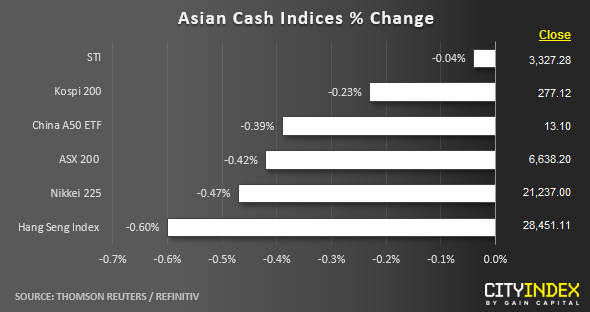

Stock market snapshot as of [28/6/2019 0525 GMT]

- Ahead of the European session, profit taking were seen across the board for Asian stock markets that retraced yesterday’s gains ahead of the key meeting between U.S President Trump and China President Xi on the side-lines of the G20 summit on Sat, 29 Jun at 0230 GMT.

- The worst performer is the Hong Kong’s Hang Seng Index where it has shed by -0.60% after yesterday’s rally that almost hit its recent swing high of 28634 printed on 24 Jun. Given the magnitude of its current loss, it is still trading above yesterday, 27 Jun low of 28287.

- As at today’s Asian mid-session, on the average the key Asian benchmark stock indices are almost unchanged for the week and are still holding above their respective key medium-term supports within an up-trending phase (click here for a recap).

- The S&P 500 E-mini futures is almost unchanged at yesterday’s U.S. session close of 2933 and traded within a tight range of 7 points as at today’s Asian mid-session.

- European stock indices CFD futures are showing mix performances where the German DAX is up by 0.11% and the FTSE 100 almost unchanged.

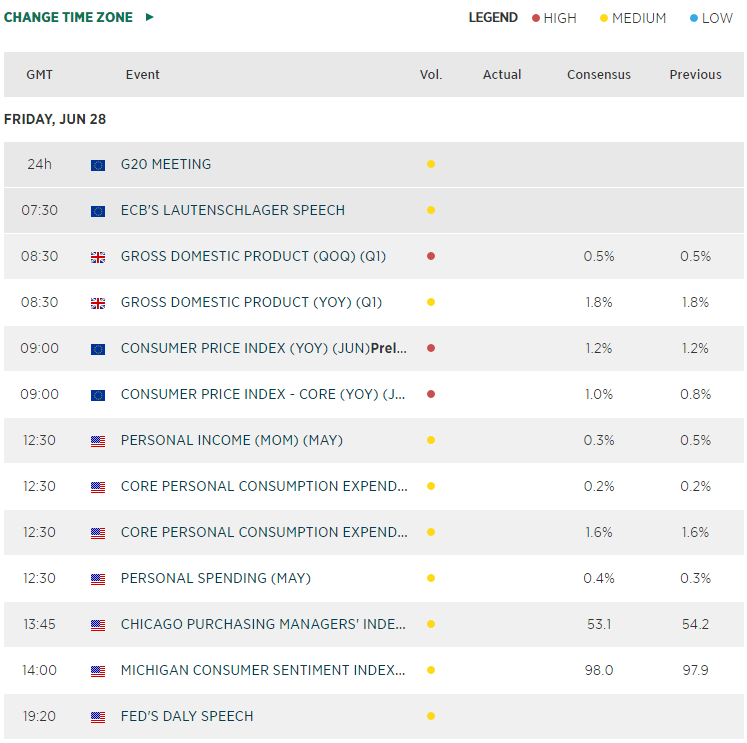

- Key European/U.K economic data releases to take note later will be U.K Q1 GDP out at 0830 GMT and Eurozone Jun CPI at 0900 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM