EU indices in a bullish mood | TA focus on Wizz Air

INDICES

Yesterday, European stocks charged higher, with the Stoxx Europe 600 Index jumping 1.6%. Germany's DAX 30 surged 3.8% following a holiday on Monday. The U.K.'s FTSE 100 gained 0.9% and France's CAC 40 increased 2.0%.

EUROPE ADVANCE/DECLINE

78% of STOXX 600 constituents traded higher yesterday.

93% of the shares trade above their 20D MA vs 91% Monday (above the 20D moving average).

38% of the shares trade above their 200D MA vs 34% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.58pt to 30.68, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Basic Resources

3mths relative low: none

Europe Best 3 sectors

insurance, real estate, automobiles & parts

Europe worst 3 sectors

health care, food & beverage, personal & household goods

INTEREST RATE

The 10yr Bund yield rose 5bps to -0.4% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -24bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Apr Unemployment Rate Harmonised, exp.: 3.5%

FR 08:50: May Markit Composite PMI final, exp.: 11.1

FR 08:50: May Markit Services PMI final, exp.: 10.2

GE 08:55: May Unemployment Rate, exp.: 5.8%

GE 08:55: May Unemployment chg, exp.: 373K

GE 08:55: May Markit Services PMI final, exp.: 16.2

GE 08:55: May Markit Composite PMI final, exp.: 17.4

EC 09:00: May Markit Services PMI final, exp.: 12

EC 09:00: May Markit Composite PMI final, exp.: 13.6

UK 09:30: May Markit/CIPS UK Services PMI final, exp.: 13.4

UK 09:30: May Markit/CIPS Composite PMI final, exp.: 13.8

EC 10:00: Apr Unemployment Rate, exp.: 7.4%

EC 10:00: Apr PPI MoM, exp.: -1.5%

EC 10:00: Apr PPI YoY, exp.: -2.8%

GE 10:40: 5-Year Bobl auction, exp.: -0.74%

MORNING TRADING

In Asian trading hours, EUR/USD rose further to 1.1192 and GBP/USD climbed to 1.2577. USD/JPY eased to 108.51. AUD/USD extended its rally to 0.6937. This morning, official data showed that the Australian economy grew 1.4% on year as expected.

Spot gold marked a day-low near $1,720 an ounce before bouncing to $1,728 an ounce.

#UK - IRELAND#

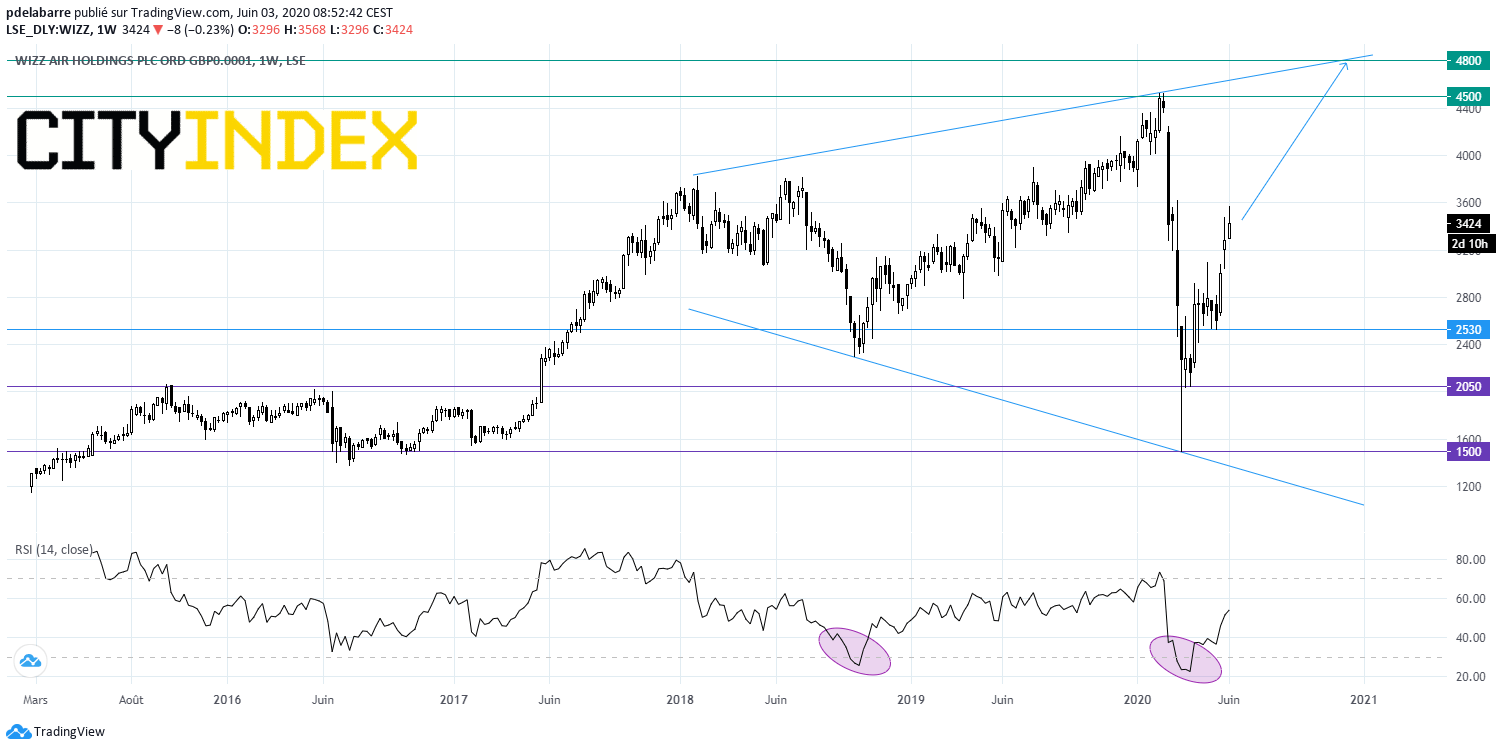

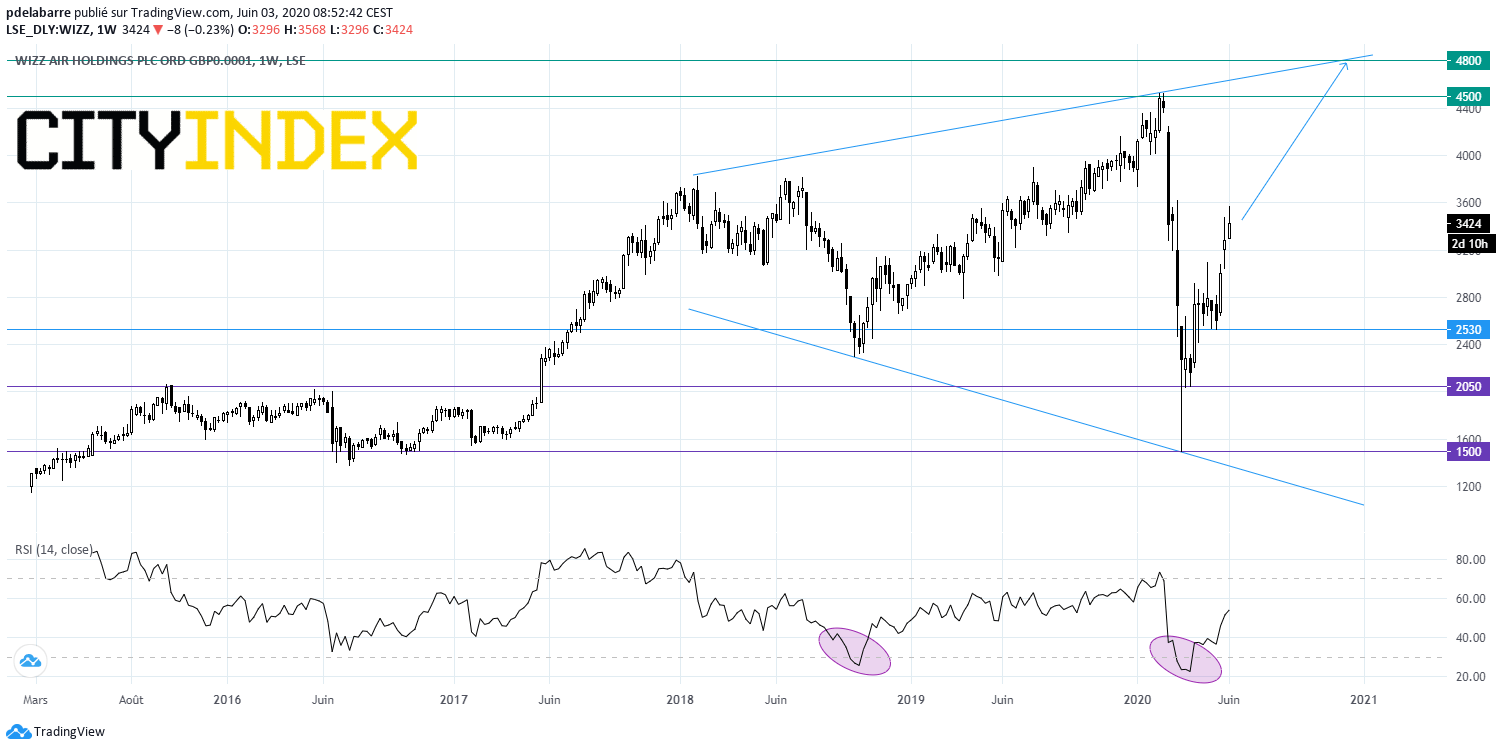

Wizz Air, a low-cost airline company, posted full-year results: "Underlying net profit grew 29.9% to a record E344.8 million and underlying net profit margin was 12.5%. (...) Total revenue increase of 19.1% to E2,761.3 million. (...) Total unit revenue improved by 2.6% to 3.95 euro cents per available seat kilometre (ASK). (...) We have taken various initiatives during the COVID-19 pandemic to safeguard the Company's cost position and excellent balance sheet with E1.5 billion of cash, one of the strongest in the airline industry. (...) It is too early to provide a detailed outlook for FY21 due to the ongoing uncertainty caused by COVID-19".

From a chartist point of view, the share aims the upper end of a large broadening formation (4500-4800 area) after the RSI indicator bounced off its oversold area (same situation as October 2018).

Source: GAIN Capital, TradingView

SSP Group, a catering and retail group, announced 1H results: "Revenue of £1,214.6m: down 2.7% at constant currency2; 3.7% at actual exchange rates. (...) Like-for-like sales down 8.4%: heavily impacted by Covid-19 and the closure of most of the global travel markets during March. (...) On a pro forma IAS 17 basis, underlying operating profit was £1.3m (2019: £62.5m). (...) On a pro forma IAS 17 basis, the underlying loss before tax was £10.7m (2019: profit of £54.2m). On a pro forma IAS 17 basis, underlying basic loss per share of 4.0 pence (2019: underlying basic earnings per share of 6.7 pence)."

#GERMANY#

BMW's, an automobile group, "A2" credit rating outlook was revised to "Negative" from "Ratings Under Review" at Moody's. The rating agency said: "The negative outlook reflects the potentially severe impact that the coronavirus could have on BMW's operating performance and credit metrics into 2021 and that the currently expected recovery may be harder to achieve."

Volkswagen's, an automotive manufacturing group, "A3" credit rating outlook was revised to "Negative" from "Ratings Under Review" at Moody's. The rating agency pointed out: "The negative outlook reflects the potentially severe impact that the coronavirus could have on VW's operating performance and credit metrics into 2021."

#FRANCE#

Renault, a vehicle manufacturer, was upgraded to "buy" from "neutral" at Goldman Sachs.

Iliad, a telecommunication services provider, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#SWEDEN#

Sandvik, a Swedish engineering group, was upgraded to "overweight" from "underweight" at JPMorgan.

EX-DIVIDEND

Deutsche Wohnen: E0.9

Yesterday, European stocks charged higher, with the Stoxx Europe 600 Index jumping 1.6%. Germany's DAX 30 surged 3.8% following a holiday on Monday. The U.K.'s FTSE 100 gained 0.9% and France's CAC 40 increased 2.0%.

EUROPE ADVANCE/DECLINE

78% of STOXX 600 constituents traded higher yesterday.

93% of the shares trade above their 20D MA vs 91% Monday (above the 20D moving average).

38% of the shares trade above their 200D MA vs 34% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.58pt to 30.68, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Basic Resources

3mths relative low: none

Europe Best 3 sectors

insurance, real estate, automobiles & parts

Europe worst 3 sectors

health care, food & beverage, personal & household goods

INTEREST RATE

The 10yr Bund yield rose 5bps to -0.4% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -24bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Apr Unemployment Rate Harmonised, exp.: 3.5%

FR 08:50: May Markit Composite PMI final, exp.: 11.1

FR 08:50: May Markit Services PMI final, exp.: 10.2

GE 08:55: May Unemployment Rate, exp.: 5.8%

GE 08:55: May Unemployment chg, exp.: 373K

GE 08:55: May Markit Services PMI final, exp.: 16.2

GE 08:55: May Markit Composite PMI final, exp.: 17.4

EC 09:00: May Markit Services PMI final, exp.: 12

EC 09:00: May Markit Composite PMI final, exp.: 13.6

UK 09:30: May Markit/CIPS UK Services PMI final, exp.: 13.4

UK 09:30: May Markit/CIPS Composite PMI final, exp.: 13.8

EC 10:00: Apr Unemployment Rate, exp.: 7.4%

EC 10:00: Apr PPI MoM, exp.: -1.5%

EC 10:00: Apr PPI YoY, exp.: -2.8%

GE 10:40: 5-Year Bobl auction, exp.: -0.74%

MORNING TRADING

In Asian trading hours, EUR/USD rose further to 1.1192 and GBP/USD climbed to 1.2577. USD/JPY eased to 108.51. AUD/USD extended its rally to 0.6937. This morning, official data showed that the Australian economy grew 1.4% on year as expected.

Spot gold marked a day-low near $1,720 an ounce before bouncing to $1,728 an ounce.

#UK - IRELAND#

Wizz Air, a low-cost airline company, posted full-year results: "Underlying net profit grew 29.9% to a record E344.8 million and underlying net profit margin was 12.5%. (...) Total revenue increase of 19.1% to E2,761.3 million. (...) Total unit revenue improved by 2.6% to 3.95 euro cents per available seat kilometre (ASK). (...) We have taken various initiatives during the COVID-19 pandemic to safeguard the Company's cost position and excellent balance sheet with E1.5 billion of cash, one of the strongest in the airline industry. (...) It is too early to provide a detailed outlook for FY21 due to the ongoing uncertainty caused by COVID-19".

From a chartist point of view, the share aims the upper end of a large broadening formation (4500-4800 area) after the RSI indicator bounced off its oversold area (same situation as October 2018).

Source: GAIN Capital, TradingView

SSP Group, a catering and retail group, announced 1H results: "Revenue of £1,214.6m: down 2.7% at constant currency2; 3.7% at actual exchange rates. (...) Like-for-like sales down 8.4%: heavily impacted by Covid-19 and the closure of most of the global travel markets during March. (...) On a pro forma IAS 17 basis, underlying operating profit was £1.3m (2019: £62.5m). (...) On a pro forma IAS 17 basis, the underlying loss before tax was £10.7m (2019: profit of £54.2m). On a pro forma IAS 17 basis, underlying basic loss per share of 4.0 pence (2019: underlying basic earnings per share of 6.7 pence)."

#GERMANY#

BMW's, an automobile group, "A2" credit rating outlook was revised to "Negative" from "Ratings Under Review" at Moody's. The rating agency said: "The negative outlook reflects the potentially severe impact that the coronavirus could have on BMW's operating performance and credit metrics into 2021 and that the currently expected recovery may be harder to achieve."

Volkswagen's, an automotive manufacturing group, "A3" credit rating outlook was revised to "Negative" from "Ratings Under Review" at Moody's. The rating agency pointed out: "The negative outlook reflects the potentially severe impact that the coronavirus could have on VW's operating performance and credit metrics into 2021."

#FRANCE#

Renault, a vehicle manufacturer, was upgraded to "buy" from "neutral" at Goldman Sachs.

Iliad, a telecommunication services provider, was downgraded to "equalweight" from "overweight" at Morgan Stanley.

#SWEDEN#

Sandvik, a Swedish engineering group, was upgraded to "overweight" from "underweight" at JPMorgan.

EX-DIVIDEND

Deutsche Wohnen: E0.9

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM