EU indices flat this morning | TA focus on Sanofi

INDICES

Yesterday, European stocks rebounded strongly. The Stoxx Europe 600 Index jumped 1.97%. Germany's DAX 30 surged 2.84%, France's CAC 40 advanced 2.49%, and the U.K.'s FTSE 100 was up 1.34%.

EUROPE ADVANCE/DECLINE

89% of STOXX 600 constituents traded higher yesterday.

64% of the shares trade above their 20D MA vs 42% Wednesday (below the 20D moving average).

46% of the shares trade above their 200D MA vs 43% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.54pts to 27.59, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals

3mths relative low: Media

Europe Best 3 sectors

banks, automobiles & parts, chemicals

Europe worst 3 sectors

health care, media, telecommunications

INTEREST RATE

The 10yr Bund yield rose 6bps to -0.4% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -25bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: May Budget Balance, exp.: E-92.1B

FR 08:50: Jun Markit Services PMI final, exp.: 31.1

FR 08:50: Jun Markit Composite PMI final, exp.: 32.1

GE 08:55: Jun Markit Services PMI final, exp.: 32.6

GE 08:55: Jun Markit Composite PMI final, exp.: 32.3

EC 09:00: Jun Markit Services PMI final, exp.: 30.5

EC 09:00: Jun Markit Composite PMI final, exp.: 31.9

UK 09:30: Jun Markit/CIPS UK Services PMI final, exp.: 29

UK 09:30: Jun Markit/CIPS Composite PMI final, exp.: 30

MORNING TRADING

In Asian trading hours, EUR/USD bounced to 1.1245 while GBP/USD was broadly flat at 1.2464. USD/JPY was little changed at 107.53. AUD/USD held gains at 0.6926. This morning, official data showed that Australia's retail sales rose 16.9% on month in May (+16.3% expected).

Spot gold edged up to $1,776 an ounce.

#UK#

Essentra, a provider of essential components and solutions, posted a 1H trading statement: "As highlighted in the Company's last announcement dated 21 May 2020, Group like-for-like (LFL) revenue declined 17% in April. Group LFL revenue performance has improved as the quarter progressed - in May it was -10%, in June it is expected to be -1%. The Company therefore expects that LFL Q2 performance will be -10%, whilst LFL H1 performance is anticipated to be -9%."

Associated British Foods, a food processing and retailing company, was downgraded to "neutral" from "buy" at Goldman Sachs.

Next, a retail group, was downgraded to "sell" from "neutral" at Goldman Sachs.

#GERMANY#

Deutsche Bank's, a banking group, chief economist Torsten Slok, will leave the bank to join alternative investment firm Apollo Global Management, according to Bloomberg.

HeidelbergCement, a building materials supplier, was upgraded to "overweight" from "underweight" at Morgan Stanley.

#FRANCE#

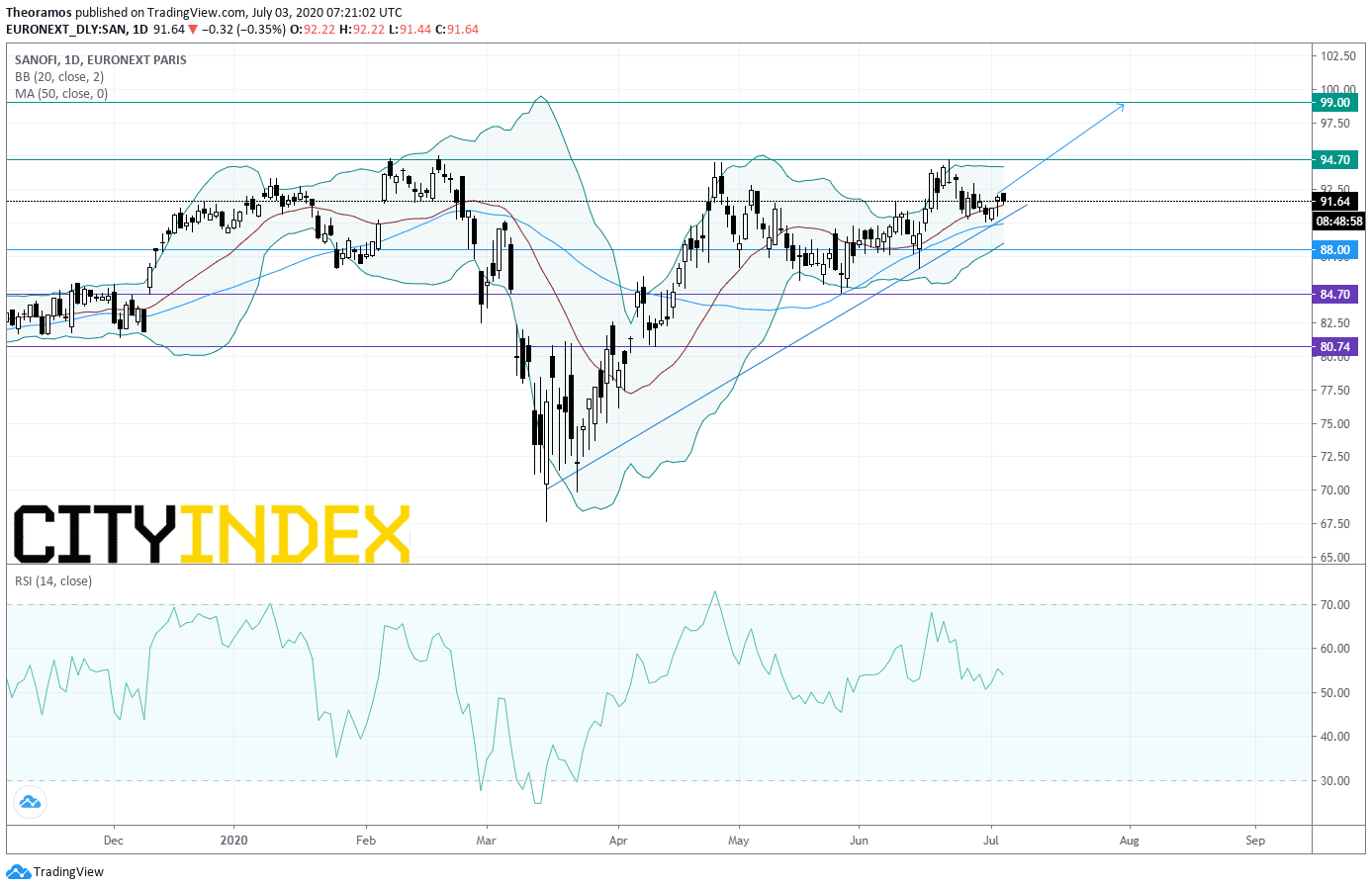

Sanofi, a French pharmaceutical group, and American biotech firm Regeneron announced that a phase 3 trial of their Kevzara in COVID-19 patients did not meet its primary and key secondary endpoints. Looking at a daily chart, Sanofi's stock price stands above the support at 88 euros and is supported by a rising trend line since march the 16th. Moreover the 50DMA is still ascending and provides support near 90 euros. Above 88 euros look for the horizontal resistance 94.7 and 99 euros in extension.

Yesterday, European stocks rebounded strongly. The Stoxx Europe 600 Index jumped 1.97%. Germany's DAX 30 surged 2.84%, France's CAC 40 advanced 2.49%, and the U.K.'s FTSE 100 was up 1.34%.

EUROPE ADVANCE/DECLINE

89% of STOXX 600 constituents traded higher yesterday.

64% of the shares trade above their 20D MA vs 42% Wednesday (below the 20D moving average).

46% of the shares trade above their 200D MA vs 43% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.54pts to 27.59, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals

3mths relative low: Media

Europe Best 3 sectors

banks, automobiles & parts, chemicals

Europe worst 3 sectors

health care, media, telecommunications

INTEREST RATE

The 10yr Bund yield rose 6bps to -0.4% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -25bps (below its 20D MA).

ECONOMIC DATA

FR 07:45: May Budget Balance, exp.: E-92.1B

FR 08:50: Jun Markit Services PMI final, exp.: 31.1

FR 08:50: Jun Markit Composite PMI final, exp.: 32.1

GE 08:55: Jun Markit Services PMI final, exp.: 32.6

GE 08:55: Jun Markit Composite PMI final, exp.: 32.3

EC 09:00: Jun Markit Services PMI final, exp.: 30.5

EC 09:00: Jun Markit Composite PMI final, exp.: 31.9

UK 09:30: Jun Markit/CIPS UK Services PMI final, exp.: 29

UK 09:30: Jun Markit/CIPS Composite PMI final, exp.: 30

MORNING TRADING

In Asian trading hours, EUR/USD bounced to 1.1245 while GBP/USD was broadly flat at 1.2464. USD/JPY was little changed at 107.53. AUD/USD held gains at 0.6926. This morning, official data showed that Australia's retail sales rose 16.9% on month in May (+16.3% expected).

Spot gold edged up to $1,776 an ounce.

#UK#

Essentra, a provider of essential components and solutions, posted a 1H trading statement: "As highlighted in the Company's last announcement dated 21 May 2020, Group like-for-like (LFL) revenue declined 17% in April. Group LFL revenue performance has improved as the quarter progressed - in May it was -10%, in June it is expected to be -1%. The Company therefore expects that LFL Q2 performance will be -10%, whilst LFL H1 performance is anticipated to be -9%."

Associated British Foods, a food processing and retailing company, was downgraded to "neutral" from "buy" at Goldman Sachs.

Next, a retail group, was downgraded to "sell" from "neutral" at Goldman Sachs.

#GERMANY#

Deutsche Bank's, a banking group, chief economist Torsten Slok, will leave the bank to join alternative investment firm Apollo Global Management, according to Bloomberg.

HeidelbergCement, a building materials supplier, was upgraded to "overweight" from "underweight" at Morgan Stanley.

#FRANCE#

Sanofi, a French pharmaceutical group, and American biotech firm Regeneron announced that a phase 3 trial of their Kevzara in COVID-19 patients did not meet its primary and key secondary endpoints. Looking at a daily chart, Sanofi's stock price stands above the support at 88 euros and is supported by a rising trend line since march the 16th. Moreover the 50DMA is still ascending and provides support near 90 euros. Above 88 euros look for the horizontal resistance 94.7 and 99 euros in extension.

Source: GAIN Capital, TradingView

EDF, an electric utility company, said it has raised its nuclear output estimate in France for 2020 to 315-325 TWh from 300 TWh estimated in April.

#SCANDINAVIA#

Sandvik, an engineering company, was upgraded to "equalweight" from "underweight" at Barclays.

#EX-DIVIDEND#

L'Oréal: E3.85

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM