EU indices mostly closed for Labor Day | TA focus on Ryanair

INDICES

Yesterday, European stocks turned to the downside, with the Stoxx Europe 600 Index falling 2.0%. Germany's DAX 30 lost 2.2%, France's CAC 40 slipped 2.1%, and the U.K.'s FTSE 100 slumped 3.5%.

EUROPE ADVANCE/DECLINE

80% of STOXX 600 constituents traded lower or unchanged yesterday.

86% of the shares trade above their 20D MA vs 95% Wednesday (above the 20D moving average).

23% of the shares trade above their 200D MA vs 26% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 3.19pts to 33.91, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

personal & household goods, real estate, utilities

Europe worst 3 sectors

banks, basic resources, insurance

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.5% (below its 20D MA). The 2yr-10yr yield spread rose 4bps to -17bps (above its 20D MA).

ECONOMIC DATA

UK 09:30: Mar Net Lending to Individuals MoM, exp.: £5.2B

UK 09:30: Mar Mortgage Approvals, exp.: 73.55K

UK 09:30: Mar Mortgage Lending, exp.: £4B

UK 09:30: Mar BoE Consumer Credit, exp.: £0.9B

UK 09:30: Apr Markit/CIPS Manufacturing PMI final, exp.: 47.8

MORNING TRADING

In Asian trading hours, EUR/USD firmed at 1.0945 while GBP/USD eased to 1.2563. USD/JPY held above the 107.00 level.

Spot gold rebounded to $1,690 an ounce.

#UK - IRELAND#

U.K. house prices grew 0.7% on month in April (-0.3% expected), according to the Nationwide Building Society.

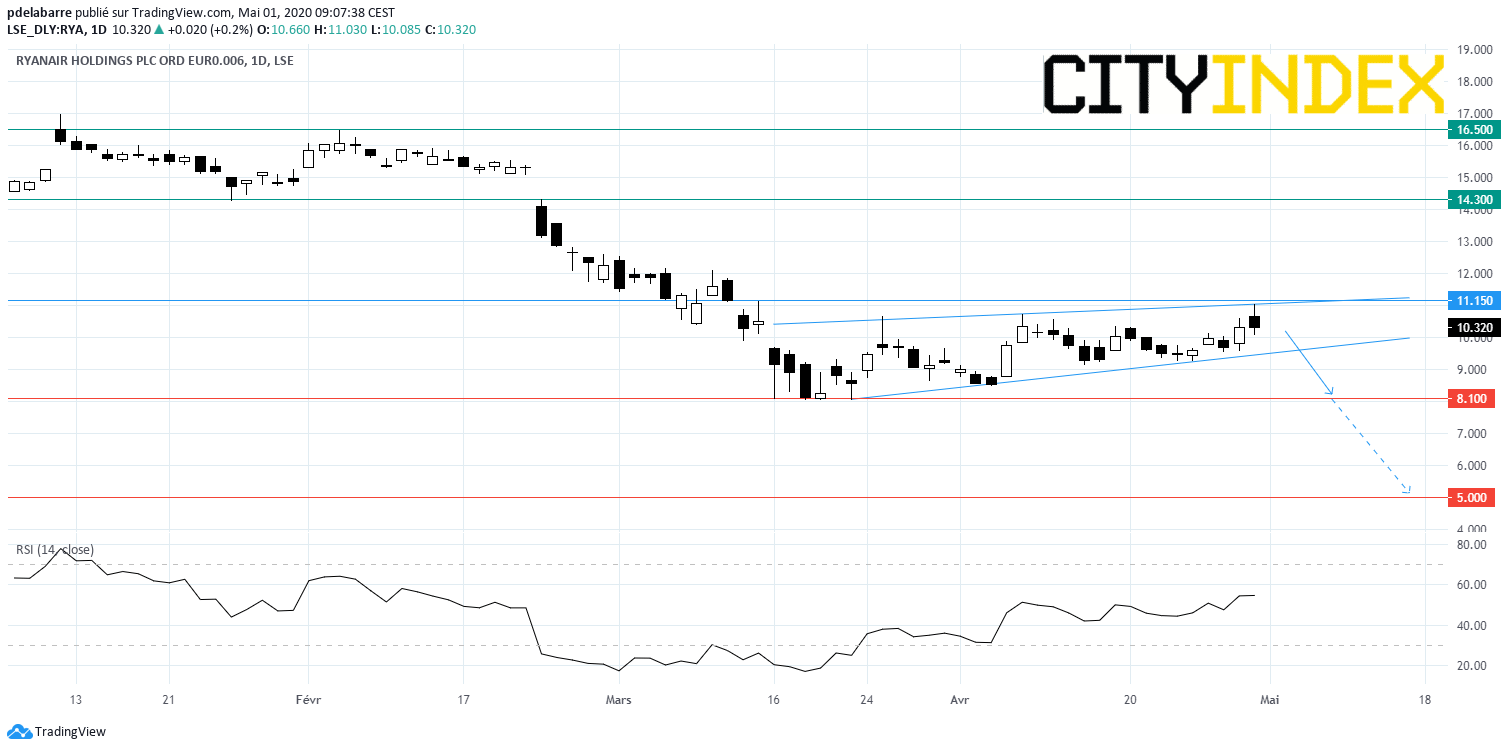

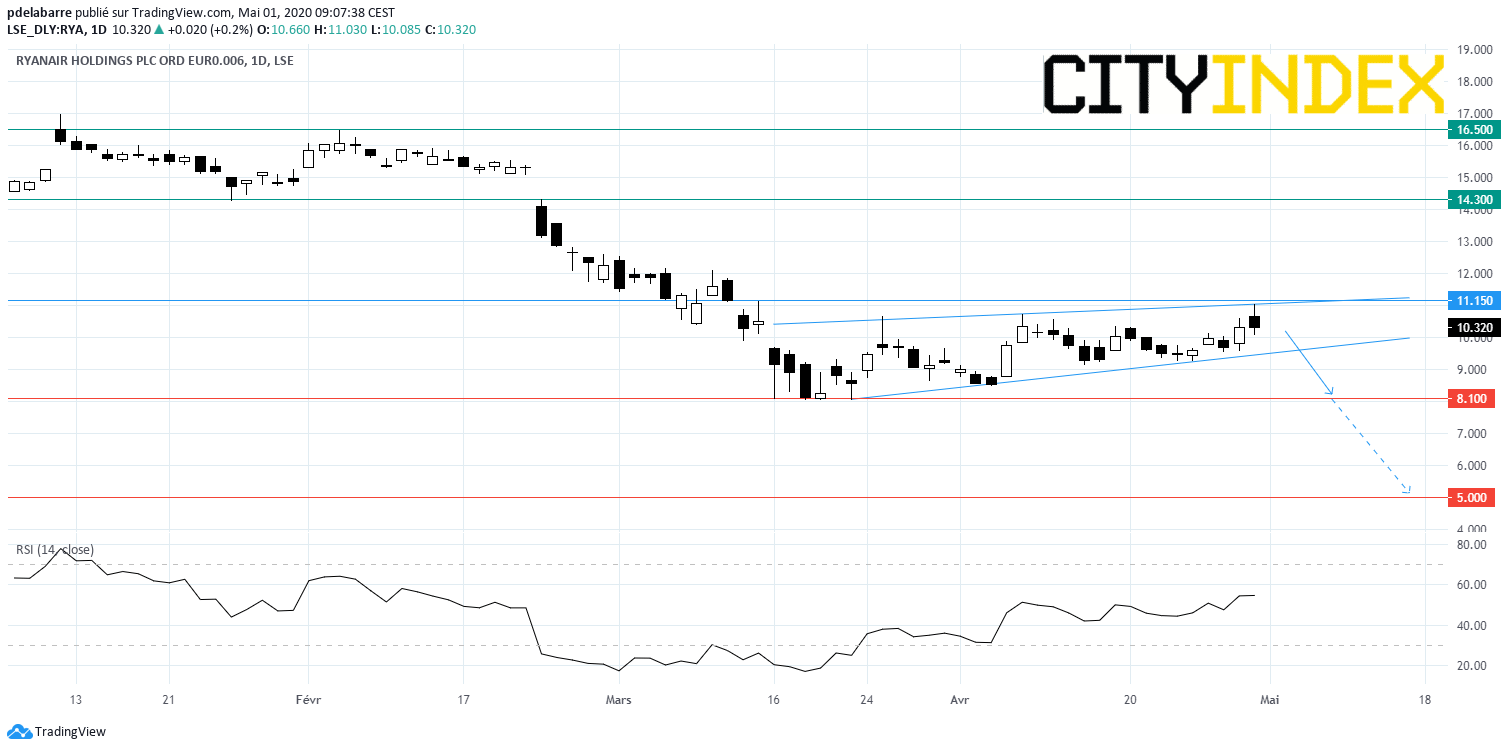

Ryanair, an airline group, posted a COVID-19 update: "The Ryanair Airlines will shortly notify their trade unions about its restructuring and job loss program, (...) and may result in the loss of up to 3,000 mainly pilot and cabin crew jobs, (...) The Group expects to report a net loss of over E100m in Q1, with further losses in Q2 (peak summer) due to the substantial decline in traffic arising from Covid-19 fleet groundings. Ryanair expects that its return to scheduled services will be rendered more difficult by competing with flag carrier airlines, who will be financing below cost selling with the benefit of over E30 billion in unlawful State Aid, in breach of both EU State Aid and competition rules."

Source: GAIN Capital, TradingView

Barratt Developments, a house-builder, released a COVID-19 update: "Work on our construction sites will recommence from 11 May, initially to implement the changes required under our new working practices and protocols. We will then start a phased return to construction, with 180 sites - around 50% of the total - in the first phase. (...) Initially our construction activities will prioritize sold plots at advanced stages of construction, and we therefore expect a limited number of additional completions this financial year. As at 26 April 2020, the Group has completed 11,776 homes (2019: 11,723 homes) (including JVs). Our total forward sales are 12,271 homes at a value of £2,852.9m (including JVs)."

Lloyds Banking Group, a major U.K. banking group, announced that Chief Operating Officer Juan Colombas has agreed to delay his retirement, and will remain in the post until September 18, 2020."

Royal Dutch Shell, an oil giant, was downgraded to "hold" from "buy" at HSBC.

Next, a retail group, was upgraded to "buy" from "hold" at HSBC.

#GERMANY#

Allianz, a financial services group, said it expects 1Q net income of 1.4 billion euros, down from 2.0 billion euros in the prior-year period, and operating profit is estimated to drop to 2.3 billion euros from 3.0 billion euros. In addition, the company announced the withdrawal of 2020 operating profit target of 11.5 - 12.5 billion euros, citing the current COVID-19 pandemic.

Wirecard, a digital financial commerce platform operator, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#FRANCE#

Societe Generale, a banking group, was downgraded to "neutral" from "buy" at Citigroup.

#BENELUX#

Ageas, an insurance group, was upgraded to "overweight" from "neutral" at JPMorgan.

#SWITZERLAND#

Lonza Group, a clinical stage biotechnology company, announced a 10-year strategic collaboration agreement to enable larger scale manufacture of Moderna's mRNA vaccine (mRNA-1273) against the novel coronavirus (SARS-CoV-2) and additional Moderna products in the future. The company said: "Our common goal is to potentially enable manufacturing of up to 1 billion doses of mRNA-1273."

Yesterday, European stocks turned to the downside, with the Stoxx Europe 600 Index falling 2.0%. Germany's DAX 30 lost 2.2%, France's CAC 40 slipped 2.1%, and the U.K.'s FTSE 100 slumped 3.5%.

EUROPE ADVANCE/DECLINE

80% of STOXX 600 constituents traded lower or unchanged yesterday.

86% of the shares trade above their 20D MA vs 95% Wednesday (above the 20D moving average).

23% of the shares trade above their 200D MA vs 26% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 3.19pts to 33.91, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

personal & household goods, real estate, utilities

Europe worst 3 sectors

banks, basic resources, insurance

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.5% (below its 20D MA). The 2yr-10yr yield spread rose 4bps to -17bps (above its 20D MA).

ECONOMIC DATA

UK 09:30: Mar Net Lending to Individuals MoM, exp.: £5.2B

UK 09:30: Mar Mortgage Approvals, exp.: 73.55K

UK 09:30: Mar Mortgage Lending, exp.: £4B

UK 09:30: Mar BoE Consumer Credit, exp.: £0.9B

UK 09:30: Apr Markit/CIPS Manufacturing PMI final, exp.: 47.8

MORNING TRADING

In Asian trading hours, EUR/USD firmed at 1.0945 while GBP/USD eased to 1.2563. USD/JPY held above the 107.00 level.

Spot gold rebounded to $1,690 an ounce.

#UK - IRELAND#

U.K. house prices grew 0.7% on month in April (-0.3% expected), according to the Nationwide Building Society.

Ryanair, an airline group, posted a COVID-19 update: "The Ryanair Airlines will shortly notify their trade unions about its restructuring and job loss program, (...) and may result in the loss of up to 3,000 mainly pilot and cabin crew jobs, (...) The Group expects to report a net loss of over E100m in Q1, with further losses in Q2 (peak summer) due to the substantial decline in traffic arising from Covid-19 fleet groundings. Ryanair expects that its return to scheduled services will be rendered more difficult by competing with flag carrier airlines, who will be financing below cost selling with the benefit of over E30 billion in unlawful State Aid, in breach of both EU State Aid and competition rules."

Source: GAIN Capital, TradingView

Barratt Developments, a house-builder, released a COVID-19 update: "Work on our construction sites will recommence from 11 May, initially to implement the changes required under our new working practices and protocols. We will then start a phased return to construction, with 180 sites - around 50% of the total - in the first phase. (...) Initially our construction activities will prioritize sold plots at advanced stages of construction, and we therefore expect a limited number of additional completions this financial year. As at 26 April 2020, the Group has completed 11,776 homes (2019: 11,723 homes) (including JVs). Our total forward sales are 12,271 homes at a value of £2,852.9m (including JVs)."

Lloyds Banking Group, a major U.K. banking group, announced that Chief Operating Officer Juan Colombas has agreed to delay his retirement, and will remain in the post until September 18, 2020."

Royal Dutch Shell, an oil giant, was downgraded to "hold" from "buy" at HSBC.

Next, a retail group, was upgraded to "buy" from "hold" at HSBC.

#GERMANY#

Allianz, a financial services group, said it expects 1Q net income of 1.4 billion euros, down from 2.0 billion euros in the prior-year period, and operating profit is estimated to drop to 2.3 billion euros from 3.0 billion euros. In addition, the company announced the withdrawal of 2020 operating profit target of 11.5 - 12.5 billion euros, citing the current COVID-19 pandemic.

Wirecard, a digital financial commerce platform operator, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#FRANCE#

Societe Generale, a banking group, was downgraded to "neutral" from "buy" at Citigroup.

#BENELUX#

Ageas, an insurance group, was upgraded to "overweight" from "neutral" at JPMorgan.

#SWITZERLAND#

Lonza Group, a clinical stage biotechnology company, announced a 10-year strategic collaboration agreement to enable larger scale manufacture of Moderna's mRNA vaccine (mRNA-1273) against the novel coronavirus (SARS-CoV-2) and additional Moderna products in the future. The company said: "Our common goal is to potentially enable manufacturing of up to 1 billion doses of mRNA-1273."

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM