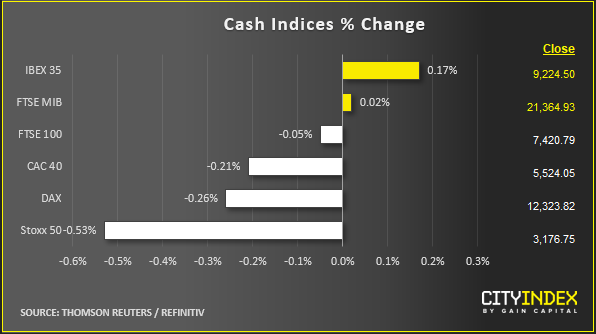

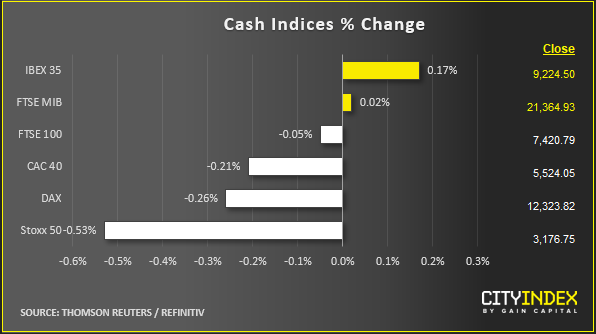

Stock market snapshot as of [21/6/2019 2:24 PM]

- Overtones of the trade conflict are, like the unseasonably wet weather in much of Europe right now, difficult to avoid and likely to put a dampener on things. The impact on the broad STOXX 600 gauge was a 0.3% slip a short while ago

- Stock markets here were already on the lookout for excuses to consolidate their biggest monthly gain since January

- A report that U.S. President Donald Trump was close to issuing an executive order to force disclosure of health industry prices echoed in European pharma and health shares

- The simmering and increasingly unpredictable U.S.-Iran stand-off has also chilled the week’s revived cheer. The latest is that Iran says it refrained from downing an aircraft accompanying the U.S. drone it destroyed earlier this week

- The news sets oil prices on course for their third session gain of the week and biggest weekly gain of the year

- The Brent benchmark was up 0.8% on the day. Norway’s oil-stock laden OMX lifted 1%, outperforming regional counterparts

- Business sentiment surveys, are a counterbalance on sentiment. Or are they? To the extent that better than expected ‘flash’ manufacturing PMIs act as a brake on rate cuts hinted at by ECB president Mario Draghi, signs that Eurozone economies may have bottomed out might not be immediately welcome for investors

Corporate News

- GlaxoSmithKline led heavyweight losers on those Trump reports, falling 1.8% towards Wall Street’s open. It derives about a third of revenues in the U.S.

- Oil shares pushed the energy sector out in front again, with BP leading, followed closely by France’s Total and Royal Dutch Shell. The supermajors traded around 1% higher just now

- Consumer staples stocks pared their better-than-market-average returns for the year to date, implying profit taking from safety-tinged rotation plays

- U.S. stock index futures are between 0.2% and 0.3% lower; so the return of less sure-footed sentiment is set to carry over to Wall Street

- Slack is set to be an outlier as it extends gains made at a stellar IPO on Thursday. It closed 48% higher than the price it was offered at in its direct listing. ‘WORK’ is quoted about 4% higher

- Carnival Corp, the cruise operator will be among heavyweight fallers. The stock is marked 4% lower in pre-market trading as brokerage downgrades pile in after a weaker than expected full-year forecast

Upcoming corporate highlights

AMC: after market close

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM