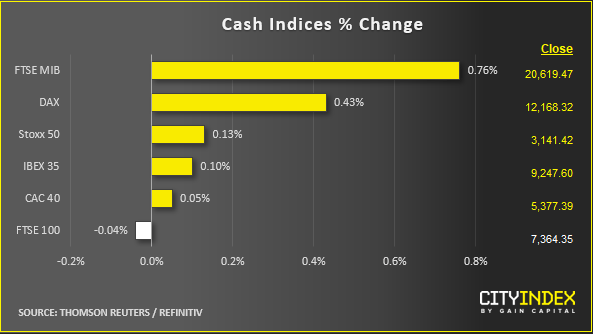

Stock market snapshot as of [13/6/2019 3:44 PM]

- After a session-and-a-half consolidation of the recent rebound, investors may be in the mood to add more upside, with less emphasis on ‘quality’

- Thursday’s early-session swing off lows was not entirely down to a sudden spike in oil prices, but it played a large part

- Both U.S. WTI and Brent benchmark crude oil futures contracts surged almost 5% higher and were last trading up around 3% on the day apiece

- It follows reports that two tankers were attacked near the Strait of Hormuz; one by some form of projectile “shell”— some reports cited a torpedo—the other suffering three detonations

- The attacks follow incidents around a month ago when four vessels were sabotaged in the same region. Then, U.S. authorities pointed the finger at Iran, citing naval mines

- Before news suggesting 35% of the world’s oil supply—the amount shipped through the Strait daily—could be put in jeopardy, risk appetite was thin on the ground

- Hong Kong protesters appear to be gearing up for more confrontations, whilst Greater China itself and the U.S. seem no nearer to resolving their trade dispute

- Higher than forecast U.S. weekly jobless claim are keeping the monetary easing narrative going

Corporate News

- Oil-related stocks are predictably leading in Europe, though it’s worth noting that oilfield contractor stocks saw the most interest after they were dumped particularly hard on Wednesday

- The high-yielding residential and commercial property sector, a ‘safety’ play, rose the most

- Europe’s tech shares rose 0.5% overall with software strongest. Hardware stocks were dragged lower by telecom equipment makers Nokia and Ericsson

- Shipping shares surged on the S&P 500 as the tanker attack could inflate shipping rates. Frontline, the owner of one of the attacked tankers jumped as much as 11%

Upcoming corporate highlights

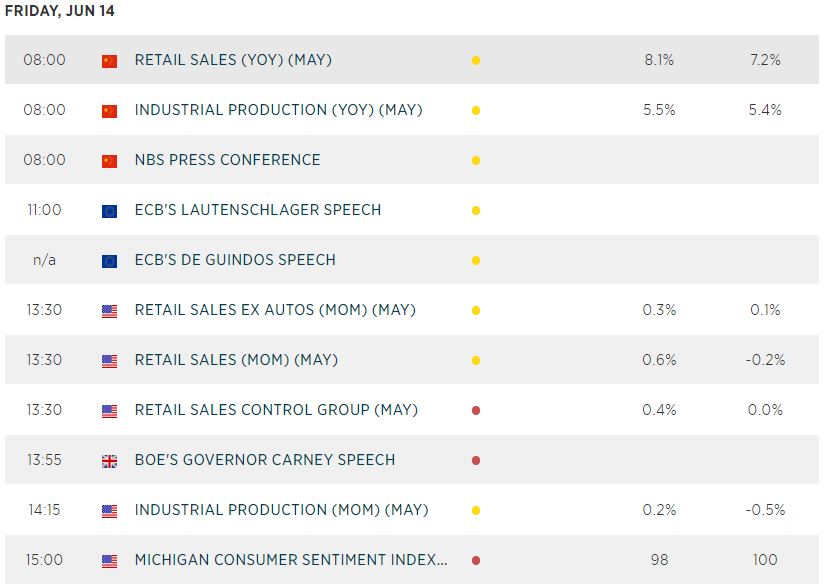

Upcoming economic highlights

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM