Stock market snapshot as of [14/6/2019 0540 GMT]

- As we head into the European opening session, the S&P 500 E-mini futures has continued to inch higher by 0.4% in today’s Asian mid-session from yesterday, 13 Jun U.S. session close to print a current intraday high at 2901. The current optimistic sentiment seems to be led by an increasing expectation of a Fed rate cut in the July FOMC meeting after the release of a weak U.S. initial jobless claims data yesterday despite heightened geopolitical tensions in the Middle East where U.S. has identified Iran as the attacker on an oil tanker near the entrance to the Persian Gulf.

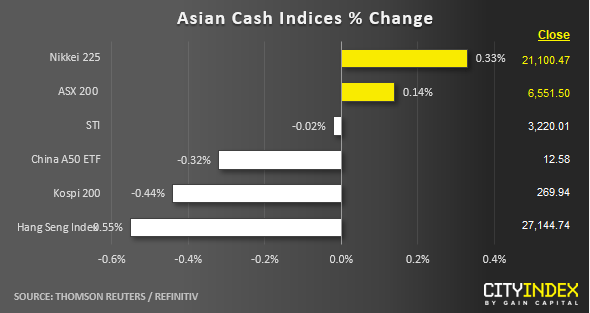

- Asian stock markets are mixed where China and Hong Kong are both recording losses of -0.32% and -0.55% respectively as at today’s Asian mid-session where the worst underperformer is the Hang Seng Index due to on-going localised social unrest as protesters plan to have another massive demonstration this coming Sunday over the China extradition bill.

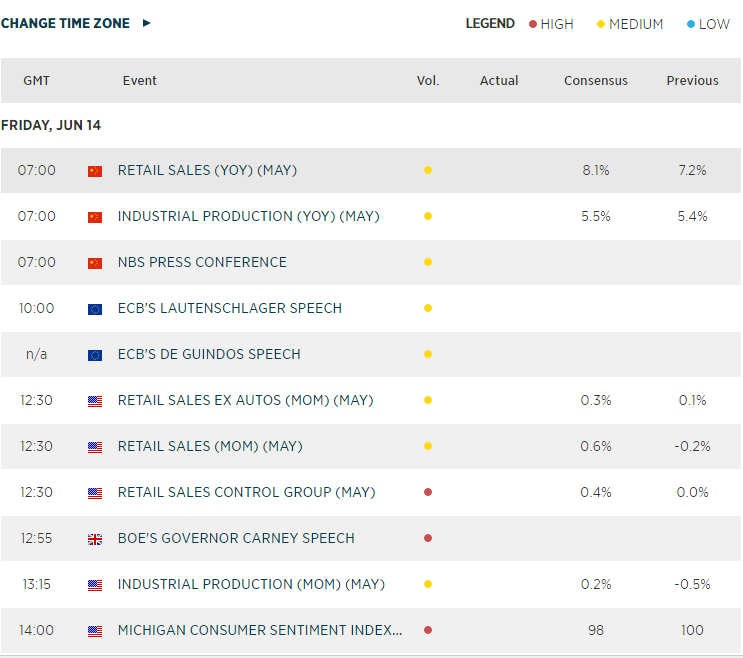

- Key Asian economic data to take note will be China retail sales and industrial production for May, out later at 0700 GMT.

- BOE’s Governor will be speaking later at 1255 GMT and as we head into the U.S. opening session, U.S. retail sales for May will be out at 1230 GMT.

- No significant movement in the FTSE 100 and Germany DAX CFD indices futures where the FTSE 100 is showing a modest gain of 0.16% and German DAX is almost unchanged.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.