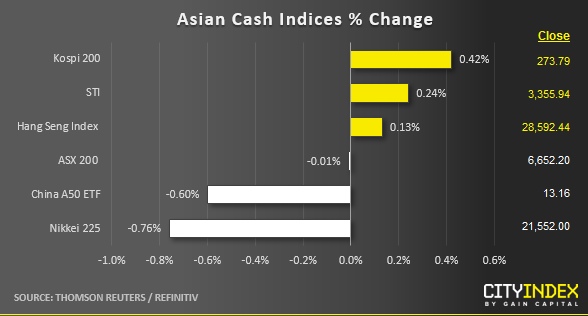

Stock market snapshot as of [16/07/2019 0425 GMT]

- Ahead of the European opening session, Asian stock markets are trading in a mix bag fashion with without any key economic data releases as at today’s Asian mid-session. Leading the pack is Korea’s Kospi 200 where it has rallied modestly by 0.42% as market participants are eyeing for a potential interest rate cut by the Bank of Korea on Thurs, 18 Jul monetary policy meeting.

- The worst performer is Japan’s Nikkei 225; the cash market has reopened for trading today after a national day closure on Mon, 15 Jul. It has declined by -0.76% as local market participants digested the weak China Q2 QDP data release yesterday. In addition, the on-going weakness seen in the Nikkei 225 can also be attributed to the current strength seen in the JPY where the USD/JPY has remained below yesterday’s high of 108.11.

- The S&P 500 E-mini futures has traded slightly higher by 0.10% to print a current intraday high of 3020 in today’s Asian session from yesterday’s low of 3012. Overall, the medium-term uptrend remains intact but from a technical analysis perspective, the S&P 500 is coming close to a key medium-term resistance/risk zone of 3045/55 where it faces the risk of topping out. Click here for our latest weekly technical outlook report.

- U.S. Q2 earnings session has kickstarted with key banks earnings reports out this week. For today, Wells Fargo, Goldman Sachs and JP Morgan will release their earning numbers.

- No significant movement seen the European stock indices CFD futures at this juncture; the German DAX is up slightly by 0.10% while the FTSE 100 is almost unchanged.

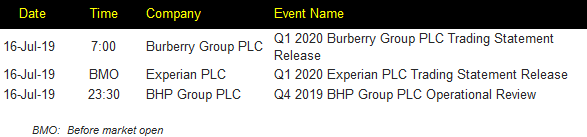

Corporate Highlights

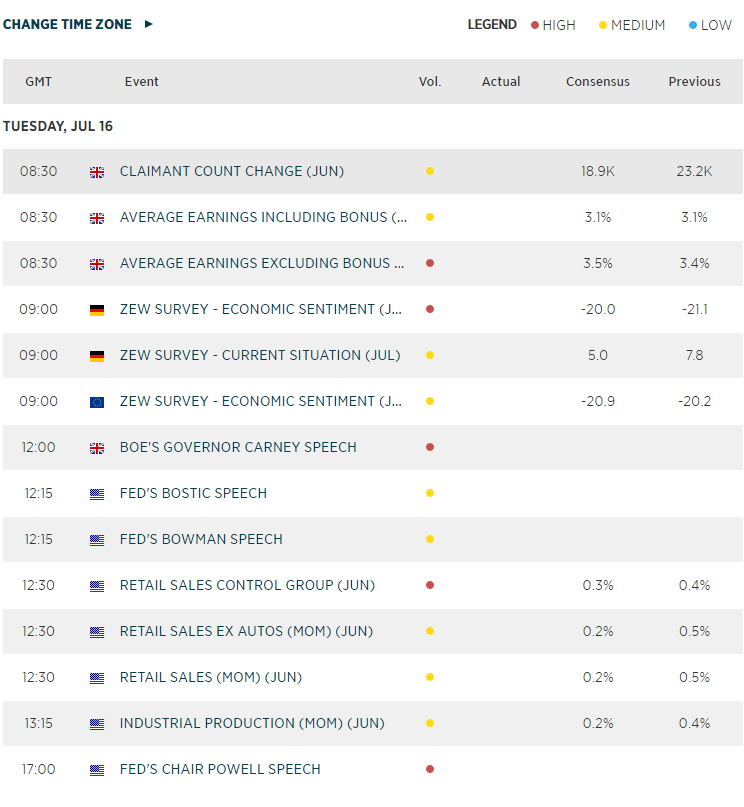

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM