Stock market snapshot as of [27/6/2019 0433 GMT]

- Ahead of the European session open, “trade optimism” has started to build up again where Asian stocks have reversed up after 4-days of losses since last Fri, 21 Jun. Another major Asian based media outlet, SCMP has reported that U.S. and China officials have tentatively agreed another round of trade tariff truce ahead of the Trump-Xi G20 meeting on 29 Jun.

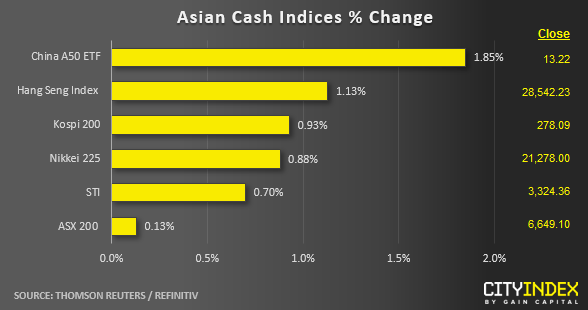

- In addition, the media report has quoted two sources that suggested a deadline of six months while both sides work to restart trade negotiation talks after the G20 meeting before additional U.S. tariffs are being imposed. China related plays are the outperformer today where the China A50 and Hang Seng Index rallied by 1.85% and 1.13% so far in today’s Asian mid-session as expected, click here for a recap.

- The S&P 500 E-mini futures has gained as well by 0.39% to print a current intraday high of 2926 from yesterday’s U.S session close of 2915.

- European stock indices CFD futures are showing modest gains at this juncture where the Germany DAX is up by 0.34% and almost unchanged for the FTSE 100.

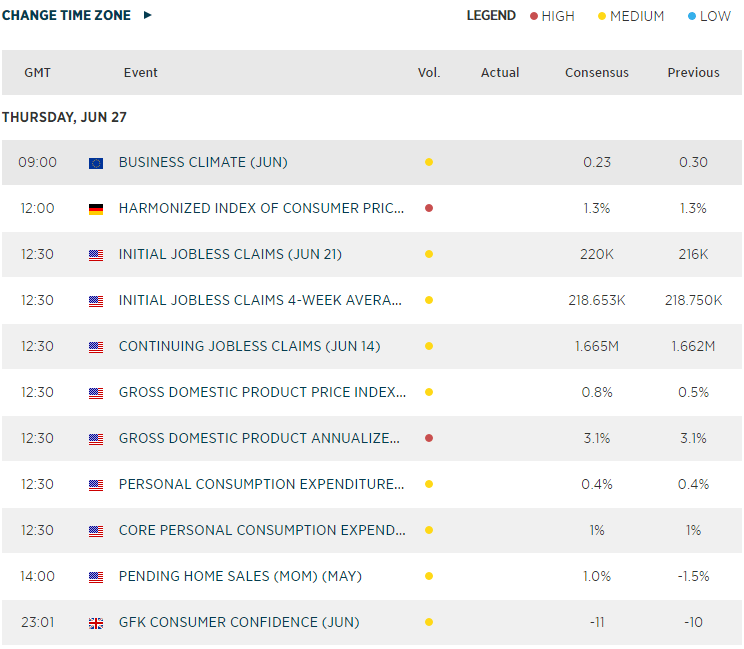

- Key European economic data releases to take note later will be EU business climate survey for Jun at 0900 GMT follow by Germany’s Jun CPI at 1200 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM