EU indices positive this morning | TA focus on Lonza Group

INDICES

Yesterday, European stocks were lower, with the Stoxx Europe 600 Index slipping 0.7%. Germany's DAX 30 lost 0.5%, the U.K.'s FTSE 100 fell 0.6% and France's CAC 40 was down 0.2%.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded lower or unchanged yesterday.

93% of the shares trade above their 20D MA vs 93% Wednesday (above the 20D moving average).

45% of the shares trade above their 200D MA vs 46% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.95pt to 27.66, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial

3mths relative low: none

Europe Best 3 sectors

real estate, telecommunications, banks

Europe worst 3 sectors

automobiles & parts, utilities, health care

INTEREST RATE

The 10yr Bund yield rose 6bps to -0.35% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -29bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Apr Factory Orders MoM, exp.: -15.6%

UK 08:30: May Halifax House Price Idx MoM, exp.: -0.6%

UK 08:30: May Halifax House Price Idx YoY, exp.: 2.7%

UK 09:00: UK-EU Brexit Talks

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1335 while GBP/USD eased to 1.2593. USD/JPY stayed above the 109.00 level. This morning, official data showed that Japan's household spending slid 11.1% on year in April (-12.8% expected).

Spot gold retreated to $1,710 an ounce.

#UK - IRELAND#

TUI, a travel and tourism company, is considering to reduce its German airline capacity by half amid cost-cutting, reported Bloomberg citing people familiar with the matter.

#GERMANY #

Deutsche Lufthansa, an airline company, will be replaced by Deutsche Wohnen, a property group, in the German Dax Index effective June 22, according to Deutsche Boerse.

Telefonica Deutschland, a telecommunications group, is nearing a deal to sell a portfolio of wireless towers to investment firm KKR & Co for 1.5 billion euros, reported Bloomberg citing people familiar with the matter.

Kion, a manufacturer of materials handling equipment, was downgraded to "hold" from "buy" at HSBC.

#FRANCE#

Legrand, an industrial group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#SPAIN#

Endesa, a Spanish electric utility company, was upgraded to "equalweight" from "underweight" at Barclays.

Acciona, an infrastructure and renewable energy company, was upgraded to "neutral" from "sell" at Citigroup.

#ITALY#

Enel, an energy company, was upgraded to "overweight" from "equalweight" at Barclays.

#SWITZERLAND#

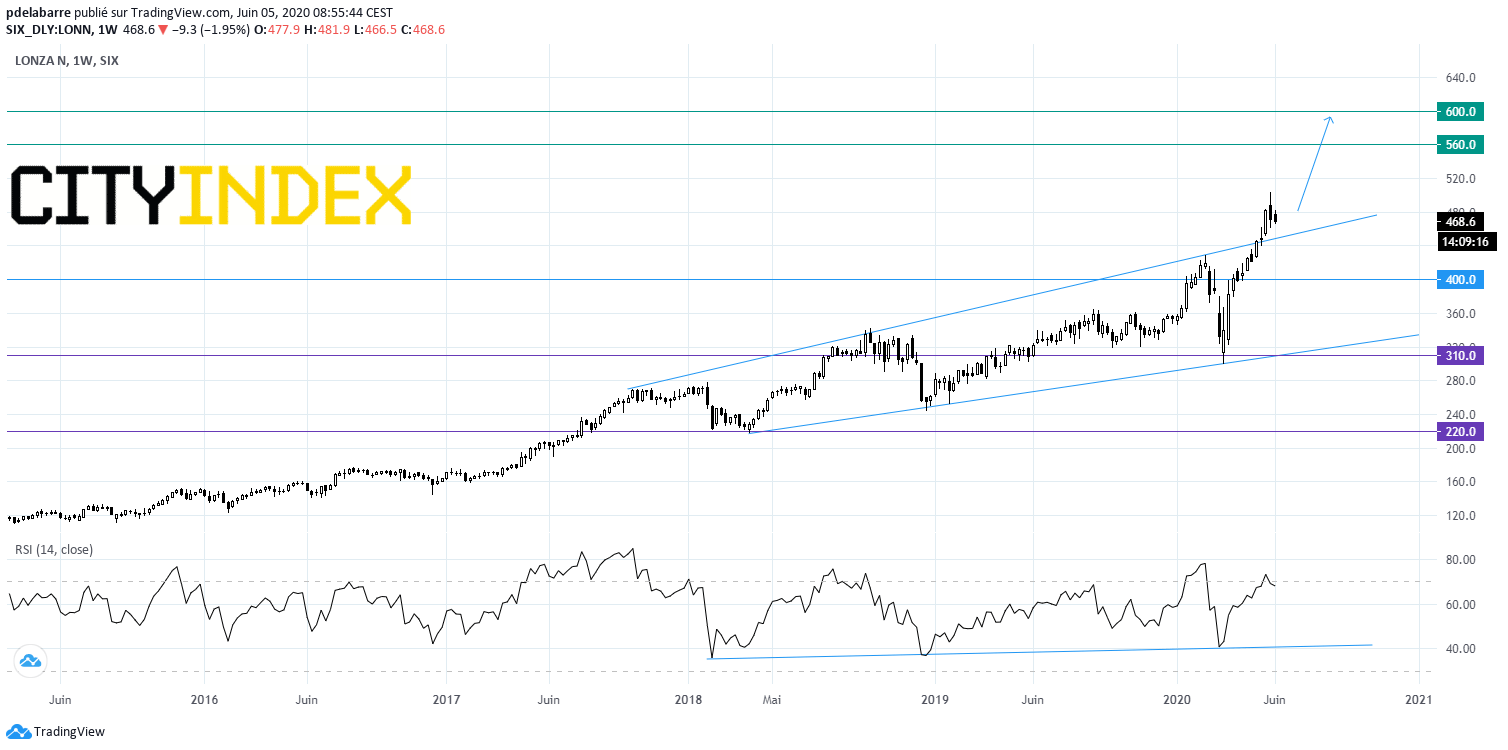

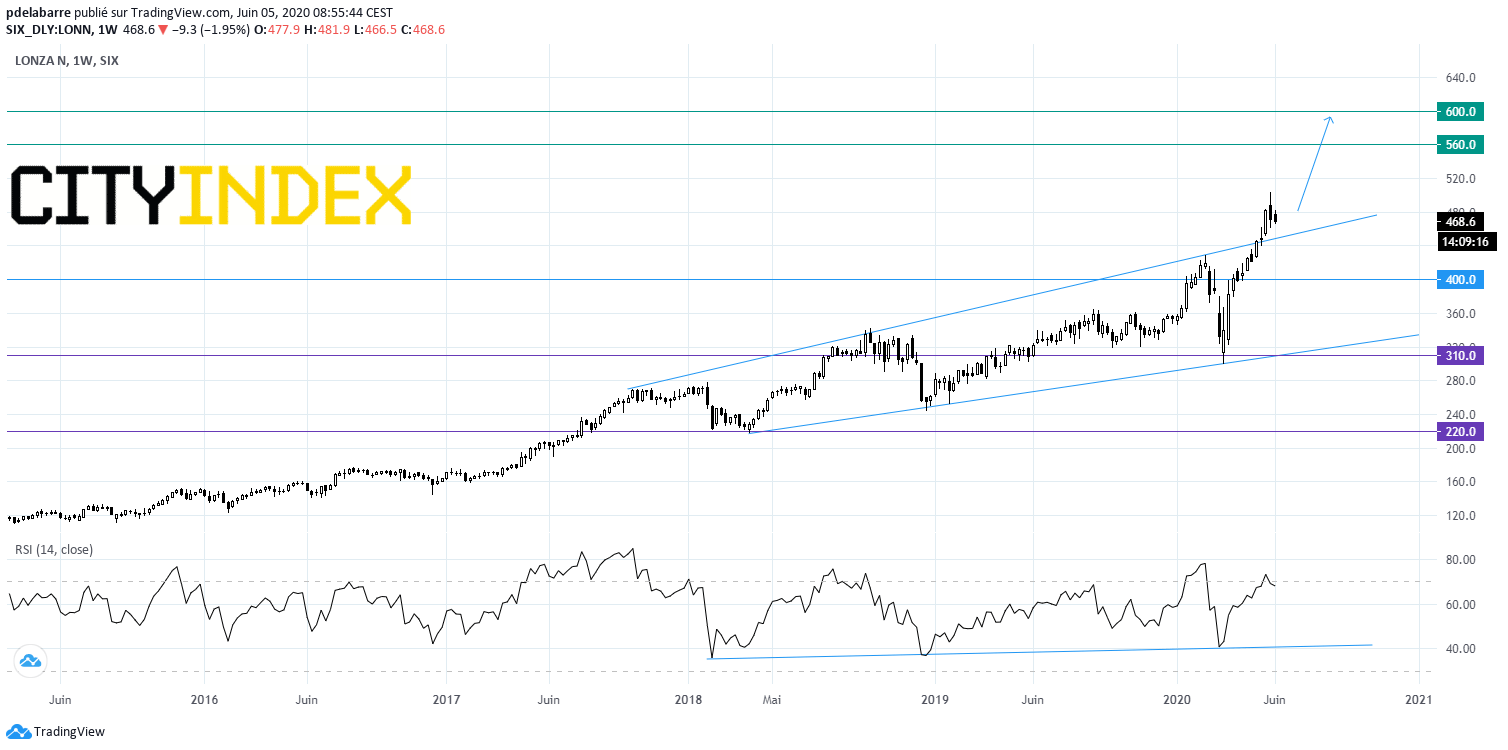

Lonza Group, a biotechnology company, announced the appointment of Pierre-Alain Ruffieux, currently Head of Global Pharma Technical Operations at Roche, as new CEO effective November 1. From a chartist point of view, the share has pushed above the upper end of an ascending broadening formation. Look for 560 & 600.

Source: GAIN Capital, TradingView

Novartis, a pharmaceutical group, said a phase 3b study of its Enerzair Breezhaler, for the treatments in uncontrolled asthma, met primary endpoint.

EX-DIVIDEND

HeidelbergCement: E0.6

Yesterday, European stocks were lower, with the Stoxx Europe 600 Index slipping 0.7%. Germany's DAX 30 lost 0.5%, the U.K.'s FTSE 100 fell 0.6% and France's CAC 40 was down 0.2%.

EUROPE ADVANCE/DECLINE

58% of STOXX 600 constituents traded lower or unchanged yesterday.

93% of the shares trade above their 20D MA vs 93% Wednesday (above the 20D moving average).

45% of the shares trade above their 200D MA vs 46% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.95pt to 27.66, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial

3mths relative low: none

Europe Best 3 sectors

real estate, telecommunications, banks

Europe worst 3 sectors

automobiles & parts, utilities, health care

INTEREST RATE

The 10yr Bund yield rose 6bps to -0.35% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -29bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Apr Factory Orders MoM, exp.: -15.6%

UK 08:30: May Halifax House Price Idx MoM, exp.: -0.6%

UK 08:30: May Halifax House Price Idx YoY, exp.: 2.7%

UK 09:00: UK-EU Brexit Talks

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1335 while GBP/USD eased to 1.2593. USD/JPY stayed above the 109.00 level. This morning, official data showed that Japan's household spending slid 11.1% on year in April (-12.8% expected).

Spot gold retreated to $1,710 an ounce.

#UK - IRELAND#

TUI, a travel and tourism company, is considering to reduce its German airline capacity by half amid cost-cutting, reported Bloomberg citing people familiar with the matter.

#GERMANY #

Deutsche Lufthansa, an airline company, will be replaced by Deutsche Wohnen, a property group, in the German Dax Index effective June 22, according to Deutsche Boerse.

Telefonica Deutschland, a telecommunications group, is nearing a deal to sell a portfolio of wireless towers to investment firm KKR & Co for 1.5 billion euros, reported Bloomberg citing people familiar with the matter.

Kion, a manufacturer of materials handling equipment, was downgraded to "hold" from "buy" at HSBC.

#FRANCE#

Legrand, an industrial group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#SPAIN#

Endesa, a Spanish electric utility company, was upgraded to "equalweight" from "underweight" at Barclays.

Acciona, an infrastructure and renewable energy company, was upgraded to "neutral" from "sell" at Citigroup.

#ITALY#

Enel, an energy company, was upgraded to "overweight" from "equalweight" at Barclays.

#SWITZERLAND#

Lonza Group, a biotechnology company, announced the appointment of Pierre-Alain Ruffieux, currently Head of Global Pharma Technical Operations at Roche, as new CEO effective November 1. From a chartist point of view, the share has pushed above the upper end of an ascending broadening formation. Look for 560 & 600.

Source: GAIN Capital, TradingView

Novartis, a pharmaceutical group, said a phase 3b study of its Enerzair Breezhaler, for the treatments in uncontrolled asthma, met primary endpoint.

EX-DIVIDEND

HeidelbergCement: E0.6

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM