EU indices consolidate this morning | TA focus on Heineken

INDICES

Yesterday, European stocks rebounded. The Stoxx Europe 600 Index jumped 1.76%. Germany's DAX 30 advanced 1.84%, France's CAC 40 surged 2.03%, and the U.K.'s FTSE 100 was up 1.83%.

EUROPE ADVANCE/DECLINE

84% of STOXX 600 constituents traded higher yesterday.

75% of the shares trade above their 20D MA vs 64% Tuesday (above the 20D moving average).

50% of the shares trade above their 200D MA vs 48% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.36pt to 27.57, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial

3mths relative low: Real Estate

Europe Best 3 sectors

travel & leisure, industrial goods & services, health care

Europe worst 3 sectors

telecommunications, real estate, technology

INTEREST RATE

The 10yr Bund yield rose 5bps to -0.42% (above its 20D MA). The 2yr-10yr yield spread rose 2bps to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: May Average Earnings excl. Bonus, exp.: 1.7%

UK 07:00: May Average Earnings incl. Bonus, exp.: 1%

UK 07:00: May Unemployment Rate, exp.: 3.9%

UK 07:00: Jun Claimant Count chg, exp.: 528.9K

UK 07:00: Apr Employment chg, exp.: 6K

FR 07:45: Jun Inflation Rate YoY final, exp.: 0.4%

FR 07:45: Jun Inflation Rate MoM final, exp.: 0.1%

FR 07:45: Jun Harmonised Inflation Rate YoY final, exp.: 0.4%

FR 07:45: Jun Harmonised Inflation Rate MoM final, exp.: 0.2%

EC 10:00: May Balance of Trade, exp.: E2.9B

FR 10:00: 3-Year BTAN auction, exp.: -0.56%

FR 10:00: 5-Year BTAN auction, exp.: -0.48%

UK 12:15: BoE Gov Bailey speech

EC 12:45: ECB Interest Rate Decision, exp.: 0%

EC 12:45: Marginal Lending Rate, exp.: 0.25%

EC 12:45: Deposit Facility Rate, exp.: -0.5%

EC 13:30: ECB Press Conference

UK 00:01: Jul Gfk Consumer Confidence Flash, exp.: -30

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.1404 and GBP/USD retreated to 1.2559. USD/JPY remained subdued at 106.97. AUD/USD slid to 0.6985. This morning, official data showed that China's 2Q GDP grew 3.2% on year (+2.4% expected) and China's industrial production rose 4.8% in June (as expected), while retail sales declined 1.8% (+0.5% expected). On the other hand, the Australian economy added 210,800 jobs in June (+100,000 jobs expected), though full-time jobs dropped 38,100 while part-time jobs increased 249,000, according to the government. Also, Australia's jobless rate climbed to 7.4% in June (7.2% expected) from 7.1% in May.

Spot gold slipped to $1,809 an ounce.

#UK - IRELAND#

Anglo American, a multinational mining group, posted a 2Q production report: "Rough diamond production decreased by 54% to 3.5 million carats. (...) Copper production increased by 5% to 166,800 tonnes. (...) Platinum and palladium production decreased by 41% to 307,400 ounces and 34% to 228,400 ounces, respectively. (...) Kumba - Total production volumes (iron ore) decreased by 20% to 8.5 million tonnes. (...) Minas-Rio - Production (iron ore) increased by 5% to 6.2 million tonnes. (...) Export metallurgical coal production decreased by 32% to 4.0 million tonnes. (...) Export thermal coal production decreased by 22% to 3.6 million tonnes. (...) Nickel production increased by 10%. (...) Manganese ore production decreased by 4% to 796,000 tonnes."

GVC Holdings, a sports-betting and gaming group, issued a 1H trading update: " Encouraging start to the year, despite the impact of COVID-19, with Group net gaming revenue ("NGR") down 11% (-10%cc) and Online NGR up 19% (+21%cc) in H1. (...) Online NGR grew 22% (+23%cc1) in Q2. (...) H1 EBITDA2 expected to be in the range of £340m-£350m. (...) As announced separately today, Kenneth Alexander, Chief Executive Officer, is to retire from the Board and from the Company. He will be succeeded by Shay Segev, GVC's Chief Operating Officer."

SSE, an energy company, released a 1Q trading update: "Coronavirus impacts on operating profit for the first three months of trading are in line with our expectations, with the total for 2020/21 still anticipated to be in the range of £150m to £250m before mitigation. SSE continues to keep this assessment under review and will provide guidance on adjusted earnings per share later in the financial year."

Experian, a consumer credit reporting company, issued a 1Q trading update: "We delivered growth in North America and Brazil during Q1, which helped offset weaker conditions elsewhere, and as a result total revenue was down just (1)% at constant exchange rates, with organic revenue down (2)%. At actual exchange rates total revenue declined by (5)% due to the weakness of the Brazilian Real relative to the US dollar. (...) We currently expect that organic revenue for Q2 FY21 will be in the range of flat to (5)%."

#GERMANY - AUSTRIA#

Sartorius, a laboratory equipment supplier, said it has raised its full-year revenue growth forecast to 22% - 26% from 15% - 19% previously, citing "the strong performance of the Bioprocess Solutions Division in the first half of 2020 as well as on high demand also expected to continue for the rest of the current fiscal year". Meanwhile, the company reported that 1H preliminary order intake grew 27.5% in constant currencies and revenue was up 17.9%.

Zalando, a e-commerce company, is expected to released a 2Q trading update.

#FRANCE#

Alstom, a transport system and equipment manufacturer, posted 1Q revenue dropped 27% on year (-25% organic growth) to 1.51 billion euros, while orders received grew 2% (+2% organic growth) to 1.65 billion euros. The company said: "The objective of a 5% average annual growth rate over the period from 2019/20 to 2022/23 should be slightly impacted by the temporary slowdown of tender activity, yet the 2022/23 objectives of 9% aEBIT margin and of a conversion from net income to free cash flow above 80% are confirmed."

Vinci, a concessions and construction company, is expected to release a 2Q business update after market close.

#PORTUGAL#

EDP, a Portuguese electric utilities company, announced that it has agreed to acquire a 75% stake in electricity company Viesgo from Macquarie Infrastructure and Real Assets, financing by a 1.02 billion euros rights issue.

#BENELUX#

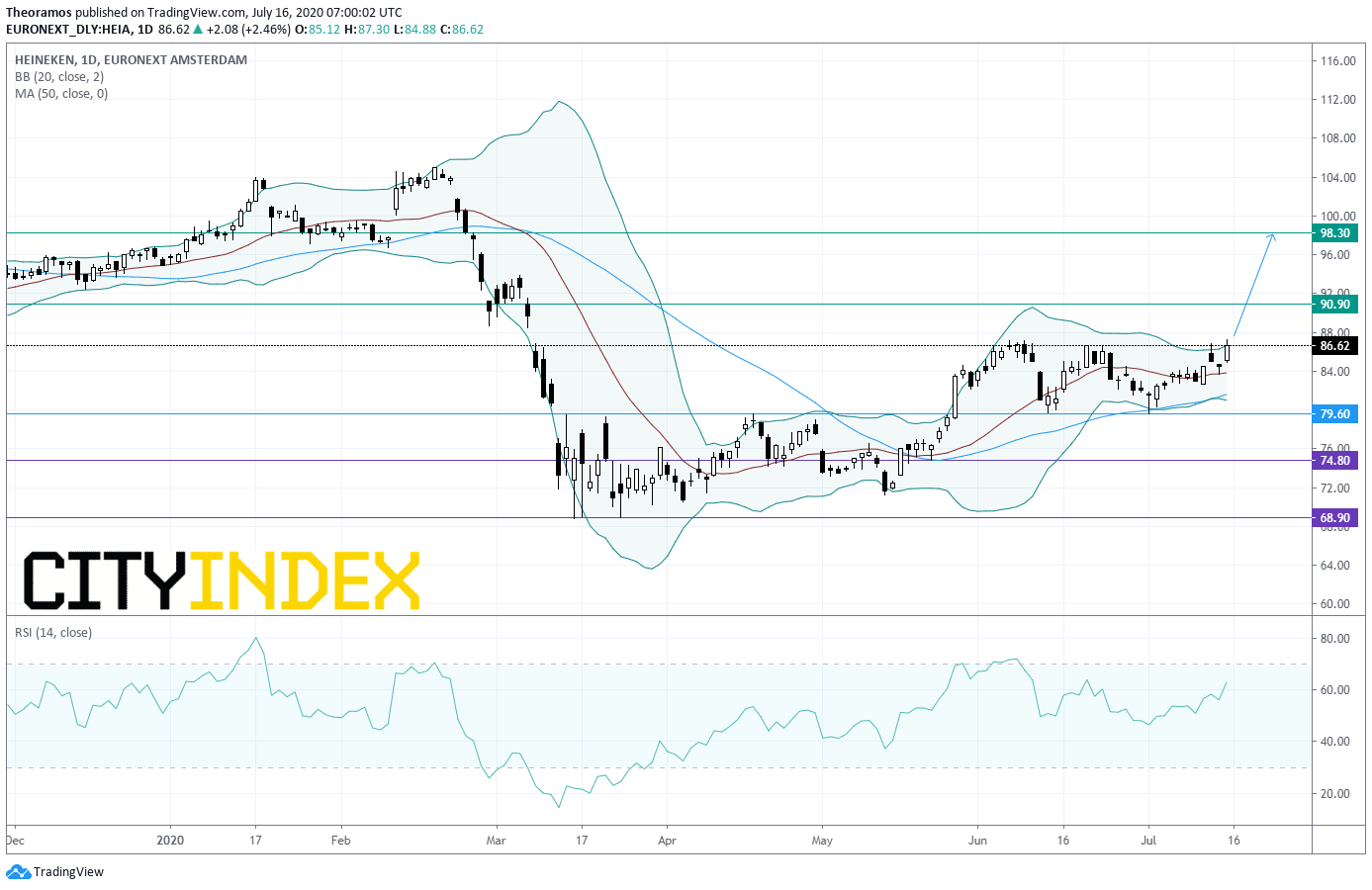

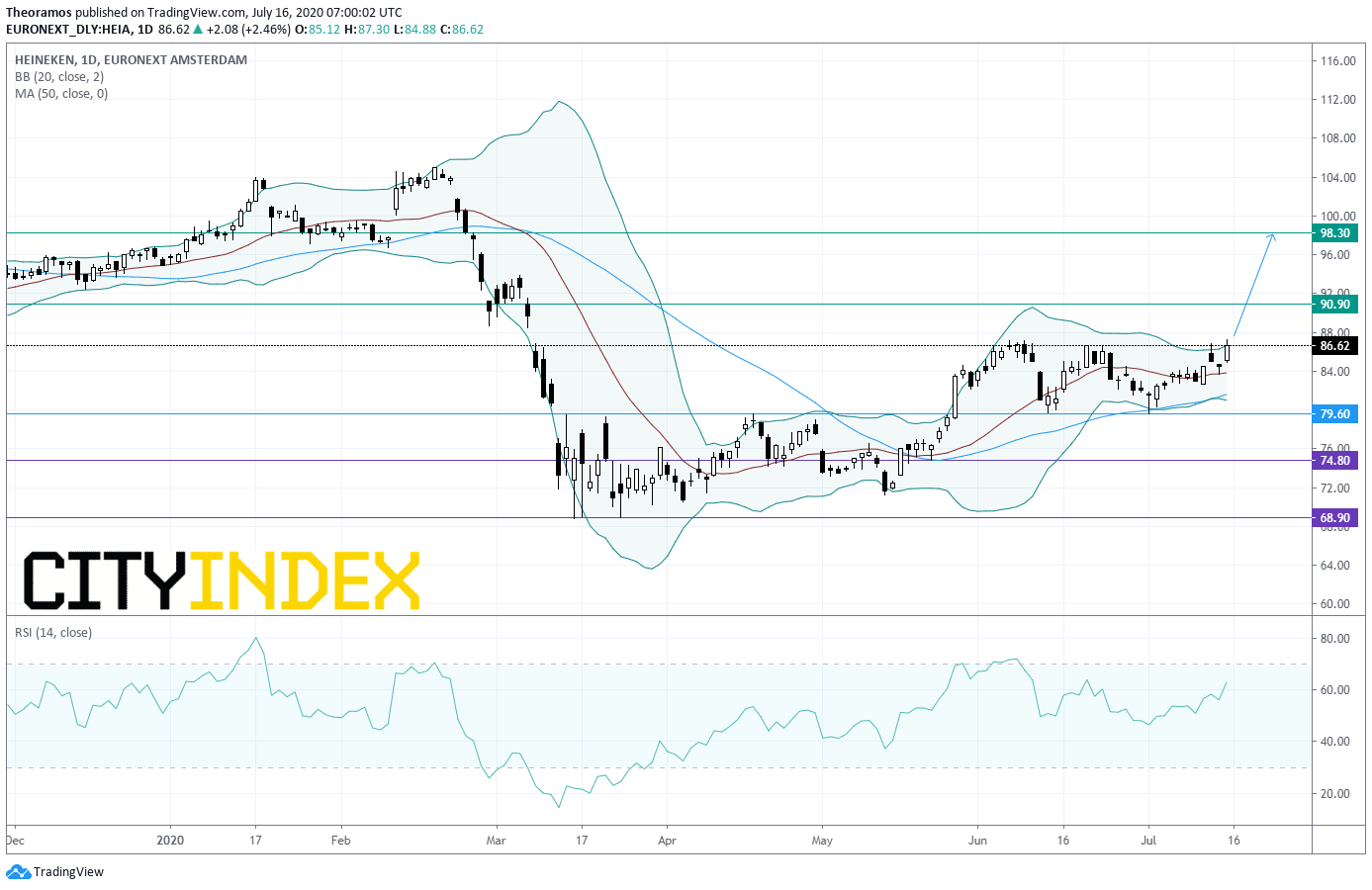

Heineken, a Dutch brewing company, announced that 1H preliminary net revenue dropped 16.4% on year on an organic basis and beer volume declined organically by 11.5%. Also, preliminary operating profit sank 52.5% and net profit slid 75.8%. The company said: "Exceptional items will include around E550 million of impairments on tangible and intangible assets, leading to a reported net loss of around E300 million." From a daily point of view, the share is pushing above the upper end of the trading-range. The 50-period moving average is pushing the stock towards the upside. Moreover, the RSI has rebounded and is not overbought. Above 79.6E look for the horizontal resistance at 90.9E and 98.3E in extension.

Source: GAIN Capital, TradingView

#SWITZERLAND#

Temenos, an enterprise software developer, announced that 2Q adjusted EPS declined 13% on year to 0.70 dollars and adjusted EBIT slid 8% to 67 million dollars on adjusted revenue of 216 million dollars, down 9% (-8% at constant currency). Regarding the outlook, the company said: "We continued to see an impact on license signings in the second quarter due to Covid-19, however we expect a gradual improvement in Q3 and Q4. (...) We are reconfirming our guidance for the year. We are guiding for recurring revenue growth of at least 13%, and EBIT growth of at least 7%."

#SCANDINAVIA - DENMARK#

Telenor, a Norwegian telecommunications company, reported that 2Q net income surged 155% on year to 4.43 billion Norwegian krone and EBITDA rose 19% to 14.33 billion Norwegian krone on revenue of 30.90 billion Norwegian krone, up 15% (-4% organic growth). The company said: "For 2020, we expect a low single digit percent decline in subscription and traffic revenues, stable organic EBITDA and around 13 percent capex to sales."

Atlas Copco, a Swedish multinational industrial company, is expected to release 2Q results.

Yesterday, European stocks rebounded. The Stoxx Europe 600 Index jumped 1.76%. Germany's DAX 30 advanced 1.84%, France's CAC 40 surged 2.03%, and the U.K.'s FTSE 100 was up 1.83%.

EUROPE ADVANCE/DECLINE

84% of STOXX 600 constituents traded higher yesterday.

75% of the shares trade above their 20D MA vs 64% Tuesday (above the 20D moving average).

50% of the shares trade above their 200D MA vs 48% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.36pt to 27.57, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial

3mths relative low: Real Estate

Europe Best 3 sectors

travel & leisure, industrial goods & services, health care

Europe worst 3 sectors

telecommunications, real estate, technology

INTEREST RATE

The 10yr Bund yield rose 5bps to -0.42% (above its 20D MA). The 2yr-10yr yield spread rose 2bps to -22bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: May Average Earnings excl. Bonus, exp.: 1.7%

UK 07:00: May Average Earnings incl. Bonus, exp.: 1%

UK 07:00: May Unemployment Rate, exp.: 3.9%

UK 07:00: Jun Claimant Count chg, exp.: 528.9K

UK 07:00: Apr Employment chg, exp.: 6K

FR 07:45: Jun Inflation Rate YoY final, exp.: 0.4%

FR 07:45: Jun Inflation Rate MoM final, exp.: 0.1%

FR 07:45: Jun Harmonised Inflation Rate YoY final, exp.: 0.4%

FR 07:45: Jun Harmonised Inflation Rate MoM final, exp.: 0.2%

EC 10:00: May Balance of Trade, exp.: E2.9B

FR 10:00: 3-Year BTAN auction, exp.: -0.56%

FR 10:00: 5-Year BTAN auction, exp.: -0.48%

UK 12:15: BoE Gov Bailey speech

EC 12:45: ECB Interest Rate Decision, exp.: 0%

EC 12:45: Marginal Lending Rate, exp.: 0.25%

EC 12:45: Deposit Facility Rate, exp.: -0.5%

EC 13:30: ECB Press Conference

UK 00:01: Jul Gfk Consumer Confidence Flash, exp.: -30

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.1404 and GBP/USD retreated to 1.2559. USD/JPY remained subdued at 106.97. AUD/USD slid to 0.6985. This morning, official data showed that China's 2Q GDP grew 3.2% on year (+2.4% expected) and China's industrial production rose 4.8% in June (as expected), while retail sales declined 1.8% (+0.5% expected). On the other hand, the Australian economy added 210,800 jobs in June (+100,000 jobs expected), though full-time jobs dropped 38,100 while part-time jobs increased 249,000, according to the government. Also, Australia's jobless rate climbed to 7.4% in June (7.2% expected) from 7.1% in May.

Spot gold slipped to $1,809 an ounce.

#UK - IRELAND#

Anglo American, a multinational mining group, posted a 2Q production report: "Rough diamond production decreased by 54% to 3.5 million carats. (...) Copper production increased by 5% to 166,800 tonnes. (...) Platinum and palladium production decreased by 41% to 307,400 ounces and 34% to 228,400 ounces, respectively. (...) Kumba - Total production volumes (iron ore) decreased by 20% to 8.5 million tonnes. (...) Minas-Rio - Production (iron ore) increased by 5% to 6.2 million tonnes. (...) Export metallurgical coal production decreased by 32% to 4.0 million tonnes. (...) Export thermal coal production decreased by 22% to 3.6 million tonnes. (...) Nickel production increased by 10%. (...) Manganese ore production decreased by 4% to 796,000 tonnes."

GVC Holdings, a sports-betting and gaming group, issued a 1H trading update: " Encouraging start to the year, despite the impact of COVID-19, with Group net gaming revenue ("NGR") down 11% (-10%cc) and Online NGR up 19% (+21%cc) in H1. (...) Online NGR grew 22% (+23%cc1) in Q2. (...) H1 EBITDA2 expected to be in the range of £340m-£350m. (...) As announced separately today, Kenneth Alexander, Chief Executive Officer, is to retire from the Board and from the Company. He will be succeeded by Shay Segev, GVC's Chief Operating Officer."

SSE, an energy company, released a 1Q trading update: "Coronavirus impacts on operating profit for the first three months of trading are in line with our expectations, with the total for 2020/21 still anticipated to be in the range of £150m to £250m before mitigation. SSE continues to keep this assessment under review and will provide guidance on adjusted earnings per share later in the financial year."

Experian, a consumer credit reporting company, issued a 1Q trading update: "We delivered growth in North America and Brazil during Q1, which helped offset weaker conditions elsewhere, and as a result total revenue was down just (1)% at constant exchange rates, with organic revenue down (2)%. At actual exchange rates total revenue declined by (5)% due to the weakness of the Brazilian Real relative to the US dollar. (...) We currently expect that organic revenue for Q2 FY21 will be in the range of flat to (5)%."

#GERMANY - AUSTRIA#

Sartorius, a laboratory equipment supplier, said it has raised its full-year revenue growth forecast to 22% - 26% from 15% - 19% previously, citing "the strong performance of the Bioprocess Solutions Division in the first half of 2020 as well as on high demand also expected to continue for the rest of the current fiscal year". Meanwhile, the company reported that 1H preliminary order intake grew 27.5% in constant currencies and revenue was up 17.9%.

Zalando, a e-commerce company, is expected to released a 2Q trading update.

#FRANCE#

Alstom, a transport system and equipment manufacturer, posted 1Q revenue dropped 27% on year (-25% organic growth) to 1.51 billion euros, while orders received grew 2% (+2% organic growth) to 1.65 billion euros. The company said: "The objective of a 5% average annual growth rate over the period from 2019/20 to 2022/23 should be slightly impacted by the temporary slowdown of tender activity, yet the 2022/23 objectives of 9% aEBIT margin and of a conversion from net income to free cash flow above 80% are confirmed."

Vinci, a concessions and construction company, is expected to release a 2Q business update after market close.

#PORTUGAL#

EDP, a Portuguese electric utilities company, announced that it has agreed to acquire a 75% stake in electricity company Viesgo from Macquarie Infrastructure and Real Assets, financing by a 1.02 billion euros rights issue.

#BENELUX#

Heineken, a Dutch brewing company, announced that 1H preliminary net revenue dropped 16.4% on year on an organic basis and beer volume declined organically by 11.5%. Also, preliminary operating profit sank 52.5% and net profit slid 75.8%. The company said: "Exceptional items will include around E550 million of impairments on tangible and intangible assets, leading to a reported net loss of around E300 million." From a daily point of view, the share is pushing above the upper end of the trading-range. The 50-period moving average is pushing the stock towards the upside. Moreover, the RSI has rebounded and is not overbought. Above 79.6E look for the horizontal resistance at 90.9E and 98.3E in extension.

Source: GAIN Capital, TradingView

#SWITZERLAND#

Temenos, an enterprise software developer, announced that 2Q adjusted EPS declined 13% on year to 0.70 dollars and adjusted EBIT slid 8% to 67 million dollars on adjusted revenue of 216 million dollars, down 9% (-8% at constant currency). Regarding the outlook, the company said: "We continued to see an impact on license signings in the second quarter due to Covid-19, however we expect a gradual improvement in Q3 and Q4. (...) We are reconfirming our guidance for the year. We are guiding for recurring revenue growth of at least 13%, and EBIT growth of at least 7%."

#SCANDINAVIA - DENMARK#

Telenor, a Norwegian telecommunications company, reported that 2Q net income surged 155% on year to 4.43 billion Norwegian krone and EBITDA rose 19% to 14.33 billion Norwegian krone on revenue of 30.90 billion Norwegian krone, up 15% (-4% organic growth). The company said: "For 2020, we expect a low single digit percent decline in subscription and traffic revenues, stable organic EBITDA and around 13 percent capex to sales."

Atlas Copco, a Swedish multinational industrial company, is expected to release 2Q results.

Latest market news

Today 01:15 PM

Today 07:49 AM

Today 04:24 AM