Stock market snapshot as of [19/6/2019 0520 GMT]

- Ahead of the European opening session, Asian stock markets have rallied across the board; taking the cue from a broad-based up move seen in the U.S. stock indices led by the Industrial & Technology sectors (up by 1.94% & 1.81% respectively).

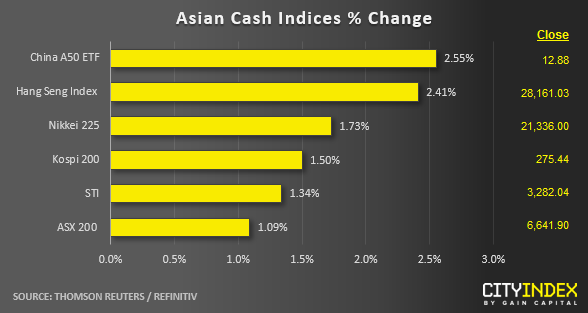

- As at today’s Asian mid-session, China related plays have outperformed where the China A50 and Hang Seng Index are leading the pack with gains of 2.55% and 2.41% respectively. The S&P 500 E-mini futures is now appearing to be consolidating yesterday’s U.S. session gains as it traded in a tight range between 2930 and 2923. The on-going optimism has been triggered by a dovish ECB follow by a planned meeting between U.S President Trump and China’s Xi in the upcoming G20 summit on 28/29 Jun 2019.

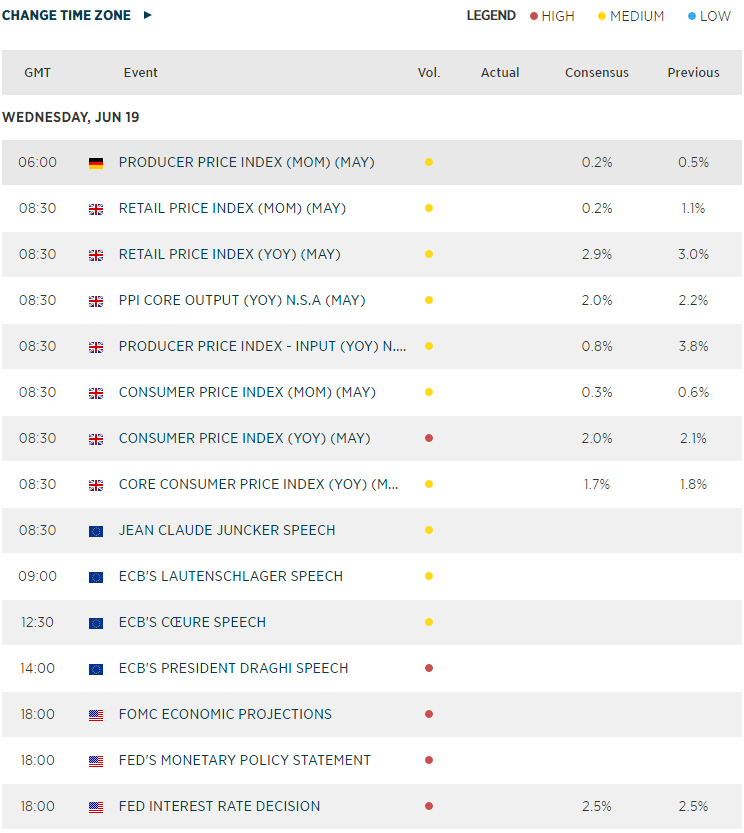

- As we head into the “mother of all event” for this week, the Fed FOMC meeting outcome later at 1800 GMT follow by Chairman Powell’s press conference at 1830 GMT, the medium-term uptrend remains intact for the major stock indices (click here for a recap our weekly technical outlook).

- The FTST 100 and Germany DAX CFD futures are showing modest gains at this juncture; up by 0.16% and 0.10% respectively.

- Other the Fed FOMC meeting, key U.K/EU economic data releases to take note later will be Germany producer price index for May and a slew of U.K inflation data as well.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM