Stock market snapshot as of [10/7/2019 5:16 PM]

- Once again, U.S. stock markets are able to benefit more from Jerome Powell’s best hint yet that a Fed cut in July remains probable

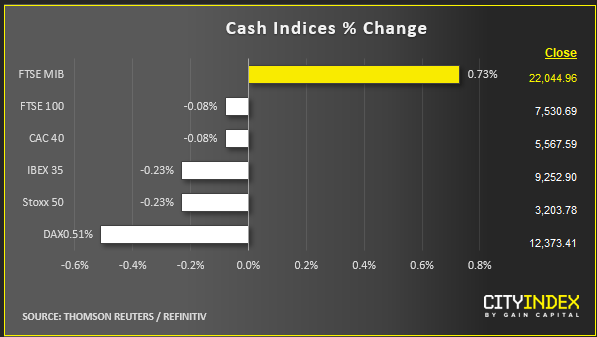

- Only Italy’s stock market posted a fair gain whilst other large EU equity regions merely came off lows, at best. The FTSE MIB rose 0.7% on mild relief that a messy government collapse on governance concerns is unlikely anytime soon. Deputy PM Matteo Salvini’s lower-ranked ministers may not be so much in the clear though, according to reports

- Key phrases from Powell included: “No”! (in answer to a question asking whether the June jobs report shifted the Fed’s policy outlook. He also acknowledged that “uncertainties on trade and growth still dim the outlook”

- It wasn’t enough to offset rising pessimism on European shares though, where anecdotal evidence is beginning to back up persistent pessimism on earnings as the earnings season gets underway

- Some of the positive Wall Street reaction faded too as the lengthy (but largely amicable) Financial Services committee session continued. Still, it was rate-sensitive banks which fared worst. Nine of the S&P 500’s remaining 12 major sectors trade higher

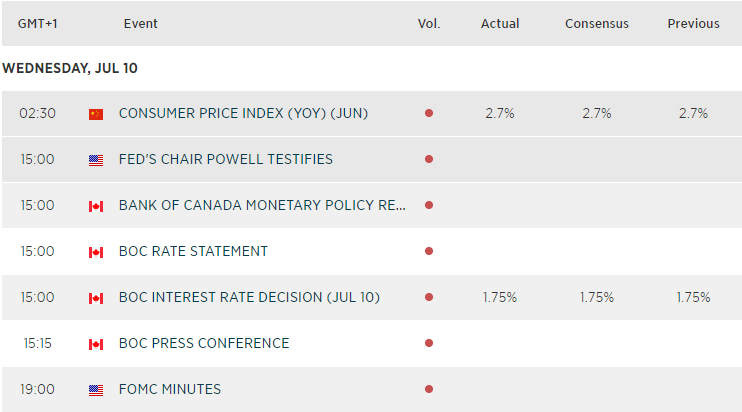

- A just as important focus for Fed watchers (AKA global markets) will come in the form of minutes from the June meeting of the Federal Open Markets Committee, on Wednesday. The chance that markets have overestimated a perceived wave of dovishness at the meeting may have diminished given more up-to-date events, but the risk remains to a degree

Corporate News

- The U.S. energy sector rose the most, gaining about 1%. But advances were firm across all key S&P 500 industrial indices, all the way down to a slight uptick for Materials (including miners and steel stocks)

- Almost all giant oil exploration and production groups were in the green led by Conoco Philips’ 1.5% rise. Oil shares are tracking signs that a new Gulf Coast storm is brewing and data showing a recent slide in stockpiles that has underpinned crude prices

- Facebook shares dipped after Fed chair Jerome Powell said the network’s plans to create a digital currency raised “many serious concerns” regarding privacy, money laundering, consumer protection and financial stability

- Facebook stock softness hasn’t hampered the uptrend for the large-cap technology sector though. It rises 1%, led once again by chip stocks, but with Software & Services also gaining by 0.7%

Upcoming economic highlights