EU indices in positive territory this morning | TA focus on Saint-Gobain

INDICES

Yesterday, European stocks were broadly higher again, with the Stoxx Europe 600 Index advancing 1.1%. Germany's DAX 30 gained 1.0%, France's CAC 40 jumped 1.5%, and the U.K. market was up 1.2%.

EUROPE ADVANCE/DECLINE

74% of STOXX 600 constituents traded higher yesterday.

86% of the shares trade above their 20D MA vs 78% Monday (above the 20D moving average).

31% of the shares trade above their 200D MA vs 31% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.12pt to 28.04, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: Telecom

Europe Best 3 sectors

travel & leisure, banks, insurance

Europe worst 3 sectors

health care, telecommunications, chemicals

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.49% (above its 20D MA). The 2yr-10yr yield spread fell 3bps to -21bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: May Consumer Confidence, exp.: 95

EC 08:30: ECB President Lagarde speech

EC 09:30: ECB Guindos speech

GE 14:30: Bundesbank Mauderer speech

MORNING TRADING

In Asian trading hours, EUR/USD retreated to 1.0956 and GBP/USD eased to 1.2315. USD/JPY slipped to 107.45.

Spot gold remained subdued at $1,710 an ounce.

#UK - IRELAND#

British Land, a property group, posted full-year results: "The IFRS loss after tax for the year was £1,114m, compared with a loss after tax for the prior year of £320m. As a result, IFRS basic EPS was (110.0)p per share, compared to (30.0)p per share in the prior year. This primarily reflects the downward valuation movement on the Group's properties of £1,105m, and an increase in the capital and other income loss from joint ventures and funds of £306m, both driven principally by outward yield shift of 101 bps and ERV decline of 11.7% in the Retail portfolio."

St. James's Place, a wealth management company, reported that funds under management grew 1.5% on year to 108.83 billion pounds as of April 30, where net inflows in totaled 0.81 billion pounds April , compared with 0.80 billion pounds in the prior-year period.

Auto Trader Group, a digital automotive marketplace, released a COVID-19 update: "The government's guidance on 25 May confirmed that vehicle retailers in England can reopen from 1 June. Today, we will advise those customers of the support we will provide as they resume trading. This will include a 25% discount for the month of June."

Britvic, a soft drinks producer, announced 1H results: "Revenue increased 1.4% to £698.8m (reported -9.1%). (...) Adjusted EBIT increased 9.4%* to £75.7m (reported -9.6%). (...) Profit after tax increased 11.5% to £38.9m. (...) Adjusted earnings per share increased 2.7% to 19.0p (reported -14.8%). (...) Board prudently defers dividend decision to later in year, when impact of Covid-19 will be clearer."

Hammerson, a property developer, announced that CEO David Atkins has decided to step down from his position before spring 2021.

Kingspan Group, a building materials supplier, was downgraded to "underweight" from "equalweight" at Barclays.

#GERMANY#

Commerzbank, a major German bank, reported that it has decided to launch an issuance program for additional tier 1 capital, with total subordinated bonds value of up to 3 billion euros.

LEG Immobilien and TAG Immobilien, the two property groups, said they have decided to terminate talks on a possible combination.

Infineon Technologies, a semiconductor manufacturer, announced that it has raised 1.06 billion euros through share placement, to repay a part of the acquisition financing provided by banks for the purchase of Cypress Semiconductor.

Volkswagen, a vehicle manufacturer, is nearing a deal to acquire a 50% stake in Chinese car maker Anhui Jianghuai Automobile Group for 491 million dollars, reported Bloomberg citing people familiar with the matter.

#FRANCE#

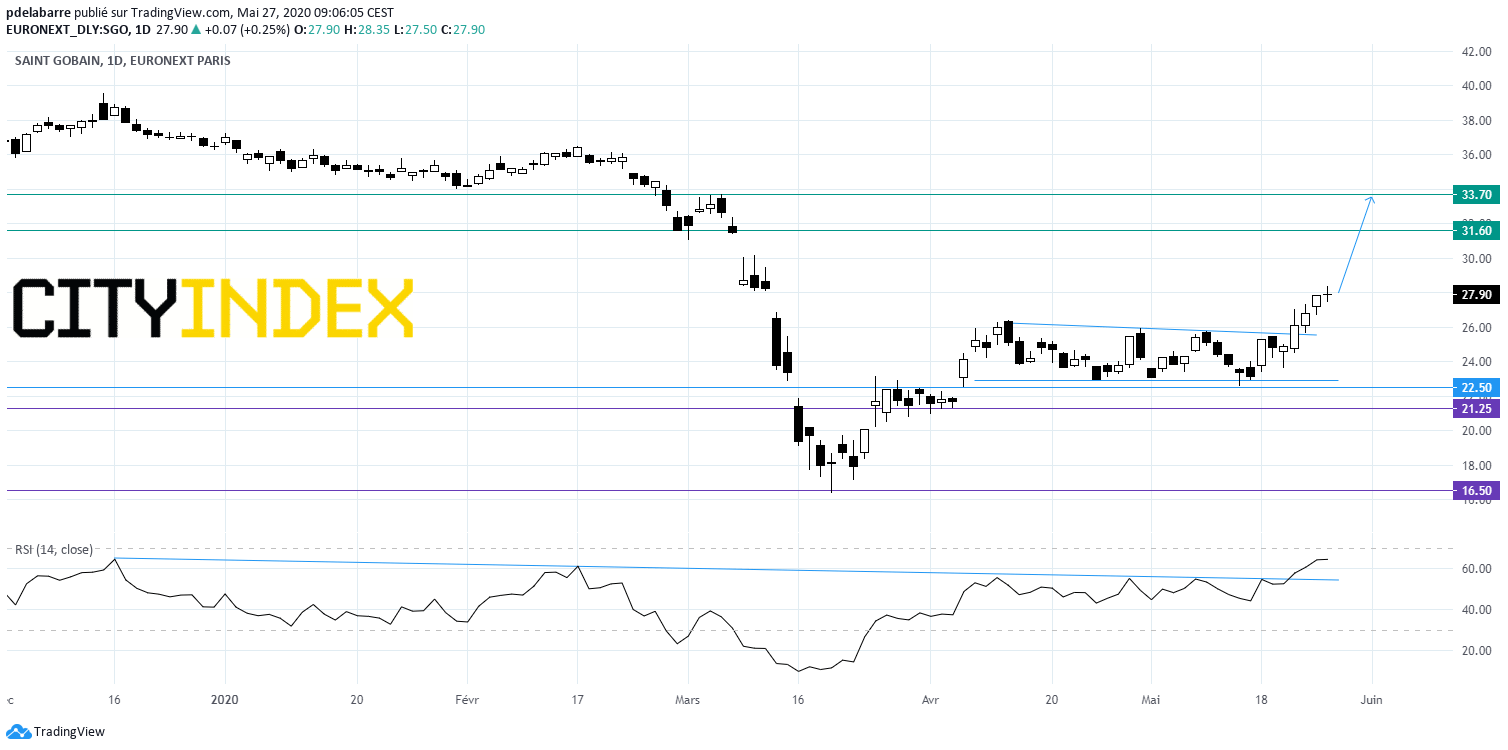

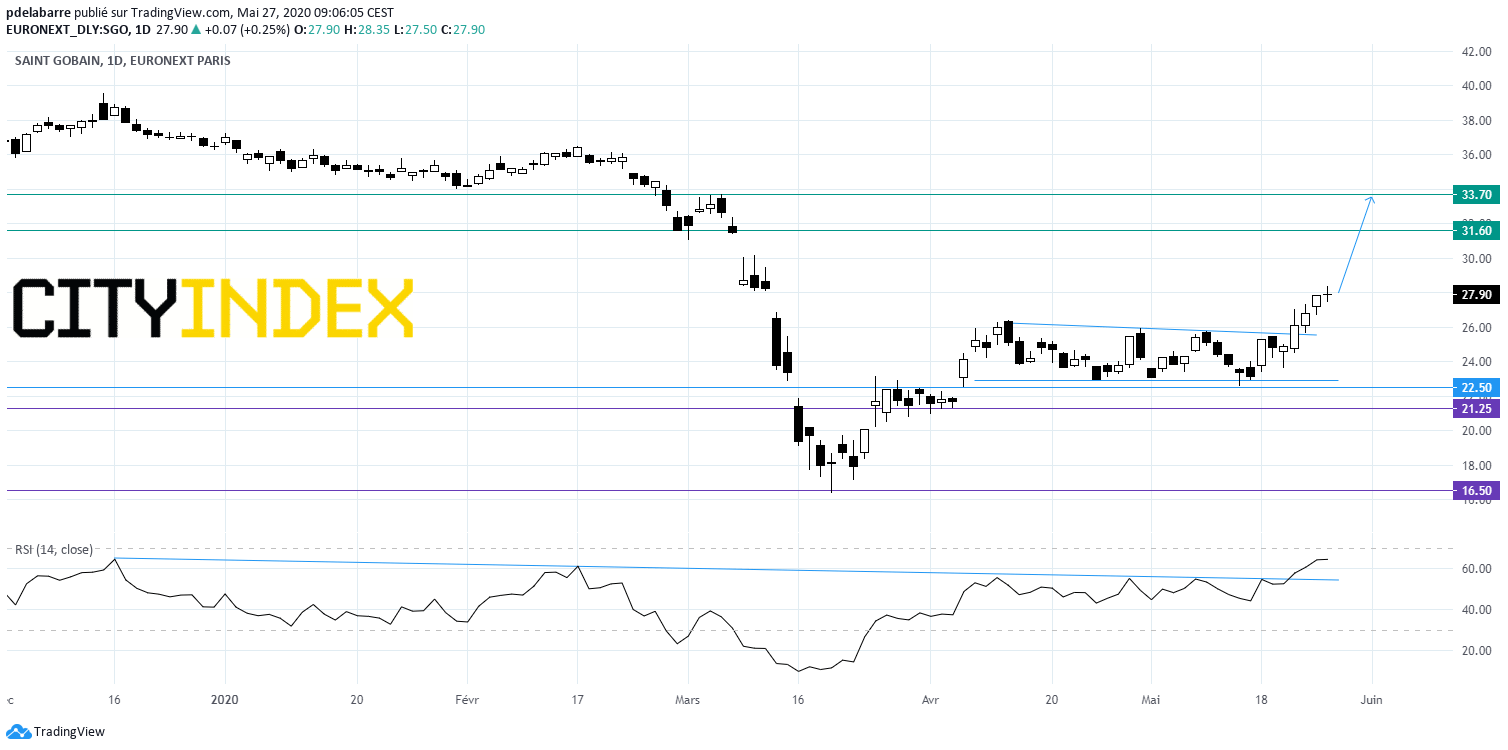

Saint-Gobain, a building materials supplier, announced the disposal of its entire stake in Sika of 15.2 million shares, representing approximately 2.7 billion Swiss franc, through a private placement to institutional investors. From a chartist point of view, a bullish continuation pattern in pennant has been confirmed. Furthermore, the RSI broke up a declining trend line. Above 22.5, the share aims 31.6 and 33.70 euros.

Source: GAIN Capital, TradingView

BNP Paribas, a banking group, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

#SWITZERLAND#

Sika's, a specialty chemical company, shareholder Saint-Gobain announced the sale of its entire stake in the company of 15.2 million shares, representing approximately 2.7 billion Swiss franc, through a private placement to institutional investors.

Roche, a pharmaceutical group, said the phase 3 trial, evaluating its Port Delivery System with ranibizumab in people living with neovascular or wet age-related macular degeneration, met its primary endpoint.

#DENMARK#

Rockwool International, a manufacturer of mineral wool products, was upgraded to "overweight" from "underweight" at Barclays.

EX-DIVIDEND

Safran: E2.38

Yesterday, European stocks were broadly higher again, with the Stoxx Europe 600 Index advancing 1.1%. Germany's DAX 30 gained 1.0%, France's CAC 40 jumped 1.5%, and the U.K. market was up 1.2%.

EUROPE ADVANCE/DECLINE

74% of STOXX 600 constituents traded higher yesterday.

86% of the shares trade above their 20D MA vs 78% Monday (above the 20D moving average).

31% of the shares trade above their 200D MA vs 31% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.12pt to 28.04, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: Telecom

Europe Best 3 sectors

travel & leisure, banks, insurance

Europe worst 3 sectors

health care, telecommunications, chemicals

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.49% (above its 20D MA). The 2yr-10yr yield spread fell 3bps to -21bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: May Consumer Confidence, exp.: 95

EC 08:30: ECB President Lagarde speech

EC 09:30: ECB Guindos speech

GE 14:30: Bundesbank Mauderer speech

MORNING TRADING

In Asian trading hours, EUR/USD retreated to 1.0956 and GBP/USD eased to 1.2315. USD/JPY slipped to 107.45.

Spot gold remained subdued at $1,710 an ounce.

#UK - IRELAND#

British Land, a property group, posted full-year results: "The IFRS loss after tax for the year was £1,114m, compared with a loss after tax for the prior year of £320m. As a result, IFRS basic EPS was (110.0)p per share, compared to (30.0)p per share in the prior year. This primarily reflects the downward valuation movement on the Group's properties of £1,105m, and an increase in the capital and other income loss from joint ventures and funds of £306m, both driven principally by outward yield shift of 101 bps and ERV decline of 11.7% in the Retail portfolio."

St. James's Place, a wealth management company, reported that funds under management grew 1.5% on year to 108.83 billion pounds as of April 30, where net inflows in totaled 0.81 billion pounds April , compared with 0.80 billion pounds in the prior-year period.

Auto Trader Group, a digital automotive marketplace, released a COVID-19 update: "The government's guidance on 25 May confirmed that vehicle retailers in England can reopen from 1 June. Today, we will advise those customers of the support we will provide as they resume trading. This will include a 25% discount for the month of June."

Britvic, a soft drinks producer, announced 1H results: "Revenue increased 1.4% to £698.8m (reported -9.1%). (...) Adjusted EBIT increased 9.4%* to £75.7m (reported -9.6%). (...) Profit after tax increased 11.5% to £38.9m. (...) Adjusted earnings per share increased 2.7% to 19.0p (reported -14.8%). (...) Board prudently defers dividend decision to later in year, when impact of Covid-19 will be clearer."

Hammerson, a property developer, announced that CEO David Atkins has decided to step down from his position before spring 2021.

Kingspan Group, a building materials supplier, was downgraded to "underweight" from "equalweight" at Barclays.

#GERMANY#

Commerzbank, a major German bank, reported that it has decided to launch an issuance program for additional tier 1 capital, with total subordinated bonds value of up to 3 billion euros.

LEG Immobilien and TAG Immobilien, the two property groups, said they have decided to terminate talks on a possible combination.

Infineon Technologies, a semiconductor manufacturer, announced that it has raised 1.06 billion euros through share placement, to repay a part of the acquisition financing provided by banks for the purchase of Cypress Semiconductor.

Volkswagen, a vehicle manufacturer, is nearing a deal to acquire a 50% stake in Chinese car maker Anhui Jianghuai Automobile Group for 491 million dollars, reported Bloomberg citing people familiar with the matter.

#FRANCE#

Saint-Gobain, a building materials supplier, announced the disposal of its entire stake in Sika of 15.2 million shares, representing approximately 2.7 billion Swiss franc, through a private placement to institutional investors. From a chartist point of view, a bullish continuation pattern in pennant has been confirmed. Furthermore, the RSI broke up a declining trend line. Above 22.5, the share aims 31.6 and 33.70 euros.

Source: GAIN Capital, TradingView

BNP Paribas, a banking group, was upgraded to "overweight" from "equalweight" at Morgan Stanley.

#SWITZERLAND#

Sika's, a specialty chemical company, shareholder Saint-Gobain announced the sale of its entire stake in the company of 15.2 million shares, representing approximately 2.7 billion Swiss franc, through a private placement to institutional investors.

Roche, a pharmaceutical group, said the phase 3 trial, evaluating its Port Delivery System with ranibizumab in people living with neovascular or wet age-related macular degeneration, met its primary endpoint.

#DENMARK#

Rockwool International, a manufacturer of mineral wool products, was upgraded to "overweight" from "underweight" at Barclays.

EX-DIVIDEND

Safran: E2.38

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM