Equity Handover: Facebook Gains 4% on Cryptocurrency Optimism

Index names may not reflect tradable instruments and not all markets are available in all regions.

Headlines

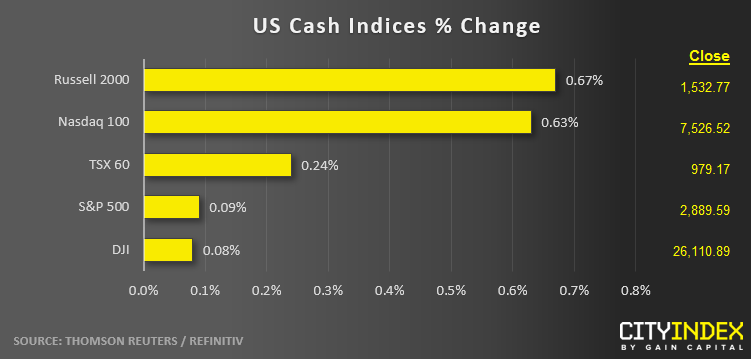

- After trading in positive territory for the entire day, US indices closed essentially flat in a quiet session.

- Communication Services (XLC) was the best performing sector on the day; Financials (XLF) were the weakest.

- US macroeconomic data:

- The Empire Fed Manufacturing Index (June) dropped to a nearly 3-year low at -8.6.

- The NAHB Housing Market Index (June) dropped to 64, below 67 expected

- Stocks on the move:

- Facebook (FB) rose 4% ahead of the tomorrow’s release of the whitepaper for its cryptocurrency Libra coin

- Netflix (NFLX) tacked on 3% after an analyst at Piper Jaffray issued a bullish forecast for US subscriber growth.

- Array BioPharma (ARRY) rocketed 56% after agreeing to be acquired by Pfizer for $11.4B.

- Auction house Sotheby’s (BID) rallied 59% in a $3.7B takeover deal from BidFair USA.

*There are no high-impact corporate announcements expected during tomorrow’s Asian session.*