Stock market snapshot as of [29/7/2019 6:22 PM]

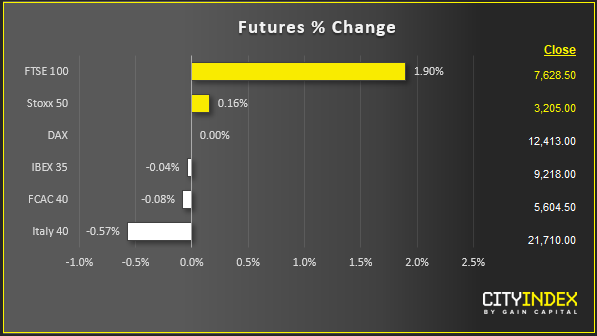

- It’s a session of sharp contrasts for major markets as Dow Industrials eke out a moderate gain, whilst tech stocks weigh the Nasdaq down again and Britain’s FTSE 100 outshines European counterparts with its best one-day rise since June

- Global exporters based in the UK powered the country’s benchmark 3% higher at one point as the drum beat harder for a no-deal Brexit, sending sterling to fresh two-plus year lows

- Elsewhere, more trade sabre rattling accounts for a less than sure-footed start to a busy week of earnings, central bank meetings and other top-tier economic events

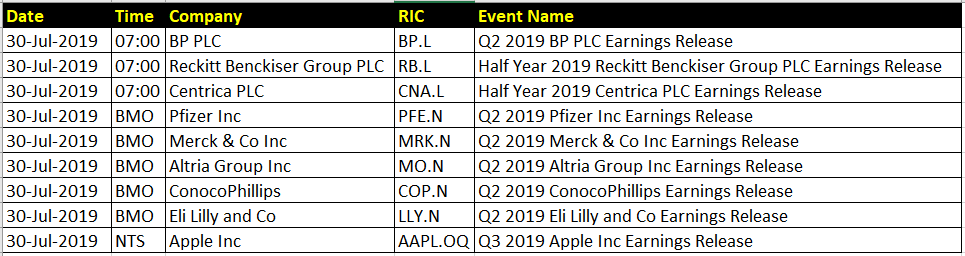

- Ironically, Apple is a tech-sector exception as its stock rises 1%. It is spared the day’s turbulence as Wall Street appears to anticipate third-quarter results that could pace modest expectations when they’re released on Tuesday. That’s despite U.S. President Trump declining, with much fanfare to give, the iPhone maker a ‘waiver’ in the event of tariffs being imposed on some of the goods it has made in China

- Other tech giants fare worse as Amazon, Netflix and Facebook remain under pressure. Increasing regulatory cloud cover and mixed earnings over the last few days help account for investors’ retreat

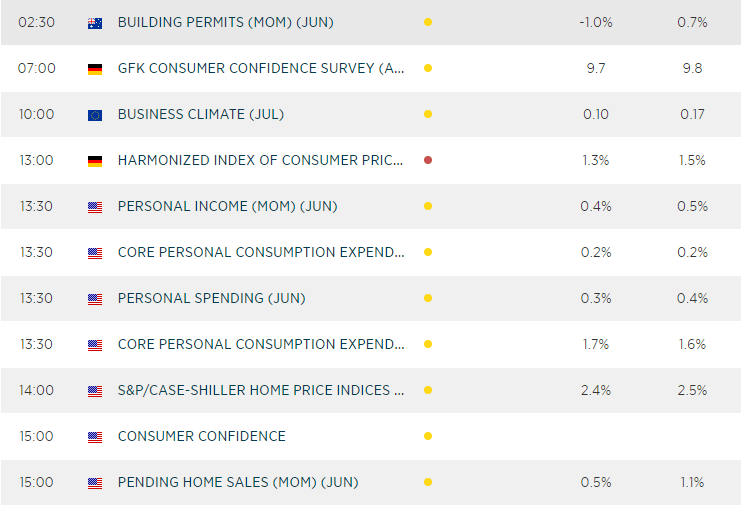

- Anticipation of another key event—Wednesday’s Fed policy announcement, and likely cut—is almost certainly responsible for a fresh Treasury yield headwind. The 10-year rate was down for a second day to stand at 2.056% a short while ago from Friday’s 2.070% finish. That slide comes despite the dollar surging to the highest in almost two months, with a little help from sterling. Greenback revival vibes could well be sending a chill across Wall Street too

- Investors are likely to hold off from punchy positions as high-level U.S.-China talks resume on Tuesday. Treasury Secretary Steven Mnuchin and arch China hawk Robert Lighthizer, Trade Representative, will lead the Washington delegation. A hefty dose of scepticism is advisable ahead of the two days of discussions. Washington and Beijing positions look as intractable as they seemed in May when talks broke down in acrimony. At least the language on both sides sounds less incendiary, for the moment

Corporate News

- Health and retail shares are in demand in Europe and the U.S., though that appearance is mostly skewed by just a handful of stocks. Just Eat, the British take-away food platform zoomed almost 23% higher as analysts signalled that it could be ‘in play’. That follows news that the £4.3bn group is in talks to be acquired by Dutch rival Takeaway.com, worth just slightly more, in dollar terms

- AstraZeneca led Europe’s pharma sector and health stocks generally, adding 3%. Investors are optimistic about a lawsuit it launched last week against a generic competitor. Pfizer’s multibillion dollar mega deal with Mylan is also adding froth to the sector. Mylan was among the big U.S. large-cap movers, with a 14% jump. Roche offset some of the industry’s cheer with a slight fall after data showed weaker sales of some key medicines

- Perhaps just as remarkable is the 6% slip by Beyond Meat, the plant-based meat substitute maker whose shares are only up about 800% since their IPO in May. With earnings out tonight it might just be that most upside that could possibly be hitched to results is now baked well in to the price

Upcoming corporate highlights

BMO: before market open NTS: no time specified

Upcoming economic highlights

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM