Stock market snapshot as of [28/6/2019 2:43 PM]

- The highly anticipated G20 summit is beginning on the last trading day of 2019’s first half. This calls for a pinch of salt whilst observing markets as they’re likely to be influenced by contract expirations, portfolio rebalancing and forms of ‘window dressing’

- At Friday’s U.S. closing bell, FTSE Russell’s annual index reconstitution is set to trigger some $170bn in additional trades as funds tracking FTSE Russell benchmarks ensure they’re aligned

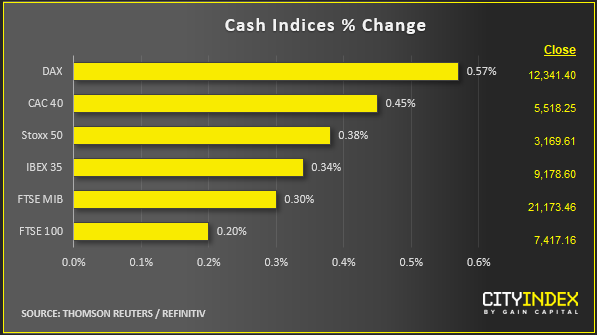

- Beforehand, U.S. shares are picking up the baton from European indices where a fairly solid sea of green saw the larger stock markets trade 0.4% to 0.6% higher

- Wall Street is largely shrugging off as-expected Personal Consumption and Expenditure readings that will be neutral for the Fed whilst it weighs a rate cut in July

- The more definitive stock upswing in the West contrasts curiously with an almost uniform dip by Asia-Pacific indices

- To-and-fro rhetoric out of Beijing and Washington has continued even as Presidents Xi and Trump arrive in Osaka, Japan, ahead of their meeting on Saturday. However the latest tones from both have been less optimistic even if an agreement not to escalate tariffs still looks on the cards

- Donald Trump noted he hadn’t promised not to issue new tariffs, though expects a “productive” meeting. Xi Jinping warned that “bullying practices” won’t work, though he didn’t name his U.S. counterpart

Corporate News

- Deutsche Bank takes a one-day break from being sector laggard after a surprise first-attempt pass of the Federal Reserve’s 2019 stress tests. Germany’s largest bank failed to achieve this last year. The stock rose as much as 4%

- Technology and consumer shares also rise strongly in Europe. UK housebuilders shone after the favourite to become Britain’s next prime minister, Boris Johnson, floated an overhaul of stamp duty, a form of taxation paid on some property purchases

- Nike shares rise a little despite missing earnings estimates for the first time in seven years. The shares fell 3% in Thursday’s after-hours trading following results

- Corona and Modelo brewer Constellation Brands adds 4% after a comfortable quarterly sales beat and a crisp comparable earnings per share beat

- The stock joins S&P 500 cyclicals that topped ‘defensive’ returns in June, as Materials, technology, Energy and consumer indices paced sectors perceived to be safer like Utilities and Real Estate

- The moves point underlying risk appetite despite volatility so far in 2019, though may not predict which sectors are favoured in the second half

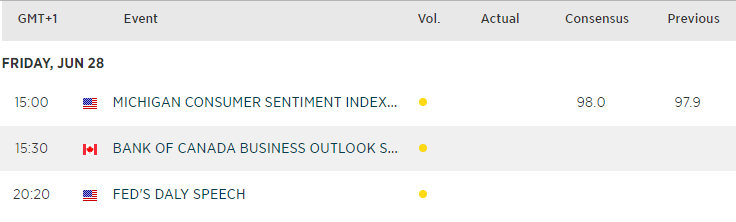

Upcoming economic highlights

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM