Stock market snapshot as of [18/07/2019 0430 GMT]

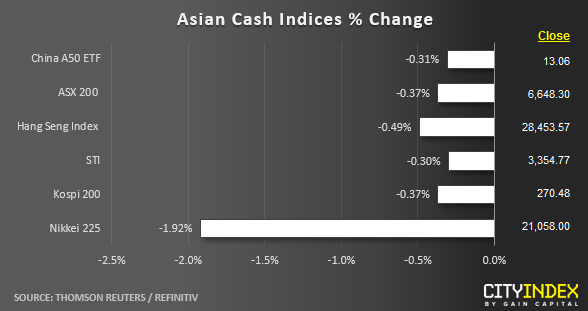

- Ahead of the European opening session, Asian stock markets have declined in line with a weak performance seen overnight in the U.S. stock market. The worse performer so far as at today’s Asian mid-session is the Nikkei 225 which has tumbled by -1.92% and broke below the 21500 key medium-term pivotal support that has damaged the medium-term uptrend in place since 04 Jun 2019.

- Catalysts that have contributed to the on-going weakness seen in the Nikkei 225 are weak Japanese trade numbers where exports have decline to -6.7% y/y in Jun that has came in below consensus of -5.6% y/y and recorded the 7th consecutive month of declines. Secondly, the USD/JPY has broken below a key short-term technical support of 107.80 that has reinforced further JPY strength in the short-term.

- The weak earnings report out from Netflix, part of the high beta “FAANG” cohort after the close of yesterday, 17 Jul U.S. session has spooked the overall sentiment in risk assets. The S&P E-min futures has continued to slide in today’s Asia session by -0.46% where it has printed a current intraday low of 2974; the cash S&P 500 has closed yesterday, 17 Jul U.S. session at 2984.

- Overall, the S&P 500 is likely to have form a medium-term top where the Index is now in progress of shaping a potential corrective decline sequence of -10% to -15% as per highlighted in our weekly outlook report published earlier on Mon, 15 Jul (click here for a recap). Even though, the ASX 200 and Hang Seng Index are still trading above their respective supports of 6590 and 28000 at this juncture but conviction is low to see a continuation of their impulsive up move sequence.

- The European stock indices CFD futures are also extending their losses from yesterday’s European session close at this juncture. Both the German DAX and FTSE 100 are down by -0.84% and -0.40% respectively. A break below 12200 on the German DAX may see a further drop towards 11900/800.

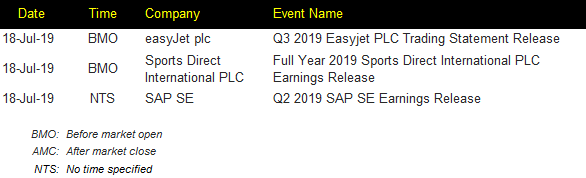

Corporate Highlights

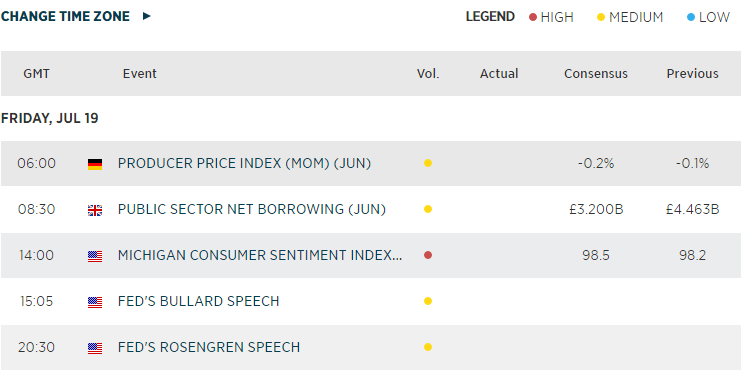

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM