously, and may adjust its dividend proposal for the prior year.

Sartorius Stedim Biotech, a biopharma company, posted 1Q underlying net income revenue increased 28.4% on year to 80 million euros and underlying EBITDA climbed 29.2% to 127 million euros on revenue of 422 million euros, up 23.1% (+22.3% at constant currency). The company lifted its full-year revenue growth forecast to 17% - 21% from 11% - 14% previously. In addition, the company said it may adjust dividend proposal for the prior year.

#FRANCE#

Peugeot, an automobile group, reported that 1Q revenue dropped 15.6% on year to 15.18 billion euros and total auto sales were down 29.2% to 627,024 units, citing Covid-19 impacts. Regarding market outlook, the company stated: "In 2020, the Group now anticipates a decrease of the automotive market by 25% in Europe, 10% in China, 25% in Latin America and 20% in Russia."

Danone, a food-products manufacturer, announced the withdrawal of 2020 guidance due to lack of visibility related to COVID-19, adding that 2Q demand and supply conditions will be broadly and deeply impacted by a global lockdown. Meanwhile, the company reported that 1Q revenue grew 1.7% on year (+3.7% on a like-for-like basis) to 6.24 billion euros.

Carrefour, a retail group, said it has decided to reduce the dividend proposed for 2019, initially announced in February, by 50% to 0.23 euro per share, amid the COVID-19 pandemic.

#BENELUX#

Vopak, a storage and transshipment company, announced that 1Q net income dropped 4.0% on year to 81 million euros and EBITDA declined 6.7% 200 million euros.

#SWITZERLAND#

Sika, a specialty chemical company, reported that 1Q revenue rose 10.3% on year (+15.4% in local currencies) to 1.81 billion Swiss franc. Regarding the outlook, the company said: "Sika confirms its strategic targets 2023. (...) Sika is seeking to grow by 6-8% a year in local currencies by 2023. (...) Given the volatility of the current backdrop, it is not possible to issue any concrete forecast as regards the course of business for full-year 2020."

EX-DIVIDEND

Swiss Re: SF5.9, Vivendi: E0.6

Yesterday, European stocks were higher, with the Stoxx Europe 600 Index rising 0.7%. Both Germany's DAX 30 and the U.K.'s FTSE 100 added 0.5%, and France's CAC 40 was up 0.7%.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded higher yesterday.

82% of the shares trade above their 20D MA vs 85% Friday (above the 20D moving average).

21% of the shares trade above their 200D MA vs 20% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.06pts to 41.2, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Healthcare

3mths relative low: Banks, Real Estate

Europe Best 3 sectors

health care, personal & household goods, media

Europe worst 3 sectors

real estate, automobiles & parts, travel & leisure

INTEREST RATE

The 10yr Bund yield was unchanged to -0.47% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Feb Average Earnings excl. Bonus, exp.: 3.1%

UK 07:00: Feb Average Earnings incl. Bonus, exp.: 3.1%

UK 07:00: Feb Unemployment Rate, exp.: 3.9%

UK 07:00: Mar Claimant Count chg, exp.: 17.3K

UK 07:00: Jan Employment chg, exp.: 184K

EC 10:00: Apr ZEW Economic Sentiment Idx, exp.: -49.5

GE 10:00: Apr ZEW Current Conditions, exp.: -43.1

GE 10:00: Apr ZEW Economic Sentiment Idx, exp.: -49.5

GE 10:40: 2-Year Schatz auction, exp.: -0.65%

UK 10:45: 5-Year Treasury Gilt auction, exp.: 0.12%

MORNING TRADING

In Asian trading hours, EUR/USD dipped 1.0829 and GBP/USD fell to 1.2403. USD/JPY was little changed at 107.66.

Spot gold retreated to $1,687 an ounce.

#UK - IRELAND#

Associated British Foods, a food processing and retailing company, posted a 1H trading update: "Revenue for the group of £7.6bn was 2% ahead of last year at actual exchange rates and 3% ahead at constant currency. Adjusted profit before tax of £636m was 1% ahead of last year at actual exchange rates. Adjusted operating profit of £682m was 7% ahead of last year at actual exchange rates. (...) Adjusted earnings per share increased by 1%. (...) it is too early to provide earnings guidance for the remainder of the current financial year."

London Stock Exchange, a stock market operator, released a 1Q trading statement: "Q1 total income up 13% year-on-year to £615 million, driven by increased equity trading in Capital Markets and higher clearing activity across listed and OTC products leading to higher NTI in Post Trade. (...) While the Group has performed well in Q1, it is too early to comment specifically on the impact of the coronavirus pandemic on the outlook for LSEG and its customers for the remainder of the year."

Halma, a life-saving technology company, issued an update on Covid-19: "We continue to expect our adjusted profit before tax for the year ended 31 March 2020 to be in a range of £265 million to £270 million, (...) We expect revenues to be approximately £1,330 million. (...) The COVID-19 pandemic is expected to have a net adverse impact on our markets and our full year financial results to 31 March 2021, which are likely to have a significant second half weighting even though the timing and profile of recovery remains uncertain at this stage."

Quilter, a financial services company, released a 1Q trading update: "Assets under Management and Administration (AuMA) of £95.3 billion at the end of March 2020, with: Net inflows of £0.5 billion, stable on prior year (Q1 2019: £0.5 billion); (...) Average AuMA for the quarter at £105.2 billion versus £105.7 billion for full year 2019."

#GERMANY#

SAP, a software developer, announced that 1Q adjusted net income fell 6% on year to 1.02 billion euros while adjusted operating income increased 1% to 1.48 billion euros on adjusted revenue of 6.52 billion euros, up 7% (+5% at constant currency).

Source: GAIN Capital, TradingView

Sartorius, a pharmaceutical and laboratory equipment supplier, reported that 1Q underlying net income rose 17.5% on year to 57 million euros and underlying EBITDA grew 20.9% to 138 million euros on revenue of 510 million euros, up 17.0% (+16.5% at constant currency). The company said it now expects full-year revenue to increase by 15% - 19%, compared with 10% - 13% previously, and may adjust its dividend proposal for the prior year.

Sartorius Stedim Biotech, a biopharma company, posted 1Q underlying net income revenue increased 28.4% on year to 80 million euros and underlying EBITDA climbed 29.2% to 127 million euros on revenue of 422 million euros, up 23.1% (+22.3% at constant currency). The company lifted its full-year revenue growth forecast to 17% - 21% from 11% - 14% previously. In addition, the company said it may adjust dividend proposal for the prior year.

#FRANCE#

Peugeot, an automobile group, reported that 1Q revenue dropped 15.6% on year to 15.18 billion euros and total auto sales were down 29.2% to 627,024 units, citing Covid-19 impacts. Regarding market outlook, the company stated: "In 2020, the Group now anticipates a decrease of the automotive market by 25% in Europe, 10% in China, 25% in Latin America and 20% in Russia."

Danone, a food-products manufacturer, announced the withdrawal of 2020 guidance due to lack of visibility related to COVID-19, adding that 2Q demand and supply conditions will be broadly and deeply impacted by a global lockdown. Meanwhile, the company reported that 1Q revenue grew 1.7% on year (+3.7% on a like-for-like basis) to 6.24 billion euros.

Carrefour, a retail group, said it has decided to reduce the dividend proposed for 2019, initially announced in February, by 50% to 0.23 euro per share, amid the COVID-19 pandemic.

#BENELUX#

Vopak, a storage and transshipment company, announced that 1Q net income dropped 4.0% on year to 81 million euros and EBITDA declined 6.7% 200 million euros.

#SWITZERLAND#

Sika, a specialty chemical company, reported that 1Q revenue rose 10.3% on year (+15.4% in local currencies) to 1.81 billion Swiss franc. Regarding the outlook, the company said: "Sika confirms its strategic targets 2023. (...) Sika is seeking to grow by 6-8% a year in local currencies by 2023. (...) Given the volatility of the current backdrop, it is not possible to issue any concrete forecast as regards the course of business for full-year 2020."

EX-DIVIDEND

Swiss Re: SF5.9, Vivendi: E0.6

Latest market news

Today 11:30 AM

Today 08:18 AM

Yesterday 10:40 PM