EU indices decline this morning | TA focus on Aviva

INDICES

Yesterday, European stocks were broadly higher, with the Stoxx Europe 600 Index gaining 1.0%. Germany's DAX 30 rose 1.3%, the U.K.'s FTSE 100 advanced 1.1% and France's CAC 40 was up 0.9%.

EUROPE ADVANCE/DECLINE

67% of STOXX 600 constituents traded higher yesterday.

68% of the shares trade above their 20D MA vs 67% Tuesday (below the 20D moving average).

28% of the shares trade above their 200D MA vs 26% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.06pt to 29.11, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Technology

3mths relative low: Real Estate

Europe Best 3 sectors

technology, chemicals, energy

Europe worst 3 sectors

real estate, insurance, financial services

INTEREST RATE

The 10yr Bund yield was unchanged to -0.46% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -20bps (above its 20D MA).

ECONOMIC DATA

FR 08:15: May Markit Composite PMI Flash, exp.: 11.1

FR 08:15: May Markit Manufacturing PMI Flash, exp.: 31.5

FR 08:15: May Markit Services PMI Flash, exp.: 10.2

GE 08:30: May Markit Composite PMI Flash, exp.: 17.4

GE 08:30: May Markit Services PMI Flash, exp.: 16.2

GE 08:30: May Markit Manufacturing PMI Flash, exp.: 34.5

EC 09:00: May Markit Composite PMI Flash, exp.: 13.6

EC 09:00: May Markit Services PMI Flash, exp.: 12

EC 09:00: May Markit Manufacturing PMI Flash, exp.: 33.4

UK 09:30: May Markit/CIPS Manufacturing PMI Flash, exp.: 32.6

UK 09:30: May Markit/CIPS UK Services PMI Flash, exp.: 13.4

UK 09:30: May Markit/CIPS Composite PMI Flash, exp.: 13.8

UK 11:00: May CBI Industrial Trends Orders, exp.: -56

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.0960 and GBP/USD fell to 1.2199. USD/JPY held gains at 107.66. This morning, official data showed that Japan recorded a trade deficit of 996 billion yen in April (503 billion yen deficit expected), where exports declined 21.9% on year (-22.2% expected) and imports slid 7.2% (-13.2% expected).

Spot gold slipped to $1,744 an ounce.

#UK - IRELAND#

Whitbread, a hotel and restaurant company, posted preliminary full-year results: "Statutory revenue up 1.1% to £2,072m. (...) Adjusted profit before tax decreased by 8.2% to £358m, (...) Adjusted basic earnings per share increased 12.6% to 193.6p." Meanwhile, the company announced plans to raise gross proceeds of about 1 billion pounds though an 1 for 2 fully underwritten rights issue.

Intertek Group, a product testing and certification company, released a trading update for the period from January 1 to April 30: "Resilient trading performance with Revenue of £882m, down 4.6% year-on-year (YoY) both at constant and actual rates, with Like-for-Like (LfL) revenue down 4.9% YoY at constant currency. (...) The speed at which the global pandemic has unfolded and the broad-based nature of the lock-down initiatives in every country makes it difficult to attempt any precise guidance and it is too early to quantify the impact of the Coronavirus for 2020."

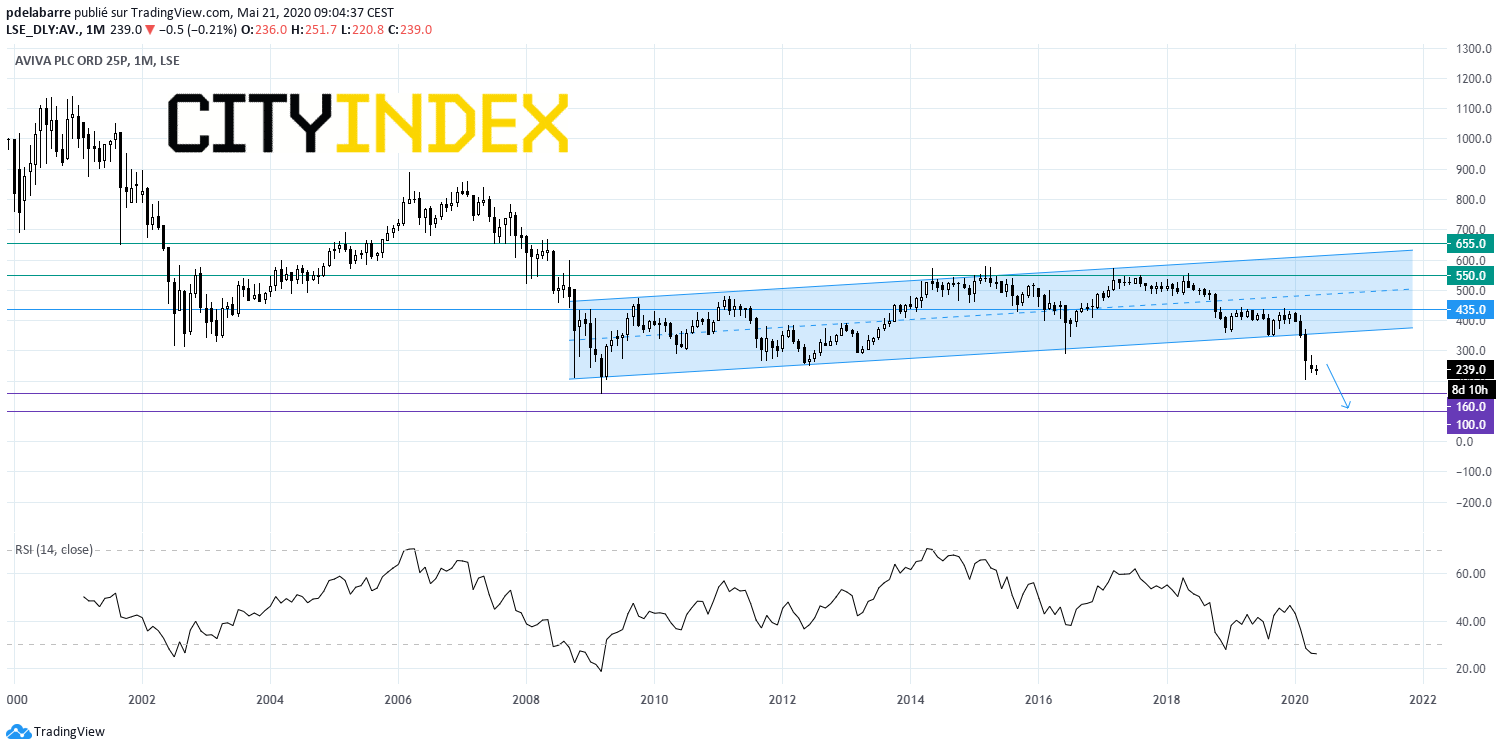

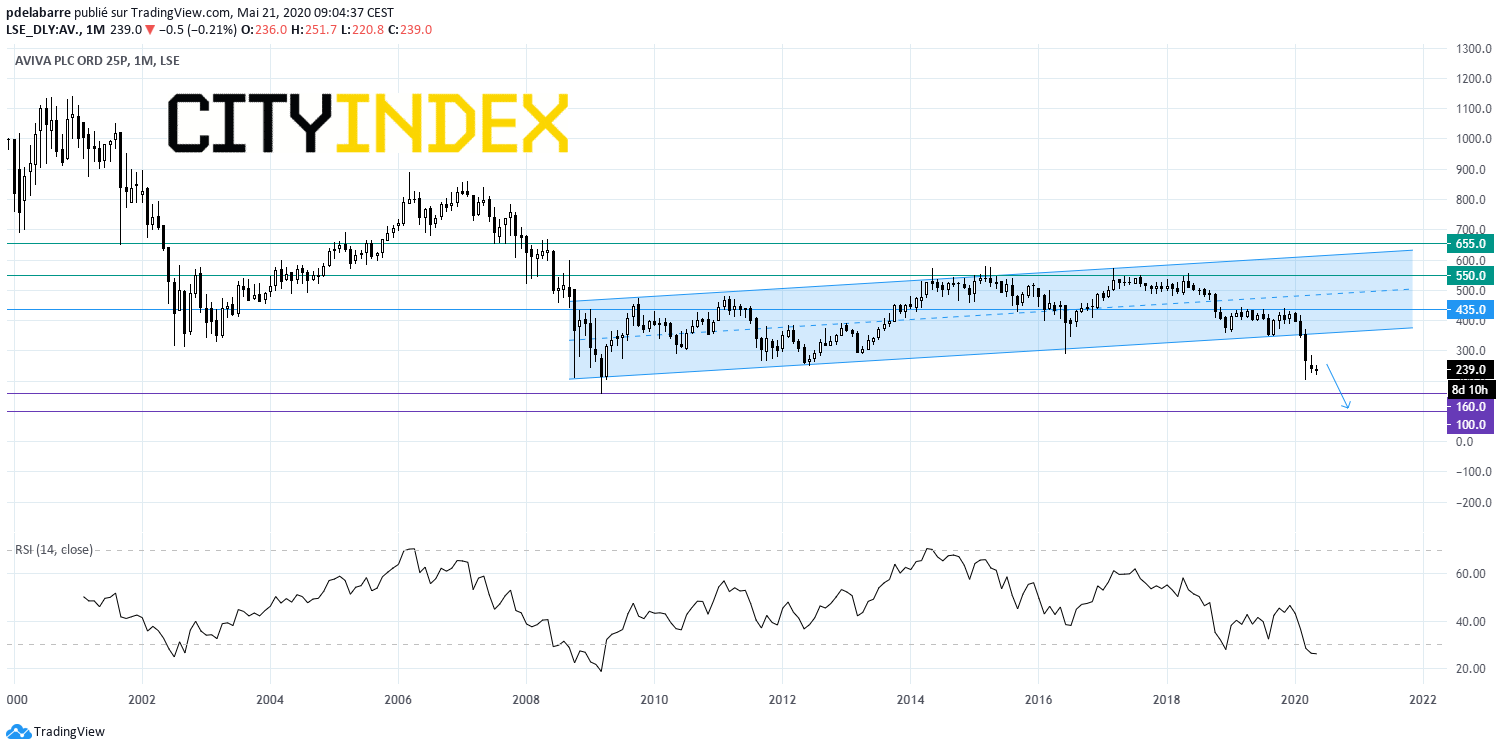

Aviva, an insurance group, released an 1Q operating update: "Life new business sales (PVNBP) rose 28% to £12.3 billion (1Q19: £9.6 billion) and value of new business (VNB) grew 18% to £311 million (1Q19: £263 million); (...) General insurance net written premium gained 3% to £2.4 billion (1Q19: £2.3 billion). (...) However, based on analysis as at 30 April, our estimate of COVID-19 related claims in our general insurance businesses, incorporating notified and projected claims, is £160 million net of reinsurance; (...) Early 2Q20 trends have seen new business sales decline across many of our businesses due to worldwide Government enforced confinement measures. (...) sales volumes for the year overall are likely to remain below expectations."

Source: GAIN Capital, TradingView

Easyjet, a low-cost airline group, said it will resume flights on June 15, adding: "We will continue to refine our schedule planning and our capacity expectations for the remainder of 2020, which will be confirmed in due course, whilst also continuing our focus on minimising cash burn."

Tate & Lyle, a supplier of food and beverage ingredients, reported that full-year adjusted EPS rose 8% on year to 57.8p and adjusted profit before tax grew 4% to 331 million pounds on revenue of 2.88 billion pounds. The company proposed a dividend of 29.6p per share, up from 29.4p in the prior year.

#GERMANY#

Deutsche Lufthansa, an airline company, confirmed it is in advanced talks with the German government's Economic Stabilization Fund regarding an aid package of up to 9 billion euros, where the fund may take a 20% stake in the company's increased share capital.

#SPAIN#

Amadeus, an IT services provider, was downgraded to "hold" from "buy" at Deutsche Bank.

#BENELUX#

Altice Europe, a telecommunications company, reported that 1Q adjusted EBITDA grew 1.0% on year to 1.30 billion euros on revenue of 3.51 billion euros, up 3.6% (+3.1% at constant currency).

Galapagos, a pharmaceutical research company, said its Filgotinib achieved all primary endpoints in a phase 2b/3 trial for treating patients with moderately to severely active ulcerative colitis.

#ITALY#

Generali, an insurance group, announced that 1Q net income plunged 81.7% on year to 113 million euros, citing a 655 million euros in net impairments on investments caused by the Covid-19. Meanwhile, operating profit grew 7.6% to 1.45 billion euros on gross written premiums of 19.16 billion euros, up 0.3%.

#SWITZERLAND#

Logitech International, a manufacturer of computer peripherals and software, was downgraded to "neutral" from "overweight" at JPMorgan.

EX-DIVIDEND

Intertek Group:71.6p, SAP: E1.58, Tesco:6.5p

Yesterday, European stocks were broadly higher, with the Stoxx Europe 600 Index gaining 1.0%. Germany's DAX 30 rose 1.3%, the U.K.'s FTSE 100 advanced 1.1% and France's CAC 40 was up 0.9%.

EUROPE ADVANCE/DECLINE

67% of STOXX 600 constituents traded higher yesterday.

68% of the shares trade above their 20D MA vs 67% Tuesday (below the 20D moving average).

28% of the shares trade above their 200D MA vs 26% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.06pt to 29.11, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Technology

3mths relative low: Real Estate

Europe Best 3 sectors

technology, chemicals, energy

Europe worst 3 sectors

real estate, insurance, financial services

INTEREST RATE

The 10yr Bund yield was unchanged to -0.46% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -20bps (above its 20D MA).

ECONOMIC DATA

FR 08:15: May Markit Composite PMI Flash, exp.: 11.1

FR 08:15: May Markit Manufacturing PMI Flash, exp.: 31.5

FR 08:15: May Markit Services PMI Flash, exp.: 10.2

GE 08:30: May Markit Composite PMI Flash, exp.: 17.4

GE 08:30: May Markit Services PMI Flash, exp.: 16.2

GE 08:30: May Markit Manufacturing PMI Flash, exp.: 34.5

EC 09:00: May Markit Composite PMI Flash, exp.: 13.6

EC 09:00: May Markit Services PMI Flash, exp.: 12

EC 09:00: May Markit Manufacturing PMI Flash, exp.: 33.4

UK 09:30: May Markit/CIPS Manufacturing PMI Flash, exp.: 32.6

UK 09:30: May Markit/CIPS UK Services PMI Flash, exp.: 13.4

UK 09:30: May Markit/CIPS Composite PMI Flash, exp.: 13.8

UK 11:00: May CBI Industrial Trends Orders, exp.: -56

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.0960 and GBP/USD fell to 1.2199. USD/JPY held gains at 107.66. This morning, official data showed that Japan recorded a trade deficit of 996 billion yen in April (503 billion yen deficit expected), where exports declined 21.9% on year (-22.2% expected) and imports slid 7.2% (-13.2% expected).

Spot gold slipped to $1,744 an ounce.

#UK - IRELAND#

Whitbread, a hotel and restaurant company, posted preliminary full-year results: "Statutory revenue up 1.1% to £2,072m. (...) Adjusted profit before tax decreased by 8.2% to £358m, (...) Adjusted basic earnings per share increased 12.6% to 193.6p." Meanwhile, the company announced plans to raise gross proceeds of about 1 billion pounds though an 1 for 2 fully underwritten rights issue.

Intertek Group, a product testing and certification company, released a trading update for the period from January 1 to April 30: "Resilient trading performance with Revenue of £882m, down 4.6% year-on-year (YoY) both at constant and actual rates, with Like-for-Like (LfL) revenue down 4.9% YoY at constant currency. (...) The speed at which the global pandemic has unfolded and the broad-based nature of the lock-down initiatives in every country makes it difficult to attempt any precise guidance and it is too early to quantify the impact of the Coronavirus for 2020."

Aviva, an insurance group, released an 1Q operating update: "Life new business sales (PVNBP) rose 28% to £12.3 billion (1Q19: £9.6 billion) and value of new business (VNB) grew 18% to £311 million (1Q19: £263 million); (...) General insurance net written premium gained 3% to £2.4 billion (1Q19: £2.3 billion). (...) However, based on analysis as at 30 April, our estimate of COVID-19 related claims in our general insurance businesses, incorporating notified and projected claims, is £160 million net of reinsurance; (...) Early 2Q20 trends have seen new business sales decline across many of our businesses due to worldwide Government enforced confinement measures. (...) sales volumes for the year overall are likely to remain below expectations."

Source: GAIN Capital, TradingView

Easyjet, a low-cost airline group, said it will resume flights on June 15, adding: "We will continue to refine our schedule planning and our capacity expectations for the remainder of 2020, which will be confirmed in due course, whilst also continuing our focus on minimising cash burn."

Tate & Lyle, a supplier of food and beverage ingredients, reported that full-year adjusted EPS rose 8% on year to 57.8p and adjusted profit before tax grew 4% to 331 million pounds on revenue of 2.88 billion pounds. The company proposed a dividend of 29.6p per share, up from 29.4p in the prior year.

#GERMANY#

Deutsche Lufthansa, an airline company, confirmed it is in advanced talks with the German government's Economic Stabilization Fund regarding an aid package of up to 9 billion euros, where the fund may take a 20% stake in the company's increased share capital.

#SPAIN#

Amadeus, an IT services provider, was downgraded to "hold" from "buy" at Deutsche Bank.

#BENELUX#

Altice Europe, a telecommunications company, reported that 1Q adjusted EBITDA grew 1.0% on year to 1.30 billion euros on revenue of 3.51 billion euros, up 3.6% (+3.1% at constant currency).

Galapagos, a pharmaceutical research company, said its Filgotinib achieved all primary endpoints in a phase 2b/3 trial for treating patients with moderately to severely active ulcerative colitis.

#ITALY#

Generali, an insurance group, announced that 1Q net income plunged 81.7% on year to 113 million euros, citing a 655 million euros in net impairments on investments caused by the Covid-19. Meanwhile, operating profit grew 7.6% to 1.45 billion euros on gross written premiums of 19.16 billion euros, up 0.3%.

#SWITZERLAND#

Logitech International, a manufacturer of computer peripherals and software, was downgraded to "neutral" from "overweight" at JPMorgan.

EX-DIVIDEND

Intertek Group:71.6p, SAP: E1.58, Tesco:6.5p

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM