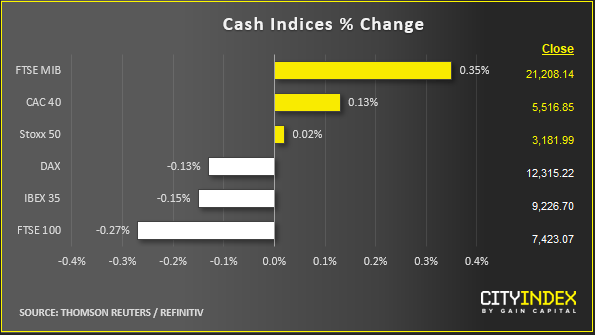

Stock market snapshot as of [19/6/2019 3:08 PM]

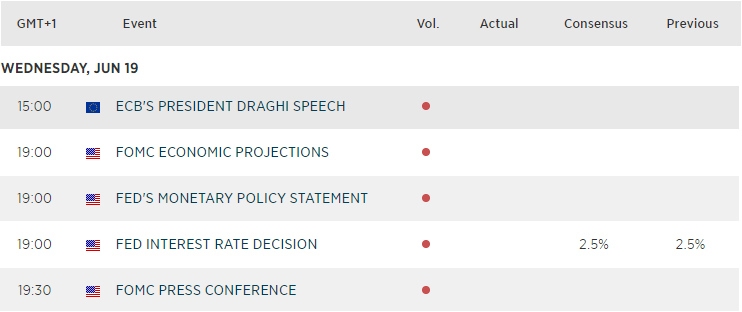

- European stock investors have pressed the pause button ahead of the most widely anticipated Federal Reserve Interest rate decision for months

- The region’s broad STOXX 600 gauge was down 0.4% heading into the U.S. session, though U.S. stock indices caught some momentum from Tuesday’s propulsive moves, extending them slightly

- Still, trade conflict currents remain near the surface. U.S. President Donald Trump’s criticism of European Central Bank president Mario Draghi, whose accommodative comments hit the euro, hangs in the air. Reports that the U.S. might levy tariffs on Turkey also feature, weighing on the lira

- And although the S&P 500 is within 1% of record high, rotation into defensive ‘value’ sectors and moves away from cyclical ‘high-growth’ shares belies the strong look of the U.S. market on the surface

- Treasurys are also sending less-than-creditable signals, with yields still close to two-year lows despite a three-tick lift by the 10-year yield to 2.08% just now, and volatility in interest-rate options spiking. There are lots of reminders around that despite palpable optimism, there’s little that’s normal about the markets right now

Corporate News

- Europe’s hardware-focused tech sector, particularly chips, joined the losers, though consumer and retail shares fell harder

- The industry isn’t in the best shape, but Benelux retailer Colruyt Group is almost the only driver of Wednesday’s sector underperformance. It was more than 13% lower at last check after the group warned of stiffening price competition in Belgium

- Adobe is the big-name mover stateside, with a 4.5% jump on open as reward for beating fourth quarter adjusted EPS estimates

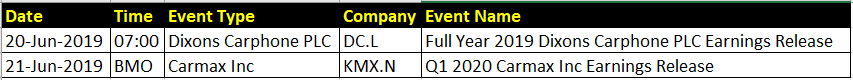

Upcoming corporate highlights

Upcoming economic highlights

Latest market news

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM

Yesterday 11:30 AM

Yesterday 08:18 AM