EU indices significantly down this morning | TA focus on Sage Group

Yesterday, European stocks were mixed, with the Stoxx Europe 600 Index adding 0.3%. Germany's DAX 30 was little changed, France's CAC 40 fell 0.4%, while the U.K.'s FTSE 100 rose 0.9%.

EUROPE ADVANCE/DECLINE

50% of STOXX 600 constituents traded higher yesterday.

71% of the shares trade above their 20D MA vs 70% Monday (below the 20D moving average).

26% of the shares trade above their 200D MA vs 25% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.24pts to 27.67, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Financial Services, Technology

3mths relative low: Real Estate

Europe Best 3 sectors

telecommunications, retail, utilities

Europe worst 3 sectors

real estate, travel & leisure, insurance

INTEREST RATE

The 10yr Bund yield rose 3bps to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -22bps (above its 20D MA).

#ECONOMIC DATA#

UK 07:00: Mar Industrial Production MoM, exp.: 0.1%

UK 07:00: Mar Industrial Production YoY, exp.: -2.8%

UK 07:00: Mar Manufacturing Production MoM, exp.: 0.5%

UK 07:00: Mar Manufacturing Production YoY, exp.: -3.9%

UK 07:00: Mar Construction Output YoY, exp.: -2.7%

UK 07:00: Mar Balance of Trade, exp.: £-2.8B

UK 07:00: Q1 GDP Growth Rate YoY Prel, exp.: 1.1%

UK 07:00: Q1 GDP Growth Rate QoQ Prel, exp.: 0%

UK 07:00: Q1 Business Investment QoQ Prel, exp.: -0.5%

UK 07:00: Q1 Business Investment YoY Prel, exp.: 1.8%

UK 07:00: Mar GDP MoM, exp.: -0.1%

UK 07:00: Mar GDP 3-Mth Avg, exp.: 0.1%

UK 07:00: Q1 Construction Orders YoY, exp.: -0.4%

UK 07:00: Mar GDP YoY, exp.: 0.3%

UK 07:00: Mar Goods Trade Balance, exp.: £-11.487B

EC 10:00: Mar Industrial Production MoM, exp.: -0.1%

EC 10:00: Mar Industrial Production YoY, exp.: -1.9%

GE 10:40: 30-Year Bund auction, exp.: -0.09%

EC 12:00: ECB Lane speech

UK 14:00: Apr NIESR Monthly GDP Tracker, exp.: -4.8%

EC 16:00: ECB Guindos speech

EC 17:00: ECB Lane speech

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.0851 while GBP/USD rebounded slightly to 1.2273. USD/JPY edged up to 107.23. NZD/USD slid to 0.6035. The Reserve Bank of New Zealand said it has decided to expand the Large Scale Asset Purchase programme potential to 60 billion New Zealand dollars from a previous limit of 33 billion New Zealand dollars, while keeping its benchmark rate unchanged at 0.25%. The central bank added: "The Monetary Policy Committee is prepared to use additional monetary policy tools if and when needed, including reducing the OCR further."

Spot gold climbed to $1,703 an ounce.

#UK - IRELAND#

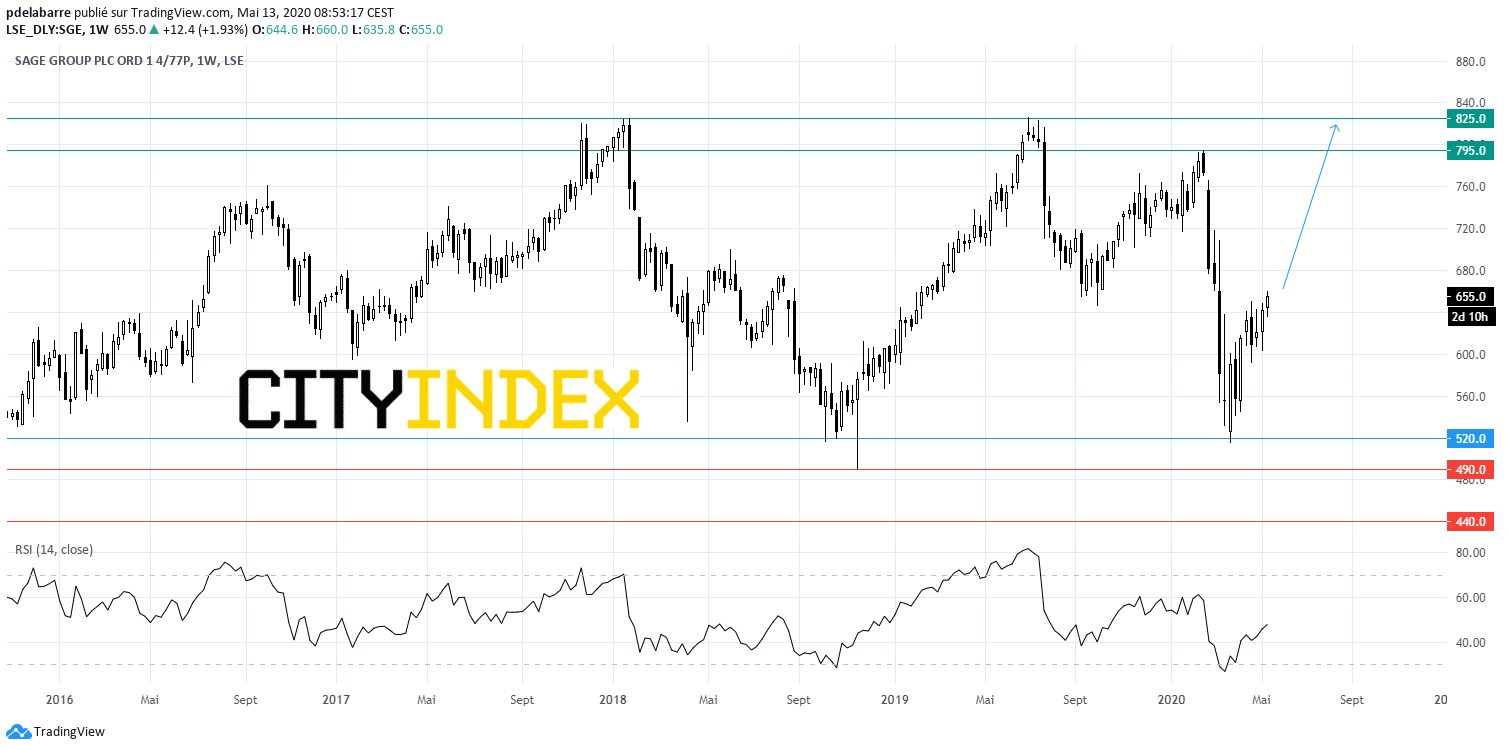

Sage Group, an enterprise software company, reported 1H results: "The Group achieved statutory total revenue of £975m, a 2% increase on the prior year, (...) Statutory operating profit increased by 38% to £289m, (...) Underlying operating profit, which excludes recurring and non-recurring items, grew by 1% to £218m. (...) Underlying basic EPS of 13.75p was broadly in line with the prior period. (...) We continue to expect, as we indicated in our trading update on 6 April, that organic recurring revenue growth will be below the previously guided range of 8% to 9%, and that the decline in other revenue (SSRS and processing) will accelerate significantly in the second half, with an associated impact on margin". From a chartist point of view, the stock is aiming the upper boundary of a trading-range (520-825) shaped since the beginning of 2018.

Source: GAIN Capital, TradingView

Spirax-Sarco Engineering, a steam management systems manufacturer, released a trading update for the four months ended April 30: "While trading in the first four months of the year has held up well, we currently believe the worst of the downturn will occur in the second and third quarters of 2020. Absent a resurgence of the COVID-19 pandemic in the second half of the year, we currently expect trading conditions to improve in the last quarter of 2020, resulting in a lower contraction of organic sales in the second half of 2020 than in the first half. (...) we currently anticipate that the full year drop through of total revenue decline to operating profit in 2020 will be contained to around 45%."

Ferguson, a plumbing and heating products distributor, published a 3Q trading update: "he Group generated revenue in the ongoing businesses of $4,750 million in the third quarter, 0.9% ahead of last year or 1.7% behind on an organic basis. (...) Due to the dynamic situation unfolding with COVID-19 the Company has withdrawn formal guidance."

Taylor Wimpey, a homebuilder, issued a market update: "Housing market conditions have remained stable with signs of increased sales activity and customer interest since the re-start of site activities. (...) Show homes and sales centers will reopen for pre-booked appointments, from Friday 22 May 2020. (...) Construction is now underway on the majority of our sites across England and Wales."

TUI, a travel and tourism company, posted 2Q adjusted net loss widened to 741 million euros from 177 million euros in the prior-year period on revenue of 2.79 billion euros, down 10.1%. The company said: "Due to the ongoing pandemic and the continuing worldwide travel restrictions, the Executive Board refrains from providing a new guidance for fiscal year 2020 also under the current circumstances. Currently, 35 percent of the 2020 summer program is still booked."

Informa, a business intelligence group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#GERMANY#

Deutsche Wohnen, a property group, reported that 1Q net income grew 13.0% on year to 125 million euros while EBITDA dropped 22.6% to 156 million euros. The company said: "At EUR 0.40 per share, FFO I was more or less at the level of the corresponding period of the previous year. (...) The company is and remains in a sound condition. Consequently, we can also confirm the guidance we have already given for the current financial year."

United Internet, an internet services provider, reported that 1Q net income EBIT grew 1.7% on year to 184 million euros on revenue of 1.33 billion euros. Regarding the outlook, the company stated: "United Internet can confirm its guidance for the fiscal year 2020 and continues to expect sales and EBITDA to be approximately on a par with the previous year."

#FRANCE#

L'Oreal, a personal care company, said it has decided to withdraw the planned 10.4% increase in 2019 dividend, keeping it unchanged from the prior year at 3.85 euros per share, and share buyback operations will be suspended for the whole of 2020, amid Covid-19 pandemic.

Eiffage, a civil engineering construction company, posted 1Q revenue fell 4.3% on year to 3.75 billion euros, down 5.3% on a like-for-like basis. The company stated: "The order book and the visibility it confers remain a major strength for the Group in the face of the prevailing uncertainty. At 31 March 2020, the order book stood at E15.0bn for Contracting, a decrease of 2% year-on-year (but an increase of 5% over three months)."

JCDecaux, an outdoor advertising company, reported that 1Q adjusted revenue dropped 13.9% on year (-13.9% organic growth) to 724 million euros. The company said: "We now expect the negative impact of Covid-19 on our business to significantly increase in the short term but it is not possible to quantify its depth or duration of the impact. As a result, we are not able to provide any guidance for Q2 2020 as well as for Q3 and Q4."

Engie, an energy company, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

#SPAIN#

Santander and BBVA, the two major Spanish banks, were downgraded to "hold" from "buy" at HSBC.

#BENELUX#

ABN Amro, a banking group, announced that it swung to a 1Q net loss of 395 million euros from a net profit of 478 million euros in the prior-year period, citing impairment charges on financial instruments of 1.11 billion euros, up from 102 million euros. Operating income was down 8% on year to 1.92 billion euros and CET1 ratio dropped to 17.3% from 18.0%. The bank said: " Based on our latest assumptions, we expect the cost of risk for FY 2020 to be around 90bps, or around EUR 2.5 billion, which is well above the through-the-cycle average but well below the Q1 2020 run rate of 132bps."

Ageas, an insurance company, reported that 1Q insurance net profit dropped to 113 million euros from 258 million euros in the prior-year period, while group net result jumped to 452 million euros from 251 million euros, citing a 339 million euros positive contribution from the General Account. Meanwhile, combined ratio rose to 99.7% from 98.3%.

#SWITZERLAND#

Alcon, an eye care products manufacturer, posted 1Q net loss narrowed to 57 million dollars from 109 million dollars in the prior-year period on net sales of 1.82 billion dollars, up 2.5% on year.

#DENMARK#

AP Moller-Maersk, a danish integrated shipping company, said it swung to a 1Q underlying profit of 197 million dollars from a loss of 69 million dollars in the prior-year period. Revenue edged up 0.3% to 9.57 billion dollars. The Company added that its shipping volumes could drop up to 25% in 2Q.