EU indices flat this morning | TA focus on UBS Group

INDICES

Yesterday, European stocks had a good day, with the Stoxx Europe 600 Index jumping 1.7%. Germany's DAX 30 surged 3.1%, the U.K.'s FTSE 100 gained 1.6% and France's CAC 40 bounced 2.6%.

EUROPE ADVANCE/DECLINE

79% of STOXX 600 constituents traded higher yesterday.

78% of the shares trade above their 20D MA vs 65% Friday (below the 20D moving average).

22% of the shares trade above their 200D MA vs 21% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 5.46pts to 34.72, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: real estate

Europe Best 3 sectors

automobiles & parts, travel & leisure, banks

Europe worst 3 sectors

real estate, food & beverage, energy

INTEREST RATE

The 10yr Bund yield fell 5bps to -0.47% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -21bps (above its 20D MA).

ECONOMIC DATA

FR 07:45: Apr Consumer Confidence, exp.: 103

UK 11:00: Apr CBI Distributive Trades, exp.: -3

MORNING TRADING

In Asian trading hours, EUR/USD relatively unchanged at 1.0827 while GBP/USD held gains at 1.2424. USD/JPY was steady at 107.28.

Spot gold slid to $1,703 an ounce.

#UK - IRELAND#

HSBC, a global banking group, announced that 1Q profit before tax declined 48% on year to 3.23 billion dollars, citing "higher expected credit losses and other credit impairment charges and lower revenue" due to the Covid-19 outbreak and weakening oil prices. The bank said 1Q estimated credit losses (ECL) of 3.0 billion dollars were 2.4 billion dollars higher than in 1Q 2019. Regarding 2020 outlook, the bank stated: "The impact and duration of the Covid-19 crisis will likely lead to higher ECL and put pressure on revenue due to lower customer activity levels and reduced global interest rates. (...) These factors are expected to lead to materially lower profitability in 2020, relative to 2019."

Diageo, a alcoholic beverages company, said it has "launched and priced a $2.5 billion SEC-registered bond offering, consisting of $750 million 1.375% fixed rate notes due 2025; $1 billion 2.000% fixed rate notes due 2030; and $750 million 2.125% fixed rate notes due 2032."

Plus500, a online service provider for trading Contracts for Difference, posted a trading update: "Revenue from Customer Income1 in the first half to date remains at record levels, with the Group's financial performance during the second quarter continuing to show further momentum following an exceptional first quarter. (...) revenue and profitability for the full year is expected to be substantially ahead of current consensus expectations, , as revised following the Q1 trading update on 7 April."

Royal Mail, a postal service provider, was upgraded to "buy" from "sell" at Citigroup.

#GERMANY#

Delivery Hero, online food-delivery company, reported that 1Q revenue jumped 92% on a constant currency basis on year to 515 million euros and orders were up 92% to 239 million. The company confirmed its full-year revenue guidance of 2.4 - 2.6 billion euros, reflecting a growth of around 70%, and adjusted EBITDA is expected to be between -14% and -18%.

#FRANCE#

Capgemini, an IT consulting firm, reported that 1Q revenue grew 3.1% on year (+2.3% at constant exchange rates) to 3.55 billion euros. Meanwhile, the company said it has decided to reduce the dividend to 1.35 euros per share from 1.90 euros per share previously proposed, citing the COVID-19 crisis.

Worldline's, a digital transactions company, shareholder SIX said it will sell 11 million Worldline shares or 6.0% of its share capital, and will hold a 16.3% stake in the company after the sale.

Carrefour, a hypermarket chain, is expected to release a 1Q sales update.

#SPAIN#

Santander, a Spanish bank, announced that 1Q net income slumped 82.0% on year to 331 million euros, citing 1.6 billion euros coronavirus related provisions, and net interest income slid 2.2% to 8.49 billion euros. Also, CET1 ratio slipped to 11.58% from 11.65% in the prior quarter, while non-performing loan ratio improved to 3.25% from 3.32%.

#SWITZERLAND#

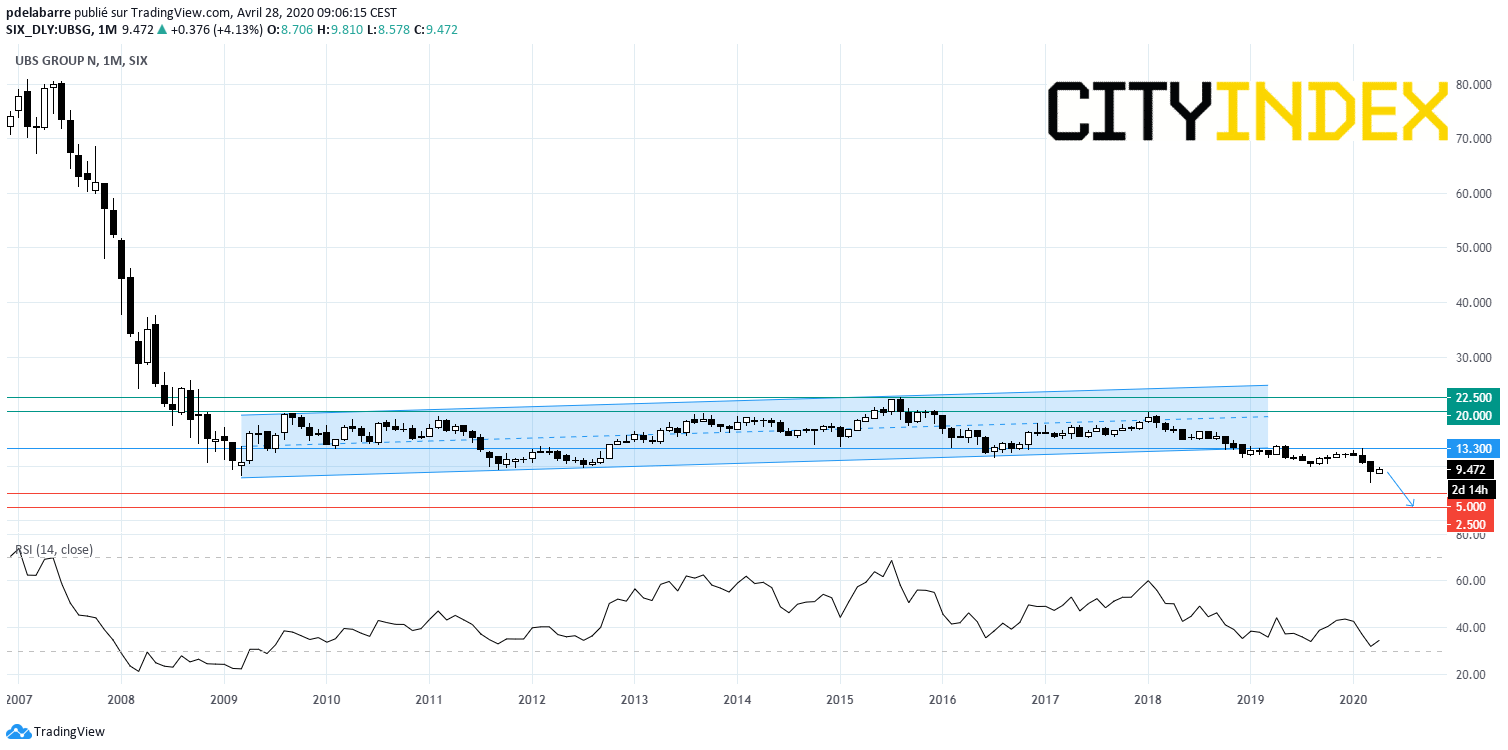

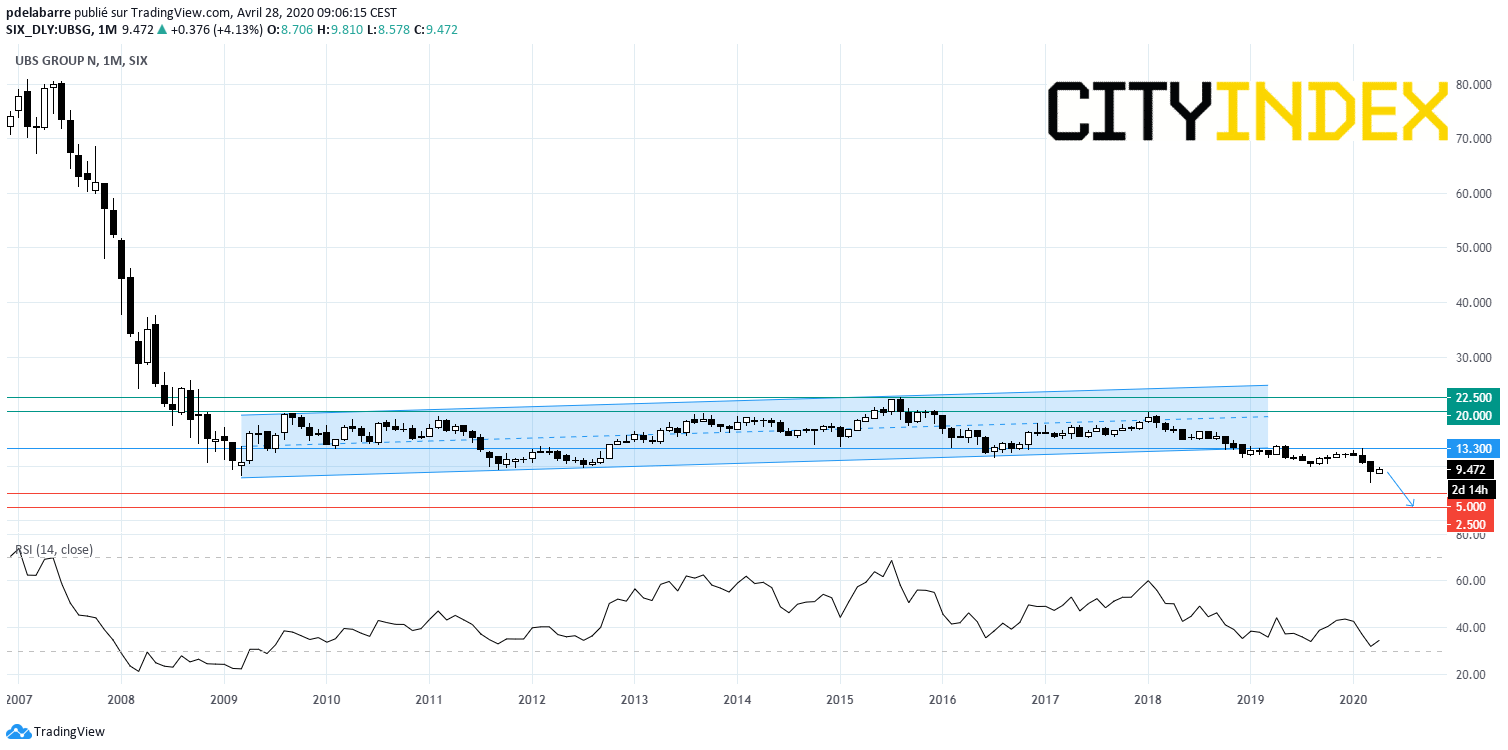

UBS Group, a Swiss bank, announced that 1Q net income rose 39.8% on year to 1.60 billion dollars and operating income increased 9.9% to 7.93 billion dollars. Also, credit loss expenses increased to 268 million dollars from 20 million dollars in the prior-year period. Meanwhile, return on equity climbed to 11.3% from 8.6% in the prior-year period while CET1 ratio fell to 12.8% from 13.0%. Regarding the outlook, the bank said: "Lower asset prices will reduce our recurring fee income, lower interest rates will present a headwind to net interest income, and client activity levels will likely decrease, affecting transaction-based income. The continued disciplined execution of our strategic plans will help to mitigate this."

Source: GAIN Capital, TradingView

Novartis, a pharmaceutical group, reported that 1Q core net income rose 26% on year to 3.55 billion dollars and operating income increased 22% to 2.74 billion dollars on net sales of 12.28 billion dollars, up 11% (+13% at constant currency). The company confirmed its full-year net sales growth guidance of "mid to high-single digit" and core operating income is expected to grow "high-single to low double digit".

ABB, a robotics and automation technology company, posted 1Q net income dropped 30% on year to 376 million dollars and operational EBITA slid 17% to 636 million dollars on revenue of 6.22 billion dollars, down 9% (-7% on a comparable basis). The company added: "ABB expects its results to be significantly impacted in the second quarter. Orders and revenues are expected to show material sequential decline in all businesses."

#SCANDINAVIA#

Telenor, a Norwegian telecommunications group, reported that 1Q net income plunged 82% on year to 698 million Norwegian krone while EBITDA climbed 13% to 13.80 billion Norwegian krone on revenue of 30.95 billion Norwegian krone, up 16%. Regarding 2020 outlook, the company said: "For 2020, Telenor expects lower subscription and traffic revenues and EBITDA growth than previously indicated."

EX-DIVIDEND

Hermes: E3.05

Yesterday, European stocks had a good day, with the Stoxx Europe 600 Index jumping 1.7%. Germany's DAX 30 surged 3.1%, the U.K.'s FTSE 100 gained 1.6% and France's CAC 40 bounced 2.6%.

EUROPE ADVANCE/DECLINE

79% of STOXX 600 constituents traded higher yesterday.

78% of the shares trade above their 20D MA vs 65% Friday (below the 20D moving average).

22% of the shares trade above their 200D MA vs 21% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 5.46pts to 34.72, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: real estate

Europe Best 3 sectors

automobiles & parts, travel & leisure, banks

Europe worst 3 sectors

real estate, food & beverage, energy

INTEREST RATE

The 10yr Bund yield fell 5bps to -0.47% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -21bps (above its 20D MA).

ECONOMIC DATA

FR 07:45: Apr Consumer Confidence, exp.: 103

UK 11:00: Apr CBI Distributive Trades, exp.: -3

MORNING TRADING

In Asian trading hours, EUR/USD relatively unchanged at 1.0827 while GBP/USD held gains at 1.2424. USD/JPY was steady at 107.28.

Spot gold slid to $1,703 an ounce.

#UK - IRELAND#

HSBC, a global banking group, announced that 1Q profit before tax declined 48% on year to 3.23 billion dollars, citing "higher expected credit losses and other credit impairment charges and lower revenue" due to the Covid-19 outbreak and weakening oil prices. The bank said 1Q estimated credit losses (ECL) of 3.0 billion dollars were 2.4 billion dollars higher than in 1Q 2019. Regarding 2020 outlook, the bank stated: "The impact and duration of the Covid-19 crisis will likely lead to higher ECL and put pressure on revenue due to lower customer activity levels and reduced global interest rates. (...) These factors are expected to lead to materially lower profitability in 2020, relative to 2019."

Diageo, a alcoholic beverages company, said it has "launched and priced a $2.5 billion SEC-registered bond offering, consisting of $750 million 1.375% fixed rate notes due 2025; $1 billion 2.000% fixed rate notes due 2030; and $750 million 2.125% fixed rate notes due 2032."

Plus500, a online service provider for trading Contracts for Difference, posted a trading update: "Revenue from Customer Income1 in the first half to date remains at record levels, with the Group's financial performance during the second quarter continuing to show further momentum following an exceptional first quarter. (...) revenue and profitability for the full year is expected to be substantially ahead of current consensus expectations, , as revised following the Q1 trading update on 7 April."

Royal Mail, a postal service provider, was upgraded to "buy" from "sell" at Citigroup.

#GERMANY#

Delivery Hero, online food-delivery company, reported that 1Q revenue jumped 92% on a constant currency basis on year to 515 million euros and orders were up 92% to 239 million. The company confirmed its full-year revenue guidance of 2.4 - 2.6 billion euros, reflecting a growth of around 70%, and adjusted EBITDA is expected to be between -14% and -18%.

#FRANCE#

Capgemini, an IT consulting firm, reported that 1Q revenue grew 3.1% on year (+2.3% at constant exchange rates) to 3.55 billion euros. Meanwhile, the company said it has decided to reduce the dividend to 1.35 euros per share from 1.90 euros per share previously proposed, citing the COVID-19 crisis.

Worldline's, a digital transactions company, shareholder SIX said it will sell 11 million Worldline shares or 6.0% of its share capital, and will hold a 16.3% stake in the company after the sale.

Carrefour, a hypermarket chain, is expected to release a 1Q sales update.

#SPAIN#

Santander, a Spanish bank, announced that 1Q net income slumped 82.0% on year to 331 million euros, citing 1.6 billion euros coronavirus related provisions, and net interest income slid 2.2% to 8.49 billion euros. Also, CET1 ratio slipped to 11.58% from 11.65% in the prior quarter, while non-performing loan ratio improved to 3.25% from 3.32%.

#SWITZERLAND#

UBS Group, a Swiss bank, announced that 1Q net income rose 39.8% on year to 1.60 billion dollars and operating income increased 9.9% to 7.93 billion dollars. Also, credit loss expenses increased to 268 million dollars from 20 million dollars in the prior-year period. Meanwhile, return on equity climbed to 11.3% from 8.6% in the prior-year period while CET1 ratio fell to 12.8% from 13.0%. Regarding the outlook, the bank said: "Lower asset prices will reduce our recurring fee income, lower interest rates will present a headwind to net interest income, and client activity levels will likely decrease, affecting transaction-based income. The continued disciplined execution of our strategic plans will help to mitigate this."

Source: GAIN Capital, TradingView

Novartis, a pharmaceutical group, reported that 1Q core net income rose 26% on year to 3.55 billion dollars and operating income increased 22% to 2.74 billion dollars on net sales of 12.28 billion dollars, up 11% (+13% at constant currency). The company confirmed its full-year net sales growth guidance of "mid to high-single digit" and core operating income is expected to grow "high-single to low double digit".

ABB, a robotics and automation technology company, posted 1Q net income dropped 30% on year to 376 million dollars and operational EBITA slid 17% to 636 million dollars on revenue of 6.22 billion dollars, down 9% (-7% on a comparable basis). The company added: "ABB expects its results to be significantly impacted in the second quarter. Orders and revenues are expected to show material sequential decline in all businesses."

#SCANDINAVIA#

Telenor, a Norwegian telecommunications group, reported that 1Q net income plunged 82% on year to 698 million Norwegian krone while EBITDA climbed 13% to 13.80 billion Norwegian krone on revenue of 30.95 billion Norwegian krone, up 16%. Regarding 2020 outlook, the company said: "For 2020, Telenor expects lower subscription and traffic revenues and EBITDA growth than previously indicated."

EX-DIVIDEND

Hermes: E3.05

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM