Stock market snapshot as of [27/6/2019 4:51 PM]

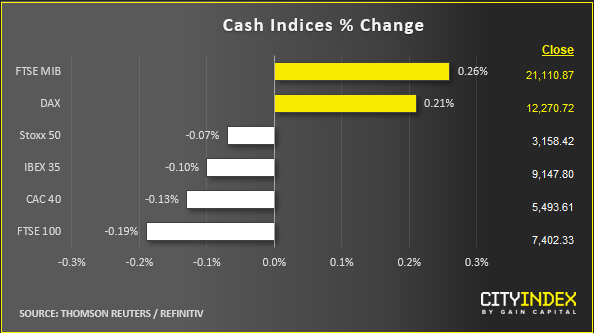

- Markets can rebound, but they can’t escape volatility. European indices endured another jumpy half session before settling down to moderate gains towards the close

- Still, the incongruous dislocation of the recent ‘everything rally’—gold on the backfoot, Treasury yields retreating and the dollar rising—shows that the market’s state is still far from ‘normal’

- Europe’s STOXX 600 barely closed in the black, only nominally breaking a four-session losing streak. The U.S. S&P 500 inches no more than 0.5% higher, though also eyes a positive session

- CBOE’s VIX index of implied volatility has steadily inched higher too, holding well above its recent reversal floor around 13

- Investors are trying to square the White House’s ‘good-cop’/’bad-cop’ commentary ahead of Friday-Saturday talks between Presidents Trump and Xi

- Trump’s “Plan B” is to “take in billions and billions of dollars a month” more from China while doing “less and less business” with the second-largest economy. His Treasury Secretary Steven Mnuchin remained “hopeful” on Wednesday. Other Washington hawks bat away Beijing’s insistence on a ‘balanced’ deal. Little wonder that ample dissonance accompanies the wide expectation that a tariff ceasefire will be agreed this weekend

Corporate News

- Markets are without their recent crude oil prop as energy prices consolidate recent Iran-headline and supply-news gains. Large-cap integrated oil shares are lower

- Wall Street sees a mini rotation into financials in sympathy with similar moves overseas. The lighter mood enables Citigroup, Wells Fargo, JPMorgan and Bank of America to lead U.S. lenders higher as attention turns to their earnings and possible dividend rises next month

- Semiconductors continue to outshine the rest of the technology sector on the back of surprisingly robust Micron earnings a day ago. The chip equipment segment is more in focus on Thursday with Applied Materials up 2%

- Apple contributes the most index weight to blue chips. It was up 0.7% a short while ago. Walgreens Boots Alliance was top heavyweight riser, with a 4.5% advance after stronger than forecast pharmacy sales

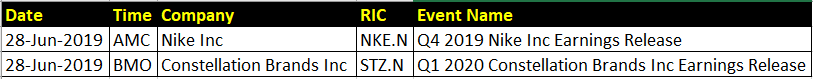

Upcoming corporate highlights

BMO: before market open AMC: after market close

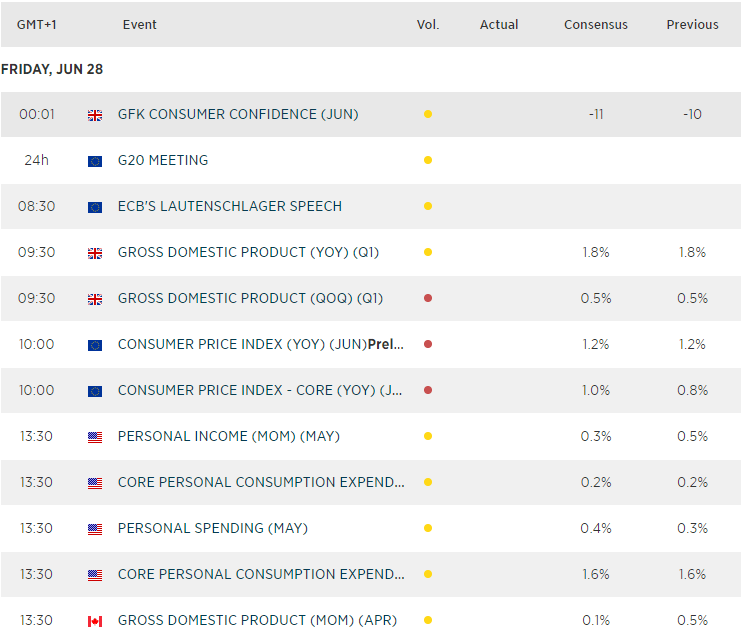

Upcoming economic highlights