EU indices flat | TA focus on B&M European Value Retail

INDICES

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index edged up 0.1%, Germany's DAX 30 increased 0.6%, while France's CAC 40 declined 0.2% and the U.K.'s FTSE 100 was down 0.9%.

EUROPE ADVANCE/DECLINE

47% of STOXX 600 constituents traded higher yesterday.

39% of the shares trade above their 20D MA vs 40% Monday (below the 20D moving average).

42% of the shares trade above their 200D MA vs 42% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.77pts to 31.72, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Technology

3mths relative low: Energy

Europe Best 3 sectors

technology, basic resources, real estate

Europe worst 3 sectors

energy, health care, banks

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.47% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -23bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: May Unemployment Rate Harmonised, exp.: 3.5%

GE 07:00: May Retail Sales YoY, exp.: -6.5%

GE 07:00: May Retail Sales MoM, exp.: -5.3%

EC 08:45: ECB Panetta speech

FR 08:50: Jun Markit Manufacturing PMI final, exp.: 40.6

GE 08:55: Jun Unemployment chg, exp.: 238K

GE 08:55: Jun Unemployment Rate, exp.: 6.3%

GE 08:55: Jun Markit Manufacturing PMI final, exp.: 36.6

EC 09:00: Jun Markit Manufacturing PMI final, exp.: 39.4

UK 09:30: Jun Markit/CIPS Manufacturing PMI final, exp.: 40.7

FR 10:00: Jun New Car Registrations YoY, exp.: -50.3%

UK 10:45: 30-Year Treasury Gilt auction, exp.: 0.03%

UK 12:00: BoE Haskel speech

GE 13:15: Bundesbank Mauderer speech

GE 16:00: Bundesbank Wuermeling speech

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.1239 while GBP/USD held gains at 1.2388. USD/JPY retreated to 107.69. This morning, Japan's Tankan Large Enterprises Manufacturing Index slid to -34 in the second quarter (-31 expected) from -8 in the first quarter, and the Large Enterprises Non-manufacturing Index fell to -17 in the second quarter (-20 expected) from 8. AUD/USD firmed at 0.6909. Earlier today, China's Caixin Manufacturing PMI rose to 51.2 in June (50.5 expected) from 50.7 in May.

Spot gold climbed to $1,783 an ounce.

#UK - IRELAND#

Smith & Nephew, a medical technology company, posted a 2Q trading update: "It expects a second quarter underlying revenue decline of around -29%. (...) We are encouraged by the improving performance as the quarter progressed, with underlying revenue declines of -47% in April (as previously disclosed), -27% in May, and around -12% in June. (...) we continue to expect that the first half trading margin will be substantially down on the prior year."

British Land, a real estate investment company, published an operational update: "As at 30 June, 894 of our stores in England were open, representing 64% of total. 116 stores in Scotland were open (50%) and 43 stores in Wales were open (64%). For the week commencing 14 June when restrictions were eased on non-essential retail in England, footfall at our English assets was 64% of the level achieved in the same week last year. Encouragingly, like-for-like retail sales for stores that were open were 91% of the same week last year. (...) As of 26 June, we had collected 88% of rent for Offices and 36% in Retail (including at our London campuses) relating to the June Quarter."

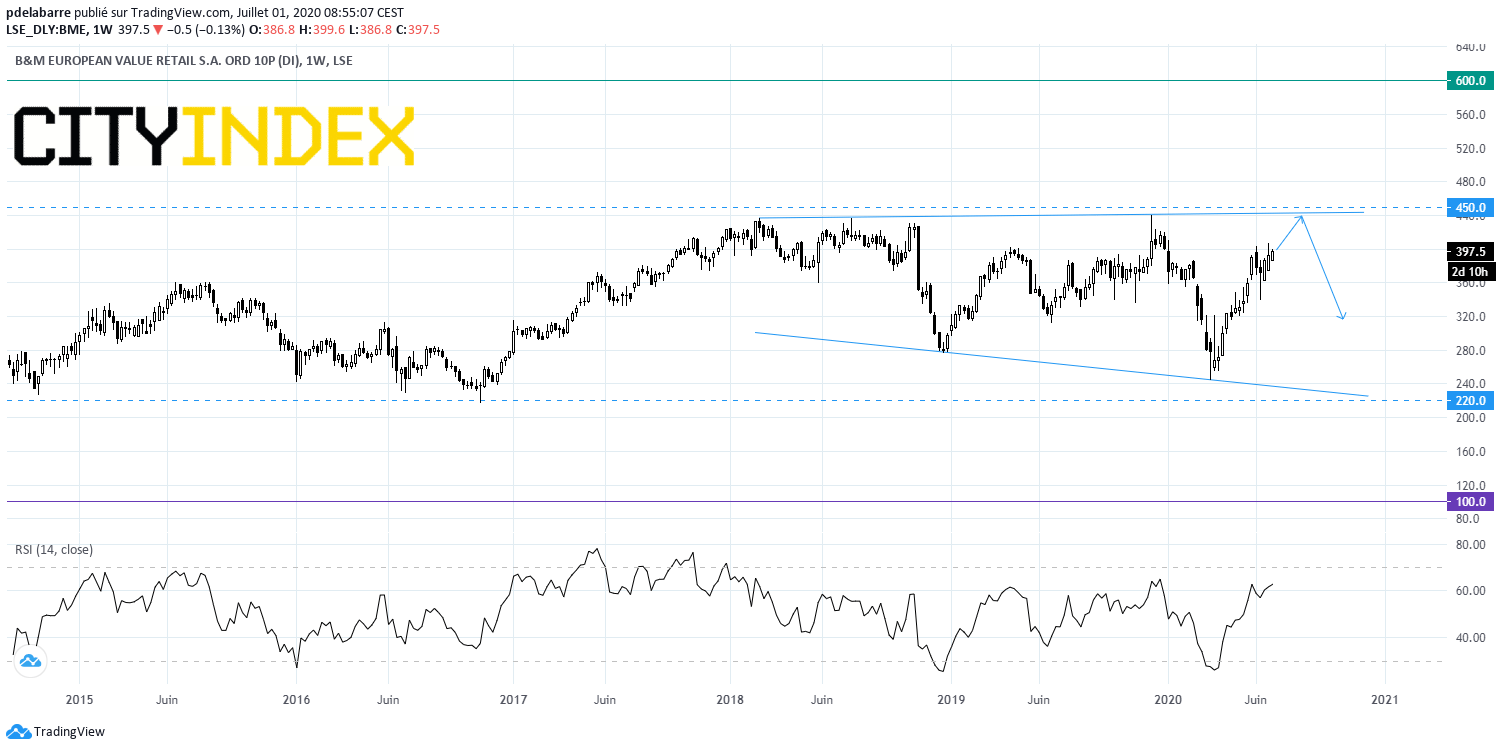

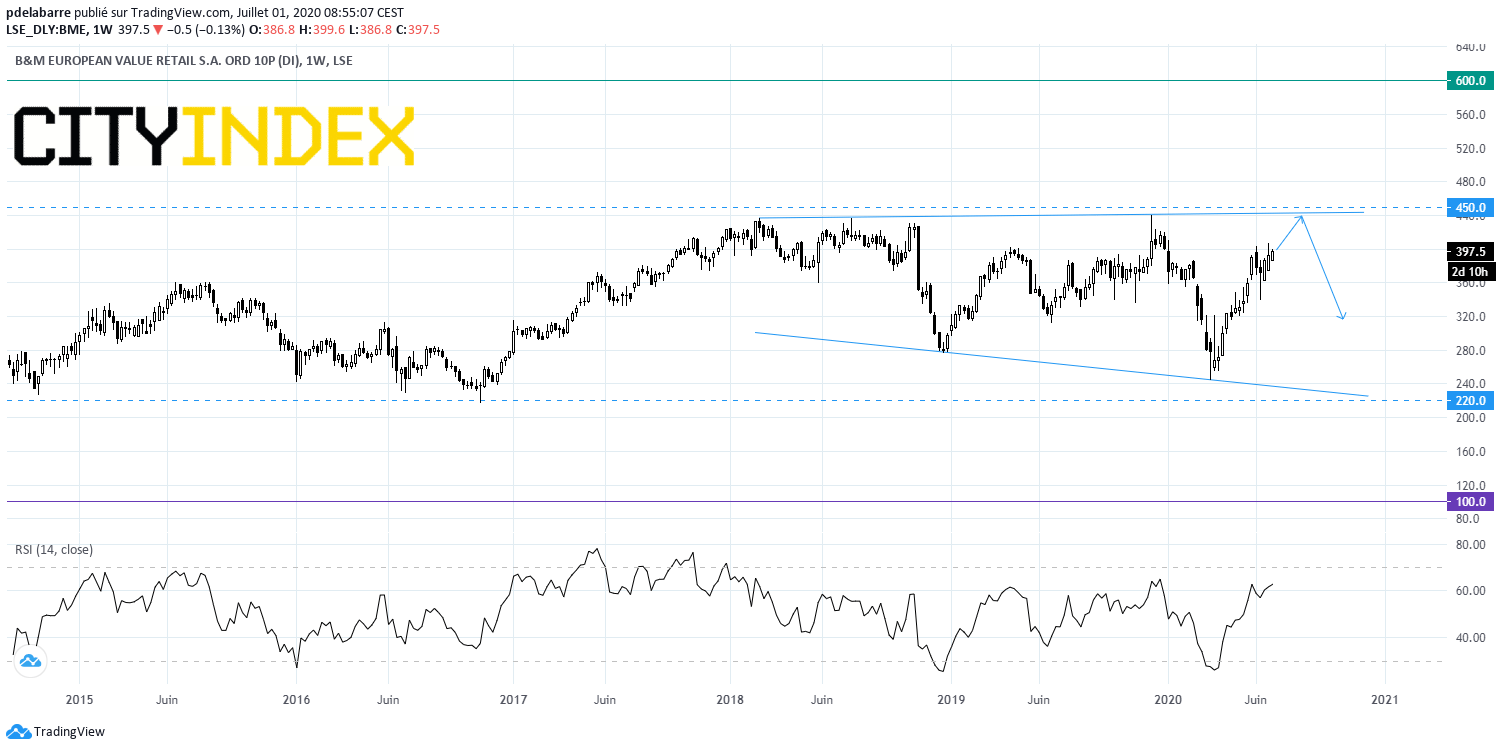

B&M European Value Retail, a general merchandise value retailer, released a 1Q trading update: "Group sales revenue for the quarter increased by 27.5% on a constant currency basis. On an actual currency basis, total sales revenue increased by 27.7% to £1,154.8m (2019: £904.6m)." From a chartist point of view, the share is trading within a broadening formation. A new test of the upper end is expected ahead of a correction move. Only a weekly push above 450 or below 220 would trigger a new medium-term trend.

Source: GAIN Capital, TradingView

John Laing Group, an investment company, issued a trading update: "NAV growth in the first half of the year has been impacted by external factors namely the exceptional impact of COVID-19, specifically changes in macro-assumptions and lower power prices. (...) Overall, we therefore expect for the first half of the year that NAV, before deducting dividends, will show a single digit decline."

Babcock, an aerospace and defence company, announced that David Lockwood, former CEO of Cobham, will join the company on August 17 as CEO designate and will become CEO on September 14.

Kingfisher, a retailing company, was upgraded to "buy" from "neutral" at Goldman Sachs.

#FRANCE#

Airbus, an aircraft manufacturer, announced a restructuring plan which is expected to result in a reduction of 15,000 positions worldwide before summer 2021.

Suez, a water and waste management company, said 1H revenue is expected to show an organic decline of 6% compared to last year and underlying EBIT is estimated to be 320 - 330 million euros. The company added: "As we reach the end of the second quarter, we can confirm that there is an overall improvement in our business trends compared to the low point of April/May in most regions in which SUEZ operates."

#ITALY#

Banca Monte Dei Paschi, an Italian bank, is considering a merger with rival Banco BPM, reported Reuters citing people familiar with the matter.

#SCANDINAVIA#

Lundin Energy, an oil and gas company, was upgraded to "hold" from "reduce" at HSBC.

EX-DIVIDEND

Michelin: E2, Vonovia: E1.57

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index edged up 0.1%, Germany's DAX 30 increased 0.6%, while France's CAC 40 declined 0.2% and the U.K.'s FTSE 100 was down 0.9%.

EUROPE ADVANCE/DECLINE

47% of STOXX 600 constituents traded higher yesterday.

39% of the shares trade above their 20D MA vs 40% Monday (below the 20D moving average).

42% of the shares trade above their 200D MA vs 42% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 2.77pts to 31.72, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Technology

3mths relative low: Energy

Europe Best 3 sectors

technology, basic resources, real estate

Europe worst 3 sectors

energy, health care, banks

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.47% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -23bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: May Unemployment Rate Harmonised, exp.: 3.5%

GE 07:00: May Retail Sales YoY, exp.: -6.5%

GE 07:00: May Retail Sales MoM, exp.: -5.3%

EC 08:45: ECB Panetta speech

FR 08:50: Jun Markit Manufacturing PMI final, exp.: 40.6

GE 08:55: Jun Unemployment chg, exp.: 238K

GE 08:55: Jun Unemployment Rate, exp.: 6.3%

GE 08:55: Jun Markit Manufacturing PMI final, exp.: 36.6

EC 09:00: Jun Markit Manufacturing PMI final, exp.: 39.4

UK 09:30: Jun Markit/CIPS Manufacturing PMI final, exp.: 40.7

FR 10:00: Jun New Car Registrations YoY, exp.: -50.3%

UK 10:45: 30-Year Treasury Gilt auction, exp.: 0.03%

UK 12:00: BoE Haskel speech

GE 13:15: Bundesbank Mauderer speech

GE 16:00: Bundesbank Wuermeling speech

MORNING TRADING

In Asian trading hours, EUR/USD was little changed at 1.1239 while GBP/USD held gains at 1.2388. USD/JPY retreated to 107.69. This morning, Japan's Tankan Large Enterprises Manufacturing Index slid to -34 in the second quarter (-31 expected) from -8 in the first quarter, and the Large Enterprises Non-manufacturing Index fell to -17 in the second quarter (-20 expected) from 8. AUD/USD firmed at 0.6909. Earlier today, China's Caixin Manufacturing PMI rose to 51.2 in June (50.5 expected) from 50.7 in May.

Spot gold climbed to $1,783 an ounce.

#UK - IRELAND#

Smith & Nephew, a medical technology company, posted a 2Q trading update: "It expects a second quarter underlying revenue decline of around -29%. (...) We are encouraged by the improving performance as the quarter progressed, with underlying revenue declines of -47% in April (as previously disclosed), -27% in May, and around -12% in June. (...) we continue to expect that the first half trading margin will be substantially down on the prior year."

British Land, a real estate investment company, published an operational update: "As at 30 June, 894 of our stores in England were open, representing 64% of total. 116 stores in Scotland were open (50%) and 43 stores in Wales were open (64%). For the week commencing 14 June when restrictions were eased on non-essential retail in England, footfall at our English assets was 64% of the level achieved in the same week last year. Encouragingly, like-for-like retail sales for stores that were open were 91% of the same week last year. (...) As of 26 June, we had collected 88% of rent for Offices and 36% in Retail (including at our London campuses) relating to the June Quarter."

B&M European Value Retail, a general merchandise value retailer, released a 1Q trading update: "Group sales revenue for the quarter increased by 27.5% on a constant currency basis. On an actual currency basis, total sales revenue increased by 27.7% to £1,154.8m (2019: £904.6m)." From a chartist point of view, the share is trading within a broadening formation. A new test of the upper end is expected ahead of a correction move. Only a weekly push above 450 or below 220 would trigger a new medium-term trend.

Source: GAIN Capital, TradingView

John Laing Group, an investment company, issued a trading update: "NAV growth in the first half of the year has been impacted by external factors namely the exceptional impact of COVID-19, specifically changes in macro-assumptions and lower power prices. (...) Overall, we therefore expect for the first half of the year that NAV, before deducting dividends, will show a single digit decline."

Babcock, an aerospace and defence company, announced that David Lockwood, former CEO of Cobham, will join the company on August 17 as CEO designate and will become CEO on September 14.

Kingfisher, a retailing company, was upgraded to "buy" from "neutral" at Goldman Sachs.

#FRANCE#

Airbus, an aircraft manufacturer, announced a restructuring plan which is expected to result in a reduction of 15,000 positions worldwide before summer 2021.

Suez, a water and waste management company, said 1H revenue is expected to show an organic decline of 6% compared to last year and underlying EBIT is estimated to be 320 - 330 million euros. The company added: "As we reach the end of the second quarter, we can confirm that there is an overall improvement in our business trends compared to the low point of April/May in most regions in which SUEZ operates."

#ITALY#

Banca Monte Dei Paschi, an Italian bank, is considering a merger with rival Banco BPM, reported Reuters citing people familiar with the matter.

#SCANDINAVIA#

Lundin Energy, an oil and gas company, was upgraded to "hold" from "reduce" at HSBC.

EX-DIVIDEND

Michelin: E2, Vonovia: E1.57

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM