Equity Brief: US Indices Close Higher as Gold Hits a 6-Year High

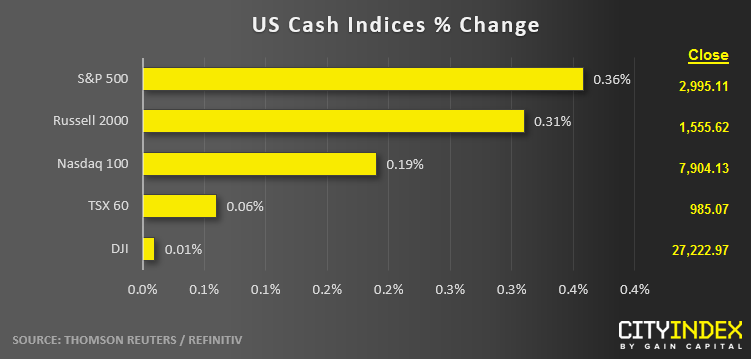

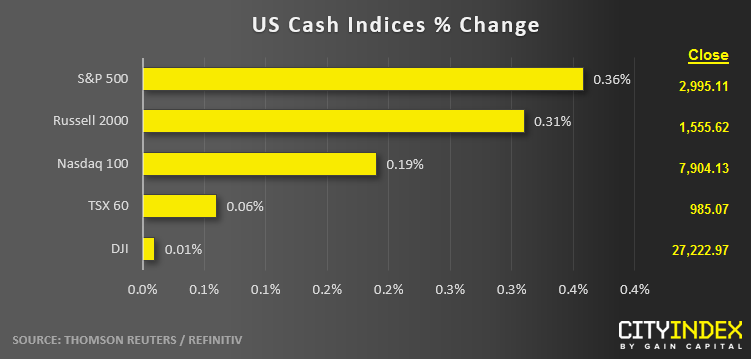

- US indices finished the day marginally higher and well off their intraday lows following a dovish speech by NY Fed President Williams, when he noted that it was “better to take a preventative approach than to wait for disaster.” Traders increased bets on a 50bps “double” rate cut later this month as a result.

- Financials (XLF) were the strongest sector on the day; Communication Services (XLC) were the weakest, dragged down by yesterday’s disappointing earnings from Netflix (NFLX, -10%).

- Gold surged to test $1445, its highest level in more than six years. Oil dropped 2% on the day, despite weakness in the US dollar.

- Stocks on the move:

- Morgan Stanley (MS) reported $1.33 in EPS, well above expectations of $1.17. The stock finished the day 1.5% higher.

- Microsoft reported better-than-expected earnings after the bell, though growth in its cloud computing division Azure fell to “just” 64%. The stock is trading up 1% after hours.

Latest market news

Yesterday 08:33 AM