Stock market snapshot as of [23/07/2019 0440 GMT]

- Ahead of the European opening session, Asian stock markets are trading in a mix fashion after a positive close seen in the overnight U.S. stock markets. The S&P 500 has managed to gain by 0.30% led by major technology stocks; Apple, Amazon and Microsoft which have rallied between 1.1% to 2.3%.

- Positive U.S/China trade related news flow where the U.S. White House had hosted U.S. technology companies to discuss economic issues that include a possible resumption of sales to Huawei. Also, U.S. and China trade officials may conduct a face to face meeting in the coming two weeks.

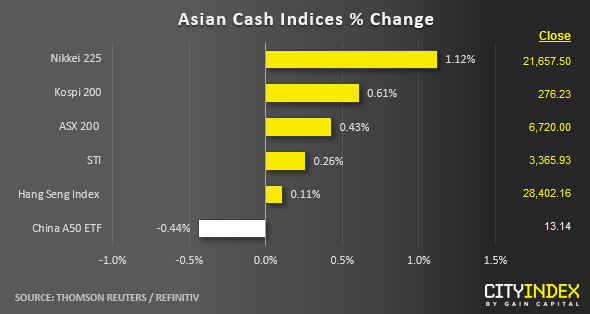

- As at today’s Asian mid-session, the best performers are Japan’s Nikkei 225 which has rallied by 1.12% followed by Korea’s Kospi 200 and Australia’s ASX 200 that are both up by around 0.40% to 0.60%.

- The on-going positive performances seen in the Nikkei 225, Kospi 200 and ASX 200 are led by their respective semiconductors sectors and energy sector on the ASX 200 due to positive U.S/China trade related news flow.

- In today’s Asian session, the S&P 500 E-mini futures has recorded a modest gain of 0.20% to print a current intraday high of 2995 with incoming intermediate resistance to watch at the 3000 level.

- Key U.S. stocks; Amazon, Boeing, Facebook and Caterpillar will announce their respective earnings results on Wed, 24 Jul that can create a significant feedback loop back into the performances of the Asian stock markets.

- European stock indices CFD futures are also showing positive performances at this juncture where the German DAX and FTSE 100 have rallied by 0.67% and 0.38% respectively. Watch the 12500 key medium-term resistance on the German DAX.

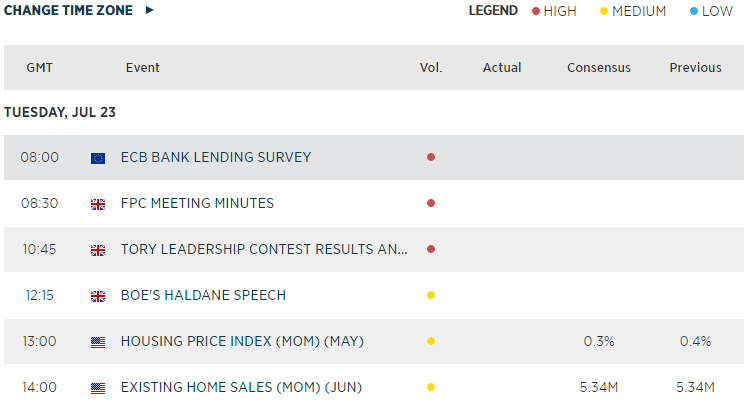

- Key event to take note later will be the selection outcome of the next U.K Prime Minister at 1045 GMT where the consensus is set for Boris Johnson.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM