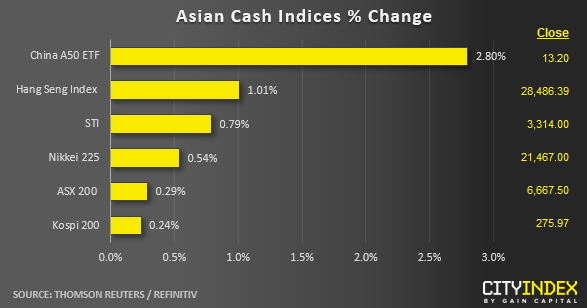

Stock market snapshot as of [20/6/2019 0520 GMT]

- Ahead of the European session open, Asian stock markets have continued their 3rd day of consecutive gains reinforced by a dovish Fed that has met market expectations on the delivery of an interest rate cut in the next FOMC meeting in Jul. Based on CME Fed Watch Tool derived from data obtained from Fed funds futures, the probability of a rate cut in Jul has jumped to 100% from 80% as seen before yesterday’s FOMC.

- China and Hong Kong stock markets are the star performers as at today’s Asian mid-session where the China A50 and Hang Seng Index have rallied by 2.80% and 1.01% respectively. Assisted also by a weaker USD/CNH (offshore yuan) where it has broken below a key short-term support at 6.8980. The Hang Seng Index has broken above 28000 (the upper limit of the neutrality zone) that has opened up scope for further potential upside; click here for a recap.

- European stock indices CFD futures are joining the “risk on” party as well where the FTSE 100 and German DAX are now recording gains of close to 0.40%.

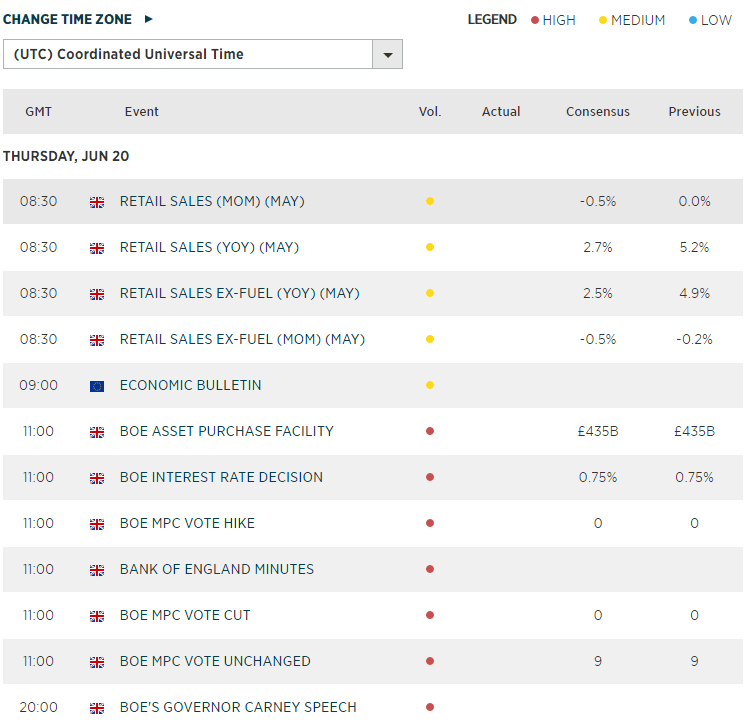

- Key economic data release and event to take note later will be U.K retail sales for May and the BoE monetary policy meeting outcome out later at 1100 GMT. Click here for a recap on our analysis on the upcoming BoE meeting.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM