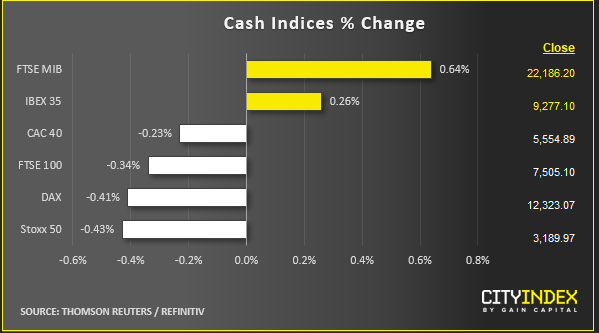

Stock market snapshot as of [11/7/2019 4:04 PM]

- The day after the Fed wafted—with Powell-comments and FOMC minutes— a confirmation that it remains highly likely to cut by 25 basis points in July, European stocks still aren’t as cheered as those in the U.S. and Asia

- Both Dow and S&P 500 opened with highly significant, albeit largely symbolic moves to the ‘psychological’ levels of 27,000 and 3,000 respectively. The jury’s out as to whether their hesitant rallies can keep the markets above those round numbers into the close. In context though, they have marked investors’ positive response to the Fed’s signal nonetheless

- As per a day ago, European markets contrast with a more mixed flavour. DAX, CAC and FTSE post anaemic gains or small losses. FTSE MIB continues its post-populism recovery, rising 0.6%. This after ECB minutes showed a strong consensus for cuts this year. Germany’s upwardly revised inflation data that lifts the euro (and a point against rate cuts) may be a bone of contention. The main drag however, remains earnings pessimism. This matches sentiment on forthcoming results Stateside, but unlike on Wall Street, there’s a sense that European large-caps may struggle to outpace even the low-ball forecasts they’ve been handed. With the broad STOXX 600 up a decent 15% for the year after last week’s 2019 high, plus with policy stimulus undefined, such sentiment may only point the market lower in the second half

Corporate News

- Illustrating Thursday’s lack of enthusiasm, Europe’s large-cap gainer was Reckitt Benckiser, rising around 2.5% near close after agreeing a $1.4bn fine. The penalty is linked to formerly owned opioid maker, Indivior. That mid-cap itself rose as much as 40%. Neither are entirely out of the woods, lawsuit-wise

- Among U.S. shares, another notable 2019 laggard, insurer United Health also took the spotlight with a 5% gain whilst select rival insurers also rallied. Pharma and biotech stocks mostly went the opposite direction. The White House has just pulled the plug on a proposed drug rebate overhaul but there’s speculation that Washington may look to target makers of high-priced drugs instead

- Retail is edging back into view in a negative way. Both GameStop and Bed Bath & Beyond fell hard, after a necessary plan to sell new shares and after Wall Street turned sceptical on forecasts, respectively

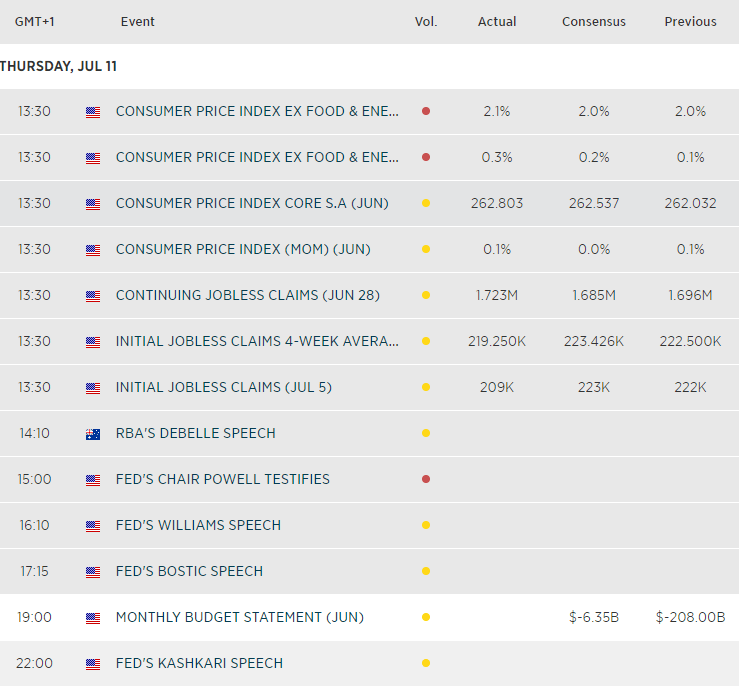

Upcoming economic highlights

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM