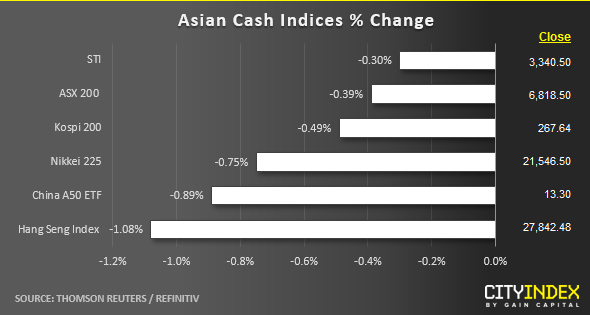

Stock market snapshot as of [31/07/2019 0500 GMT]

- Ahead of the European opening session, Asian stocks are trading in the red as markets participants have trimmed long positions ahead of the most important event of the year; the much-anticipated 25 bps interest rate cut on the Fed fund rate after today’s Fed FOMC meeting.

- Asian stock markets have shrugged off the positive vibe from technology bellwether Apple that has rallied by close to 4% to print a high of 218.44 in the after U.S. hours trading session. Earnings beat expectations where it recorded $2.18 EPS versus consensus of $2.10 EPS.

- Other catalysts that have dragged down Asian stocks today are U.S. President Trump’s overnight tweets that lambasted China’s unfair business practises as U.S. trade officials kickstart fresh negotiation talk with China’s counterparts in Shanghai today. Also, weak quarterly earnings from major Korean semiconductor firm, Samsung Electronics that posted a 56% plunge in profit from a year ago and offered a less rosy guidance. The on-going materials input curb from Japan will dampened its business outlook and delay a plan to return money to shareholders due to significant new challenges. Share price of Samsung Electronics has tumbled by -1.18% as at today’s Asian session.

- The S&P E-mini futures is up marginally by 0.17% to print a current intraday high of 3020 in today’s Asia session.

- After a tumble of -2.18% seen in the German DAX at the close of yesterday’s European session that broke below the 12200 medium-term range support (also the 2nd worst performer among European stock markets yesterday), the DAX CFD futures is trading slightly higher by 0.15% at this juncture but still below 12200/350 intermediate pull-back resistance.

Up Next

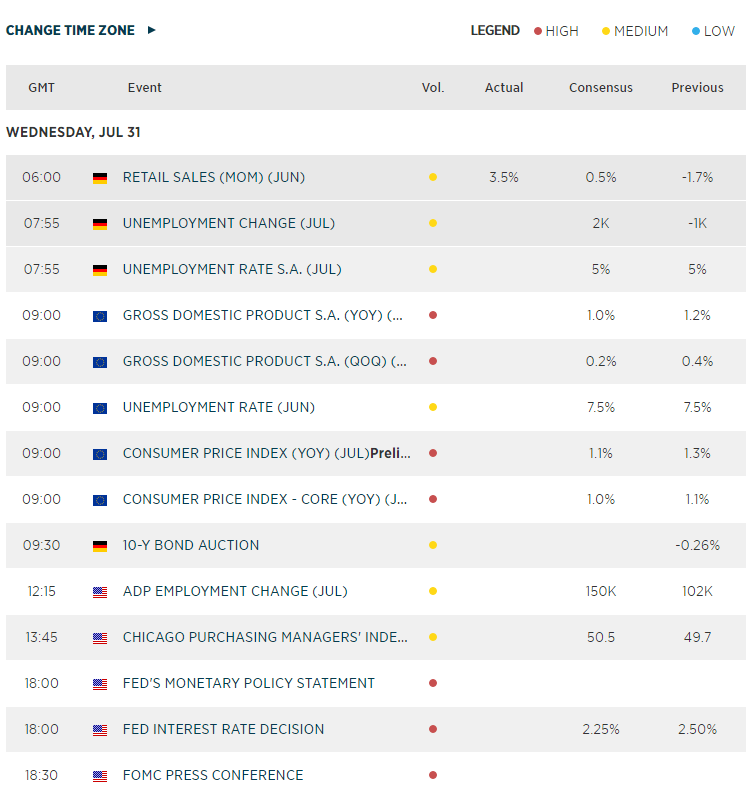

- Eurozone Q2 GDP and Eurozone Jul CPI out at 0900 GMT where consensus is pegged at 1.0% y/y and 1.1% y/y respectively.

- Fed FOMC meeting outcome at 1800 GMT follow by Fed Chair Powell press conference at 1830 GMT. CME FedWatch Tool derived from Fed funds futures pricing has indicated a fully priced in 25 bps cut on the Fed fund rate to 2.00%-2.25%. The probability of a deeper 50 bps stands at 21.9% that is holding steady from last week’s figure at 23.0%.

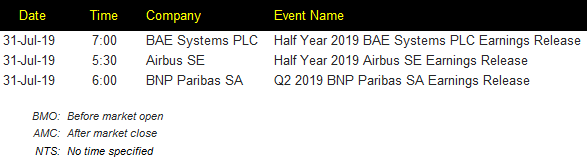

Corporate Highlights

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:33 AM