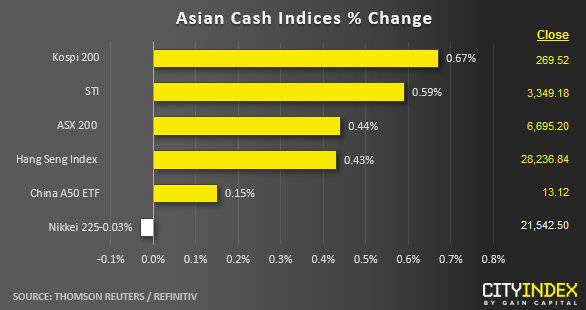

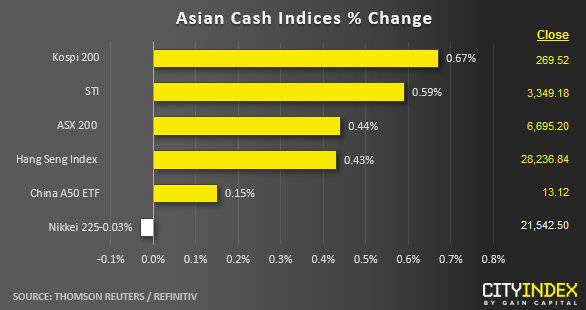

Stock market snapshot as of [10/07/2019 0430 GMT]

- Ahead of the European opening session, Asian stock markets have started to show signs of stabilisation after 3-days of consecutive decline since last Fri, 05 Jul. In addition, it is a positive follow-through where a recovery has been seen in the U.S. S&P 500 and Nasdaq 100 at the close of yesterday’s U.S. session (09 Jul). Both indices have managed to ink out a gain of 0.12% and 0.53% respectively from lower opening levels versus the previous day closes on Mon, 08 Jul.

- Interestingly, the on-going recovery/stabilisation seen across the region (Asia, Europe & U.S) has taken place near their respective key medium-term supports (click here for a recap on our latest weekly technical outlook report). The best outperformer as at today’s Asian mid-session is the Kospi 200 (prior worst performer) with a gain of 0.67% after its 2-week of decline met the 61.8% Fibonacci retracement of the previous entire up move from 29 May low to 01 Jul at 267.62 as per highlighted yesterday.

- European stock indices CFD futures have also started to stabilise from yesterday’s losses. Both the FTSE 100 and German DAX have inched up slightly by 0.10% at this juncture. The current modest rebound seen in the German DAX has occurred after a test on its key medium-term support at 12400 in yesterday, 09 Jul European session.

- U.S. White House economic adviser Larry Kudlow was quoted in the press that both U.S. and Chinese trade officials had constructive talks over the phone yesterday, thus keeping “the hopes alive” for future negotiation talks over a trade deal.

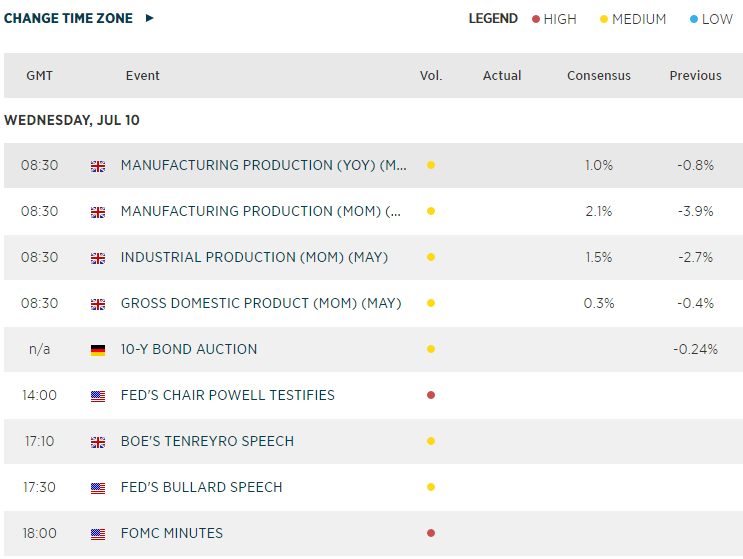

- Key event to take note later will be the 1st day of Fed Chair Powell’s semi-annual testimony to the U.S. Congress at 1400 GMT. Powell will be giving a statement on Fed’s monetary policy and the state of the U.S. economy. A dovish statement is likely to maintain the expectation of a 25% bps cut in the Fed funds rate in the upcoming FOMC meeting on 31 Jul.

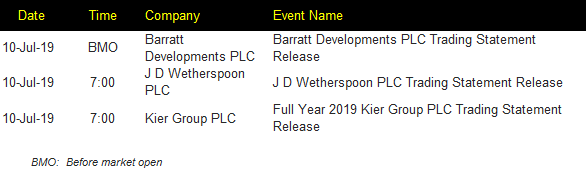

Corporate Highlights

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 08:33 AM