Stock market snapshot as of [17/6/2019 0555 GMT]

- As we head into the European opening session, Asian stock markets have started the week on a quiet tone while traders brace for the most important event of this week; Fed FOMC meeting outcome on this Wed, 19 Jun. Latest data from CME Fed Watch tool based on market expectation calculations derived from the fed funds futures contract has almost ruled out a rate cut for this coming Wed but the chances of a rate cut in the next FOMC meeting in July has increased to 80%. Thus, the press conference and the “dot plot” release after the FOMC meeting will be paramount as traders screen for further evidence of any “dovish guidance” from the Fed.

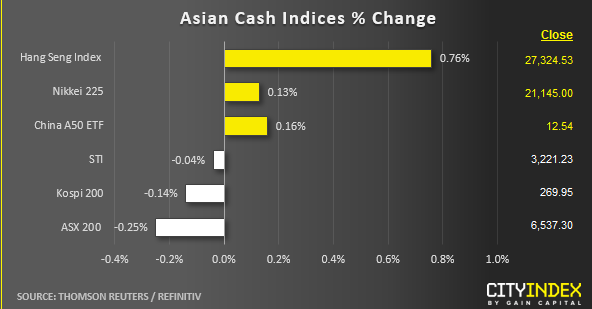

- As at today’s Asian mid-session, the S&P 500 E-mini futures has inched higher by 0.4% from last Fri, 14 Jun U.S. session close to print a current intraday high of 2904 that has erased last Fri’s losses. The outlier for Asian stock market is the Hong Kong’s Hang Seng Index where it has rallied by 0.76% to recoup last week’s bloodshed. The Hong Kong administration has suspended the voting of the controversial China extradition bill due to massive public demonstrations. However, from a technical analysis perspective, the Index is still being trapped within a range configuration despite its current outperformance seen today. Click here to read our latest weekly technical outlook on stock indices.

- European stock indices CFD futures are showing modest gains at this junctures where the FTSE 100 and the German DAX have inched up by 0.19% and 0.14% respectively.

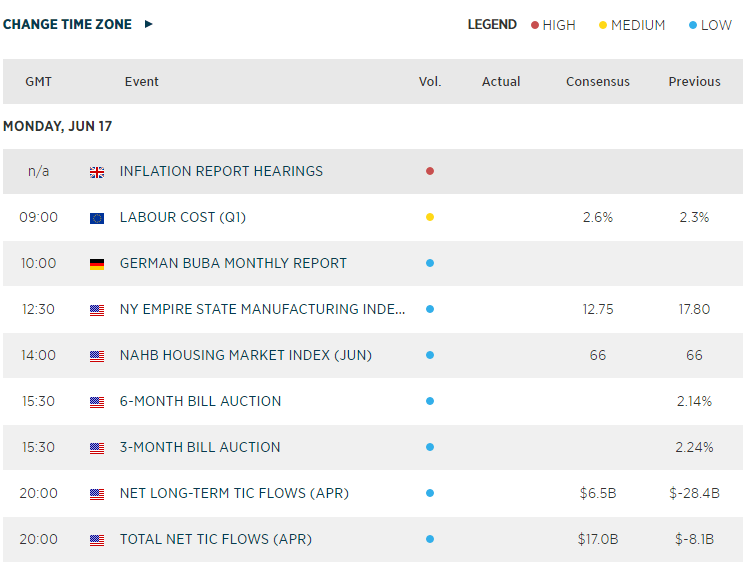

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM