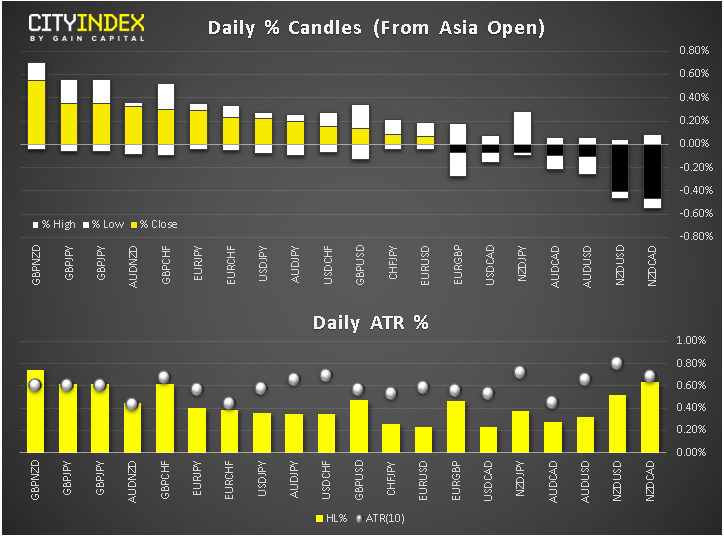

- At midday in London, GBP was the strongest and NZD the weakest, with EUR mixed as EUR/GBP has pulled back to our noted 0.89 support level on the back of stronger UK wages and weaker Eurozone investor confidence data this morning.

- UK Average Earnings Index including bonuses came in at +3.1% vs. +2.9% expected on a 3m/y basis, while excluding bonuses they were up +3.4%, greater than +3.3% expected. Pound also boosted by comments from BoE’s Saunders, who stated earlier in the session that the bank will ‘probably’ need to return to a neutral policy stance sooner than markets expect.

- Eurozone Sentix Investor Confidence printed -3.3 vs. 2.3 expected, but not much data to look forward to from North America today, with the exception of PPI perhaps. Making up the numbers will be the IBD/TIPP Economic Optimism and NFIB Small Business Index

- Overall a quiet day in the markets with equities broadly higher despite renewed threat of China tariffs from Trump, which were brushed aside.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM