Equity Brief: G20 Trade Truce Gains Fade to Start Holiday-Shortened Week

Index names may not reflect tradable instruments and not all markets are available in all regions.

Headlines

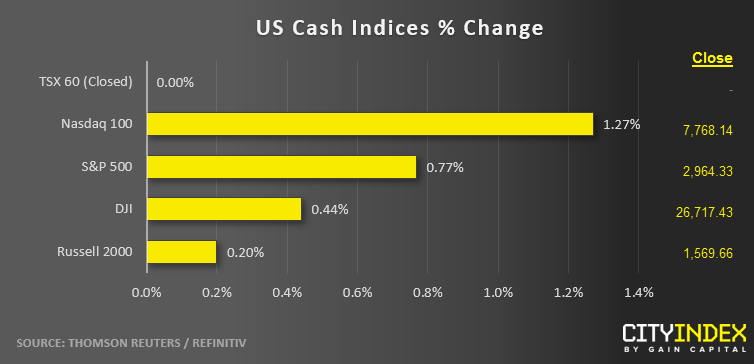

- US indices faded throughout the day as the glow of the G20 trade war “truce” faded. See why the S&P 500’s all-time high could be short-lived.

- Nine of eleven major sectors closed higher on the day, led by Technology’s (XLK) 1.6% gain. Utilities (XLU) were the weakest sector, shedding a quarter of a percent today.

- Oil (WTI) hit a five-week high above $60 on news of a nine-month extension to output cuts before fading to close near $59, up just 1% on the day.

- Stocks on the move:

- Semiconductor stocks rallied as the US relaxed restrictions on Chinese phone maker Huawei: AMAT +1.7%, QRVO +6%, QCOM +1.9%, AVGO +4.3%

- Boeing (BA) dumped another 7.5% as the stock continues to struggle following the grounding of its 737 Max jets.

- Coca-Cola (KO) tacked on 1.3% after an arbitration court ruled the company could sell energy drinks without violating a contract with Monster Beverage.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM