Stock market snapshot as of [01/07/2019 0600 GMT]

- Ahead of the European session, Asian stock markets have kickstarted on a positive note for a brand-new trading month in Jul. Positive momentum plays were seen in technology sector that has been reinforced by the agreed trade war truce between U.S. and China post G20 summit and U.S. President Trump’s “180 degree policy U-turn” on China’s technology firm, Huawei by allowing U.S. corporations to resume business dealings with Huawei on certain products after it was blacklisted earlier due to U.S. national security concerns.

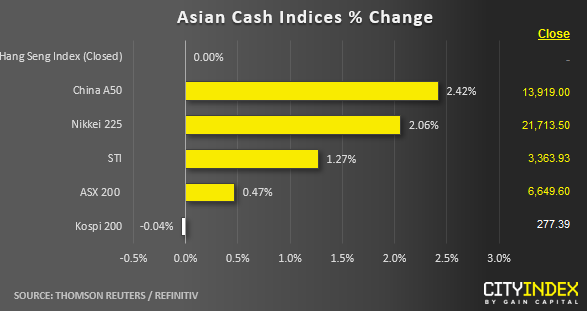

- China A50 is the best performer that has rallied by 2.42% as at today’s Asian mid-session while Hong Kong’s stock market, Hang Seng Index is closed for a public holiday today. The USD/CNH (offshore yuan) has also weakened to a 4-week low of 6.8166 that has reinforced the on-going risk on scenario.

- The outlier is the Korea’s Kospi 200 that has traded against the bullish trend of the rest. It is almost unchanged from last Fri, 28 Jun close due to negative trade related news flow as Japan has announced plans to enact export restrictions on some technology items to South Korea.

- The S&P 500 E-mini futures has gapped up as well in today’s Asian session where it rallied by 0.80% to print a current intraday high of 2977. The on-going rally seen in risk assets has ignored the fundamental aspects of a “slowing global economic growth situation”. The latest China’s Caixin manufacturing PMI data for Jun has contracted the first time in four months since Feb 2019 where it has decline to 49.4 from 50.2 in May, also below consensus of 50.0.

- European stock indices CFD futures are joining the risk on party as well where the both the FTSE 100 and German DAX are up by 0.89% and 1.48% respectively. Overall, the medium-term uptrend phase for stock indices remain intact. Click here for our latest weekly technical outlook report.

- Manufacturing PMI data day for Europe and U.K where Germany’s manufacturing PMI data for Jun will be out at 0755 GMT and U.K’s manufacturing PMI out later at 0830 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM