EU indices globally flat | TA focus on Grifols

Yesterday, European stocks retreated from their recent rally, with the Stoxx Europe 600 Index easing 0.3%. Both Germany's DAX 30 and the U.K.'s FTSE 100 declined 0.2%, and France's CAC 40 was down 0.4%.

EUROPE ADVANCE/DECLINE

56% of STOXX 600 constituents traded lower or unchanged yesterday.

88% of the shares trade above their 20D MA vs 90% Friday (above the 20D moving average).

48% of the shares trade above their 200D MA vs 50% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.23pt to 28.12, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Autos, Basic Resources

3mths relative low: none

Europe Best 3 sectors

banks, energy, utilities

Europe worst 3 sectors

technology, real estate, retail

INTEREST RATE

The 10yr Bund yield rose 4bps to -0.28% (above its 20D MA). The 2yr-10yr yield spread rose 2bps to -30bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Apr Current Account, exp.: E24.4B

GE 07:00: Apr Balance of Trade, exp.: E17.4B

GE 07:00: Apr Imports MoM s.a, exp.: -5.1%

GE 07:00: Apr Exports MoM s.a, exp.: -11.8%

GE 07:00: Apr Balance of Trade s.a, exp.: E12.8B

FR 07:45: Apr Current Account, exp.: E-3.3B

FR 07:45: Apr Balance of Trade, exp.: E-3.3B

EC 10:00: Q1 GDP Growth Rate YoY 3rd Est, exp.: 1%

EC 10:00: Q1 GDP Growth Rate QoQ 3rd Est, exp.: 0.1%

EC 10:00: Q1 Employment chg YoY final, exp.: 1.1%

EC 10:00: Q1 Employment chg QoQ final, exp.: 0.3%

MORNING TRADING

In Asian trading hours, EUR/USD slipped to 1.1286 and GBP/USD eased to 1.2715. USD/JPY dropped further to 108.17.

Spot gold marked a day-high near $1,704 an ounce before retreating to $1,696 an ounce.

#UK - IRELAND#

Aveva, an IT company, released full-year results: "Revenue was £833.8 million, which was up 8.8% versus the previous year (FY19: £766.6 million on a statutory basis). Adjusted EBIT grew by 23.3% to £216.8 million (FY19: £175.9 million), primarily due to revenue growth, higher gross margin and operational leverage. For the same reasons, on a statutory basis, profit before tax increased by 97% to £92.0 million. (...) Organic constant currency revenue grew 7.4%, (...) Adjusted diluted EPS grew 24.9% to 108.15 pence (FY19: 86.60 pence). (...) AVEVA's Board intends to maintain a final dividend of 29.0 pence per share at a cost of £46.8 million (FY19: 29.0 pence per share at a cost of £46.8 million)."

Big Yellow Group, a self-storage company, announced full-year results: "Revenue for the year was £129.3 million (2019: £125.4 million), an increase of 3.1%. Like-for-like revenue growth was 3.8%. (...) this revenue growth has delivered an increase of 5.2% in the adjusted profit before tax in the year of £71.0 million (2019: £67.5 million). (...) This brings the total distribution declared for the year to 33.8 pence per share representing an increase of 1.8% from 33.2 pence per share last year."

Bellway, a property developer, published a trading update: "Construction activity has recommenced on around 230 sites, (...) The forward sales position is substantial, with an order book comprising 6,038 homes (2 June 2019 - 6,312 homes) and a value of £1,568 million (2 June 2019 - £1,643 million)."

Flutter Entertainment, a bookmaking holding company, was downgraded to "reduce" from "hold" at HSBC.

GVC, a sports betting company, was downgraded to "hold" from "buy" at HSBC

Greggs, a bakery chain, was upgraded to "hold" from "reduce" at HSBC.

#GERMANY#

BASF, a chemical producer, was downgraded to "hold" from "buy" at HSBC.

#FRANCE#

Vinci, a concessions and construction company, said "flights between Lisbon, Porto and Faro and Lyon-Saint Exupery and Nantes Atlantique airports, all members of the Vinci Airports network, will resume on 15 June".

#SPAIN#

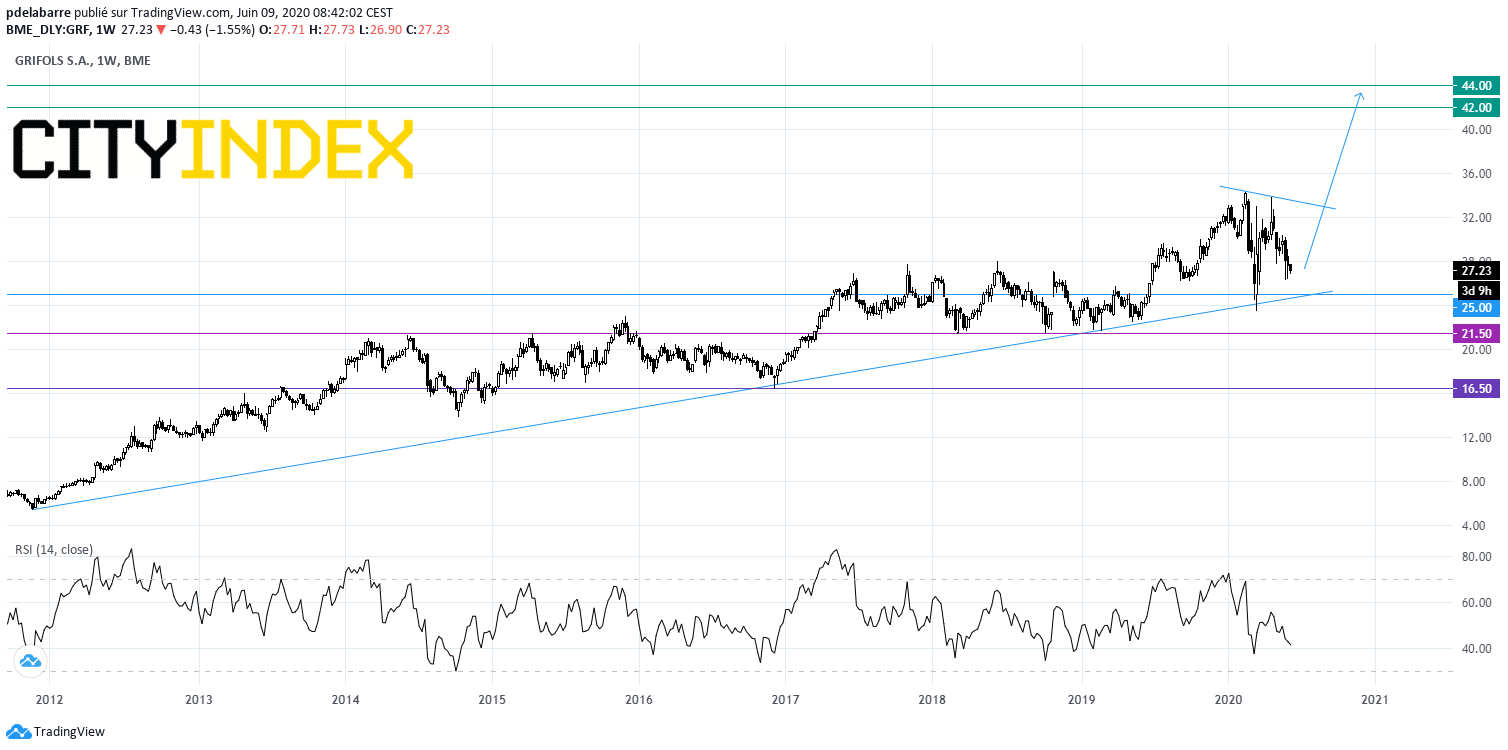

Grifols, a Spanish pharmaceutical group, said it expects a 200 million euros Covid-19 related impact on fiscal year 2020, due inventory valuation rather than revenue or cash generation. Meanwhile, the company was upgraded to "hold" from "reduce" at HSBC. From a chartist point of view, the share is supported by a long-term rising trend line.

Source: GAIN Capital, TradingView

#SWITZERLAND#

SGS, a testing and certification services provider, was upgraded to "overweight" from "equalweight" at Barclays.

EX-DIVIDEND

Anheuser-Busch InBev: E0.5