EU indices positive this morning | TA focus on Givaudan

INDICES

Yesterday, European stocks got deeper in negative territory, with the Stoxx Europe 600 Index losing 1.2%. Both Germany's DAX 30 and France's CAC 40 fell 1.6%, and the U.K.'s FTSE 100 shed 2.1%.

EUROPE ADVANCE/DECLINE

80% of STOXX 600 constituents traded lower or unchanged yesterday.

86% of the shares trade above their 20D MA vs 88% Monday (above the 20D moving average).

45% of the shares trade above their 200D MA vs 48% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.63pt to 29.75, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

health care, technology, food & beverage

Europe worst 3 sectors

banks, travel & leisure, energy

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.32% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -30bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: Apr Industrial Production MoM, exp.: -16.2%

EC 12:00: ECB Schnabel speech

EC 14:30: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1340 and GBP/USD bounced to 1.2731. USD/JPY was little changed at 107.73. This morning, official data showed that Japan's core machine orders dropped 12.0% on month in April (-7.0% expected). AUD/USD was relatively flat at 0.6956. Earlier today, government data showed that China's CPI rose 2.4% on year in May (+2.7% expected) while PPI dropped 3.7% (-3.3% expected).

Spot gold advanced to $1,717 an ounce.

#UK - IRELAND#

Segro, a property investment and development company, announced the results of share placing: "In light of the strong demand received both from existing investors and potential new holders, (...) The Placing and Retail Offer in aggregate comprised 82,926,829 new Ordinary Shares which will raise gross proceeds of approximately £680 million for the Company. The Placing Price of 820 pence represents a discount of 4.5 per cent to the closing share price of 858.8 pence on 9 June 2020." Separately, the company issued a trading update: ""New lettings and pre-let development agreements across the Group are tracking ahead of pre-crisis expectations. £20.9 million of headline rent has been contracted in the five months to 31 May 2020. (...) (...) the Board currently intends to declare a 2020 interim dividend of 6.9 pence per share (H1 2019: 6.3 pence)."

Shaftesbury, a real estate group, posted 1H results: "After the impact of Covid-19 related charges, net property income decreased by £2.4 million, compared with the same period last year, to £46.2 million. (...) EPRA earnings decreased by 7.3% to £25.3 million (31.3.2019: £27.3 million) resulting in EPRA EPS of 8.2p (31.3.2019: 8.9p). (...) EPRA NAV per share now stands at £8.78, a decrease of 10.6% over the six month period to 31 March 2020."

#GERMANY#

Commerzbank, a banking group, may be demanded by private equity fund Cerberus Capital Management, which revealed its 5% stake in the bank in July 2017, to replace two supervisory broad members with Cerberus representatives, reported Bloomberg citing people familiar with the matter.

MTU Aero Engines, an aircraft engine manufacturer, was downgraded to "hold" from "buy" at HSBC.

#FRANCE#

Safran, an aircraft engine maker, expects no improvement in revenue for May and repeats outlook for less than 1,000 Leap engines in 2020, according to CEO Philippe Petitcolin cited by French media France Info.

Veolia Environnement, an environmental services provider, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

Suez, a water and waste management company, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

#BENELUX#

Randstad, a human resource consulting firm, was downgraded to "neutral" from "buy" at Citigroup.

#SWITZERLAND#

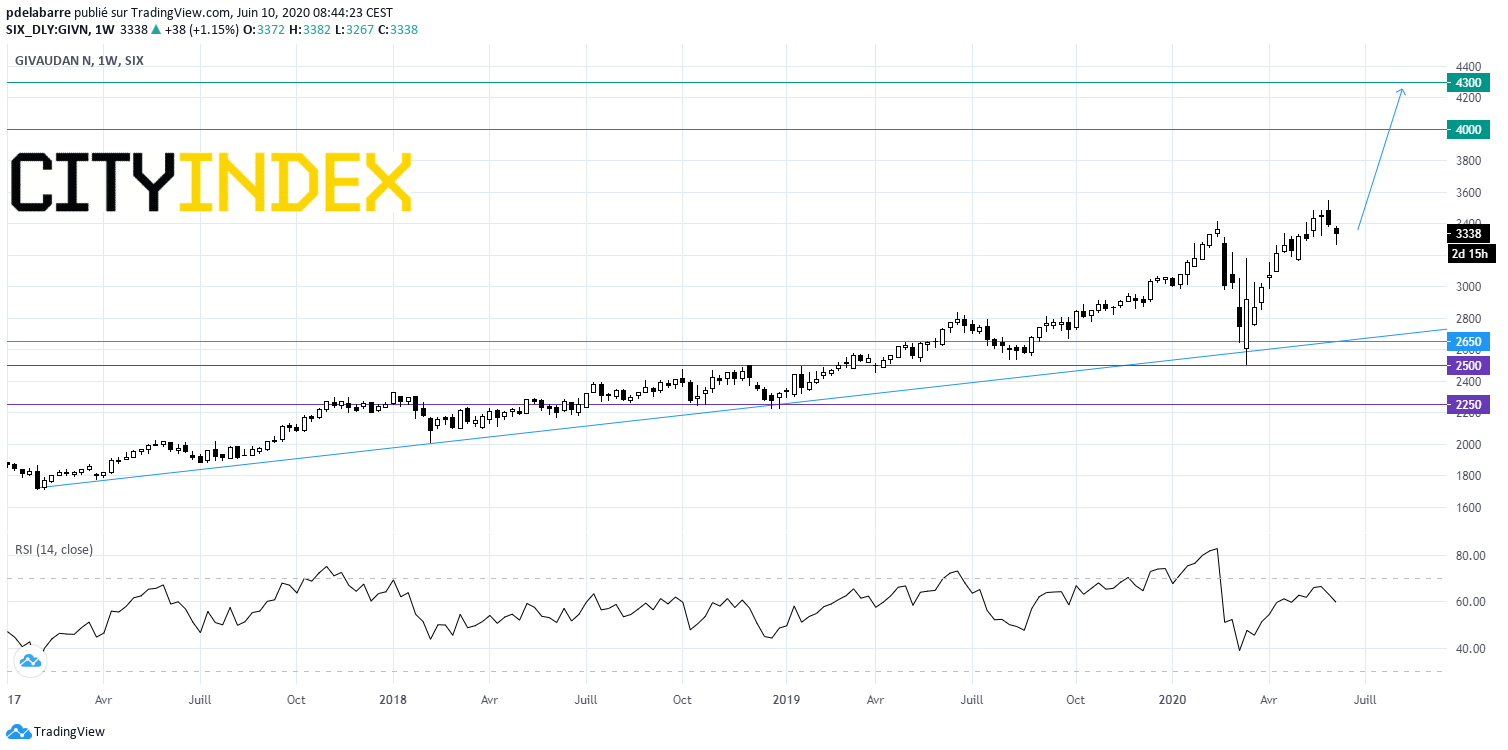

Givaudan, a fragrances manufacturer, was upgraded to "equalweight" from "underweight" at Morgan Stanley. From a chartist point of view, the share is supported by a long-term (since the beginning of 2017) rising trend line. Above this one, look for 4000 & 4300.

Source: GAIN Capital, TradingView

#SWEDEN#

Epiroc, a Swedish manufacturer of mining equipment, was upgraded to "hold" from "sell" at Deutsche Bank.

Yesterday, European stocks got deeper in negative territory, with the Stoxx Europe 600 Index losing 1.2%. Both Germany's DAX 30 and France's CAC 40 fell 1.6%, and the U.K.'s FTSE 100 shed 2.1%.

EUROPE ADVANCE/DECLINE

80% of STOXX 600 constituents traded lower or unchanged yesterday.

86% of the shares trade above their 20D MA vs 88% Monday (above the 20D moving average).

45% of the shares trade above their 200D MA vs 48% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.63pt to 29.75, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

health care, technology, food & beverage

Europe worst 3 sectors

banks, travel & leisure, energy

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.32% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -30bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: Apr Industrial Production MoM, exp.: -16.2%

EC 12:00: ECB Schnabel speech

EC 14:30: ECB Guindos speech

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1340 and GBP/USD bounced to 1.2731. USD/JPY was little changed at 107.73. This morning, official data showed that Japan's core machine orders dropped 12.0% on month in April (-7.0% expected). AUD/USD was relatively flat at 0.6956. Earlier today, government data showed that China's CPI rose 2.4% on year in May (+2.7% expected) while PPI dropped 3.7% (-3.3% expected).

Spot gold advanced to $1,717 an ounce.

#UK - IRELAND#

Segro, a property investment and development company, announced the results of share placing: "In light of the strong demand received both from existing investors and potential new holders, (...) The Placing and Retail Offer in aggregate comprised 82,926,829 new Ordinary Shares which will raise gross proceeds of approximately £680 million for the Company. The Placing Price of 820 pence represents a discount of 4.5 per cent to the closing share price of 858.8 pence on 9 June 2020." Separately, the company issued a trading update: ""New lettings and pre-let development agreements across the Group are tracking ahead of pre-crisis expectations. £20.9 million of headline rent has been contracted in the five months to 31 May 2020. (...) (...) the Board currently intends to declare a 2020 interim dividend of 6.9 pence per share (H1 2019: 6.3 pence)."

Shaftesbury, a real estate group, posted 1H results: "After the impact of Covid-19 related charges, net property income decreased by £2.4 million, compared with the same period last year, to £46.2 million. (...) EPRA earnings decreased by 7.3% to £25.3 million (31.3.2019: £27.3 million) resulting in EPRA EPS of 8.2p (31.3.2019: 8.9p). (...) EPRA NAV per share now stands at £8.78, a decrease of 10.6% over the six month period to 31 March 2020."

#GERMANY#

Commerzbank, a banking group, may be demanded by private equity fund Cerberus Capital Management, which revealed its 5% stake in the bank in July 2017, to replace two supervisory broad members with Cerberus representatives, reported Bloomberg citing people familiar with the matter.

MTU Aero Engines, an aircraft engine manufacturer, was downgraded to "hold" from "buy" at HSBC.

#FRANCE#

Safran, an aircraft engine maker, expects no improvement in revenue for May and repeats outlook for less than 1,000 Leap engines in 2020, according to CEO Philippe Petitcolin cited by French media France Info.

Veolia Environnement, an environmental services provider, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

Suez, a water and waste management company, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

#BENELUX#

Randstad, a human resource consulting firm, was downgraded to "neutral" from "buy" at Citigroup.

#SWITZERLAND#

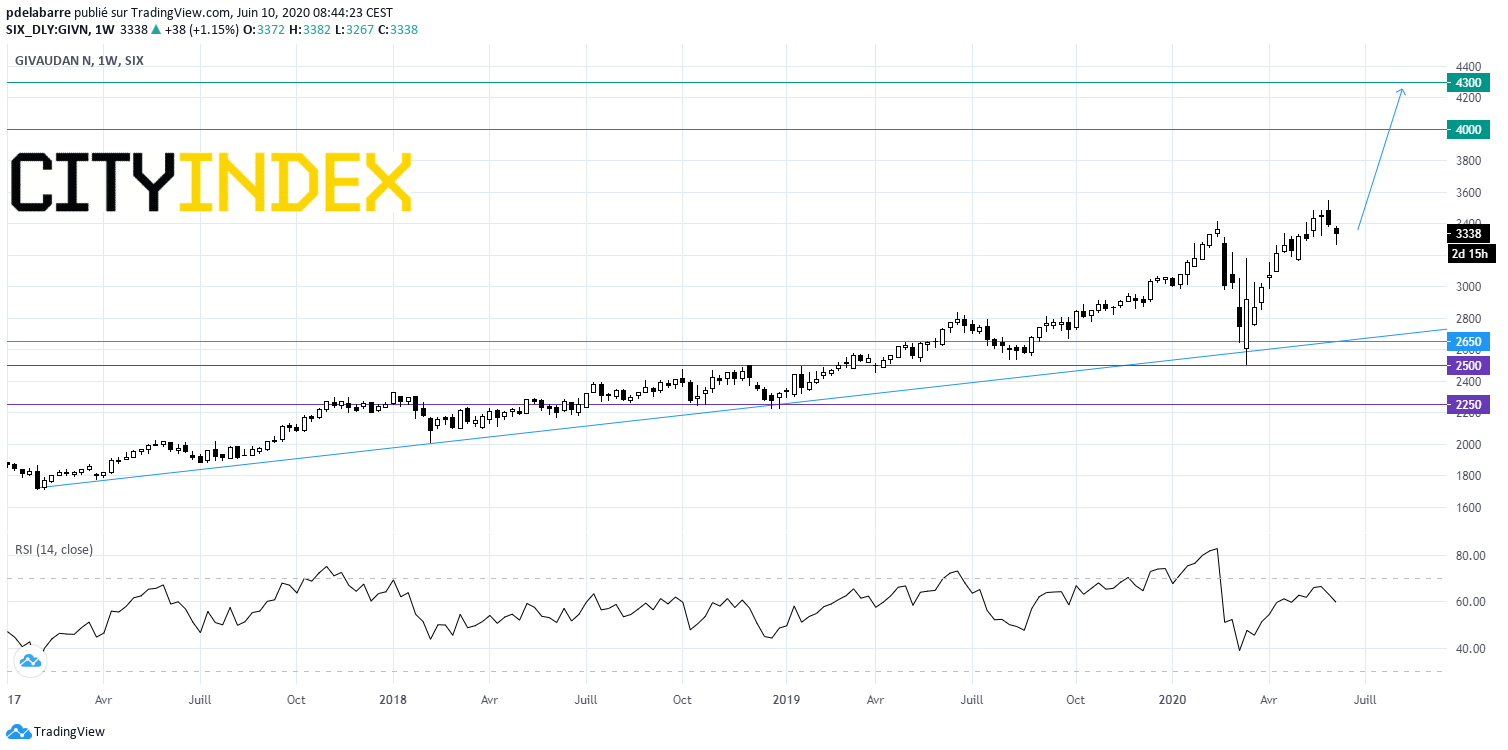

Givaudan, a fragrances manufacturer, was upgraded to "equalweight" from "underweight" at Morgan Stanley. From a chartist point of view, the share is supported by a long-term (since the beginning of 2017) rising trend line. Above this one, look for 4000 & 4300.

Source: GAIN Capital, TradingView

#SWEDEN#

Epiroc, a Swedish manufacturer of mining equipment, was upgraded to "hold" from "sell" at Deutsche Bank.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM