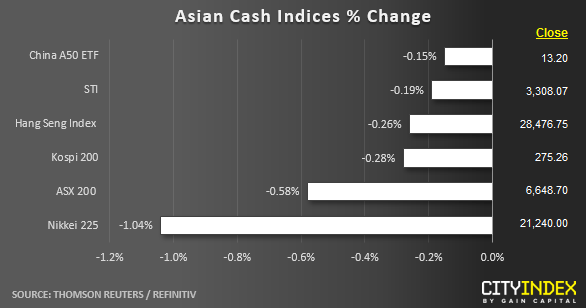

Stock market snapshot as of [21/6/2019 0500 GMT]

- Ahead of the European session open, profit taking activities can been seen across the board in Asian stock markets to retrace its prior 3-days of consecutive gains on the back of rising geopolitical tensions in the Middle East after Iran shot down a U.S. drone for the violation of Iran’s airspace.

- The worst performer in Asia as at today’s mid-session is the Nikkei 225 where it has tumbled by -1.04% reinforced by a weak preliminary Japan manufacturing PMI data for Jun where it has showed a contraction (49.5 versus 50.00 consensus). In addition, the JPY has continued to gain strength where the USD/JPY has plummeted to print an Asian session low of 107.05; on track to post its worst weekly close since 02 Jan 2019. Click here for our latest analysis on the FX markets.

- After the S&P 500 hit a fresh all-time high close at 2954 (printed an intraday all-time high of 2958) in yesterday’s U.S. session, the S&P E-mini futures have also started to retrace some of its gains by 0.30% to print a current intraday low of 2950 as seen in today’s Asia session.

- European stock indices CFD futures are showing modest losses as well where the FTSE 100 and German DAX have declined by -0.23% and -0.46% respectively.

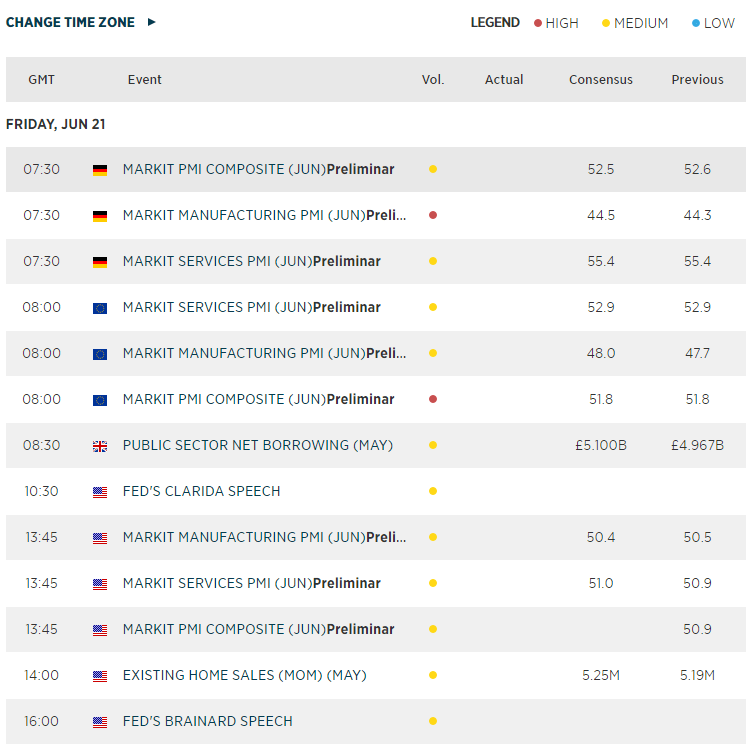

- PMI day for Europe today where German preliminary manufacturing & services PMI for Jun will be out at 0730 GMT follow by Eurozone’s PMI at 0800 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM