Stock market snapshot as of [17/6/2019 3:25 PM]

- There are signs that U.S. investors continue to half-suspect bad news may in fact be good news in a monetary policy context, particularly with the Federal Reserve meeting beginning tomorrow

- Although normally deemed ‘second-tier’, the New York Fed’s Empire Manufacturing gauge caused a stir. The headline collapsed to minus 8.6 in June from 17.8 in May. A sharp slump in business sentiment in the region was driven by an equally swift reversal of business orders

- S&P 500 and Nasdaq cash markets turned green soon after they opened, and all major indices traded higher just now

- With just as much uncertainty to go with deeply priced-in expectations of Fed easing, stock markets are likely to continue wavering till Fed events on Wednesday. Policy updates from the Bank of England and Bank of Japan later in the week will keep suspense going to a lesser degree

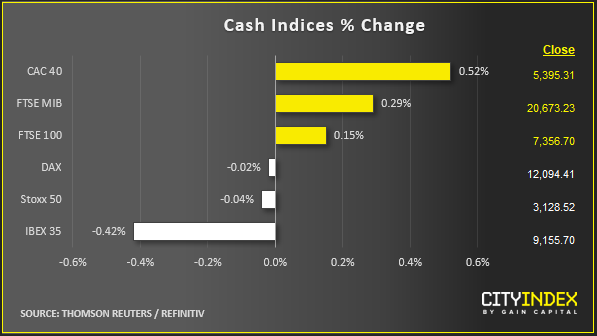

- European indices are mixed though there was more red on show earlier as relative cross-market calm was shown to be shallow

Corporate News

- Large and troubled German groups dominate the start of the European week. Deutsche Lufthansa issued its second profit warning of the year as it doubled down on growth versus profits in attempting to bolster market share at low-cost unit Germanwings. The carrier’s shares slumped as much as 13%

- Deutsche Bank went in the opposite direction, trading 1%-2% higher after floating a plan to create a ‘Bad Bank’ to house up to €50bn loss-making derivatives assets

- Facebook is a U.S. standout, rising around 3%—helping account for Nasdaq’s 0.7% advance—as it details plans for a digital currency

- Sotheby’s was bid around 60% higher. It has agreed to be taken private by Patrick Drahi, the founder of European telecom group Altice, for $2.7bn

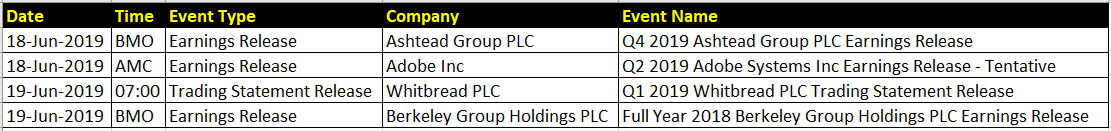

Upcoming corporate highlights

BMO: before market open AMC: after market close

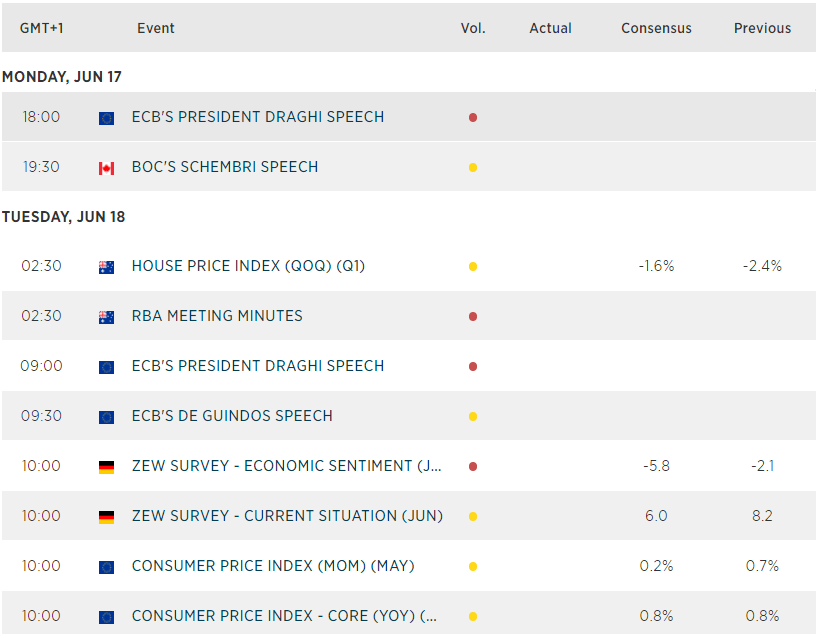

Upcoming economic highlights

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM