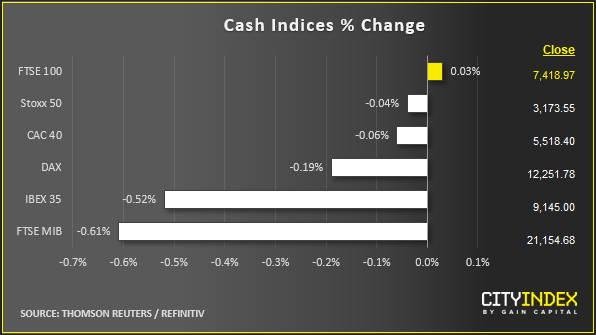

Stock market snapshot as of [25/6/2019 3:01 PM]

- Partly a holding pattern, partly a surreptitious drift to safety is a fair way to characterise the market mood as global tensions simmer ahead of the G20 meeting

- That was represented almost literally by the 339 of six hundred STOXX Europe 600 shares trading lower half-way through the session, whilst 251 rose and a minority were flat

- It’s a third straight day of losses for the broad regional gauge but the 1% slide since Thursday essentially takes the market back to its range a week ago

- North American indices start on a similarly lacklustre footing. All main Wall Street gauges were lower together with Toronto’s TSX just now. Only Mexico’s Mexbol was on the rise

- Gold and the yen and most EU and U.S. government bonds to continue to rally as a function of both safety seeking and the massive accommodation expected from broad monetary easing. The dollar index is only flat after falling almost 2% since 18th June

- Oil prices fluctuate, last trading moderately higher with traders unsure U.S. crude can extend gains of 8% in just three days, unless Iran tensions boil over again. OPEC’s supply announcement is still a week away and the probable decision to maintain lower output looks priced in

Corporate News

- To be sure, the most hamstrung European stock market sectors of the year continue to ail on trepidation whilst the energy sector barely advances

- Société Générale leads the largest banks to a continued underperformance, falling 1%, with investors reacting to a fresh record low in Germany’s 10-year bund yield, Europe’s benchmark borrowing cost

- Smaller French peers Natixis worsens a significant recent decline with a 2% fall in the wake of €1.4bn in outflows from its tainted H20 fund

- The U.S. session opens with more colossal health sector merger news as AbbVie confirms a $63bn deal to buy Botox maker Allergan. AbbVie tumbles 8%, Allergan is 32% firmer

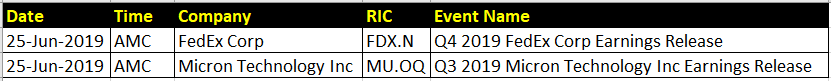

Upcoming corporate highlights

AMC: after market close

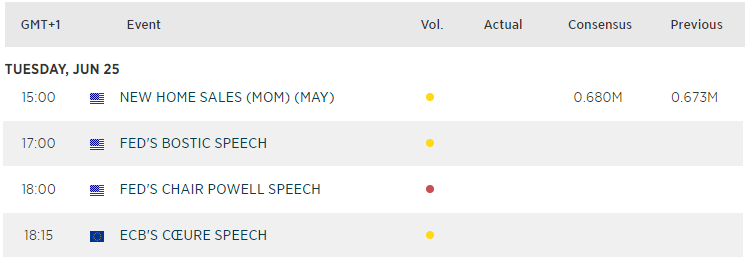

Upcoming economic highlights

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM