Stock market snapshot as of [24/6/2019 0555 GMT]

- Ahead of the European session open, stock traders in Asia has started to adopt a cautious stance at the start of a brand new week ahead of the key major G20 summit on 28 to 29 Jun where the main focus will be on the outcome of the meeting between U.S President Trump and China President Xi over the discussion on the on-going trade disputes.

- In addition, Middle East’s geopolitical tension has continued to be on the rise where U.S. will impose new sanctions on Iran from today.

- Most Asian stock markets are almost unchanged from last Fri, 21 Jun close except for Singapore’s STI which has declined buy close to 0.40% as at today’s Asian mid-session. The underperformance of STI has been led by its major component stocks; the three local banks, DBS, UOB and OCBC with losses ranging from -1.40% to -0.50%.

- As at today’s Asian mid-session, the S&P E-mini futures has manage to ink out a modest gain of 0.3% from last Fri, 21 Jun close. Overall, the medium-term uptrend of the major stock indices remains intact, but we may be due for a minor corrective decline after this residual push up. Click here for our latest weekly technical outlook report.

- European stock indices CFD futures are also in the red at this juncture. Both the FTSE 100 and German DAX has showing modest losses of -0.13% and -0.16% respectively.

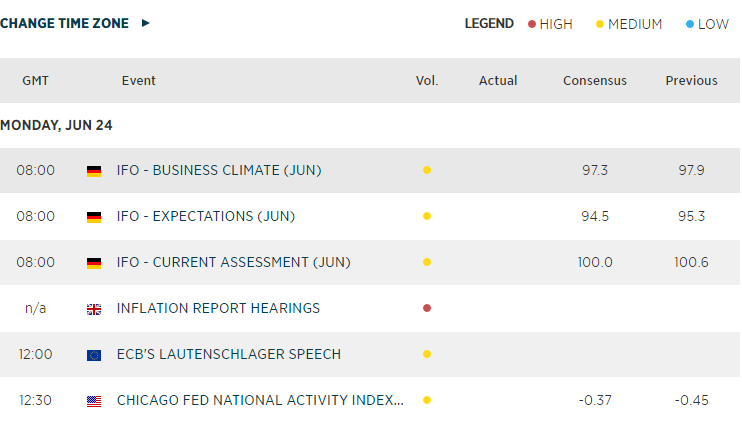

- Key European economic data release to take note later will be Germany’s IFO business sentiment survey results for Jun out at 0800 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM

Yesterday 11:30 AM

Yesterday 08:18 AM