Stock market snapshot as of [12/7/2019 4:47 PM]

- Wall Street is holding in positive territory, affording a chance of a firm close to a busy week of risk events, which would support sentiment in another challenging week ahead

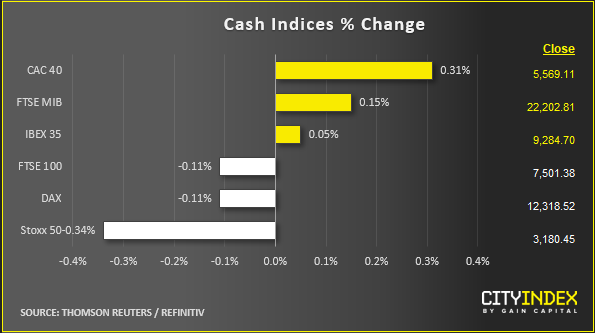

- On the European side though, stock markets couldn’t quite cut it. A marginally soft close for the STOXX 600 showed the market gave back much of the optimism it began the session with

- A second consecutive day of data topping expectations has sent a small chill through those betting big on ECB rate cuts in the relatively near term. Yesterday brought Germany’s upwardly revised inflation, on Friday firmer than forecast Eurozone industrial output could give the central bank pause for thought

- With Singapore GDP unexpectedly taking a turn for the worst and China’s exports and imports also in decline, there may be too many chickens coming home to roost for large European exporters to gain

- A dollar drop, and unabashed Fed optimism is keeping Wall Street aloft even after ‘good news was once again bad news’ in the shape of forecast-beating inflation, twice in two days. The sense that U.S. markets expect to be buttressed more by Fed rate cuts and a cheaper dollar than other regions, continues

Corporate News

- Sweden’s OMX was a big exception to falling EU shares banking giant SEB topped quarterly expectations, triggering a rally at rival Swedbank and for industrial conglomerate Skanska

- More broadly, Europe’s Materials, Industrials and Consumer shares paced the weakening trend, whilst energy shares barely gained as traders reassessed risks from storm Barry

- Beer giant AB InBev spilt some consumer cheer, falling as much as 3.6%, with markets dissatisfied with pricing at its Hong Kong IPO

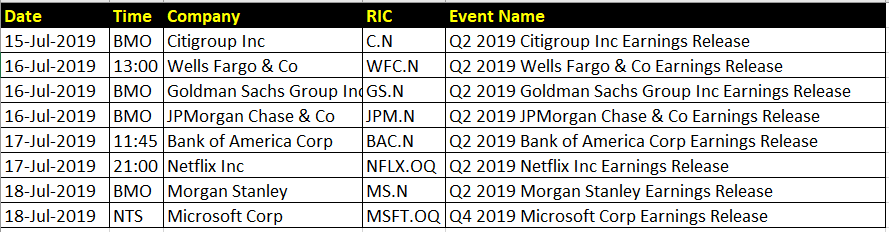

Upcoming corporate highlights

BMO: before market open NTS: no time specified

Upcoming economic highlights

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM