Stock market snapshot as of [26/6/2019 0430 GMT]

- Ahead of the European session open, we are seeing a mix picture for Asian stock markets after a sell-off seen in the U.S. stock markets yesterday, 25 Jun led by the tech heavy Nasdaq 100 where it has declined by -1.7%.

- Earlier morning losses seen in Asian stocks have been trimmed where the Hang Seng Index and Kospi 200 have managed to inch back up almost unchanged as at today’s Asian mid-session. We have highlighted in an article that the recent sell-off seen in stocks trigged by G20 news flow may have been overdone, click here for details.

- Japan’s Nikkei 225 is the worst underperformer where it has shed by -0.45%. A point to take note is that the Index is coming close to the 20900 key medium-term pivotal support.

- European stock indices CFD futures are faring not so bad with modest loss of around -0.30% seen in the FTSE 100 and German DAX. Watch the 12180 key medium-term pivotal support on the DAX, click here for a recap on our weekly technical outlook.

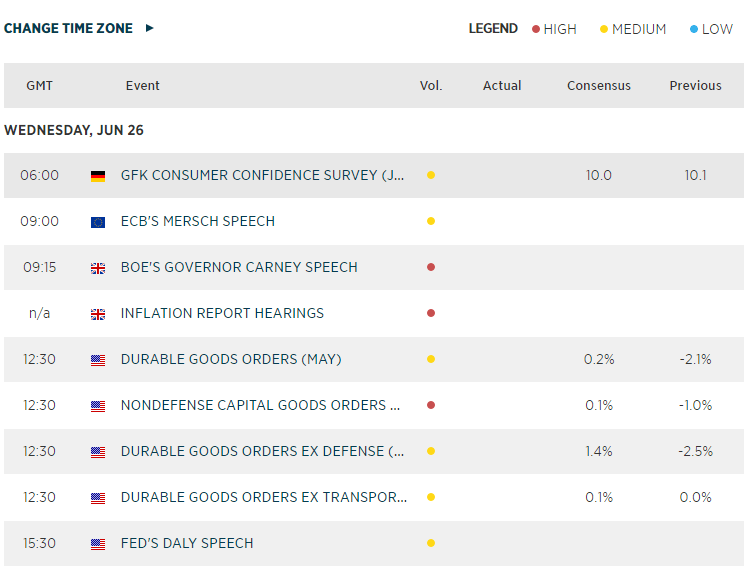

- Key European/U.K economic data release and event to take note will be Germany consumer confidence survey out later at 0600 GMT and BoE Governor’s speech at 0915 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM